Digital Turbine (NASDAQ:APPS) financial results continue to disappoint, dragging the stock lower, despite a very low valuation. Extremely weak Q4 results were largely attributed to soft device sales and the migration of the company’s tech stack onto a consolidated platform. Digital Turbine’s performance has been poor for the past two years though, making it difficult to continue shifting blame onto the macro environment.

While there is doubt hanging over the company, and a sizeable amount of debt, the equity could prove to be extremely cheap if Digital Turbine can stabilize its revenue and rein in costs. SingleTap and consolidation of the tech platform could create an inflection point, but it is difficult to buy into this given the company’s recent struggles.

The last time I wrote about Digital Turbine, I suggested it had execution issues and that this would take time to resolve. The stock is down over 50% since then, despite initially looking fairly attractively priced. A return to growth and profitability would likely see the share price increase significantly, in the meantime, it feels like the void is calling.

Market Conditions

Post-paid upgrade rates in the US were around 3% of the base in the March quarter, implying more than an 8-year upgrade cycle. While macro weakness may currently be impacting upgrade rates, I also think this probably represents a new reality where consumers are upgrading less due to a lack of innovation from smartphone OEMs. Digital Turbine has also seen fewer software updates on devices, reducing monetization opportunities. Again, a lack of innovation could be driving this.

Digital Turbine’s inability to distribute Chinese non-gaming applications in the US is also a headwind, although there is no reason to expect this to reverse. Spend from non-gaming Chinese companies decreased by around $20 million in FY2024 compared to the prior year, despite those companies wanting to spend more. While this is important, it represents a fraction of Digital Turbine’s revenue decline in FY2024.

The potential acquisition of US Cellular by T-Mobile could also be a headwind. US Cellular represents something like 1-2% of Digital Turbine’s revenue, and T-Mobile is a customer of one of Digital Turbine’s competitors. US Cellular is the fourth-largest full service wireless carrier in the US, but it is relatively small compared to the larger carriers. While this won’t have a dramatic impact, it highlights the problem of customer concentration and growing competition in the on-device segment of the business. Digital Turbine also recently released GamesHub with US Cellular. GamesHub provides a curated environment for premium app discovery, content recommendations and direct-to-device install capabilities.

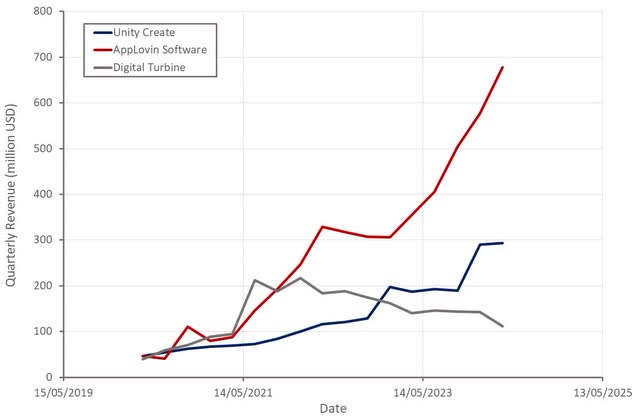

Looking at the results of Unity (U) and Digital Turbine, it is hard not to feel that these companies have been negatively impacted by AppLovin’s (APP) growing dominance. Unity’s recent Create segment growth has been driven by its acquisition of ironSource. Outside of this, the business has been performing poorly.

Figure 1: Digital Turbine Revenue (source: Created by author using data from company reports)

Digital Turbine Business Updates

Digital Turbine recently released a new version of Ignite, its service for OEMs and carriers, which enables on-device app installs and updates. While device sales are currently weak, this part of the business should be aided by the addition of 70 plus million devices launching with various Ignite capabilities. This number has been boosted by Digital Turbine’s growing relationship with Motorola. Digital Turbine has stated that its pipeline is robust, with many global operators and OEMs wanting to work with the company.

Over the past few years, Digital Turbine has been trying to consolidate its adtech assets onto a common platform, a process that is now largely complete. An example of this is the consolidation of exchanges from the Fyber and AdColony acquisitions onto the Digital Turbine Exchange. This will hopefully lower costs and improve performance, but only time will tell. This is important as privacy changes and the shift to real-time in app bidding appears to have significantly changed the competitive landscape.

Digital Turbine also recently launched SDK bidding, which could provide a meaningful benefit in coming quarters. SDK Bidding is now a requirement for many brands and agencies and also allows Digital Turbine to grow its revenue from DSPs like The Trade Desk (TTD) and Google (GOOG) (GOOGL) DV360. Over one third of Digital Turbine’s DT Exchange revenue is now coming from SDK Bidding.

Digital Turbine also believes that its media relationships will be a growth driver going forward. The company is working directly with brands like Apple, Amazon, Starbucks and P&G and with advertising agencies. Digital Turbine is also GroupM’s only global preferred partner for mobile.

Digital Turbine’s exposure to brand advertising has likely contributed to its struggles in recent quarters. Brand revenue was up 15% YoY in Q4 though, suggesting this part of the business is beginning to bounce back. Digital Turbine also believes that the deprecation of cookies will increase the attractiveness of its mobile app inventory relative to SSPs that rely on these identifiers.

SingleTap continues to add devices and advertisers but doesn’t appear to be a meaningful growth driver at this stage. Digital Turbine launched SingleTap on devices in Korea in May. This relationship will be extended outside of Korea, and Digital Turbine also has partnerships with Aptoide and Flexion supporting its alternative app distribution business.

The Digital Markets Act was recently launched in the EU but given Apple’s (AAPL) response, it is not clear that it will provide Digital Turbine with any benefit. Digital Turbine expects EU regulators to weigh in on this later in the year.

Digital Turbine is supposed to be launching a SingleTap app installation pilot program with a large social media partner (likely Meta (META)). This isn’t live yet though, with Digital Turbine previously stating that the holdup was due to an administrative issue on the partner’s side. Digital Turbine hasn’t provided any commentary on this lately, which is likely a negative.

Financial Analysis

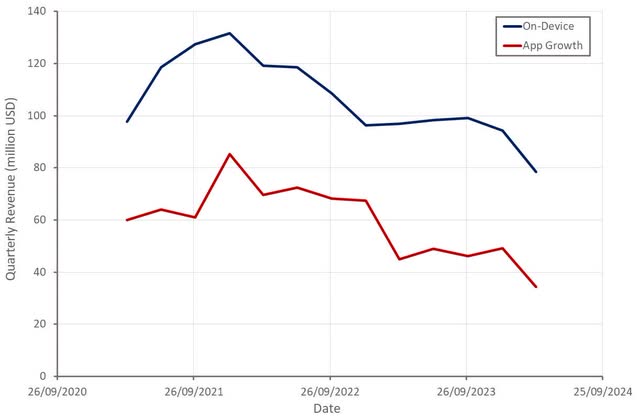

Digital Turbine generated $112 million revenue in Q4, down 20% YoY. ODS revenue was $78 million, a decrease of approximately 19% YoY, which was attributed to weak device sales. AGP revenue was $34 million, down roughly 23% YoY. This result was driven by Digital Turbine sunsetting their legacy business line in early January. As part of its deprecation of the AdColony exchange, Digital Turbine has chosen not to migrate many of its smaller customers to the Digital Turbine Exchange. The company is still in the process of lapping this headwind.

Digital Turbine expects its business to begin normalizing in Q1, returning to modest sequential growth, in line with historical seasonality. The company expects $540-$560 million revenue in FY25, which would be roughly flat YoY at the midpoint. It should be noted that the company’s guidance and commentary imply a fairly significant decline in revenue early in the financial year, followed by a return to robust growth later in the year.

Figure 2: Digital Turbine Revenue by Segment (source: Created by author using data from Digital Turbine)

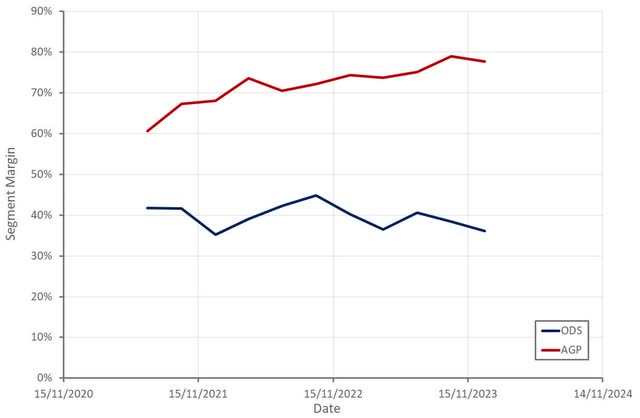

Digital Turbine’s gross profit margin was 46% in Q4, up slightly YoY on the back of revenue mix and cost reductions. Cloud computing expenses is one area where Digital Turbine has been trying to reduce its cost of revenue, and this is now beginning to pay off.

Figure 3: Digital Turbine Segment Margins (source: Created by author using data from Digital Turbine)

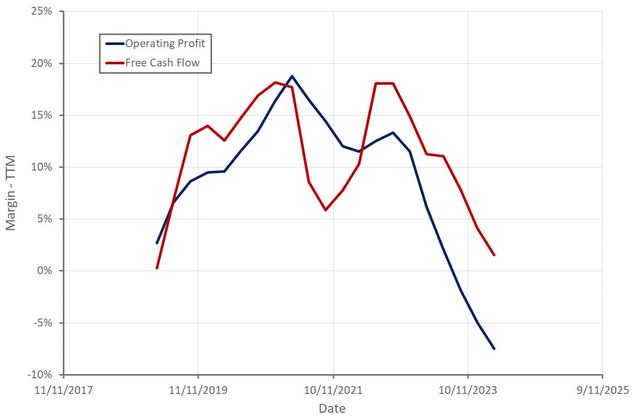

While Digital Turbine’s adjusted EBITDA was $12.3 million in Q4, the company’s operating profit margins and free cash flows continue to slide. Digital Turbine also recorded a $189.5 million non-cash goodwill impairment to the AGP business. There is still around $220 million of goodwill on the balance sheet though, down from a peak of close to $600 million.

Cash flow from operations was negative in Q4, which Digital Turbine attributed to delays in invoicing timing. While working capital was a modest headwind, the company’s profitability problems go beyond this.

Figure 4: Digital Turbine Operating Profit Margin (source: Created by author using data from Digital Turbine)

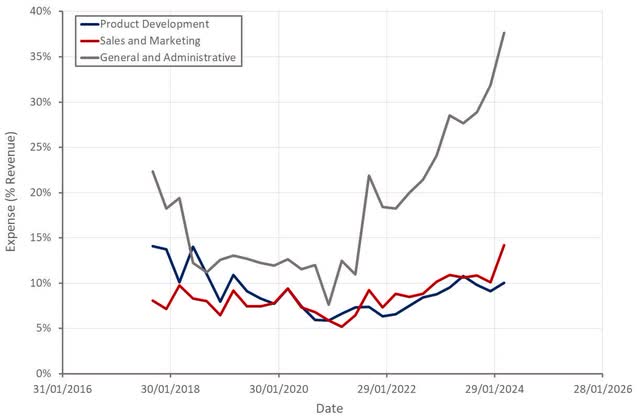

The slide in profitability is probably the most concerning aspect of Digital Turbine’s business. Operating expenses continue to steadily rise, even as revenue has plummeted. Unless Digital Turbine focuses on efficiency, it is hard to be optimistic about the company’s prospects.

Figure 5: Digital Turbine Operating Expenses (source: Created by author using data from Digital Turbine)

Digital Turbine’s cash balance was only $33 million at the end of Q1, but the company still has $139 million available to draw on the revolving line of credit, excluding the accordion feature, subject to the required covenants.

Digital Turbine currently has around $385 million debt, which is down over $100 million from its peak in early 2022. This debt is due in early 2026, but I don’t consider this a particular point of concern. If Digital Turbine has returned to growth and profitability by this time, this debt will be easy to manage. If Digital Turbine is still having problems at that time, its business is probably worth little, regardless of the debt.

Conclusion

Digital Turbine’s stock could prove to be extremely inexpensive if the company is able to even modestly improve its performance. Assuming Digital Turbine can return to growth and generate reasonable margins, the stock could easily be trading on a 2-3x free cash flow multiple in the next few years. At this point, it seems safe to assume the stock will continue to fall until there is a meaningful shift in performance, which likely won’t come until at least the second half of FY25.

While debt could be considered a problem, if Digital Turbine isn’t in a position to easily manage its debt by early 2026, it will likely mean the business has little future anyway.

This all hinges on SingleTap and recent changes to the company’s tech stack. Given initial reactions to the Digital Markets Act, I have fairly low expectations for alternative app distribution in the near-term. It is also difficult to get excited about the consolidation of Digital Turbine’s solutions, given the company’s past performance.

Figure 6: Digital Turbine EV/S Ratio (source: Seeking Alpha)

Read the full article here