Digest Some Profit

Our group was investing in food and beverage companies in 2017. We mistakenly thought The Kraft Heinz Company (NASDAQ:KHC) stock was a good buy. It was selling then for $86.67 per share. The company unraveled but recently got traction with other consumer staples stocks.

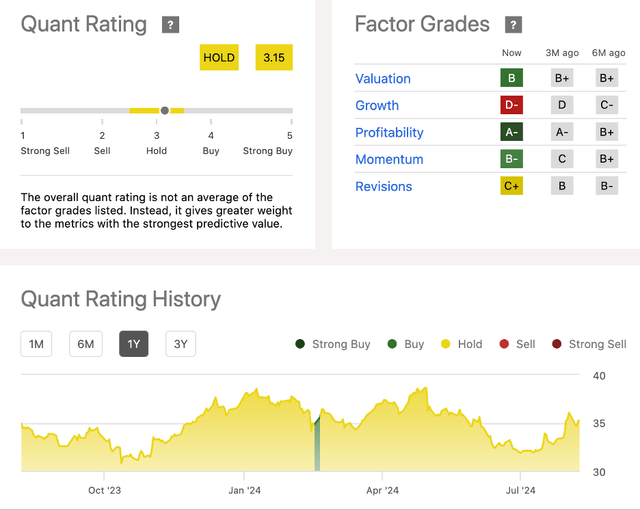

We think the stock is a Sell opportunity after its pop in price last week. Seeking Alpha’s Quant Rating is Hold, and has been for most of the past three years. If the share price slips to around $30 again it can be an opportunity to make Moderate Buys.

Despite the stock’s price pop during the first week in August, the share price is still down -4.6% YTD. Despite a profit beat reported in Q2 ’24, we do not foresee any catalyst for the shares rising much higher in price this year.

Share Price Ups & Downs (Seeking Alpha)

Sales were reportedly down 3.6% in Q2 ’24 Y/Y, and in July, management cut full-year sales guidance to zero-to-minus 2%. They maintain the EPS will be $3.01 to $3.07. Calculating the P/E (11.64 FWD) to 2024 earnings, about $35 is a fair price. However, Kraft Heinz stock is not easy to predict. Graphed fluctuations look like a mountain range with peaks and valleys.

Downsides and Highlights

There are plenty of metrics at this time to suggest there will be opportunities for retail value investors to buy back any shares one might sell. First, there is the conservative guidance from management. Management was cautious in July’s talk with analysts and shareholders. The momentum is still not strong or consistent. Growth prospects weakened this year. Inflation and recession threats loom. The share price is +2% over the last 12 months, but that is after a 7-day winning streak to open August ’24. The share price plummeted to ~$22 in March 2020, topped $44 per share in 2022, dived to below $31 in October ’23, and is opening the second week of August at $35.67, which is closer to its 52-week high of $38.96.

Quant Rating & Factor Grades (Seeking Alpha)

Why consider any buyback of shares at lower prices? Kraft Heinz owns ~13% of the market share relative to food processing competitors and 6.2% of the retail food distribution industry. It is the third-largest food and beverage firm in North America and fifth globally. Market power and the profitability of Kraft Heinz give the company the potential for growth that investors overlook, perhaps because we are so familiar with the company. Another reason we foresee potential in owning the shares bought at the right price is the dividend yield is a safe 4.2%. Short interest stands at a low 2.2%. Q2 ’24 EPS beat estimates but was reported lower at $0.78 than the EPS of $0.79 in Q2 ’23.

Second-quarter highlights noted by the company include:

- Net sales decreased by 3.6%, and Organic Net Sales fell by 2.4%.

- The gross profit margin increased to 35.5%.

- Operating income was -62.1%.

- Net cash from operating activities was $1.7B or +8.1%; free cash flow was $1.2B up 8.7%.

- EBIT is up almost 8% over 12 months.

Risks

Last week’s price rise was bootstrapped by the positive news about profit beats announced across the consumer sector. The Seeking Alpha newsletter editor observed that 7 out of 11 corporations beat profit estimates, but “only two companies exceeded revenue estimates….” The Consumer Staples Select Sector SPDR Fund ETF (XLP) is up from $65.18 in October ’23 closing last week at $79.15, i.e., 5.77% over 12 months and 9.88% YTD. Seeking Alpha assigns the stock with a Buy rating while Seeking Alpha analysts judge it as a Strong Buy opportunity.

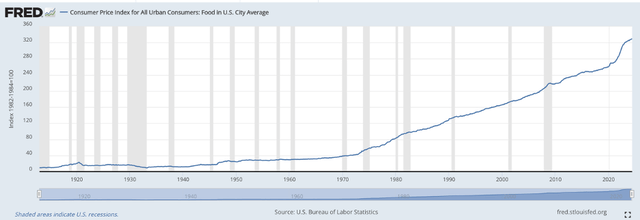

Management was able to report advances realized in the Q2 ’24 earnings report from long-term changes in marketing, procedures, and policies taking hold. Highlights for us from the talk are the $1.5B return of capital via the better-than-sector average dividend and company stock buybacks. Cash flow was up $100M or 9% Y/Y. Moderating the impacts of inflation and higher maritime shipping costs will be an intense long-term process for management. Then there is the threat of a recession per the shaded areas on the FRED chart below:

CPI Food in USA (U.S. Bureau Labor Statistics)

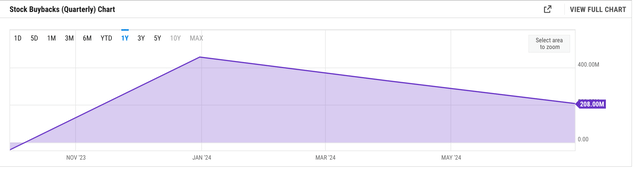

The substantial long-term debt incurred largely from M&As. EBIT covers interest payments. Total debt has held near constant for the last several years but is down from ~$28B in 2020 to $19.26B in June ’24. Some shareholders prefer that their companies buy back stock rather than increase the dividend. Kraft Heinz repurchased $537M in stock since the $3B plan was approved last November.

Stock Buybacks (YCharts)

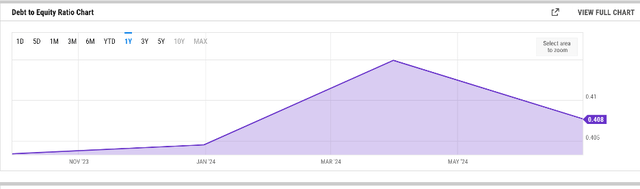

We prefer the company make serious paydowns to the debt rather than increase the dividend or share buybacks, especially following management’s flat top-line forecast. The current debt-to-equity ratio of ~40% is satisfactory but on the high side of what we prefer; the average ratio in the food processing industry is 33.27%.

Debt to Equity Ratio (YCharts)

Hedge funds decreased their share-holdings by +850 thousand last quarter. There is no trend in hedge fund ownership other than the number of funds holding steady the past year at ~44. Likewise, with insider trading. Institutions hold 53% of the outstanding common shares, public companies own 27%, and the public owns +19%. Mr. Buffett reportedly owns 325M shares, 25% of the company.

Expectations are factored into the positive Factor Grades the company gets. The B for valuation is based on the company’s good P/E to the sector’s P/E both TTM and FWD. Price-to-book and Cash Flow are better than satisfactory. The Price-to-Sales grade of C- reflects the weaker current top line and prospects. Growth is expected to be less than 2% in FY ’24. The company rating benefits from its profitability after margins largely came in higher than the sector’s margins. Weakness is most evident in Return on Common Equity (3.89%) and Asset Turnover (0.29x). We do not expect Kraft Heinz can squeeze better Net Income Per Employee at ~54 thousand dollars each after years of micromanagement cost-cutting.

Takeaway

Kraft Heinz is a powerhouse in the marketplace. Its condiments and brand names dominate large parts of the consumer staples industry. The debt level and scant growth continue to cause distress among investors despite profitability and the stock being undervalued. The consensus for the average target share price is $45 to $55 over the next 12 months. We do not foresee the price rising much above $37 per share. Share price momentum recently improved on profit reports among most of Kraft Heinz’s peers; strong sustainable momentum, in our opinion, needs top-line growth and good bottom-line margins to spur the share price. We believe this is a good time for retail value investors to consider our Sell assessment after the share price increase; they can consider modestly acquiring shares on price weakness.

Read the full article here