Lately, there has been a lot of chatter around W. P. Carey Inc. (NYSE:NYSE:WPC), where many investors (and seemingly the market as well) have questioned the Management’s decision to cut the dividend and what kind of signal it sends about WPC’s commitment to distribute consistent dividends going forward.

Moreover, the fact that a large chunk of WPC’s office segment has been spun off has lead to a notable decrease in the AFFO generation, which, in turn, has introduced negative rate of change dynamics in the most recent earnings reports.

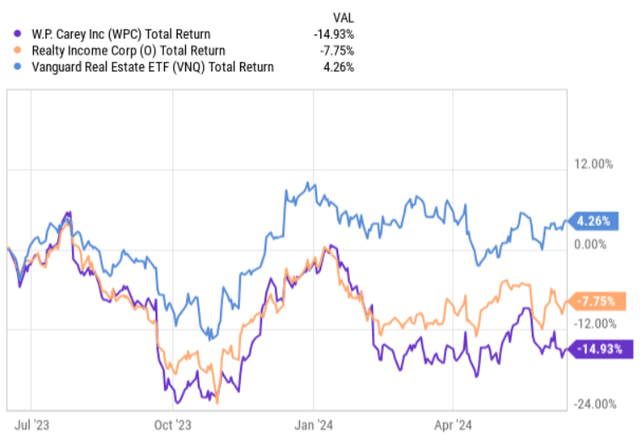

If we look at the TTM total return performance, we will see that WPC has underperformed the broader REIT market including a household name in the net lease space – Realty Income Corporation (NYSE:O).

Ycharts

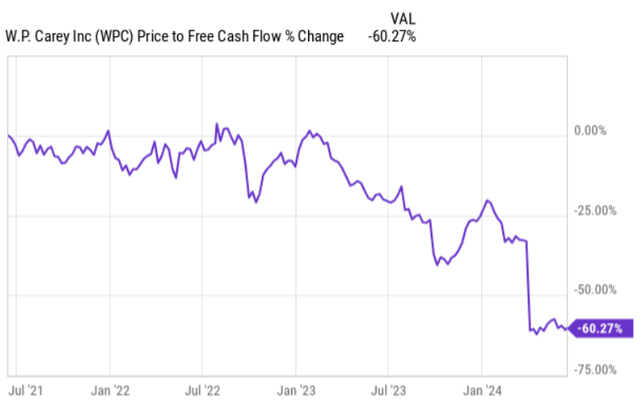

And then what is quite evident in the chart below is that the key driver of the depressed share price has been the massive drop in the multiple.

Ycharts

With this in mind, let me know elaborate on why I think that the market has overreacted here and why WPC is now, in my opinion, the best pick in the net lease space.

Thesis

The essence lies in two aspects: (1) depressed multiple, and (2) the irrationality of this heavy discount.

If we take the Q1, 2024 AFFO result and annualize it, we will arrive at a P/AFFO multiple of 12.2x, which is more or less in line with average multiples in the diversified REIT segment in which WPC is also included.

However, this is below the net lease retail REIT sector average of 13.5x and also below other investment grade net lease REITs such as Realty Income, Agree Realty Corporation (NYSE:ADC) and Essential Properties Realty Trust (NYSE:EPRT), which are trading at P/FFO of 12.8x, 15x and 14.6x.

Now, the question is whether this is justified. The simple answer is – totally not. Let me know list some of the key fundamentals metrics of WPC:

- WPC’s net debt to EBITDA is at 5.3x, which is even slightly lower than what we could find in the direct peer leverage statistics.

- The current occupancy level is at 99.1%.

- The weighted-average lease term is 12.2 years, which again is perfectly in line with peer comps.

- The properties count is huge at over 1200 and consequently the tenant profile is rather diversified spread across 335 lessees.

- The weighted average cost of debt is 3.2%, which is one of the lowest levels one will find in the entire REIT universe.

- The same store NOI has assumed a steady growth trajectory of ~3%.

As we can see, there is nothing uncommon about WPC. Put differently, there is no fundamental reason to assign heavier discount to WPC relative to what has been priced in for other similar net lease players.

Yet, the thing is that I would argue the opposite – i.e., that there is a sufficient basis for the market to actually value WPC higher than the closest peers. These are the two key reasons.

First, after the Management did a spin-off of the office properties, 63% of WPC’s ABR stems now from industrial and warehouse properties. Then another 6% comes for self storage operations, which leaves roughly 31% of the ABR for mostly retail properties.

Effectively, this implies that WPC is less of a retail net-lease as it is a owner of higher multiple segments such as industrials and self storage. For example, the average 2024 P/FFO multiple of industrial and self storage REITs is 17.1x and 17x, respectively.

In this context, we have to also consider that the Management has assumed a strong focus on growing the exposure towards these more defensive and highly valued segments. For example, on a YTD basis, WPC has completed investments totaling $375 million from which the lion’s share is attributable to the industrial properties. The cap rates of these acquisitions have been at mid-7s, which sends a clear signal that WPC is growing the industrial exposure through high quality properties.

Second, WPC has a significant growth potential ahead. Currently, WPC has just over $1 billion in cash, which is circa 8% of the total market cap level. The Management has expressed a commitment to deploy a majority of this liquidity into new investments, which will not only contribute positively to the AFFO generation, but also accelerate the increase of exposure towards industrial properties.

According to Jason Fox – CEO & Director – commentary in the recent earnings call, we should see a continued focus of WPC delivering its ~ $1.5 to $2 billion M&A target over the remainder of the year:

So we’re making good progress towards the $1.5 billion to $2 billion of investment volume in our guidance. The significant liquidity we’ve built up gives us a distinct advantage executing on those transactions. Essentially, prefunding our deal pipeline at a time when the outlook for interest rates has become increasingly uncertain and net lease REITs generally have an unfavorable cost of equity.

By looking at these investment amounts, we could theoretically think that the funding structure would be around 50:50 between equity and debt, which would in turn inflate the debt percentage in the WPC’s books. However, we have to also factor in the retained AFFO generation after servicing the quarterly dividend. Based on an annualized Q1, 2024 statistics, the AFFO retention for WPC lands at ~ $250 million, which would be sufficient to keep the leverage ratio at around 40%, while funding the incremental acquisitions.

All of this (including the aforementioned FWD multiple of WPC) is based on an assumption that the AFFO per share does not move higher after the Q1, 2024. In my view, this is a very unlikely scenario as the investments made on during Q1 will ultimately boost the AFFO generation, which are estimated to provide initial accretion and average yields around 9% (reflecting rent growth over the life of the leases). On top of this, WPC has 99.6% of its ABR linked to built-in rent growth escalators, which are currently just over 3% on a contractual same-store basis. Finally, it would be only logical to assign some further AFFO growth potential to the current ~ $1 billion liquidity position that will eventually be deployed during this year into additional accretive properties.

The bottom line

Given the above, it is clear that WPC is unfairly punished by the market, where the current multiple is disconnected from the underlying value.

The key aspect that the market is overlooking is WPC’s exposure to industrial / warehouse and self storage properties, which together explain the bulk of WPC’s NOI and / or ABR. Instead, the market is pricing WPC just as any other retail focused net lease REIT and even in some instances assigning a heavier discount than for other retail REIT peers.

It it difficult to predict when and by how much WPC will get re-rated higher, but I am rather confident that sooner or later it will happen and the investors will get rewarded accordingly. In my opinion, the process of WPC allocating its ~ $1 billion of fresh liquidity in combination with incremental debt into new industrial properties will stimulate not only AFFO growth, but also the market’s sentiment towards treating WPC more as a high multiple property owner than a pure play retail net lease REIT.

Until we wait for the thesis to play out, the current dividend of ~ 6% adds a complementary return component, making the overall investment case even more enticing.

As a result of this, I am giving W. P. Carey Inc. a strong buy.

Read the full article here