Three months ago, in early April of this year, I wrote a bullish article regarding a fairly small bank by the name of Pathward Financial (NASDAQ:CASH). Of course, small as relative. For context, the company has, as of this writing, a market capitalization of $1.14 billion. Back then, the size of the business was a bit smaller. But the market has rewarded good performance over this window of time. Since the publication of that article, shares have skyrocketed by 14.5%. That’s well above the 5.2% increase seen by the S&P 500 over the same window of time.

With such a move higher over such a small period, you might think that the purpose of this article would be to downgrade the stock. That is a reasonable expectation, especially when you consider how expensive shares are on a price to book and price to tangible book basis. However, the business continues to achieve attractive growth on both its top and bottom lines. Furthermore, shares are cheap relative to earnings, and the quality of the institution’s assets is quite high. At the end of the day, I believe that there is further upside to be had. So because of that, I have decided to keep the company rated a ‘buy’ for now.

A solid play

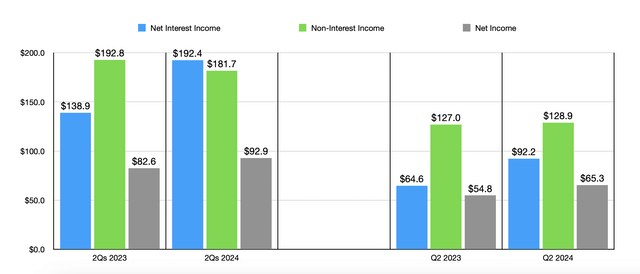

When I last wrote about Pathward Financial in April, we had data extending through the first quarter of the 2024 fiscal year. Today, that data now extends through the second quarter. In that prior article, I made clear that one of the reasons why I liked the business was because it continued to grow. And that sentiment hasn’t changed. Take, as an example, the net interest income generated by the institution in the second quarter of 2024. Net interest income for that time came in at $92.2 million. That’s 42.7% above the $64.6 million generated the same time one year earlier. Part of this improvement was because of a $10.7 million year over year drop in the provision for credit losses that the business booked. However, the company also benefited from other changes.

Author – SEC EDGAR Data

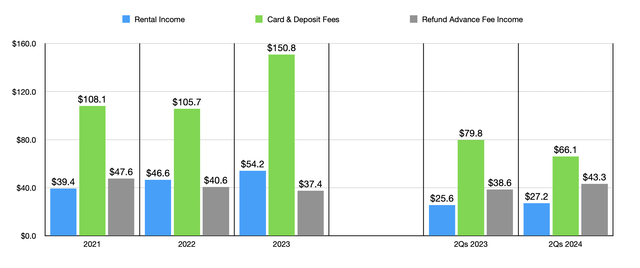

Most notably, interest income and fees managed to rise from $83.9 million to $102.8 million during this window of time. A lot of this was because of a rise in the total value of loans and leases from an average balance of $4.01 billion to $4.90 billion. There were other contributors as well. Normally with banks, you expect a significant increase in the cost of deposits when interest rates are on the rise. However, only 9.5% of the company’s average deposits during the most recent quarter were interest bearing in nature. So even though the cost of those deposits grew from 2.19% to 3.87%, the ultimate impact on the company’s top line was negligible. The fact that most of the deposits are non-interest bearing can be chalked up to the firm’s overall business model, essentially operating as a banking-as-a-service (or BaaS) provider that deals with prepaid cards, payment solutions, and that also engages in other activities like offering short term refund advance loans and short-term electronic return originator advance loans.

Author – SEC EDGAR Data

This is not the only part of the company that has seen some growth. In the second quarter of 2022, non-interest income was $128.9 million. In recent years, the bank had seen some attractive growth from certain market segments. In the chart above, you can see what some of these have been. However, the growth experienced in some weakness in these areas, such as when it came to card and deposit fees, and refund transfer product fees. The increase, then, largely came from a rise in refund advance fee income and a slight increase in rental income. With net interest income and non-interest income both rising, net profits for the institution also improved. They ultimately rose from $54.8 million to $65.3 million. Of course, the second quarter was not a one-time blip. For the first half of the year as a whole, net income increased, rising from $82.6 million to $92.9 million.

Author – SEC EDGAR Data Author – SEC EDGAR Data

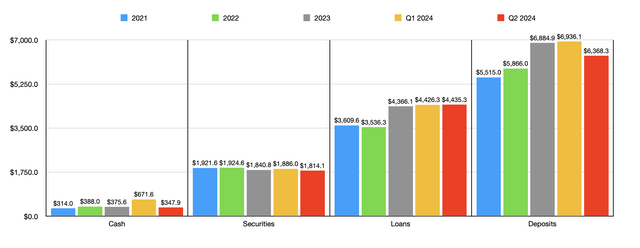

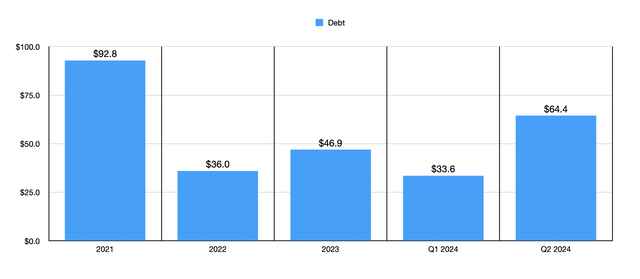

There have been other parts of the company that have expanded as well. But a big exception to this would be the value of deposits on its books. These actually contracted from $6.94 billion to $6.37 billion. Normally, I would find this concerning. I would also find the drop in cash from $671.6 million to $347.9 million, and the decline in securities from $1.89 billion to $1.81 billion, concerning. However, the value of loans did increase modestly from $4.43 billion to $4.44 billion, while debt remained low at only $64.4 million. I also take comfort in the fact that uninsured deposits account for only 16.2% of total deposits. This makes the probability of a crisis at the institution, similar to what we saw in March of last year throughout the sector, quite low.

Author – SEC EDGAR Data

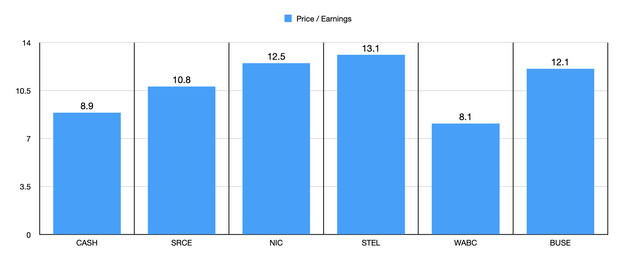

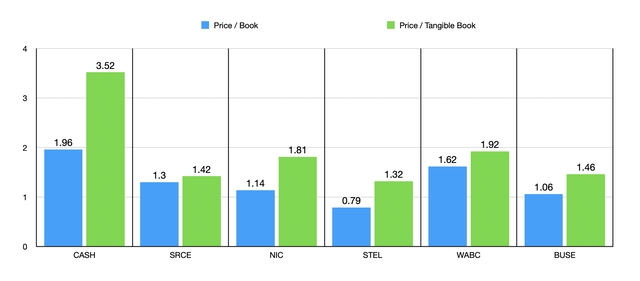

In terms of valuation, the company is both cheap and expensive. In the chart above, you can see how shares are priced relative to earnings. With a price to earnings multiple of 8.9, we find that only one of the five companies I compared it to in that chart ended up being cheaper than it. In the chart below, meanwhile, I looked at the business through the lens of the price to book multiple and the price to tangible book multiple. And in both of those instances, Pathward Financial ended up being the most expensive of the group.

Author – SEC EDGAR Data

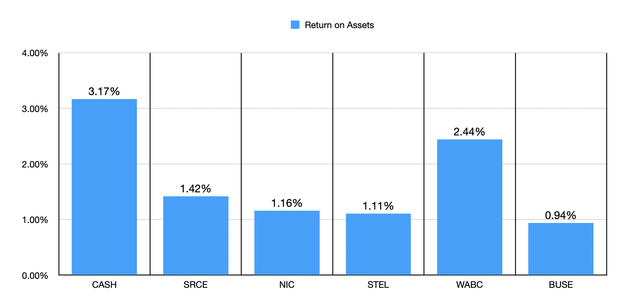

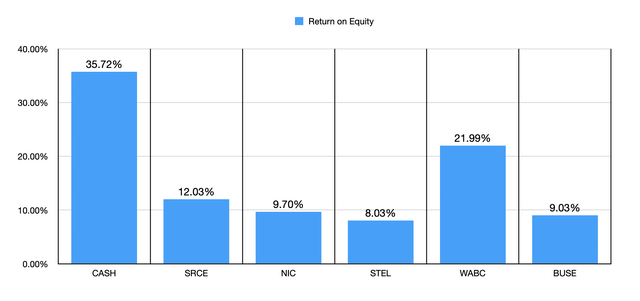

Usually, I would consider such a high price to book multiple a deal breaker for a financial institution, especially a bank. However, considering that the majority of the company’s revenue comes from non-interest income, I view the picture a bit differently. At its core, Pathward Financial is more a diverse financial institution that just so happens to have banking operations, as opposed to being the opposite. This also reflects in the quality of the institution’s assets. In the first chart below, you can see how the firm stacks up against five similar businesses when it comes to the return on assets metric. Of the group, Pathward Financial ended up being the highest. In the subsequent chart, I did the same thing when it came to return on equity. Once again, our candidate was better than its peers.

Author – SEC EDGAR Data Author – SEC EDGAR Data

Obviously, as with any investment, investors would be wise to pay careful attention to risk factors. I would argue that one of the bigger risks facing Pathward Financial at this time would be a decline in interest rates. With many financial institutions, rising interest rates can prove a problem. This is because the increase in interest rates can make it appealing for depositors to place funds elsewhere. Good seeing as how the vast majority of Pathward Financial’s deposits are not interest bearing, the math here changes. The Federal Reserve began raising interest rates in March of 2022. In 2021, the net interest margin for the company was 3.84%. This number grew to 6.05% in 2023. The fact that an overwhelming majority of its assets are interest-bearing ($6.42 billion compared to $399.7 million that is in the form of interest-bearing liabilities as of the end of the 2023 fiscal year) is indicative that a reduction in interest rates could prove painful for the company.

There are always other risks as well. In April of this year, news broke that the company would be paying refunds and a penalty related to an investigation by the New York Attorney General Letitia James. The combined amount is just over $700,000, with $627,000 of it in the form of a penalty. According to the investigation, from 2016 to 2022, Pathward Financial ‘illegally froze some 1,400 accounts belonging to New Yorkers’. It’s supposedly instructed third party servicers to do this and to turn over consumers funds to debt collectors. This allegedly happened multiple times. This can best be described as a compliance and managerial problem. But whenever there is something of this nature, the public perception at least is that there is an increased chance that there are other compliance and managerial issues yet to be discovered. So from a regulatory perspective, there is some concern.

Takeaway

Fundamentally speaking, Pathward Financial is doing really well for itself. Recent share price performance has reflected improved fundamentals, though it is true that some parts of the balance sheet declined in value. The company’s top and bottom lines continue to grow, asset quality is top notch, and shares are cheap relative to earnings. Given these factors, I have no problem keeping the business rated a ‘buy’ at this time.

Read the full article here