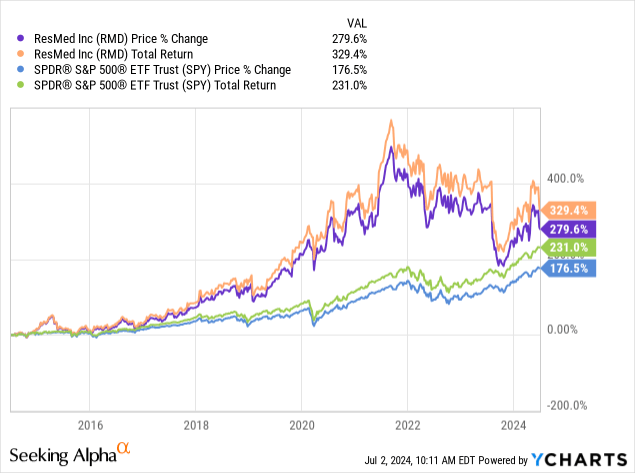

This is my first time covering ResMed (NYSE:RMD), and I am allocating a Buy rating to the stock because I currently consider it to be potentially undervalued based on the long-term outlook the company is facing. I expect the investment to deliver a high level of short-term to medium-term alpha, and I forecast that it will beat the market over the next 10 years. While the company has faced short-term growth rate contractions, largely a result of supply chain disruptions and macroeconomic slowdowns, this has caused market pessimism and opened up an opportunity where the stock is currently trading 36.4% below its high after a 277.7% gain in 10 years.

Operational Analysis

ResMed is a global leader in digital health and connected medical devices, focusing on sleep apnea and respiratory care solutions. The company holds approximately 55-62% of the market share in obstructive sleep apnea (‘OSA’) treatment. The company’s portfolio of products includes CPAP machines, masks, ventilators, and diagnostic devices—for example, the AirSense and AirCurve series for sleep apnea treatment. The company operates in over 140 countries; approximately 60% of its revenue comes from the United States, and 40% comes from the rest of the world.

ResMed’s USP is in its integrated approach to sleep and respiratory care, where it combines innovative hardware with advanced software. Management has developed an ecosystem that improves patient outcomes, enhances healthcare provider efficiency, and generates valuable data insights. The company has over 9,500 issued or pending patents and designs. In addition, management has established its reputation well in key markets, largely a result of the positive feedback it gets from customers about its products.

Trustpilot

There are an estimated 936 million adults worldwide who have obstructive sleep apnea. In the United States alone, over 30 million people are believed to have sleep apnea, but approximately only 6 million have been diagnosed. In addition, approximately 80-90% of OSA cases remain undiagnosed globally. Another source suggests over 50 million people have OSA in the United States, but only 15% use CPAP devices, which could mean there is a potential market of approximately 40 million untreated patients. All of these factors suggest a vast untapped market for ResMed to continue to expand into, especially as it already has the market lead. Untreated OSA was estimated to cost $149.6 billion in the United States alone in 2015—by treating OSA early and with proper technology, such as that offered by ResMed, there is likely to be a reduction in total healthcare utilization and costs.

In my opinion, given the data and ResMed’s market position, this is likely to be a very strong long-term investment. Additionally, I think it is also undervalued at the present price, opening up the opportunity for significant near-term price returns even if the medium term to long-term future is met with slower traction toward global expansion, awareness, and adoption of advanced sleep apnea solutions.

Financial & Valuation Analysis

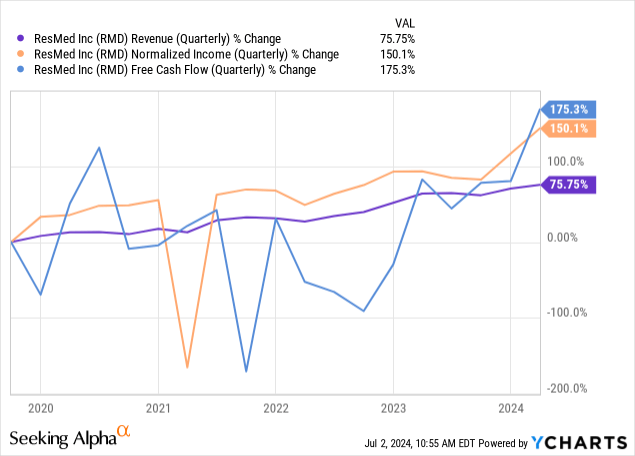

Investors grew concerned about the company’s free cash flow and normalized income in 2021. There was a large surge in demand for ventilators in fiscal 2020 due to the COVID-19 pandemic, but as the pandemic-related demand normalized in 2021, the absence of these extraordinary sales impacted the firm financially. Management also significantly increased its manufacturing capacity over the period, which increased its operating expenses and contributed to the short-term contraction in free cash flow. In 2022, which was a period of significantly high capex for ResMed, the company opened a new manufacturing hub in Singapore, committed €30 million to a new technology R&D facility in Ireland, and acquired MEDIFOX DAN to expand its SaaS offerings and presence in Europe. This led to a net capex of $134.8 million in 2022 versus $102.7 million in 2021 and $119.7 million in 2023.

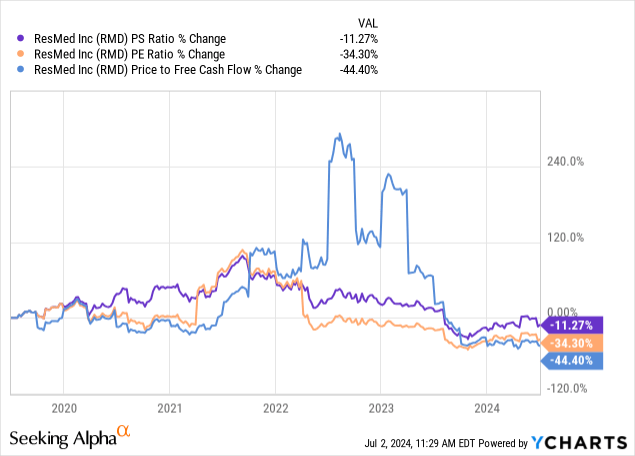

However, these momentary contractions do not indicate any areas of significant long-term weakness, although Wall Street analysts are expecting the company’s growth to be more moderate moving forward compared to historically. The company has reported a 5Y average for diluted EPS growth of 23.28%, but the forward estimate for normalized EPS is 19.82% for fiscal period 2024, 11.57% for 2025, and 10.56% for 2026. Therefore, investors would be wise to question whether the recent contraction in the company’s price and valuation ratios is a result of dampened sentiment for the stock as a result of lower future growth expectations.

In my opinion, some contraction in the price and valuation multiples has been warranted over the past three years, but I believe the sell-off has been too severe. In addition, I think the present caution surrounding the next few years’ results will improve if the company can raise awareness about OSA and tap into the large portions of the market still not yet penetrated. As a long-term investor who prefers to seek opportunities that could outperform over 10+ years, I believe ResMed is a valuable candidate because the future growth trajectory remains intact, and the company is leading in its field. Furthermore, its operational resilience will be supported by its strong balance sheet, where it has an equity-to-asset ratio of 0.68 and a debt-to-equity ratio, including lease obligations, of just 0.25. This will support its ability to acquire other smaller and emerging competitors and to solidify its moat.

ResMed stock is trading at a -31.65% discount from its 5Y average in FWD P/E GAAP. It is also selling at a -27.29% discount from its 5Y average in FWD P/S. If the company manages 15% annual diluted EPS growth over the next 5 years, this is a 35.58% reduction from its 5Y average for YoY diluted EPS growth. Additionally, it is reasonable to assume its revenue grows at 9% annually over the next 5 years, which is a 29.58% reduction from its 5Y average for YoY revenue growth.

However, I think we are likely to see cyclicity from ResMed, which has been evidenced historically with periods of high growth and periods of low growth and even contraction. There are also likely to be wider macroeconomic factors that raise awareness about OSA solutions, driving customers to ResMed, especially if the issue of OSA within the United States and other key markets intensifies, causing economic headwinds in federal, state, and international governmental budgets.

I think it is reasonable to expect the company to maintain a P/E ratio of around 25 on average over the next 10 years as a base case. In addition, I think 12.5% annual EPS growth is likely over the next decade. As a result, my price target for RMD stock in 2034 is $529.25, considering the stock price is currently $189.10 and basic EPS is $6.52. The implied CAGR of this over 10 years is 10.9%. Given that there may be bursts of traction in ResMed’s core market, the EPS annual growth rate could hypothetically expand to 15% over the next decade, and the P/E ratio could rise to 30 on average. If this happens, the stock price would be $791.70, and the CAGR 15.2%. Alternatively, a lower 10% EPS annual growth over the period and a P/E ratio of 20 would result in a stock price of $338.20 and a CAGR of 5.9%. I think the initial base case, with an implied 10.9% CAGR over the next 10 years, is most likely, but the potential for outsized returns is more likely than reduced sentiment and demand related to OSA, causing contraction in ResMed’s fundamental performance. Therefore, I expect the stock to at least meet my expected S&P 500 price CAGR of 10% over the next 10 years, with the potential for ResMed to deliver high outperformance based on possible traction gained in the OSA solutions market in the United States and internationally. Therefore, my rating is a Buy rather than a Hold.

Risk Analysis

ResMed operates in a highly competitive market:

- Philips Respironics is re-entering the market after a significant recall in 2021 due to issues with sound-insulating foam in their CPAP and BiPAP devices, which could degrade and penetrate the user’s airway. Its re-emergence in the field could erode ResMed’s market share.

- Fisher & Paykel Healthcare (OTCPK:FSPKF) is another major competitor in the sleep apnea device market that has a presence in over 120 countries. It has developed a reputation for innovation and quality.

- Other competitors include Hillrom, DeVilbiss, and Apex Medical.

In my opinion, the re-emergence of Philips is likely to be the highest threat to ResMed, although there are near-term inhibitions on Philips competing effectively, including legal challenges such as class-action lawsuits to overcome. However, ResMed, with nearly 60% market share by some estimates, is unlikely to be significantly detracted from over the long term if it maintains its focus with diligence.

In addition, new technologies, including GLP-1 agonists used for weight loss, have the potential to reduce the prevalence of sleep apnea by reducing weight loss. Obesity is one of the root causes of sleep apnea, and this change could decrease the demand for traditional CPAP devices. Furthermore, current health trends that are becoming more popular with younger generations could gain more traction and lead to decreased global obesity over the long term, contracting the total addressable market for ResMed. A 2018 study by the International Food Information Council reported that 80% of millennials consider health benefits when choosing foods, compared to 64% of baby boomers.

There are also low diagnosis rates for sleep apnea. While the significant portion of the global population that remains undiagnosed is a potential opportunity for ResMed, the challenge lies in building awareness and motivating diagnosis at scale. This is difficult if many people live with sleep apnea but do not mind the side effects in many cases. Snoring, daytime fatigue and further symptoms of sleep apnea may be attributed to other factors or considered normal. There are also cost concerns, and many users are likely to feel uneasy about using devices over their face unless symptoms are severe. As such, I think there are likely to be challenges in the future for ResMed tapping into the vast market, and the TAM might be smaller than management currently presents once the nuanced realities of public perception are clearer.

Conclusion

ResMed could currently be undervalued, depending on how the market reacts to the stock over the next 10 years and the fundamental growth rates that management achieves. However, there is some uncertainty about how large the TAM for ResMed really is because a lot of potential customers are unlikely to want to seek treatment. In addition, new health trends and anti-obesity technologies are a real threat. In my opinion, ResMed is likely to at least perform as well as the S&P 500 over the next decade, but the potential for outsized returns is significant if sleep apnea becomes more widely recognized and technological solutions are sought more readily. This could expand ResMed’s fundamental growth and lead to a multiple expansion over the period on average, allowing for a potential 15%+ price return CAGR.

Read the full article here