This article was coproduced with Dividend Sensei.

Warren Buffett famously said to be “greedy when others are fearful.” In the last few weeks, we’ve seen the second biggest two-week crash in regional banking history.

A 28% plunge that was only surpassed during the worst days of the Great Financial Crisis.

I’ve been carefully monitoring the financial stress in the financial markets via the St. Louis and Chicago Fed financial stress indexes, which consist of 123 metrics.

I can confirm there’s no financial crisis brewing, yet even the highest quality regional banks have gone off a cliff as if the economy were on fire.

Let me share with you the three reasons why I just recommended U.S. Bancorp (NYSE:USB).

Specifically, when considering the above statement of being “greedy when others are fearful, why this king of regional banks is 45% undervalued and could quadruple in the next six years.

Reason One: One Of The Safest Banks On Earth

The regional banking crisis is a glorious opportunity to buy USB because it absolutely should not have fallen 22% in the last three weeks.

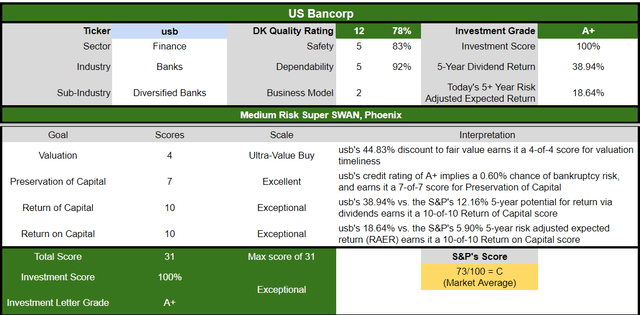

Here’s how it scores on the 3,000 point Dividend Kings Safety and Quality model, which looks at over 1,000 metrics.

Dividend Safety

|

Rating |

Dividend Kings Safety Score (250 Point Safety Model) |

Approximate Dividend Cut Risk (Average Recession) |

Approximate Dividend Cut Risk In Pandemic Level Recession |

|

1 – unsafe |

0% to 20% |

over 4% |

16+% |

|

2- below average |

21% to 40% |

over 2% |

8% to 16% |

|

3 – average |

41% to 60% |

2% |

4% to 8% |

|

4 – safe |

61% to 80% |

1% |

2% to 4% |

|

5- very safe |

81% to 100% |

0.5% |

1% to 2% |

|

USB |

83% |

0.5% |

1.90% |

|

Risk Rating |

Medium Risk 59th percentile risk management |

A+ negative outlook credit rating =0.6% 30-year bankruptcy risk |

15% or less max risk cap |

Long-Term Dependability

|

Company |

DK Long-Term Dependability Score |

Interpretation |

Points |

|

Non-Dependable Companies |

20% or below |

Poor Dependability |

1 |

|

Low Dependability Companies |

21% to 39% |

Below-Average Dependability |

2 |

|

S&P 500/Industry Average |

40% to 59% |

Average Dependability |

3 |

|

Above-Average |

60% to 79% |

Dependable |

4 |

|

Very Good |

80% or higher |

Very Dependable |

5 |

|

USB |

93% |

Very Dependable |

5 |

Overall Quality

|

USB |

Final Score |

Rating |

|

Safety |

83% |

5/5 very safe |

|

Business Model |

60% |

2/3 narrow moat |

|

Dependability |

92% |

5/5 very dependable |

|

Total |

78% |

12/13 Super SWAN |

|

Risk Rating |

3/5 Medium Risk |

|

|

15% OR LESS Max Risk Cap Rec |

10% Margin of Safety For A Potentially Good Buy |

This is one of the world’s highest-quality banks.

Why The Market Is Dead Wrong About U.S. Bank

Founded in 1929 in Minneapolis, Minnesota, US is a 94-year-old bank that has survived and thrived through:

-

15 recessions

-

the Great Depression

-

inflation as high as 22%

-

interest rates as high as 20%

-

23 bear markets

-

the Great Financial Crisis (during which it remained profitable)

U.S. Bank is Morningstar’s “lowest risk” regional bank recommendation with the lowest risk of a bank run.

Why?

“U.S. Bancorp is the largest non-GSIB in the U.S. and has been one of the most profitable regional banks we cover. Few domestic competitors can match its operating efficiency and returns on equity over the past 15 years.” – Morningstar

U.S. Bank is the fifth-largest bank in America and the largest regional bank with almost $600 billion in assets.

It’s the largest traditional bank that does almost everything outside of investment banking, including:

-

mortgage

-

refinance

-

auto

-

boat and RV loans

-

credit lines

-

credit card services

-

merchant, bank

-

checking and savings accounts

-

debit cards

-

online and mobile banking

-

ATM processing

-

mortgage banking

-

insurance, brokerage, and leasing services.

U.S. Bank has $525 billion in deposits, 48% of which are insured by the FDIC.

-

SVB had 93% uninsured deposits

-

Signature Bank was 89%

-

First Republic 67%

36% consumer and business banking.

27% payment services.

19% corporate and commercial banking.

18% wealth management.

What about unreleased bond losses on its “hold to maturity” bond portfolio? $11 billion as of March 13, or 25% of its equity.

Even if USB had to sell all of its bonds and realize the loss, it would remain solvent.

-

unlike JPM or BAC, and Citi

USB is rated A to AA by four credit rating agencies.

It currently has $53 billion in cash, and regional banks are seeing deposits return in the last week ($6 billion).

The stability of its long-term deposits is AA-rated, on par with the likes of JPM and BAC.

“The negative outlook reflects our view that USB’s acquisition of MUFG Union Bank’s core regional bank franchise heightens integration and operational risks. The acquisition is an $8 billion cash and stock transaction that increases USB’s loans and deposits by 20% and 21%, respectively, to $355 billion and $527 billion. It is the biggest acquisition USB has made since the financial crisis and should close in the first half of 2022, pending regulatory approval.” – S&P

In 2021 USB bought Union Bank growing its assets by 20%. It was a complex deal, and so far, execution has been going well.

USB’s credit ratings are on par or stronger than America’s strongest banks, with a 0.29% to 0.66% 30-year bankruptcy risk, according to Moody’s, S&P, Fitch, and DBRS (Canada’s biggest rating agency).

How can we tell?

Because after a short spike in its efficiency ratio (non-interest cost/revenue), the bank’s superior economies of scale are expected to bring the efficiency ratio down to 53% in 2025.

“The company’s balance sheet is sound, its capital investment decisions are exemplary, and its capital return strategy is appropriate.” – Morningstar

Morningstar and rating agencies consider USB one of the best-run banks in the country.

CEO Andy Cecere has been with the bank since 1985.

-

38 years with USB bank

-

Chief Financial Officer from 2007 to 2015 (including during the Great Recession)

-

Chief Operating Officer 2015 to 2017

-

CEO since 2017

Its management is among the elite of US banking, with conservative banking standards on par with Canadian banks.

“U.S. Bancorp… came through the 2008-09 global financial crisis without realizing a loss in any quarter…

We believe he did an admirable job with strategic acquisitions (such as buying trust segments from Bank of America and others in the U.S. and now from Deutsche Bank and the Quintillion acquisition to begin growth in Europe) and growth initiatives over the years, helping the bank to expand key businesses such as payments, trust, and the capital markets loan group.

With Cecere in charge, the bank has continued to control expenses while still investing in technology and efficiency initiatives. The conservative underwriting culture is also still in place.” – Morningstar

The inverted yield curve is squeezing bank net interest margins as customers move money from low-rate checking to higher-yielding accounts.

USB’s NIM is proving more resilient thanks to a unique mix of businesses. As a result of higher rates and the Union Bank deal, its net interest income is expected to remain robust and almost double from 2021 to 2025.

The bottom line is if USB fails, I’ll eat my hat. This bank should not have crashed 20% in the last three weeks.

Reason Two: One Of The Best Growth Profiles In The Industry

USB is trading as if its fundamentals are collapsing. Here is what’s actually going on.

|

Metric |

2022 Growth |

2023 Growth Consensus (recession year) |

2024 Growth Consensus |

2025 Growth Consensus |

|

Sales |

26% (Union bank acquisition) |

4% |

2% |

7% |

|

Dividend |

10% |

4% (Official) |

4% |

11% |

|

Earnings |

-28% |

29% |

13% |

13% |

|

Book Value |

-12% |

10% |

12% |

10% |

(Source: FAST Graphs, FactSet)

Does this seem like a failing bank? How about this?

Analysts expect USB to grow at 13% annually long term, one of the fastest-growing large banks in the US.

Analyst margins of error on USB tend to be plus or minus 10%, and within a reasonable 20% margin of error, it grew as expected 92% of the time in the last 11 years.

|

Investment Strategy |

Yield |

LT Consensus Growth |

LT Consensus Total Return Potential |

Long-Term Risk-Adjusted Expected Return |

|

U.S. Bancorp |

5.5% |

13.0% |

18.5% |

13.0% |

|

ZEUS Income Growth (My family hedge fund) |

4.3% |

9.9% |

14.2% |

9.9% |

|

Schwab US Dividend Equity ETF |

3.8% |

10.2% |

14.0% |

9.8% |

|

Vanguard Dividend Appreciation ETF |

2.0% |

11.3% |

13.3% |

9.3% |

|

Nasdaq |

0.8% |

10.9% |

11.7% |

8.2% |

|

Dividend Aristocrats |

1.9% |

8.5% |

10.4% |

7.3% |

|

S&P 500 |

1.7% |

8.5% |

10.2% |

7.1% |

|

REITs |

4.0% |

6.1% |

10.1% |

7.1% |

|

60/40 Retirement Portfolio |

2.1% |

5.1% |

7.2% |

5.0% |

(Source: DK Research Terminal, FactSet, Morningstar)

USB’s risk-adjusted expected returns are 13%, far superior to almost any long-term investment opportunity such as the S&P, aristocrats, or Nasdaq.

Total Returns Since 1985

Since 1985 USB has beaten the market by a modest 1%, including this current bear market that has left it almost 45% undervalued.

-

11.5% annual return (62X return) vs 11% S&P (51X return)

-

JPM 10.3% annual return

-

Citigroup 4.1% return

It’s beaten the big banks and with far less volatility to boot.

USB’s average rolling returns have been 13% to 15% per year for the last 37 years, superior to big banks, the S&P, and even the Nasdaq (13.5% returns).

But you don’t have to wait decades for USB to make you rich. Just take a look at what this deep value Super SWAN bank offers today.

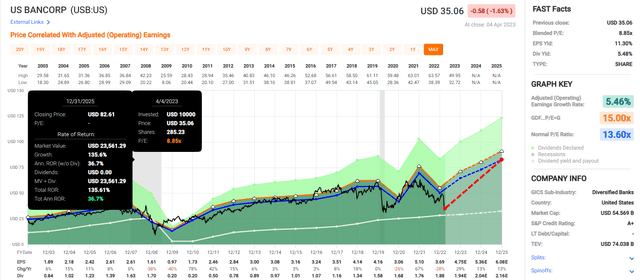

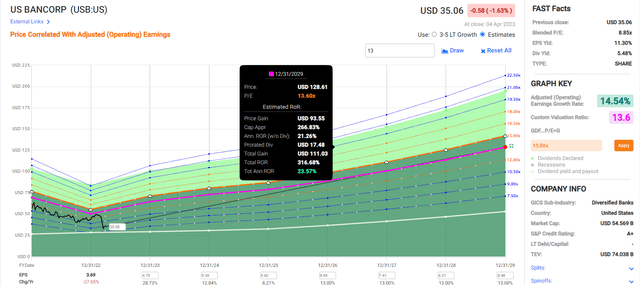

2025 Consensus Total Return Potential

FAST Graphs, FactSet

2029 Consensus Total Return Potential

FAST Graphs, FactSet

If USB grows as expected and returns to historical fair value of 13.6X earnings, it could deliver 135% total returns within the next three years and 317% within the next six years.

Think these numbers are overly optimistic? Consider USB’s historical rallies off bear market lows.

USB Best Rallies Off Bear Market Lows

-

98% within one year

-

410% within three years (72% annually)

-

804% within five years (55% annually)

-

1248% within seven years (45% annually)

-

1908% within ten years (35% annually)

-

2791% within 15 years (25% annually)

Today, USB is a screaming buy.

Reason Three: A Wonderful Company At A Flabbergastingly Great Price

For two decades, tens of millions of income investors have consistently paid between 13.1 and 13.7X earnings for USB.

|

Metric |

Historical Fair Value Multiples (all Years) |

2022 |

2023 |

2024 |

2025 |

12-Month Forward Fair Value |

|

5-Year Average Yield |

3.20% |

$58.75 |

$60.00 |

$60.00 |

$70.00 |

|

|

PE |

13.60 |

$50.18 |

$65.96 |

$72.08 |

$81.60 |

|

|

Average |

$54.13 |

$62.84 |

$65.49 |

$75.36 |

$63.55 |

|

|

Current Price |

$35.06 |

|||||

|

Discount To Fair Value |

35.23% |

44.21% |

46.46% |

53.47% |

44.83% |

|

|

Upside To Fair Value (including dividend) |

54.39% |

79.23% |

86.79% |

114.93% |

86.74% |

|

|

2023 EPS |

2024 EPS |

2023 Weighted FFO |

2024 Weighted FFO |

12-Month Forward PE |

Historical Average Fair Value Forward PE |

Current Forward PE |

|

$4.85 |

$5.30 |

$3.54 |

$1.43 |

$4.97 |

12.8 |

7.1 |

Including the dividend yield, USB’s historical fair value is about 13X earnings, and today it trades at just 7X, pricing in -2.8% growth while actually growing at double digits.

It’s an anti-bubble blue chip with nearly 100% upside to fair value.

|

Rating |

Margin Of Safety For Medium-Risk 12/13 Super SWAN |

2023 Fair Value Price |

2024 Fair Value Price |

12-Month Forward Fair Value |

|

Potentially Reasonable Buy |

0% |

$62.84 |

$65.49 |

$63.55 |

|

Potentially Good Buy |

10% |

$56.56 |

$58.94 |

$57.20 |

|

Potentially Strong Buy |

20% |

$50.27 |

$52.39 |

$50.84 |

|

Potentially Very Strong Buy |

30% |

$39.59 |

$45.84 |

$44.49 |

|

Potentially Ultra-Value Buy |

40% |

$37.70 |

$39.29 |

$38.13 |

|

Currently |

$35.06 |

44.21% |

46.46% |

44.83% |

|

Upside To Fair Value (Including Dividends) |

84.71% |

92.26% |

86.74% |

USB is a potentially table-pounding, Buffett-style “fat pitch” buy for anyone comfortable with its risk profile.

Risk Profile: Why U.S. Bancorp Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

U.S. Bancorp Risk Summary

“We assign our U.S. regional banks an Uncertainty Rating of Medium. U.S. Bancorp has a history of making smart acquisitions and securing strategic positions in attractive markets. Given the competence of management and the bank’s history, we view risks from future acquisitions as low.

We view the macroeconomic backdrop as the primary risk to the bank. U.S. Bancorp’s profitability will be materially affected by the interest rate cycle and the effects of credit and debt cycles, which are not under management’s control. In addition, the bank is subject to the Federal Reserve’s annual stress test.

From an ESG perspective, commercial banks are expected to have strong product governance. Predatory or discriminatory lending practices are examples of poor product governance, which can sometimes affect certain banks. We view most product governance and social risks as manageable and incorporate a steady level of operating expenses related to compliance and litigation in our models. Outside of the rare, headline-grabbing scandals, we don’t see social risks as having a material effect on our valuation. Banks also lend to certain sectors that can come under more scrutiny, like gun manufacturers or energy, for example. Commercial banks don’t have a large environmental footprint, and governance practices align with most companies.” – Morningstar

USB’s Risk Profile Includes

-

economic cyclicality risk (63% EPS decline in the GFC and 26% in the Pandemic)

-

regulatory risk (capital requirements and Fed approval of buybacks and dividends)

-

interest rate risk (affects net interest income)

-

M&A execution risk (strong history of smart acquisitions)

-

worker retention risk (tightest job market in 54 years)

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

-

S&P has spent over 20 years perfecting their risk model

-

which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

-

50% of metrics are industry specific

-

this risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of a company’s risk management compared to 8,000 S&P-rated companies covering 90% of the world’s market cap.

USB Scores 59th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

-

supply chain management

-

crisis management

-

cyber-security

-

privacy protection

-

efficiency

-

R&D efficiency

-

innovation management

-

labor relations

-

talent retention

-

worker training/skills improvement

-

customer relationship management

-

climate strategy adaptation

-

corporate governance

-

brand management

USB’s Long-Term Risk Management Is The 279th Best In The Master List (44th Percentile In The Master List)

|

Classification |

S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

|

BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL |

100 |

Exceptional (Top 80 companies in the world) |

Very Low Risk |

|

Strong ESG Stocks |

86 |

Very Good |

Very Low Risk |

|

Foreign Dividend Stocks |

77 |

Good, Bordering On Very Good |

Low Risk |

|

Ultra SWANs |

74 |

Good |

Low Risk |

|

Dividend Aristocrats |

67 |

Above-Average (Bordering On Good) |

Low Risk |

|

Low Volatility Stocks |

65 |

Above-Average |

Low Risk |

|

Master List average |

61 |

Above-Average |

Low Risk |

|

Dividend Kings |

60 |

Above-Average |

Low Risk |

|

U.S. Bancorp |

59 |

Average, Bordering On Above-Average |

Medium Risk (bordering on low risk) |

|

Hyper-Growth stocks |

59 |

Average, Bordering On Above-Average |

Medium Risk |

|

Dividend Champions |

55 |

Average |

Medium Risk |

|

Monthly Dividend Stocks |

41 |

Average |

Medium Risk |

(Source: DK Research Terminal)

USB’s risk-management consensus is in the bottom 44% of the world’s highest quality companies and similar to that of such other blue-chips as

-

Polaris (PII) Super SWAN dividend champion

-

Sysco (SYY) Ultra SWAN dividend aristocrat

-

Genuine Parts Company (GPC) Super SWAN dividend king

-

Essex Property Trust (ESS) Ultra SWAN dividend aristocrat

-

Pepsi (PEP) Ultra SWAN dividend king

The bottom line is that all companies have risks, and USB is average, bordering on above-average, at managing theirs, according to S&P.

How We Monitor USB’s Risk Profile

-

28 analysts

-

four credit rating agencies

-

32 experts who collectively know this business better than anyone other than management

“When the facts change, I change my mind. What do you do, sir?”

– John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: U.S. Bancorp Is A 5.5% Table-Pounding Buy

Dividend Kings Automated Investment Tool

Let me be clear: I’m not calling the bottom in USB (I’m not a market-timer).

Even Super SWANs can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

-

over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

-

in the short term; luck is 25X as powerful as fundamentals

-

in the long term, fundamentals are 33X as powerful as luck

While I can’t predict the market in the short term, here’s what I can tell you about USB.

-

the largest regional bank in America

-

one of the highest-quality banks in America

-

impeccable management team

-

A to AA-rated balance sheet

-

very safe 5.5% yield growing at 6% through 2028

-

13% risk-adjusted long-term return potential versus 10.2% S&P

-

historically 45% undervalued

-

7.1X earnings vs 13X historical

-

317% consensus return potential over the next six years, 25% annually, 6X more than the S&P 500

-

3X better risk-adjusted expected returns than the S&P 500 over the next five years

-

3X better income over the next five years than the S&P 500

If you want to profit from the market’s knee-jerk overreaction to the banking crisis, consider buying USB today.

If you want an A-rated bank with a battle-tested management team, USB is as good as they come.

And if you want to lock in a very safe 5.5% yield and the potential to quadruple your money in six years, then USB is just what the doctor ordered.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here