Thesis

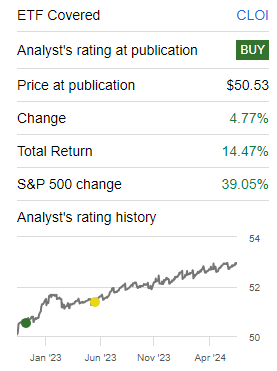

The VanEck CLO ETF (NYSEARCA:CLOI) is a fixed income exchange-traded fund. We covered this name right when it was issued with a ‘Buy’ rating and encouraged readers to keep holding the name last year:

Prior Rating (Seeking Alpha)

The ETF has provided for a very robust total return since, but most importantly, it never experienced a severe downturn.

We are now revisiting the name after one year to analyze the current collateral composition and highlight why the fund is still a name to hold given its analytics and macro market forecast.

Updated holdings analysis

The fund has moved towards holding various investment grade slices of CLOs:

- AAA CLOs …..39%

- AA CLOs……..31%

- A CLOs………..8%

- BBB CLOs…….10%

- Not Rated…….12%

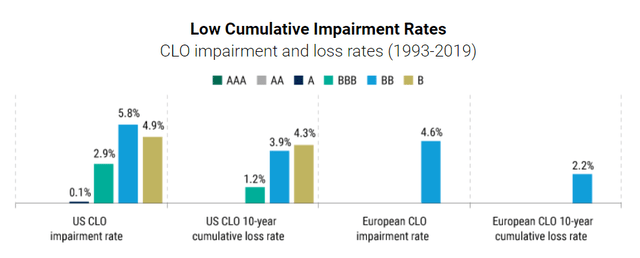

Only 39% of the holdings are AAA, with the rest dispersed among AA, A and BBB credits. Despite its perceived increased risk factor, the actual probability of default associated with investment grade CLOs is very low:

CLO losses (Pinebridge)

Only sub-investment grade BB and B tranches have sizable loss rates, with the riskiest investment grade names (i.e. BBB) coming in at only 1.2% cumulative loss rate on a 10-year look-back.

Although the fund does take an incremental amount of risk versus pure AAA names, we find that risk to be minimal and very manageable. Readers should be aware however that the ETF has significant flexibility in its allocation mandate, and actively choses which rating bands to target:

The VanEck CLO ETF (CLOI) shifted modestly into lower investment grade tranches over the quarter. This adjustment followed the tightening of the spread at the top of the capital stack since summer of 2023. Higher conviction in a stable economic environment and strong technicals allow the Fund to benefit from higher spreads in lower rated tranches, while staying positioned overall at the top of the capital stack. Should more attractive entry points emerge lower in the investment grade portion of the capital stack within the next six months, as we currently anticipate, we would shift further down in the cap stack and look to add below investment grade rated classes. But given expectations for the pace of downgrades to pick up into the second half of 2024, we remain very selective when investing in mezzanine tranches. The Fund performed in line with its benchmark in Q1

Source: Fund Commentary

The ETF has the ability to invest in sub-investment grade credits, although it has not chosen to do so. If it ever moves in that direction, the fund profile would change quite dramatically in our mind, since the name would be exposed to true probability of default risk.

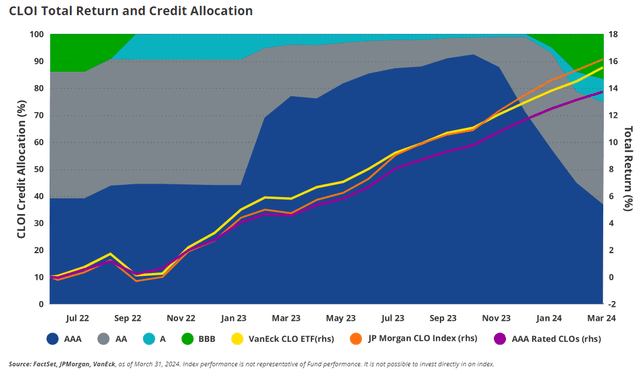

The fund even presents a very visually enticing graph regarding the rating migration we have witnessed:

Holdings migration (Fund Website)

The blue area represents AAA CLOs, while the gray is showcasing AA names, with BBB CLO tranches being the green area. AAA allocations peaked in September 2023, with the ETF moving towards A and BBB names ever since (larger green area in the above graph as time passes).

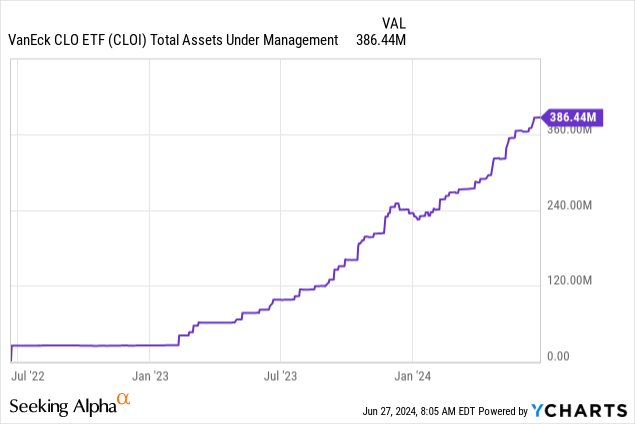

The ETF has managed to grow its AUM in the past three years:

For CLO ETFs it is important to have a minimal AUM of let us call it roughly $100 million. The reason behind this is that CLOs do not trade in small lots, with most broker dealers preferring sizes above $1 million when trading. CLOs are not vanilla corporate bonds, and thus more work goes into pricing the respective tranches. Thus, small lots do not make sense in this niche.

We can see from the above graph that CLOI has constantly increased its AUM, adding roughly $100 million in new money in 2024. This is a positive development for the name in terms of sourcing new assets.

Performance comparisons

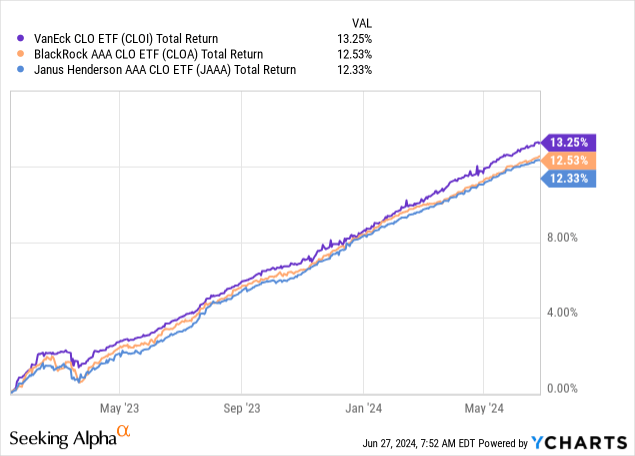

The ETF has slightly outperformed its AAA-only peers in the past three years:

When looking at the three names from a total return perspective, we can see CLOI slightly outperforming the BlackRock AAA CLO (CLOA) and the Janus Henderson AAA CLO (JAAA). The difference is expected since CLOI contains lower rated sleeves when compared to its peers.

Volatility is important for funds like CLOI

When looking at high-grade investments with low duration, annualized volatility and standard deviation are two analytical frameworks which are very important to consider. If you have an investment that yields a 6% theoretical yield but has a 5% annualized volatility, then it should not be as appealing as a 6% yielding name with a 1% annualized volatility.

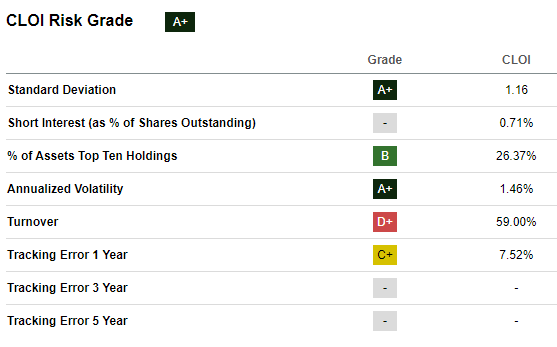

The Seeking Alpha platform contains a ‘Risk’ tab for CLOI, which presents volatility figures:

Risk (SA)

The fund has a standard deviation of only 1.16%, and an annualized volatility of 1.46%. This translates into a name which should present very low drawdowns in a risk-off scenario. The platform assigns the name a ‘D+’ rating for its turnover, but we are not very concerned here because CLOI is an actively managed fund, thus able to source the best opportunities as they present themselves.

Yields will continue to stay high until the Fed cuts

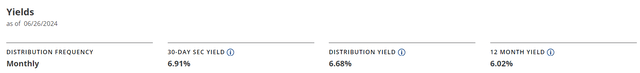

The fund pays a monthly distribution, with a 30-day SEC yield, which currently comes out to 6.9%:

Yields (Fund Website)

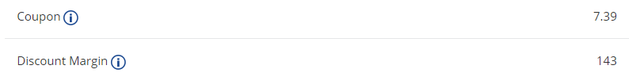

The current collateral pool has a coupon in excess of 7%, with a discount margin of 143 bps:

Details (Fund Webiste)

‘Discount Margin’ simply references the spread over SOFR that the underlying assets exhibit. It is the blended spread among all the assets in the fund.

When the Fed will eventually cut rates, the 30-day SEC yield will decrease, and the fund will become a less appealing investment vehicle. Until that point in time, the ETF offers very favorable risk/reward analytics and is an ideal security to hold in a high rate environment given the floating rate nature of CLOs.

Conclusion

CLOI is a fixed income exchange-traded fund. We started covering the name right after issuance with a ‘Buy’ rating, and have been on hold for the name ever since, believe the ETF is a good risk/reward investment in a high rate environment. We are seeing the fund migrate towards lower rated IG CLO tranches in order to reach for yield, but we feel the associated probability of default with the purchased collateral is still very low. We like the fund’s high 30-day SEC yield and its low volatility, and we are of the belief the name is a robust one to hold until the Fed actually starts cutting rates, and we see much lower SOFR rates.

Read the full article here