Article Thesis

Tesla, Inc. (NASDAQ:TSLA) reported its second-quarter earnings results on Tuesday afternoon. The company missed estimates on the bottom line, which resulted in a share price decline. I believe that these results do not support the current share price and very elevated valuation.

Past Coverage

I last covered Tesla around three months ago, when the company announced its first-quarter earnings results. Since then, shares have risen rapidly, although that was largely the result of future robotaxi announcements, while the underlying business performance was not very exciting. In fact, not too long ago, Tesla had to announce that its deliveries during the second quarter were down compared to last year’s second quarter — although Tesla still marginally beat analyst estimates with its Q2 delivery number. In today’s article, I’ll focus on Tesla’s Q2 results and what they tell us about the company.

What Happened?

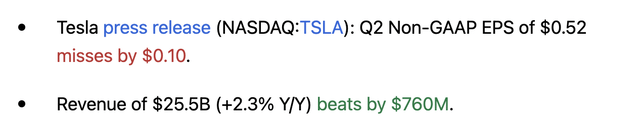

The world’s leading automobile company by market capitalization announced its most recent quarterly earnings results, for its fiscal second quarter, on Tuesday afternoon, following the market’s close. The headline numbers can be seen in the following screencap:

Tesla results (Seeking Alpha)

Tesla was able to generate revenues that were substantially higher than expected. The recent trend implied that revenues would be down on a year-over-year basis, as this had been the case during the first quarter of the current year, when Tesla reported a 9% revenue decline. Analysts were expecting a small revenue decline for the second quarter as well. Results during the second quarter were better than expected, however, with Tesla managing to deliver a small revenue increase in nominal terms.

These results were still far from great, I believe, considering the fact that EV companies are oftentimes considered growth investments. Furthermore, Tesla’s valuation of around 100x forward net profits implies that the company will grow at a massive pace in the future. However, at least right now, that is clearly not happening, as revenue growth was slightly below the recent inflation rate of 3% in June, the last month of the second quarter. Depending on whether one looks at nominal or real revenues, there is thus slow to no growth.

The fact that the company’s revenue performance was better in Q2 compared to Q1 can be partially explained by the fact that there was no disruption in the Berlin Gigafactory during the second quarter, unlike during the first quarter.

When it comes to profits, Tesla hit earnings per share of $0.42 on a GAAP basis. That is down from $0.78 during the second quarter of 2023. Thus, profitability clearly remains under pressure. The market reacted negatively to these results, sending Tesla’s shares lower by a little more than 3% at the time of writing. Let’s delve into the results.

Tesla: Growth Has Stalled

For years, the market for electric vehicles grew nicely, and Tesla and many of its peers saw substantial growth in deliveries. This former growth has ground to a halt at Tesla, with vehicle volumes being down slightly during the most recent quarter. In fact, the combination of weak prices for Tesla’s vehicles and sluggish sales numbers made Tesla’s automotive revenue decline by 7% year-over-year. In other words, Tesla’s main business, which contributes around 80% of the company’s total revenue, is declining, at least for now. To some degree, this is due to market weaknesses — in some European countries, for example, lower subsidies have resulted in lower EV sales. But not every EV company is experiencing the declines that Tesla is experiencing; thus there are company-specific factors at play as well. BYD Company (OTCPK:BYDDY, OTCPK:BYDDF), Tesla’s biggest competitor, is seeing ongoing sales growth, for example, while NIO (NIO) had a strong second quarter as well. Even legacy automobile companies such as BMW (OTCPK:BMWYY) are successful in the current environment — BMW saw its EV sales rise by 34% during the first half of the current year.

So while growth at Tesla has stalled (or is negative), some competitors are still seeing their sales numbers grow. A weaker market growth rate alone does thus not explain Tesla’s issues. Instead, it looks like consumers are increasingly finding Tesla’s offerings less appealing compared to what its peers are offering. This could be due to a somewhat stale and rather limited model line-up, while the company’s CEO Elon Musk has also been a somewhat controversial figure in the eyes of some consumers. Ultimately, it appears Tesla cannot capture the minds of the EV consumer the way it did in the past, which is why it is struggling to generate sales growth while competitors such as BYD or BMW are gaining market share.

Tesla also has its non-auto businesses, such as the energy business. Here, revenues have been lumpy, which is why there are significant quarter-to-quarter swings. Q2 was a strong quarter for the energy business, with a relative growth rate of 100%, albeit from a much lower level compared to the automobile business. Still, that was a strong result and helped Tesla to beat the analyst consensus revenue estimate. If Tesla can keep the momentum intact in the energy business, that would be great. However, history suggests that revenues will remain lumpy and that there is a good chance that revenue growth will be weaker in the future. Between Q2 of 2023 and Q1 of 2024, for example, overall revenue growth for the energy business was just a couple of percentage points, so I believe that it is unlikely that we will be seeing consistent 100% growth rates going forward.

The services business performed nicely as well, with a growth rate of around 20%. Unfortunately, this is the smallest business unit by far, which is why company-wide revenue growth remained pretty weak despite the appealing performance of both the energy business and the services business.

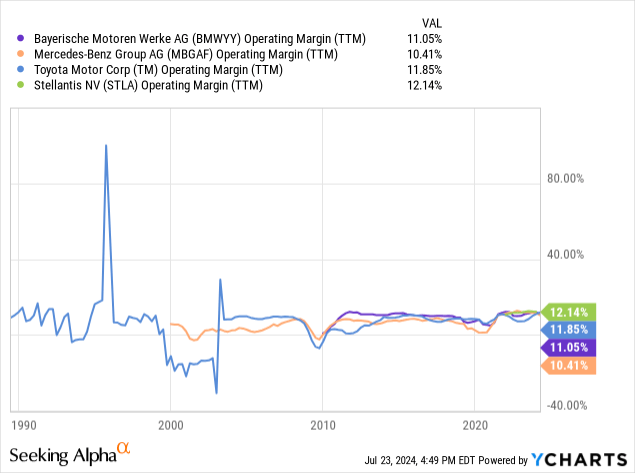

Of course, profits are ultimately even more important than revenues, as profits allow for reinvestment, shareholder returns, M&A, and so on. Here, the trend is clearly against Tesla. Despite being able to eke out a small revenue increase, profits continued to collapse. Tesla’s operating margin declined by around one-third year-over-year, from a solid (although far from great) level of 9.6% to just 6.3% — the following chart shows that this is not up to par compared to what Tesla’s peers can achieve:

Both legacy premium automobile companies such as BMW or Mercedes (OTCPK:MBGYY) and legacy mass-market players such as Toyota (TM) or Stellantis (STLA) are generating margins that are way higher than those of Tesla. Long gone are the days when Tesla was able to generate strong margins thanks to a lot of pricing power.

Earnings per share came in more than 40% lower compared to the previous year’s quarter, both on a GAAP and a non-GAAP basis, which brings up the question of why this company should be valued at 100x net profits. Alphabet/Google (GOOG, GOOGL) also announced results today, delivering an arguable far stronger report with lots of revenue growth and earnings per share growth of more than 30%. And yet, Alphabet trades at around one-quarter of Tesla’s valuation.

It is, of course, possible that Tesla eventually solves self-driving and enjoys strong profits in the robotaxi business. But so far, all of Elon Musk’s promises have failed to materialize — there aren’t a million robotaxis on the road today, and no coast-to-coast summoning is available. The highly anticipated event that was originally planned for August has been pushed down the road, and we don’t know yet when (or if) something big will be announced.

Those who want to buy Tesla due to its potential in robotaxis can do so, of course, but when we look at the existing businesses today, the current valuation seems unjustified. The core business is declining both in terms of units and revenues, and while the energy business had a strong quarter, it remains to be seen whether that trend is sustainable or not. For now, margins continue to compress, with profits falling rapidly — and yet, Tesla is trading at one of the highest valuations in the stock market. Nvidia (NVDA) trades at less than half Tesla’s earnings multiple and has explosive business and profit growth, an excellent market position, and ultra-strong (and growing) margins.

Takeaway

I think that Tesla’s results showcase that the company is overvalued right here. The core auto business is struggling, margins and profits are moving in the wrong direction, and free cash flows remain weak, at just $1.6 billion over the last four quarters. That makes for an extremely high free cash flow multiple of around 500, for a free cash flow yield of 0.2% (none of which is paid out to shareholders).

With higher-quality growth companies being available at much lower valuations, I don’t see a reason to own Tesla, Inc. stock. Those who trust in Elon Musk’s ability to deliver robotaxis may disagree, but I don’t like buying overvalued stocks due to management’s promises.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here