Investment Thesis

Taylor Devices (NASDAQ:TAYD) reported a nice quarter and full year results for 2024, setting record high sales and profits. Backlogs continues to be healthy and the company shows no signs of slowing down fundamentally, but the valuation is pretty fair. Given the company’s experience, track record, and growing momentum in fundamentals, I think the company’s products are high-quality and efficiently produced seeing that profit margins have expanded from 15.6% to 20.2%. However, at around 20x trailing earnings the stock seems reasonably priced and I think some talks of economic slowdowns may cause revenue growth to slow, specifically in the Structural and Industrial segment. Therefore, I rate shares as a hold as I am cautious about the potential industry slowdown from Taylor Device’s customers.

Company Overview

Taylor Devices is a “leading manufacturer of shock absorbers, liquid springs, shock isolation systems, seismic isolators, vibration dampers, power plant snubbers, and other types of hydro-mechanical energy management products” according to their website. They have a long track record of engineering innovation and serve customers in industries such as aerospace and defense, industrial, and nuclear.

In particular, the key area of focus Taylor Devices has is on “shock and vibration” engineering solutions. They are focused on “designing and qualifying the next generation of shock and vibration management systems and components to protect life, platform and structures throughout the world with the highest standard of integrity and excellence resulting in profitable growth”.

One of their best selling products is the Fluid Viscous Dampers, which are used in “protecting buildings, bridges and other structures worldwide” according to the product website. Investors can see that their product portfolio revolves around the theme of protection by absorbing shocks and big vibrations. The company has successfully grown over the past few years, seeing revenues climb from $28.4 million in 2020 to $44.6 million for the past TTM.

I believe their products to be highly innovative and crucial for some of their customers’ needs. Buying these tiny components, dampers, and devices are a high-value purchase because often times the cost is insignificant compared to the enormous benefit they provide, in my view. Furthermore, Taylor Devices has improved its cost profile with gross margins improving from 14.2% in 2021 to 46.6% for the past TTM.

It’s probable in my view that gross margins can exceed 50% going forward, because the cost of making these relatively small components and dampers do not look too expensive or time-consuming to make. Once management nails down a successful production formula, it should be smooth-sailing as economies of scale begin to kick in and lead to gross margin expansion.

Ultimately, I think Taylor Devices is a nice company, with growing margins and high-quality products to sustain future revenue growth. However, it does not appear to be cheap at an EV/Sales of 2.91x, so I rate the shares neutrally. Also, I do not think growth will go in a straight line up for Taylor Devices as the industries they serve can be cyclical, which may cause revenue growth be volatile going forward. Thus, investors should be cautious about the cyclical nature of Taylor Devices and factor that in while they hold their shares.

Aerospace/Defense Makes A Big Impact

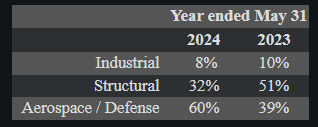

According to the 10-K, investors can see the following revenue breakdown:

10-K (Seeking Alpha)

Aerospace/Defense made up 60% of sales for 2024, which is historically very high and leads me to believe that this cyclical boom is potentially unsustainable. In the 10-K management writes,

The Company saw a 30% decrease from last year’s level in sales to structural customers who were seeking seismic / wind protection for either construction of new buildings and bridges or retrofitting existing buildings and bridges along with a 71% increase in sales to customers in aerospace / defense and a 12% decrease in sales to customers using our products in industrial applications.

While the other two segments had a decrease in sales, aerospace/defense saw a 71% increase in sales which in my view is potentially a one-time event that will eventually slow going forward. I caution investors that they will likely see some revenue slowdowns for FY 2025 because I do not expect aerospace/defense to grow at a similar pace.

In my opinion, customers who have projects will bulk-buy some of Taylor Devices products, but once they buy they don’t need another batch for potentially a few years. Because of long product development cycles in the aerospace and defense industry, I believe that we are seeing a temporary boom that is not sustainable for sales. Therefore, I predict revenue growth as a whole will slow for Taylor Devices and aerospace/defense will make up a lower percentage of sales going forward.

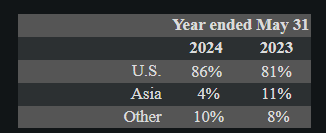

Furthermore, demand from Asia remains weak as outlined in the 10-K, “Total sales to Asia decreased 55% from the prior year”.

Seeking Alpha

Overexposure to the U.S economy can be potentially risky for revenue growth as there are talks about a potential recession in the U.S. A lack of geographical diversification can cause revenue growth to fluctuate, so I would caution investors to be careful about extrapolating past revenue growth rates into the future.

In conclusion, now is the time to remember that cyclical companies usually don’t go up in a straight-line. I expect 2025 to be a potentially slower year for Taylor Devices, and caution investors from buying at a potential peak. Even so, the long-term outlook for Taylor Devices is still strong, so it may be worth buying more at a cyclical trough.

Nuclear Potential Is Exciting

With the growth of AI and data centers, most investors may know that nuclear energy is likely to power our digital boom in our economy. According to NBC News, AI is powering a nuclear revolution as more power plants are expected to be built. One news source shows the White House is backing more nuclear power plants in the U.S, for their “large potential source of carbon-free electricity”.

This bodes well for Taylor Devices, as they have products directly designed to protect nuclear power plants. They make and sell buffers, isolators, dampers, and other components that are necessary for a nuclear power plant to function safely and efficiently. Because Taylor Devices has a lot of experience and know-how in this sector, they have good potential to be an industry leader in providing the nuts and bolts necessary to fuel a nuclear boom in the United States.

Despite this potential, I think Taylor Devices needs to do more research and development in this area in order to stay ahead of the competition. To me, it seems like their product portfolio has not grown that much, and exploring new products in the nuclear space would enhance their reputation and competitive edge for customers. Investors can see that R&D expenses for the past TTM was $388,000, down from $1.1 million in 2023. I believe this may not be enough to sustain a healthy innovation advantage and would like to see more investments made into innovation.

Overall however, I am convinced that Taylor Devices can successfully innovate new projects and develop the necessary experience to be able not only sell products, but provide analytical service to clients in the nuclear space. Thus, I view this industry sector as a potential growth opportunity for Taylor Devices, as long as they continue to research and develop new innovations to enhance their engineering reputation.

Valuation – $50 Fair Value

Because of a potential cyclical slowdown, I think sales will not grow as fast as they used to be, and project flat revenue growth going forward. Given sales of $45 million for the past TTM, I think it will stay there for the full fiscal year of 2025. If we apply a net margin of 20%, which is equal to the TTM, earnings should come in at $9 million. I think net margins can remain the same because gross margins have shown to be stable historically, and most of the operating expenses are SG&A which management has some degree of control over.

Divide $9 million by shares outstanding of 3.5 million gets me $2.5 EPS, rounded down. Apply a 20x P/E multiple gets me $50 fair value. The 20x P/E is below the sector median of 21.83x to account for the potential cyclical slowdown in revenues I project in 2025. So, investors can see that the stock is around fair value and deserves a hold rating.

While some bulls may point to the low PEG ratio of 0.44x, I argue that past growth will not continue at the same rate in the future. Therefore, the PEG ratio can be potentially misleading because past annual EPS growth may not grow in the double-digits, at least temporarily. Overall, I’m cautious on this name because of the cyclical nature of Taylor Devices’ customers.

Risks

Inventory management and obsolescence is a potential risk as the company recorded “$791,000 and $322,000 of inventory disposed of during the years ended May 31, 2024 and 2023” in their annual report. I noticed a slight uptick in this number which leads me to believe their inventory can be easily outdated as technology improves. Therefore, failure to manage working capital could lead to liquidity issues for Taylor Devices, as their products seem prone to obsolescence.

Competition in this area can intensify as making these small components do not seem to be incredibly difficult or high-tech. New entrants can seize market share and cause Taylor Devices’ market position to weaken which could result in slower revenue growth. Furthermore, Taylor Devices does business with the federal government and receives federal funded government research. If they were to lose this due to changes in regulation, they would have to pay for the research themselves which could lower profit margins.

The sector median of 20x earnings could be elevated as the entire sector undergoes a correction. My assumption of 20x P/E could be too high and a correction to say, 15x P/E would result in a fair value of $37.5, a potential loss for investors.

Hold Taylor Devices

The company is well-run with better gross margins historically, high-quality products, and customers in growing industries. Although cyclical, it looks like that Taylor Devices is already fairly pricing in all the positive revenue growth historically. I caution that we are potentially at a cyclical peak and that aerospace/defense may not continue to carry sales growth in the future, and advise investors to perhaps sell above my fair value estimate of $50.

Read the full article here