In our last coverage of Diversified Royalty Corp. (TSX:DIV:CA), we told you why we were shying away from the common shares and preferred to perch up in the capital structure.

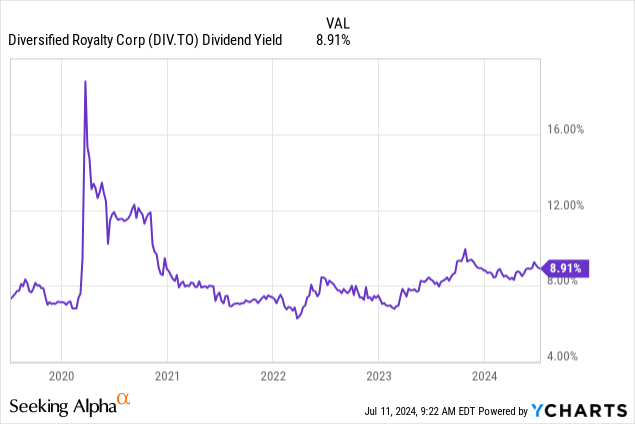

So we see the debt as very low risk here and would happily add to it in a market swoon. The common shares do offer a high yield, but we don’t see it as that attractive considering you can get about 6.6% from businesses like A&W Revenue Royalties Income Fund (AW.UN:CA) and Pizza Pizza Royalty Corp. (PZA:CA), both of which use about 1X debt to EBITDA.

Source: Another Dividend Hike Takes 8.6%-Yielder Higher.

The company has flat-lined since then, but the income has kept the tally going.

Seeking Alpha

We review the most recent results and tell you why we went for the exits.

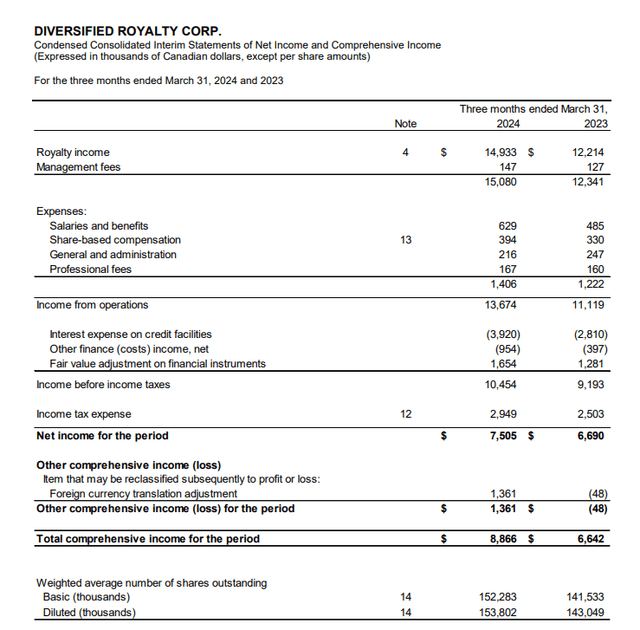

Q1-2024

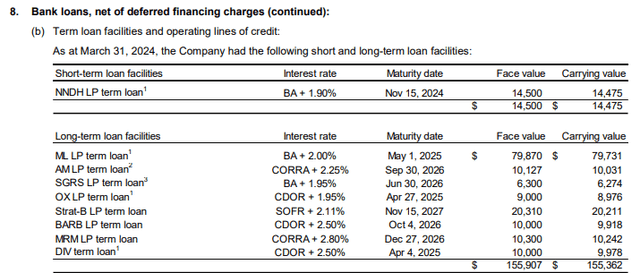

Diversified had a solid set of numbers for Q1-2024. Total revenues expanded at a brisk clip and reached over $15 million in the quarter. Expenses also rose at an operating level, but at a less glorious pace, and allowed income from operations to rise 22% year over year. If there was a detractor here, it was in the interest expense. The combination of higher flow-through rates (debt is all floating, but partially hedged) and higher debt, increased interest expenses by 40% year over year.

DIV Financials

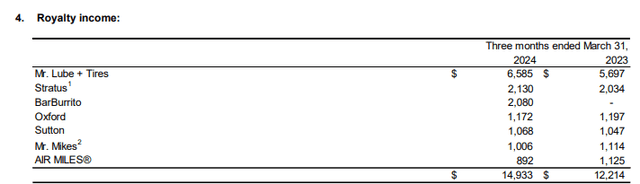

Breaking down the individual royalty partners, we can tell that most businesses are doing well. Mr. Lube was by far the best and revenues increased by 15.5%. BarBurrito made its first appearance in 2024 as the business was acquired and integrated late in 2023. MR MIKES and AIR MILES were the relative weak spots.

DIV Financials

The AIR MILES segment has been struggling for some time, ever since Bank of Montreal (BMO), (BMO:CA) took over. MR MIKES was a bit of a surprise as last quarter’s same-store sales growth was near 7%. We would see MR MIKES restaurant royalty as one of the more economically sensitive groups among the royalty set that Diversified has. We have also been seeing some increasing pressure in restaurant-related investments we cover, including AW.UN:CA, PZA:CA, and Boston Pizza Royalties Income Fund (BPF.UN:CA).

There was a hint of a slowdown late last year, but we really did not see it as the year-over-year numbers looked ok. As we rolled off the weak 2022 and rolled in the strong 2023 as comparatives, we are beginning to see the impact. All those interest rate hikes are now fully loaded onto mortgage resets, and the consumer is feeling the one-two punch of higher interest rates and high inflation. We tend to see royalty plays relatively insulated as they dabble only on the top line. But the fact that you are seeing a moderate impact here suggests the recession is not too far off.

Outlook

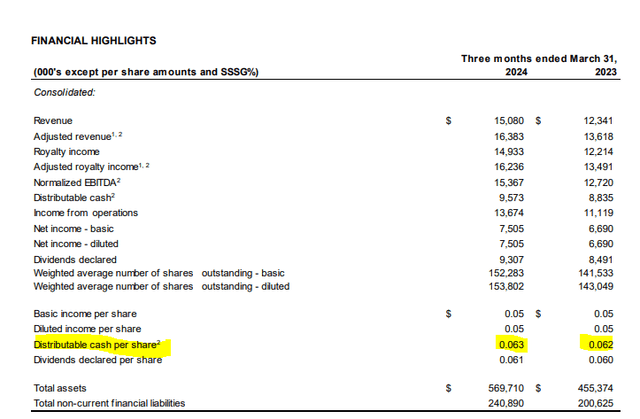

The quarter overall was fine. Diversified managed to nudge the distributable cash flow per share ahead by a smidgen. This was obviously far less than what the first set of numbers we presented, showed. The reason was, of course, the dilution and increased share counts to fund the BarBurrito acquisition.

DIV Financials

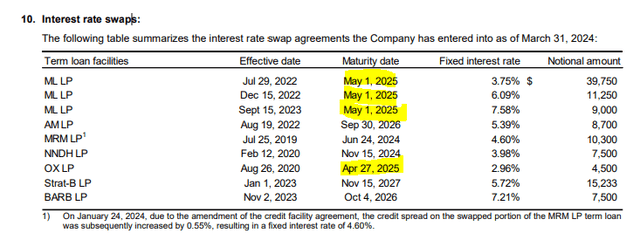

Nonetheless, and expanding the distributable cash flow per share metric, alongside a considerable yield, is pretty good. The two flies in the ointment were the expanding share count as mentioned and the really expanding interest rate expense. The latter remain manageable on an interest coverage basis. The interest rate swaps offer some protection, though we do see that more than half of the total swaps will roll off in 2025. One additional one has already rolled off on June 24, 2024 (not highlighted).

DIV Financials

The Bank of Canada did deliver one interest rate cut already, so at the minimum, this is not as bad as it looked six months back. But these debts are all floating rates, and the above rates are the fixed rate swaps that Diversified has in place. If you run an analysis of the rate structure (below) versus the fixed swapped rates (above), you can get an idea that the impact will be fairly minimal despite hedges running off.

DIV Financials

Diversified might even get a boost if we get 2-3 rate cuts by the end of 2025. The offset here is that the economy is struggling, and we will see that play on revenues and likely on valuations. The good news is that Diversified does yield a lot already, and the stock is unlikely to get cheaper than a 10%-11% dividend yield.

From our perspective, we remain on the lookout to pick Diversified Royalty Corp. stock up, but only at an attractive valuation. The current numbers don’t make the cut. Interestingly enough, the recent rally also pushed the bonds up a lot. We had given the convertible debentures our blessing when they yielded over 9% to maturity. They have a 6% coupon, but they were trading well below par then. The rally in all things big and small has pushed the price to $99.25 and the yield to maturity is now just 6.3%!

That is ridiculously low in our opinion. Yes, it is higher than what you can make on a 3-year GIC (4.6%), but we believe this pricing is wrong. We picked up a top-class BDC bond recently yielding almost 7%. Yes, those were in US dollars, but that return profile was excellent considering the upgrade in quality. We also got 8.31% locked for 5 years on a pseudo A-rated credit pipeline company. So 6.3% is “meh” at best when we are going for something like Diversified.

We sold out and are now searching for opportunities on the next sell-off. So far, trading opportunities have been a dime a dozen, and we expect big opportunities to actually come in faster when volatility increases.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here