I highlighted Booz Allen Hamilton Holding Corporation’s (NYSE:BAH) strength in the cyber, 5G and AI in defense and civil markets in my previous coverage published in May 2024. The company released its Q1 result on July 26th before the market opened, reporting 10.6% organic revenue growth and a 1.7% operating profit decline. While the company is facing near-term margin pressure, I favor the company’s continued efforts to invest internally to capture the rising demand in defense and civil markets. I reiterate a “Strong Buy” rating with a fair value of $180 per share.

Strong Top-line Growth with Weak Margins

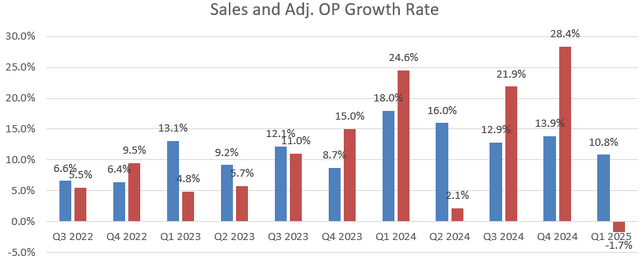

The short summary for the quarter is a double-digit topline growth clouded by a weak bottom-line growth. As shown in the chart below, the company delivered a 10.8% growth in revenue but a 1.7% decline in operating profits.

Booz Allen Hamilton Quarterly Results

The strong topline growth and weak margin were driven by several factors:

- As discussed in my previous coverage, Booz Allen Hamilton is well positioned in the civilian, intelligence, and defense mission markets. For instance, Booz Allen Hamilton’s space business reached $0.5 billion with a fast growth rate.

- The company is strategically focusing on AI and cybersecurity markets, providing leading technologies for the public sector. I continue to believe AI and cybersecurity could fuel the company’s growth in the near future.

- As disclosed in the earnings report, their client staff headcount increased 7.7% year-over-year, and is approximately 700 higher than at the end of the prior quarter. The headcount increase put lots of pressure on the company’s margin expansion for the quarter. However, I believe the investment in headcount makes strategic sense and could help the company capture the future growth in the public sector.

- As communicated over the earnings call, the management does not manage its expenses on a quarterly basis, but instead on an annual basis. I think it is understandable to see the company’s margin vary quarter-over-quarter.

FY24 Outlook and Valuation

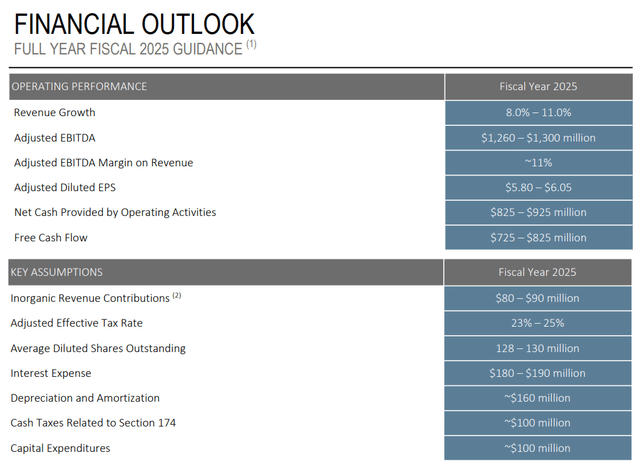

As detailed in the table below, the company guides 8%-11% revenue growth and around 10% EBITDA growth for the full year.

Booz Allen Hamilton Investor Presentation

I am assessing the following factors for its near-term growth:

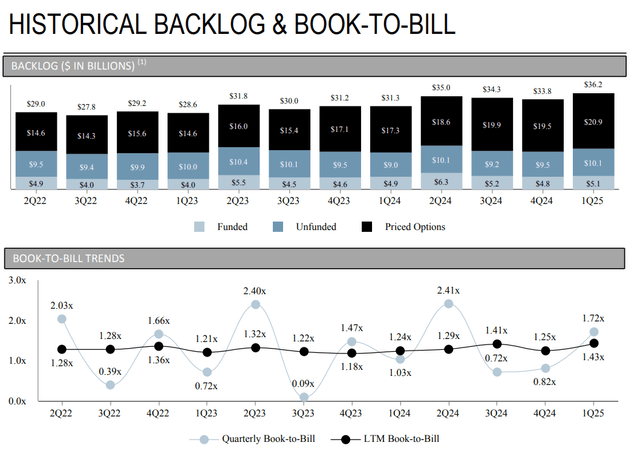

- As shown in the slide below, Booz Allen Hamilton’s backlog hit a record high of $36.2 billion, increasing by 16% year-over-year. The strong backlog growth could potentially translate into the company’s revenue growth in the coming years.

Booz Allen Hamilton Investor Presentation

- On June 10th, Booz Allen Hamilton announced to acquire PAR Government Systems Corporation for $93 million to accelerate warfighter technology on the front lines. The acquisition also contributed to the 7.7% headcount growth for the quarter. It is a small deal, but I think it meets all the criteria for Booz Allen Hamilton’s acquisition strategy.

I forecast Booz Allen Hamilton will deliver 10% growth in revenue, assuming 5% growth in the traditional IT consulting and implementation businesses; 3% growth from new technologies including AI, cyber, data analytics and 5G; 2% growth from acquisitions.

I anticipate the company will expand its margin by 10-20bps annually driven by a 5bps expansion from gross margin, and a 5-15bps operating leverage from SG&A.

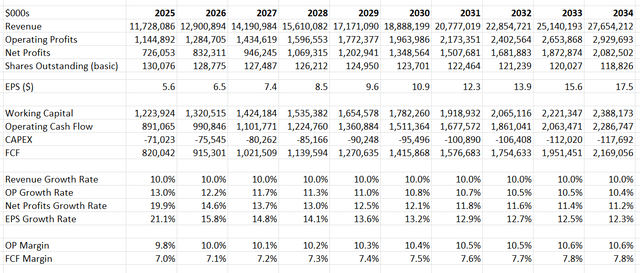

The discounted cash flow, or DCF, summary can be found as follows:

Booz Allen Hamilton DCF – Author’s Calculations

I apply a WACC at 7% in the DCF model assuming: risk-free rate 4.2% (US 10Y Treasury Yield); Beta 1.2 (5Y average); equity risk premium 7%: cost of debt 7%; equity $1 billion; debt $3.4 billion, tax rate 24%.

Discounting all the future FCF, the fair value of its stock price is calculated to be $180 per share.

Downside Risks

During the earnings call, the management expressed concerns about soft contract-level profitability and lower utilization for the quarter, which, along with headcount growth, caused margin pressure for the company. As analyzed in my previous coverage, Booz Allen Hamilton operates in the public market, where the timing and type of contracts are difficult to predict and can vary quarter-over-quarter. While I remain confident in the company’s long-term growth, the low utilization could potentially continue in the next quarter, creating ongoing cost pressures for the company.

Conclusion

While the weak margin expansion in Q1 upset the market, I think it is short-term in nature. I am impressed with the company’s double-digit revenue growth, driven by the adoption of new technologies in the public sector. I reiterate a “Strong Buy” rating with a fair value of $180 per share.

Read the full article here