Introduction

Lennar Corporation (NYSE:LEN) is set to report its Q2 earnings on the June 17, after the market closes. I wanted to revisit the company to see how well it performed throughout ’23 and whether it may be a good time to start a position before the company announces the numbers. The latter half of ’23 saw a substantial increase in revenues, fueled by strong demand, however, some economies started to cut interest rates, and the US unemployment figures are starting to creep up, which may put a damper on such demand going forward. Therefore, I am maintaining a hold rating until we get more certainty.

Briefly on Financials

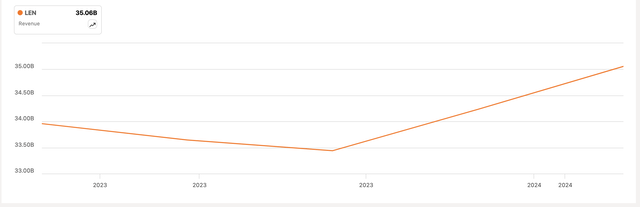

The company’s revenues started to pick up from Q3 onwards, with a very healthy increase in new orders and an increase in backlog in the last two quarters reported. It seems that there wasn’t a lot of fear of further interest rate hikes anymore, and the demand for homes saw a resurgence.

Seeking Alpha

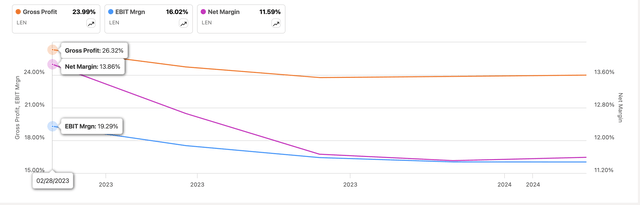

In terms of margins, the company saw a slight dip over the year, which hasn’t recovered yet to the margins it achieved at the beginning of ’23, however, margins have stayed relatively stable throughout the year with rather small contractions across the board. The margins declined due to the pressures of high interest rates, and a substantial decrease in the company’s average sales price of homes.

Seeking Alpha

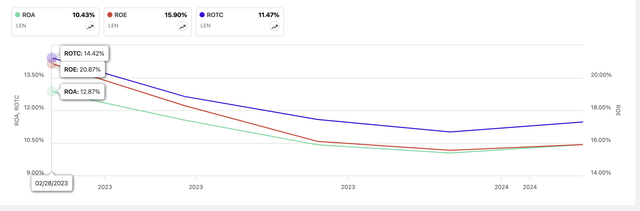

Unsurprisingly, the company’s efficiency and profitability metrics dipped due to the above factors. On the positive side, we can see a slight recovery happening in the latest quarter, however, it is still rather early to tell how these will develop over the next couple of quarters.

Seeking Alpha

In terms of liquidity, as of Q1’24, which was filed on March 29, 2024, the company had $4.9B in cash and equivalents, against around $2.4B in long-term debt. That’s still not a problem for the company given its decent EBIT of almost $1B. The company’s interest expense on debt is easily covered.

Overall, the operations seem to have picked up somewhere at the end of the year. It seems that a lot of people were becoming more accustomed to the higher interest rate environment and proceeded to not delay their home purchases any longer, and accepted the reality that these interest rates are here to stay. They may not be as high as they are right now, but it seems that people don’t want to delay their purchases any longer in hopes that they will get a slightly better contract a year or two from now.

Upcoming Earnings

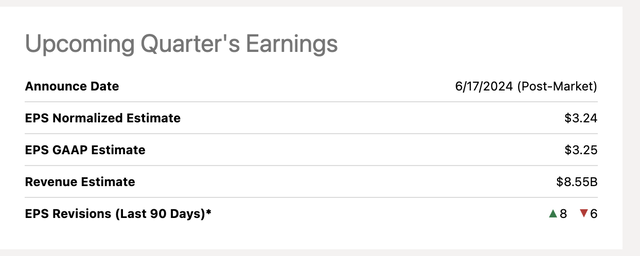

Analysts are expecting GAAP and adjusted numbers to be the same, with just a penny difference, at $3.25 and $3.24, respectively, on $8.55B in revenues, which would be a 17% increase sequentially, and around a 6% y/y increase. We can see the revenue trajectory is still on the rise, even in such a tough economic environment, with high interest rates, but as I mentioned earlier, it doesn’t seem to be affecting people’s decisions any longer.

Seeking Alpha

The company expects to see new orders of 21,100 homes at the midpoint and deliver 19,250 homes at the midpoint. The company is also expecting the average sale price of the homes to be $422,500.

Over the last nine quarters, the company beat earnings estimates on all occasions while missing revenue estimates only twice. There is a high probability that the company will beat upcoming earnings estimates, too but if we see weaker-than-expected numbers, I won’t be surprised with a slide in shares over 10% on the day.

Comments on the Outlook

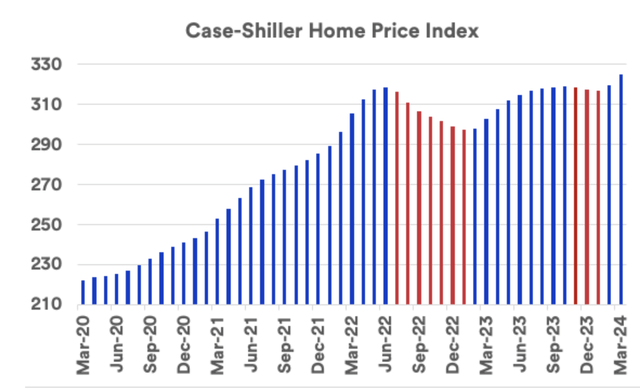

So, the 30-year mortgage rate has returned above 7%, which will continue to deter some people from making any big purchases right now. That is a negative for Lennar, however, as we saw that the company is doing rather well with the current demand numbers, and with another 6% y/y increase, it seems there is no issue at all. After a brief period of house price declines from June ’22 to Dec ’22, prices started to pick up once again all through Oct ’23. From November ‘23 through Jan ’24, house prices saw a slight decline once again, but fast forward to March, we can see house prices are hitting highs once again.

US Bank

This tells me that many people are not putting up their homes for sale at current prices due to high interest rates, and they may feel like they could get even better prices and better mortgage conditions later on. This is supported by a fall in existing home sales for April of 1.9%.

In my opinion, the hard times are not behind yet for companies like Lennar, regarding a fall in interest rates. Some economies have already started to cut interest rates, the ECB and Canada were the recent additions in cutting rates by 0.25bps. Slowly, nations are starting to look at the potential for rate cuts, however, The Fed is still being a lot more hawkish, and its decision will continue to be “data-driven”. Do I expect rate cuts this year? I will say I wouldn’t be surprised if we see one rate cut this year, however, no rate cuts are definitely on the table too. I believe that many people who are in a position to purchase a house in the next year or two are thinking hard right now about whether to start the mortgage application at the current rates or postpone for a little while longer, now that Europe and Canada have already cut interest rates, which may mean that the US is not far behind. If I was in this position, I would favor waiting it out and seeing how the macroenvironment changes over the next year or so before committing to such a large life-changing purchase.

Are these doubts going to translate to lower demand, which will lead to lower sale prices and lower revenue for Lennar? That remains to be seen, and with the upcoming earnings next week, I am eager to see what the management has to say about the visibility over the next half a year to a year if they are going to divulge such important information.

The company had a decent backlog of around 16,300 homes as of Q1, which translated to around $7.4B. I would like to see how the backlog progressed over the last quarter and would like to see further increases to support the idea that the demand is still robust.

Another point for the more negative outlook is unemployment just hit 4%. It is slowly but surely starting to go the way the FED wanted it. This metric has been very slow to hit 4%, however, further declines may be on the way over the next year or so, which will dampen the demand for housing as more and more people pinch their pockets and postpone large purchases.

Should You Buy Before Earnings?

I am going to continue sitting on the fence here because every quarter, there is always some sort of uncertainty regarding the macroeconomic outlook that keeps me from pulling the trigger. I don’t trust what we are seeing right now. This quarter, we saw that two large economies already cut interest rates, which may put a damper on the demand for houses over the next two quarters if not more because people would expect some rate cuts to come very soon, which will make their mortgages more affordable. Furthermore, existing home sales may continue to dip for the same reason. Why would someone switch homes if they expect their mortgage payments to come down over the next while, so they may not be in a rush to switch? I would like to see how the rest of the year progresses before considering any investments in homebuilders like Lennar, therefore, I am reiterating a hold rating until we get further clarity.

Read the full article here