|

Standardized performance (%) |

as of September 30, 2024 |

||||||||

|

Quarter |

YTD |

1 Year |

3 Years |

5 Years |

10 Years |

Since inception |

|||

|

Class A shares inception: 06/23/05 |

NAV |

2.53 |

25.80 |

43.77 |

7.80 |

16.72 |

13.54 |

11.10 |

|

|

Max. Load 5.5% |

-3.11 |

18.90 |

35.86 |

5.79 |

15.40 |

12.90 |

10.77 |

||

|

Class R6 shares inception: 09/24/12 |

NAV |

2.60 |

26.14 |

44.25 |

8.17 |

17.12 |

13.98 |

15.01 |

|

|

Class Y shares inception: 06/23/05 |

NAV |

2.59 |

26.07 |

44.13 |

8.08 |

17.01 |

13.83 |

11.37 |

|

|

Russell 1000 Growth Index (USD) |

3.19 |

24.55 |

42.19 |

12.02 |

19.74 |

16.52 |

– |

||

|

Total return ranking vs. Morningstar Large Growth category (Class A shares at NAV) |

– |

– |

22% (249 of 1144) |

58% (587 of 1079) |

43% (439 of 1008) |

57% (466 of 793) |

– |

||

Expense ratios per the current prospectus: Class A: Net: 0.99%, Total: 0.99%; Class R6: Net: 0.64%, Total: 0.64%; Class Y: Net: 0.74%, Total: 0.74%.

Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit Country Splash for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Returns less than one year are cumulative; all others are annualized. Index source: RIMES Technologies Corp. Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. Performance shown at NAV does not include the applicable front-end sales charge, which would have reduced the performance.

Class Y and R6 shares have no sales charge; therefore performance is at NAV. Class Y shares are available only to certain investors. Class R6 shares are closed to most investors. Please see the prospectus for more details.

Manager perspective and outlook

- Despite a decline in early August, US equity markets posted gains in the third quarter as inflation cooled and the US Federal Reserve (Fed) began its long-awaited monetary easing cycle.

- Inflation hit its lowest level since 2021, with the 12-month Consumer Price Index (CPI) for August (released in September) coming in at 2.5%, down from 2.9% in July.

- Still, the economy remained resilient, with the third estimate of second quarter GDP growth reported at 3.0%, stronger than expected and above first quarter growth of 1.4%.

- However, a weaker-than-expected payroll report seemed to surprise investors in August and employment data was largely unchanged in September, prompting the Fed to cut the federal funds rate by 0.50% at its September meeting.

- With greater certainty about interest rates, investors rotated out of the artificial intelligence and technology-related stocks that had led for much of 2024 and into small-cap and value stocks that may benefit from lower interest rates.

- Given the environment, we seek to keep the fund more balanced, with increased emphasis on higher quality companies with resilient earnings growth and the flexibility to adjust as appropriate.

- While there are multiple short-term scenarios possible, we believe a slow-growth global economy is likely for the next few years. Such an environment typically rewards the innovative, organic growth companies that we embrace.

|

Top issuers |

||

|

(% of total net assets) |

||

|

Fund |

Index |

|

|

NVIDIA Corp (NVDA) |

10.87 |

10.31 |

|

Microsoft Corp (MSFT) |

9.50 |

11.61 |

|

Apple Inc (AAPL) |

9.13 |

12.29 |

|

Amazon.com Inc (AMZN) |

7.36 |

6.28 |

|

Meta Platforms Inc (META) |

5.24 |

4.55 |

|

Alphabet Inc (GOOG)(GOOGL) |

3.85 |

6.53 |

|

Broadcom Inc (AVGO) |

3.72 |

2.85 |

|

KKR & Co Inc (KKR) |

2.96 |

0.09 |

|

Eli Lilly & Co (LLY) |

2.93 |

2.57 |

|

Blackstone Inc (BX) |

2.68 |

0.39 |

|

As of 09/30/24. Holdings are subject to change and are not buy/sell recommendations. |

||

Portfolio positioning

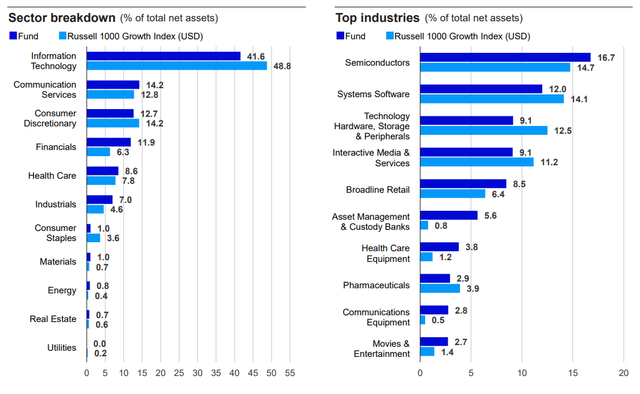

The fund’s largest overweights include financials, industrials and communication services. Financials are in our view uniquely poised to benefit from lower interest rates, and we currently favor capital markets and securities exchanges over payment companies and banks. Industrials exposure is balanced with a mix of high quality defensive and earlier cycle stocks.

Communication services is focused on three main areas: companies with exposure to AI-driven improvements, subscription media businesses positioned for profit expansion and media content creators, including video game developers, approaching new content cycles. We increased the fund’s Apple position but maintained the underweight. The fund remained underweight in IT, largely due to underweights in Apple and Microsoft. The fund was also underweight consumer staples and consumer discretionary.

New Positions

Flutter (FLUT)(OTC:PDYPY): We believe investors underestimate the value of the “moat” of sustainable competitive advantages in online sports betting. The industry has been setting up to be a duopoly of Flutter’s FanDuel and DraftKings (not a fund holding).

DoorDash (DASH): This market leader and best-in-class restaurant delivery operator has been approaching 70% US market share. The company is investing in higher growth verticals of international markets and US rapid delivery beyond restaurants.

Goldman Sachs (GS): This investment bank is in our view poised to benefit as the Fed rate-cutting cycle is expected to reopen capital markets. We believe an increase in mergers and acquisitions and IPOs should meaningfully accelerate revenue for the cyclically tilted large-cap bank.

Notable Sales

Edwards Lifesciences (EW): A newly approved heart valve replacement was expected to accelerate sales growth, but the company’s core business plateaued quickly, causing a drag on overall growth.

IDEXX Labs (IDXX): We still regard IDEXX as one of the highest quality health care businesses with a near monopolistic position in the animal diagnostics market. However, a decline in vet visits and consumer weakness has apparently weighed on the stock.

O’Reilly Automotive (ORLY): Industry growth has slowed due to lower inflation, pressure on discretionary sales and weakness among low-end consumers. We reallocated the capital to stocks where we have higher conviction.

|

Top contributors (%) |

||

|

Issuer |

Return |

Contrib. to return |

|

Apple Inc. |

10.75 |

0.83 |

|

Meta Platforms, Inc. |

13.64 |

0.68 |

|

KKR & Co. Inc. |

24.27 |

0.60 |

|

Blackstone Inc. |

24.41 |

0.43 |

|

S&P Global Inc. (SPGI) |

16.04 |

0.29 |

|

Top detractors (%) |

||

|

Issuer |

Return |

Contrib. to return |

|

Alphabet Inc. |

-8.83 |

-0.65 |

|

ASML Holding NV (ASML) |

-26.57 |

-0.41 |

|

Microsoft Corporation |

-3.55 |

-0.40 |

|

DexCom, Inc. (DXCM) |

-40.87 |

-0.40 |

|

Amazon.com, Inc. |

-3.58 |

-0.31 |

Performance highlights

The fund had a positive return for the quarter but underperformed its benchmark, primarily due to stock selection in IT, consumer discretionary and health care. Stock selection in financials, industrials and communication services added to relative return, as did overweights in financials and industrials.

Contributors to performance

Apple stock has risen on potential for its most significant hardware upgrade cycle since the pandemic as the company has been building AI into all its devices from iPhones to MacBooks.

Meta is realizing positive results from its AI investments through better recommendations, higher engagement, improved ad tools and more efficient ad targeting. We believe Meta is uniquely positioned to gain momentum as AI assistants become a large part of consumer interactions and products.

KKR, an alternative asset manager, had an excellent quarter due to acceleration in fundraising, particularly following strong relative performance across almost all of its investment strategies.

Blackstone, an alternative asset manager, benefited from the start of the Fed rate cutting cycle given its sizeable real estate portfolio, likely increases in real estate mergers and acquisitions, and potential for better relative performance from real estate assets generally.

S&P Global is a diversified information services firm with a significant corporate ratings business that we believe should benefit as lower interest rates lead to increased fixed income issuance.

Detractors from performance

Dexcom declined as management of this continuous glucose monitoring device company forecast a sales slowdown following a sales force reorganization.

Alphabet reported solid quarterly earnings, but investors appeared to expect even more following its large operating profit from the prior quarter. Google’s parent company has been facing multiple regulatory headwinds, including anti-trust lawsuits related to its advertising business, its position as Apple Safari’s default search engine, and its App store limitations. Also, future search query growth is clouded by potential competition from AI chatbots. We trimmed the position.

ASML faced export restrictions on advanced semiconductor manufacturing equipment that affected its ability to sell certain products to China and constrained its growth. We sold the stock.

Microsoft reached an all-time high in early July, then the stock corrected. While Microsoft is among the fund’s longer term holdings and one of our high conviction stocks, its AI capabilities have been constrained by a shortage of GPU capacity and our research revealed that its Azure cloud platform may be behind expectations for the company’s upcoming earnings release. We trimmed the position.

Amazon’s recent earnings results came in toward the high end of its guidance but revealed weaker revenue growth in e-commerce that was partially offset by strength in Amazon Web Services. A recent increase in expenses tied to its Kuiper satellite broadband business also appeared to weigh on the stock.

|

For more information, including prospectus and factsheet, please visit Invesco.com/VAFAX Not a Deposit Not FDIC Insured Not Guaranteed by the Bank May Lose Value Not Insured by any Federal Government Agency |

Read the full article here