Pinterest’s (NYSE:PINS) stock has performed well over the past two years on the back of accelerating growth and improving margins. There appears to be growing concern about the strength of consumers and the digital advertising market, though. While this could create short-term volatility, Pinterest is well positioned to navigate any weakness as a result of its improving tech stack and strong balance sheet.

I previously suggested that Pinterest’s share price, and the narrative surrounding the company, was trailing its recovery after a difficult multi-year period. Pinterest remains a growing platform with an under monetized user base, although this is changing as a result of initiatives like third-party partnerships. Absent changes to the macro environment, Pinterest should continue to grow at a healthy pace, with margins improving as the business scales.

Market Conditions

Most social media and adtech companies have enjoyed some respite over the past year as the ecosystem has adjusted to privacy changes. There are now mounting concerns that demand could be deteriorating as a result of consumer weakness, though. For example, it has been suggested that direct response campaigns on Facebook are under pressure, with notable weakness in June. This trend has been most apparent within ecommerce, which could be reflective of consumer weakness. Meta’s (META) return on ad spend is reportedly still outperforming peers, though.

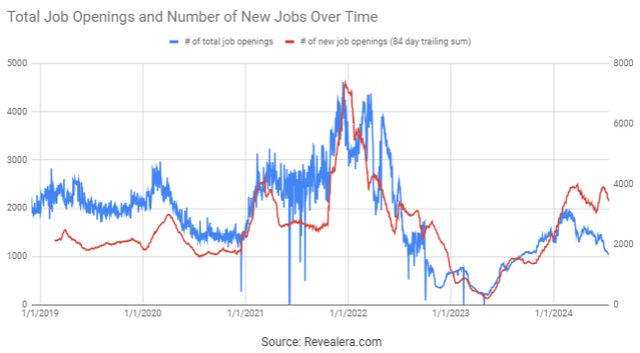

Figure 1: Meta Job Openings (source: Revealera.com)

Piper Sandler also noted slower growth in traffic from Pinterest to Amazon (AMZN) in May, with YoY traffic growth of 83%, down from 147% in April and around 100% in the prior seven months. In addition, cost per click continued to decline between February and May, which is not surprising given Pinterest has stated that pricing remains under pressure.

While Pinterest is heavily dependent on the macro environment and consumer spending, the fact that its user base is under monetized positions it to weather any macro weakness.

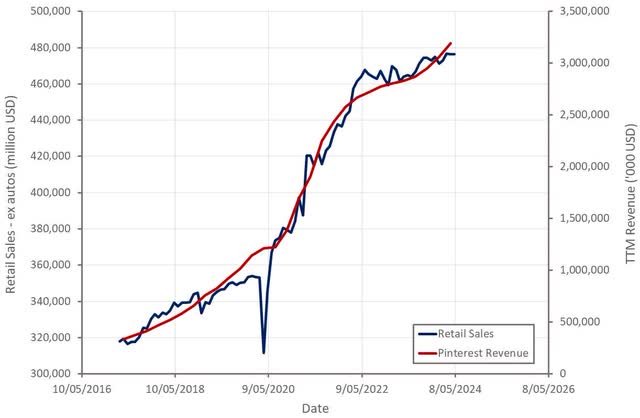

Figure 2: US Retail Sales and Pinterest Revenue (source: Created by author using data from Pinterest and The Federal Reserve) Figure 3: Peer Revenue Growth (source: Created by author using data from company reports)

Pinterest Business Updates

While the macro environment has become less of a headwind in recent quarters, Pinterest’s growth is being driven by internal efforts, including efforts to:

- Attract new users

- Increase engagement

- Increase ad load

- Improve targeting

- Improve attribution

- Attract incremental demand

AI

Pinterest has been trying to embed generative AI in the platform to improve the user experience. The company has also transitioned to GPUs, allowing it to user far larger models so that it can serve users more personalized content, and improve engagement.

Pinterest is also introducing generative AI to support the creation of advertising content. The risk is that this results in generic content which performs poorly. Pinterest wants to be able to differentiate its models using unique first-party signals, though.

Shopability

Pinterest continues to improve the shopability of its platform, which should eventually support its advertising business. This includes shoppable videos, which were introduced during the first quarter. Pinterest has been pushing shopping for several years, which is important as users have commercial intent which just needs to be realized.

Targeting and Actionability

Pinterest is also trying to increase return on ad spend by improving targeting and making its ads more actionable. Mobile deep linking and direct links improve actionability and this is contributing to increased clicks to advertisers. Pinterest finished the rollout of direct links in March and expects this feature to continue providing a tailwind going forward. Direct links now cover 97% of Pinterest’s lower funnel revenue, up from 80% in the previous quarter. While it is taking time, direct links are increasing ad spend, particularly amongst larger and more sophisticated advertisers. Some of Pinterest’s larger customers are now spending upwards of 5% of their total ad budget with Pinterest.

Attribution

In addition to improving ROAS, Pinterest also needs to demonstrate improved ad performance, The company is trying to drive adoption of API for conversions, which provides a server-to-server connection for advertisers to measure and attribute conversions. Adoption of the API now covers nearly 40% of total revenue, up from 28% in September 2023. Pinterest now also supports clean rooms and has integrations with over 20 measurement platforms.

Automation

Automation is another focus area for Pinterest, with the company trying to drive adoption amongst advertisers. The company’s suite of performance features includes tools like automated bidding, expanded targeting, and flexible daily budgets. Automated bidding now covers of 80% of Pinterest’s revenue. Pinterest also plans on introducing a campaign creation tool to simplify setup for its automated offerings.

Third-Party Demand

Third-party demand is beginning to provide a meaningful tailwind, and this should only strengthen going forward. Pinterest’s current partners are Amazon in the US and Google internationally. Pinterest’s relationship with Amazon is expected to bring in around $120 million of incremental revenue in 2024.

Google Ads Manager went live in February in unmonetized international markets. This is important as a large portion of Pinterest’s user base hasn’t been generating any revenue at all, providing an easy growth opportunity which will be supportive of margins.

Financial Analysis

Pinterest’s revenue growth accelerated significantly in the first quarter, supported by the leap year and Easter dates, which contributed an estimated 2% to growth. Third-party demand partnerships were an emerging contributor to growth.

Ad impressions increased 38% YoY in the first quarter, driven by both increased ad load and total impression growth. Ad load growth is supported by initiatives like whole-page optimization, improved personalization and an expanding advertiser base. Pinterest believes that it can continue to increase ad load without negatively impacting the user experience as it improves the actionability and relevancy of its ads.

Ad pricing declined 11% YoY, a modest improvement from the 16% drop registered in the previous quarter, with Pinterest attributing the improvement to accelerating ad demand. As Pinterest continues to improve its targeting and attribution and brings more demand to the platform through third-party partners, ad pricing should return to growth.

Second quarter revenue is expected to be in the $835-$850 million range, representing 18-20% YoY growth. I think growth is likely to come in at around 22.5%, although this may not be sufficient to move the stock significantly higher. Comparables will become more difficult as the year progresses and the impending deprecation of third-party cookies on Chrome is creating uncertainty.

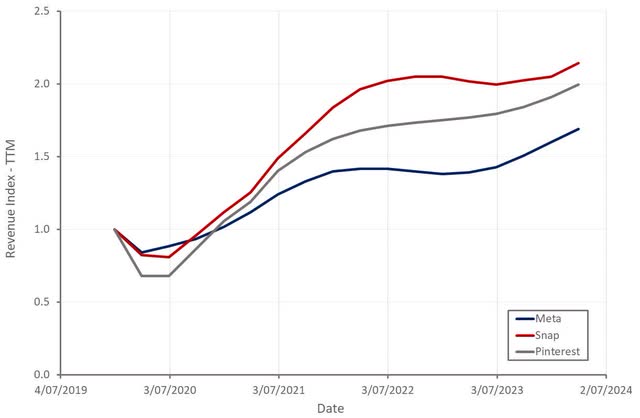

Figure 4: Pinterest Revenue Growth (source: Created by author using data from Pinterest)

Pinterest is back to pre-COVID user growth in absolute terms and most of these are mobile app users. Engagement growth also continues to exceed user growth. Gen Z remains an area of strength, with this cohort now representing more than 40% of Pinterest’s users. This is an interesting development as many internet platforms face the problem of its user base aging over time, which could eventually be an existential risk. The fact that Pinterest doesn’t have a strong social element may be allowing a diverse user base to coexist without creating tensions.

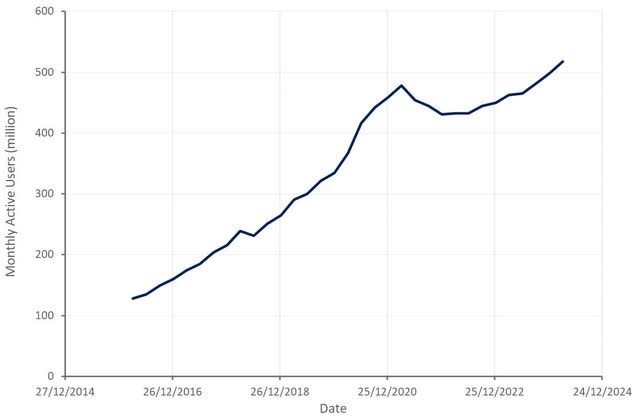

Figure 5: Pinterest Monthly Active Users (source: Created by author using data from Pinterest)

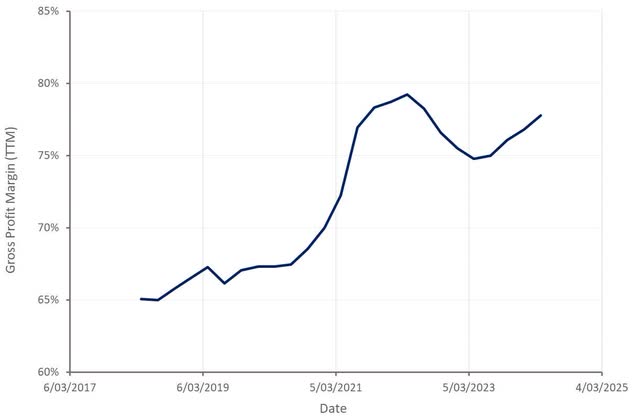

Pinterest’s gross margins continue to recover, despite pricing headwinds. The company’s infrastructure spend is increasing to support user and engagement growth, although cost optimization efforts are optimizing this somewhat. Given that Pinterest continues to improve the monetization of its user base, the company’s gross margins should generally continue to trend upward.

Figure 6: Pinterest Gross Profit Margin (source: Created by author using data from Pinterest)

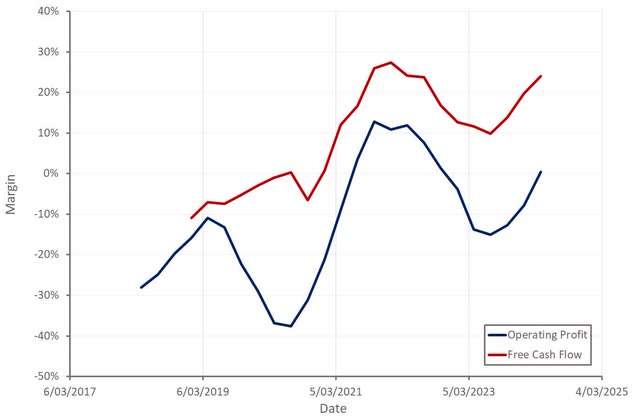

Pinterest’s operating profitability and free cash flows also continue to improve. Adjusted EBITDA was $113 million (15% margin) in Q1. Operating margins should trend upwards as Pinterest continues to scale, and I ultimately expect margins will end up in excess of 30%.

Figure 7: Pinterest Margins (source: Created by author using data from Pinterest)

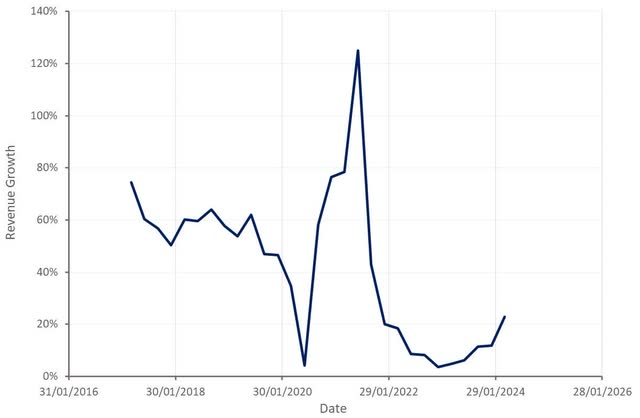

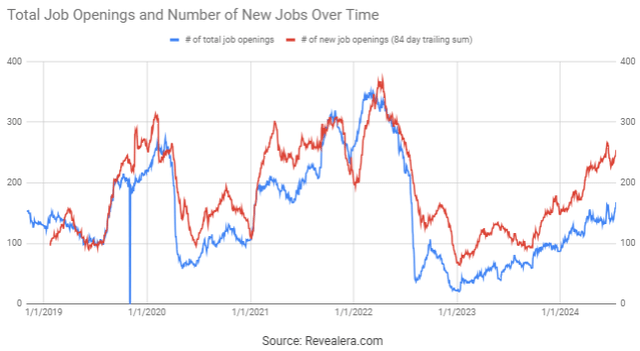

Pinterest’s job openings continue to increase, which suggests that the company’s fundamentals continue to strengthen.

Figure 8: Pinterest Job Openings (source: Revealera.com)

Conclusion

Pinterest’s revenue multiple has increased significantly over the past nine months and may not have room to run much further. The stock should continue to perform well though, driven by solid growth and improving margins. While the macro environment remains challenging, Pinterest’s fundamentals should continue to strengthen as the company better monetizes its expanding user base.

Pinterest also has around $2.8 billion of cash, cash equivalents and marketable securities. This, along with strong cash flows positions the company to return a significant portion of its current market capitalization to shareholders over the next five years.

Pinterest is not without risks though, as privacy initiatives could create more headwinds and Pinterest is heavily dependent on the broader economy, which is looking shaky. If the stock loses support at $40, Pinterest could retrace to $35 or lower. Overall, the risk-return tradeoff looks favorable, though.

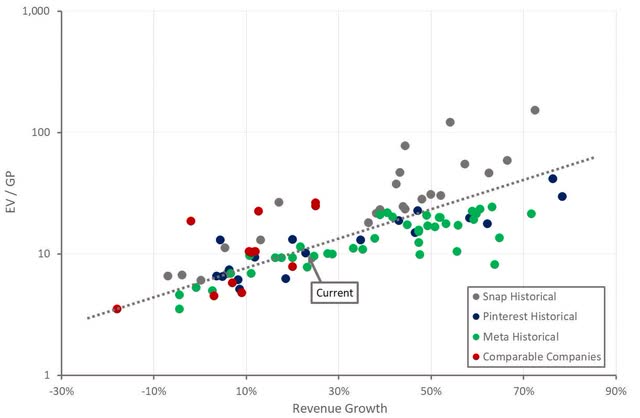

Figure 9: Pinterest Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here