- FTX engineering chief Nishad Singh often disagreed with Sam Bankman-Fried over money.

- They fought over financial investments and expenses like the execs’ $35 million penthouse apartment.

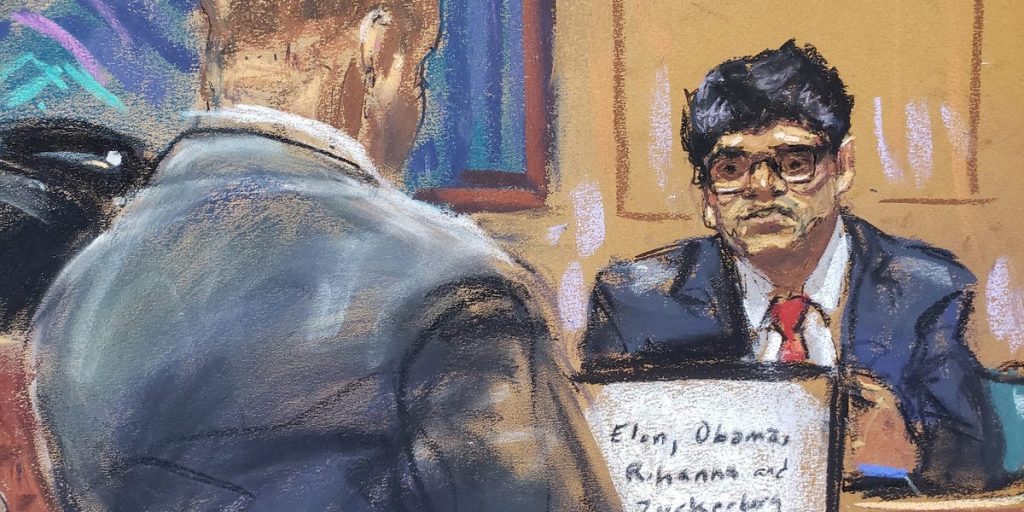

- Singh testified at Bankman-Fried’s trial that his concerns were almost always rebuffed.

Before his arrest on fraud and money laundering charges last year, Sam Bankman-Fried was known for his unkempt, flippant appearance. Though a billionaire on paper, he’d wear a dirty T-shirt and cargo shorts while onstage at a conference with Bill Clinton and Tony Blair. It was hard to find a magazine profile that didn’t mention him sleeping in a beanbag while working at FTX, his now-defunct cryptocurrency exchange.

Behind the scenes, however, Bankman-Fried was a profligate spender who had a taste for luxurious appointments and “social climbing,” according to Nishad Singh, a former FTX executive testifying at Bankman-Fried’s criminal trial.

In Manhattan federal court Monday, Singh testified about how he frequently questioned and pushed back against Bankman-Fried’s spending sprees and investment decisions — and was almost always rebuffed.

“I would hear that my opinions were already factored in, and I didn’t need to continue sharing them,” Singh testified.

On one occasion, Singh said, Bankman-Fried told him to stop sharing his views in front of a group of other FTX employees.

“It was pretty humiliating,” Singh said Monday.

Until September 2022, though, Singh didn’t know Bankman-Fried was making extravagant purchases with funds from FTX customers who remained unaware their money was being spent, he said.

How Singh got here

Bankman-Fried faces a total of seven criminal charges for committing or conspiring to commit wire fraud, securities fraud, and money laundering. Though he has pleaded not guilty, several of his former FTX and Alameda executives have pleaded guilty and agreed to work with prosecutors. Among them are Singh, Caroline Ellison, and Gary Wang, who have each testified at the trial.

Singh pleaded guilty in February to six criminal charges, including wire fraud and conspiracy charges. Separately, the US Securities and Exchange Commission filed a civil complaint against Singh in February accusing him of taking some $6 million from FTX for “personal use and expenditures, including the purchase of a multi-million dollar house,” Insider previously reported.

Attorneys for Singh told Insider at the time their defendant was “deeply sorry for his role in this and has accepted responsibility for his actions.”

Singh testified that he came to know Bankman-Fried through a friendship with the FTX founder’s younger brother, Gabe Bankman-Fried. After graduating with electrical engineering and computer science degrees from the University of California, Berkeley, Singh did a stint at Facebook before starting at Alameda as a software engineer in 2017. He moved to FTX in mid-2019, becoming a manager the following year when he gained the title of Head of Engineering.

As he rose through the ranks, so did his financial stake. Singh testified that starting in 2020, he got equity instead of FTX instead of bonuses on top of his $200,000 annual salary, making him at one point an on-paper billionaire. By 2021, he was living with Bankman-Fried and other FTX and Alameda executives in a penthouse in the Bahamas with his girlfriend.

Even so, his relationship with SBF remained complex.

“I’ve always been intimidated by Sam,” Singh testified. “Sam’s a formidable character. Brilliant. And so I had a lot of respect for him. Over time, that eroded, and I became distrustful.”

Infighting over expenses

The pair often disagreed on money, Singh testified. He said he discovered the $8 billion “hole” in FTX finances in September of 2022 and found out the money had been spent on real estate, venture capital, speculative bets, and campaign donations.

Between FTX and Alameda funds, Bankman-Fried directed spending of more than $1 billion on Genesis, a crypto mining company in Kazakhstan. He also spent $200 million investing in the venture capital firm Sequoia Capital, $500 million on an AI company called Anthropic, and $50 million on the controversial NFT company Yuga Labs, Singh testified.

FTX funds also went toward $1.3 billion in sponsorship deals, according to a spreadsheet introduced in trial evidence. Some of the biggest chunks included more than $150 million for the naming rights and other deals for the Miami Heat’s arena, $150 million in Major League Baseball sponsorships, $100 million in promotions with League of Legends, and a $45 million sponsorship with the Tomorrowland electronic dance music festival. Bankman-Fried also spent tens of millions of dollars on endorsement deals with Tom Brady, Gisele Bündchen, Steph Curry, Kevin O’Leary, and Larry David.

Singh testified that he disagreed with spending money to partner with celebrities, only to be overruled by Bankman-Fried. Tension over the promotion strategies continued to boil when Bankman-Fried invested $200 million in K5 Global after attending a post-Superbowl dinner hosted by the VC firm’s founder, founder Michael Kives. The guest list at the dinner included Hillary Clinton, Katy Perry, Orlando Bloom, Ted Sarandos, Jeff Bezos, Kate Hudson, Leonardo DiCaprio, Corey Gamble, as well as Kris and Kendall Jenner, Singh said.

Despite Bankman-Fried’s apparent enthusiasm, Singh wasn’t too impressed by the guest list. He didn’t recognize the name of Ted Sarandos, Netflix’s CEO. Asked under oath who Kris and Kendall Jenner are, he replied, “I honestly can’t tell you what they do.”

Singh hated the investment, testifying it was “value extractive” and “toxic” to FTX’s culture. The former engineering chief said he didn’t want the company to turn to “politicking and social climbing,” which he thought was wrong.

But when he raised his concerns, Bankman-Fried said, “it’s basically done,” which Singh took to mean the deal could not be reversed, he testified. The Alameda investment went forward using FTX customer money, he said.

Bankman-Fried and Singh also quarreled over more administrative expenses. As company executives sought to move to the Bahamas, they had nearly agreed on a more affordable property. Then, Bankman-Fried set his sights on the $35 million Albany penthouse.

“Sam’s a fan of views,” said Singh, who recalled protesting the purchase as exorbitant. “There was substantial disagreement about whether we should go with it, in part because it’s really expensive and in part because it’s really ostentatious.”

In the end, Bankman-Fried got his way on the penthouse — and many other things, he said.

Read the full article here