Investment Thesis: I rate Winnebago Industries as a Hold at this time.

Winnebago Industries, Inc. (NYSE:WGO) is an American motorhomes’ manufacturer – known for its array of premium RVs and boats.

Over the past year, the stock has seen a decline of just over 8%:

TradingView.com

The purpose of this article is to assess whether the stock has the capacity for upside from here, taking recent performance into consideration.

Performance

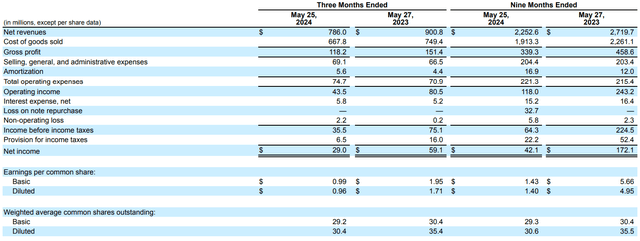

When looking at the company’s most recent earnings results (as released on June 20, 2024), we can see that net revenues saw a decline of 12% from that of the prior year quarter, while diluted earnings per share was down by 43% over the same period.

Winnebago Industries Quarterly Report: June 20, 2024

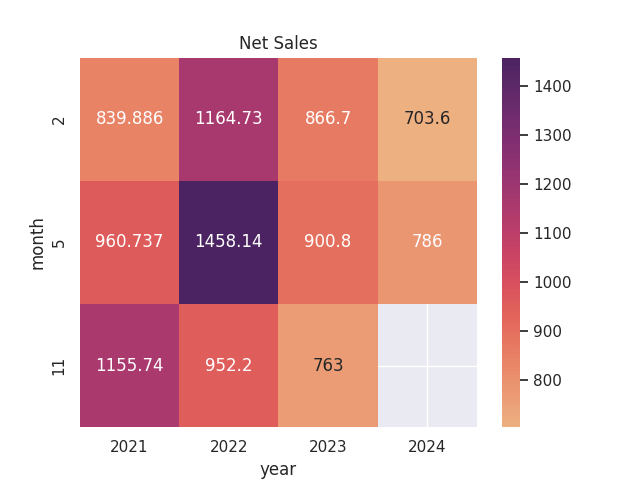

From a longer-term standpoint, we can see that net sales for this year have been down on that of the prior year quarter, and significantly below the highs seen in 2022.

Figures (in US$ millions) sourced from historical quarterly reports of Winnebago Industries. Heatmap generated by author.

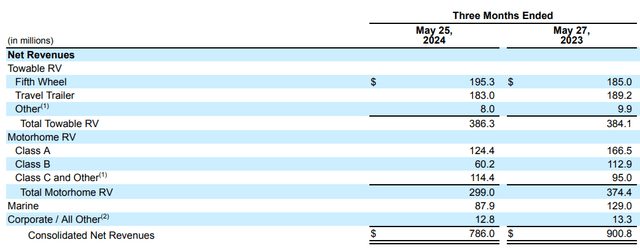

When analysing net revenue by segment, we can see that the Towable RV segment (which is the largest by revenue) was up marginally by less than 1% from that of the prior year quarter, but the Motorhome RV segment is down by 20% over the same period, with Class A and Class B having seen significant declines.

Winnebago Industries Quarterly Report: June 20, 2024

For reference, Class A motorhomes refer to the largest type of motorhome vehicle, designed to accommodate up to 8 people, while Class B refers to smaller, more compact vehicles also known as campervans. Class C is a blend between Class A and Class B – targeting consumers who are looking for larger motorhomes discounted to that of Class A vehicles.

In this regard, we can see that while Class C motorhomes have seen a boost in net revenues, those of Class A and B have been on the decline.

From a balance sheet standpoint, we can see that the company’s quick ratio (calculated as total current assets less inventories less prepaid expenses all over total current liabilities) is above 1 and has increased slightly from that of August 2023. This indicates that the company has sufficient liquid assets to meet its current liabilities.

| Aug 2023 | May 2024 | |

| Total current assets | 996.7 | 983.7 |

| Inventories | 470.6 | 441.5 |

| Prepaid expenses | 37.7 | 24.8 |

| Total current liabilities | 396 | 401.8 |

| Quick ratio | 1.23 | 1.29 |

Source: Figures (in USD millions) sourced from Winnebago Industries Quarterly Report: June 20, 2024. Quick ratio calculated by author.

From a longer-term standpoint, we can see that the ratio of long-term debt to total assets has increased slightly over the period, with long-term debt itself up by over 7%.

| Aug 2023 | May 2024 | |

| Long-term debt | 592.4 | 636.4 |

| Total assets | 2432.4 | 2425 |

| Long-term debt to total assets ratio | 24.35% | 26.24% |

Source: Figures (in USD millions) sourced from Winnebago Industries Quarterly Report: June 20, 2024. Long-term debt to total assets ratio calculated by author.

Looking Forward and Risks

In terms of growth prospects for Winnebago Industries going forward, this will hinge significantly on demand for motorhomes going forward.

Until now, the industry has largely been navigating a post-pandemic slump, and sales of recreational vehicles were reported last year to be approaching the lowest level since 2015. The decline in net revenues across the Motorhome segment appears to have persisted in the most recent year, and higher interest rates have undoubtedly affected appetite for motorhome purchases – given that RV loans have averaged around 10% versus that of 7% before interest rate hikes started to kick in.

While an interest rate cut is potentially on the cards before the end of the year – it is uncertain to what degree the Federal Reserve will choose to cut rates, and in any case, we are unlikely to see a significant shift in appetite for motorhome purchases for some time after this.

Moreover, it is notable that Class B motorhomes saw the largest drop in net revenues on a percentage basis. This indicates that consumers are showing less of a propensity for campervan purchases, potentially perceiving such vehicles as overly expensive when compared to the cost of Class A and C motorhomes – which could explain the uptick in Class C net revenues. For instance, when looking at Winnebago’s campervan offerings, the lowest priced at the time of writing is the Solis Pocket camper van starting at $143,475. In contrast, Class C offerings such as the Minnie Winnie and Spirit start at $146,248, while Class A models such as the Vista or Sunstar start at $208,885.

In this regard, it may be the case that potential motorhome purchasers are inclined to save for a Class A or Class C model – and this could be part of the reason why we have seen a drop in Class B net revenues.

While the trajectory for net revenues going forward remains unclear, I take the view that the company nevertheless has the capacity for a longer-term rebound based on several competitive advantages, both in terms of brand recognition and its wide product array.

For instance, the company has previously received the prestigious Quality Circle Award from the National RV Dealers Association, in recognition of its Class A, B, and C motorhome offerings, as well as its Towable lines. In addition, Winnebago released several new offerings in 2024 ranging from camper vans to full-size motorhomes, including the View / Navion 24T, EKKO Sprinter 23B, Revel, Access, and M-Series models.

From this standpoint, I take the view that while net revenues may have seen some downside of late – this is largely due to macroeconomic conditions and Winnebago Industries is in a strong position to see a rebound in sales given its strong reputation across the industry.

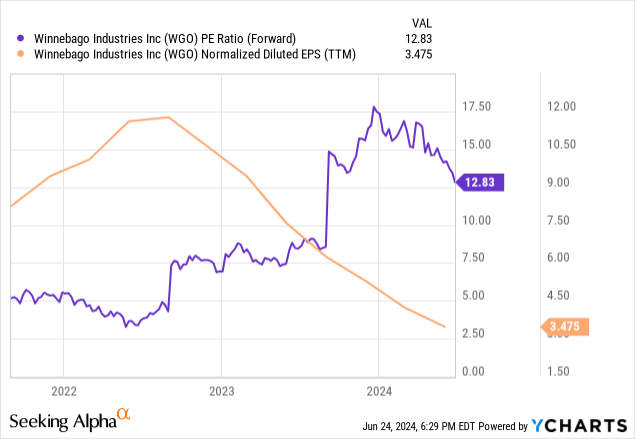

From an earnings standpoint, we can see that the P/E ratio has risen to a near 3-year high while normalized diluted earnings per share is at a three-year low.

YCharts.com

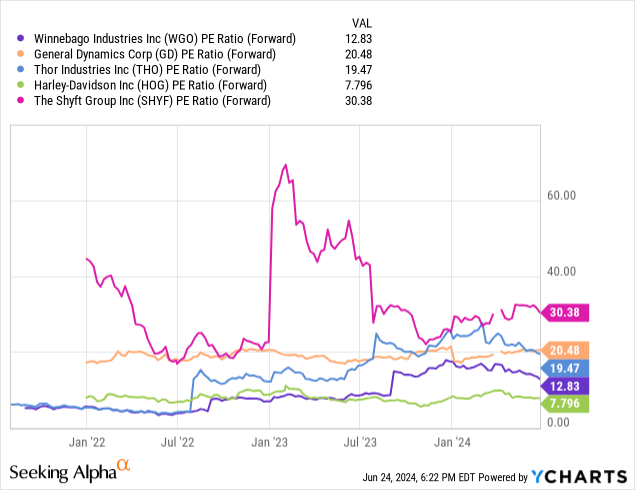

Additionally, we see that Winnebago Industries has the second-lowest P/E ratio among its peers.

YCharts.com

In my view, the stock needs to see a significant rebound in earnings to justify further upside from here. In this regard, I do not see it as prudent to attempt to value the stock based on earnings at this time.

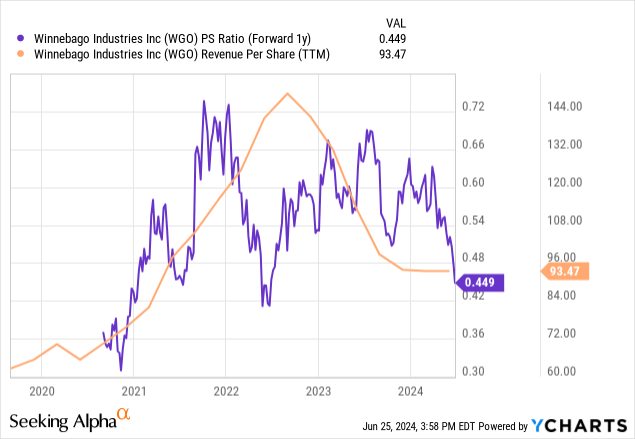

Price-to-sales is a more relevant metric at this time given the shift in sales performance that we have seen of late. We have seen that the price-to-sales ratio has seen a significant decline from that seen in 2022, while revenue per share remains at the same level.

YCharts.com

Given revenue per share of $0.449, I estimate that the fair value for the stock in 2022 ranged at the $64 mark (144 * 0.449 = 64.65), while the current value stands at $41 (93.47 * 0.449 = 41.96).

In this regard, I take the view that given a price of $55 – we could still see some downside in the stock until such time that net sales see a recovery.

In my view, the main risk for the company is that we see a further decline in net revenues – which remains a possibility given high interest rates and the post-pandemic slump continuing to affect motorhome demand.

Conclusion

To conclude, Winnebago Industries has ultimately seen net revenues come under pressure due to reduced sales across the Motorhome RV segment. I take the view that we need to ultimately see a recovery in motorhome demand to allow for an overall recovery in net sales. For this reason, I rate Winnebago Industries as a Hold at this time.

Read the full article here