I believe Citigroup’s (NYSE:C) stock could reach a triple-digit valuation by the end of 2024. I am not factoring in heroic or unrealistic assumptions and am fully cognizant of what has been holding the stock back in the last few years. I have also been tracking Citigroup’s strategic transformation quite closely.

In my recent article on Citigroup, I specifically addressed event-driven implications from the collapse of Credit Suisse. In this article, however, I am strictly focusing on its valuation. This should enable readers to assess its progress in the upcoming earnings release.

Let us start by considering what has held the stock back in recent years.

Citigroup’s Business Model

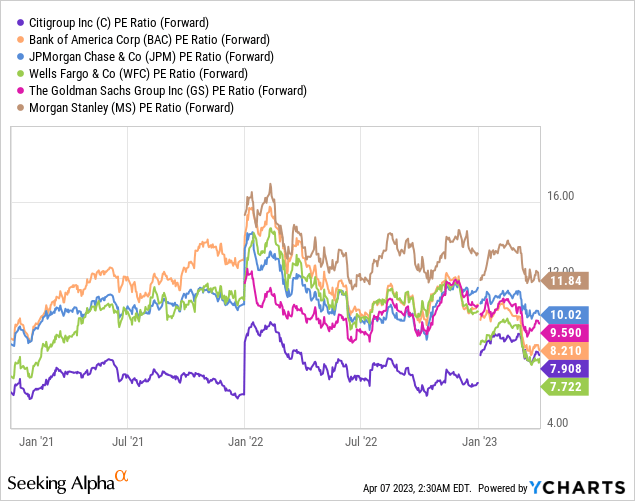

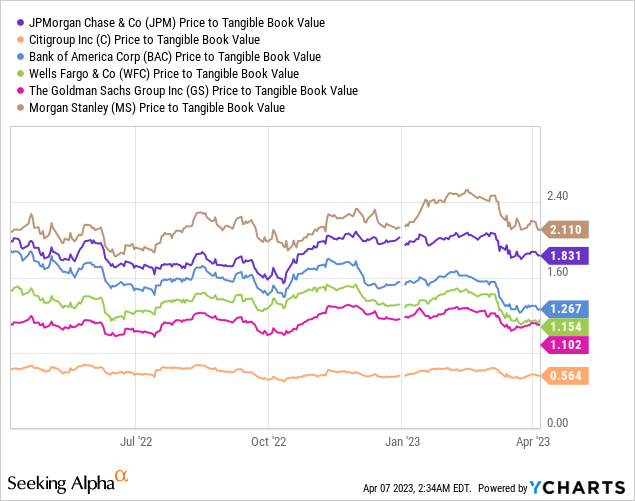

Citi has been rewarded with substantially lower valuations than its U.S. peers for many years. This is evident from the forward PE ratio as per the below chart:

The stark difference in valuation is even more pronounced when assessed through a valuation lens that considers price to tangible book value.

Morgan Stanley (MS) and JPMorgan (JPM) are seen as having the best-quality business model and thus are ascribed higher valuation multiples. MS is hugely benefiting from its focus on the capital-light asset and wealth management divisions, which it is expected to grow in relative size in upcoming periods. JPM is the largest scale player in most verticals. It is highly diversified and expects to generate 17% RoTCE throughout the cycle, rain or shine. I have been holding JPM for more than a decade and kept on buying MS on dips along the way. I do not hold MS currently as it is a tad expensive now and prefer Goldman Sachs (GS) purely on a relative valuation basis.

Citi, however, is trading at a massive discount to tangible book value and unjustifiably so, even though I understand why the market is heavily discounting it.

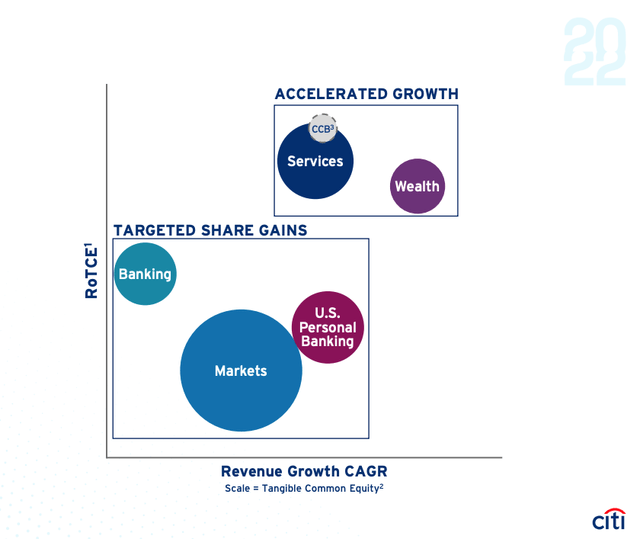

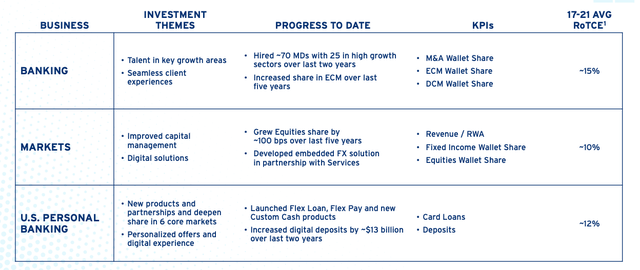

A key reason is its business model which is succinctly summarised in the below chart from the Investor Day 2022 presentation:

Citi Investor Day 2022

Note that the legacy global consumer franchises are excluded.

Also, note that the size of the bubble refers to the amount of capital allocated to these businesses.

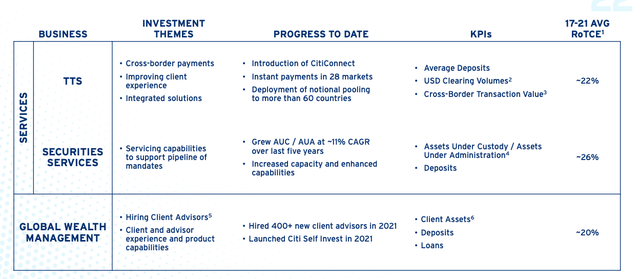

Now consider, the historical returns on equity on these businesses as disclosed in the Citi Investor Day:

Citi Investor Day 2022 Citi Investor Day 2022

As you can see, the largest bubble (i.e. highest capital allocation) is to the Markets division (FICC and Equities trading) but on average it delivered the lowest average RoTCE at ~10%. Market revenues are also notoriously volatile and uncertain. As such, Mr. Market ascribes lower multiples for such businesses. This is also a key reason why GS is trading at a much lower valuation than MS.

On the other hand, Services, comprising TTS and Security Services, are delivering high RoTCE in the mid-twenties. Whereas Global Wealth Management (“GBM”) has delivered ~20% RoTCE. These are exactly the capital-light businesses that Citi is looking to grow and invest in whilst seeking targeted share gains in the other businesses.

The idea is that by growing the capital-light, stable, and high ROE part of the franchise, the valuation multiples should increase in line.

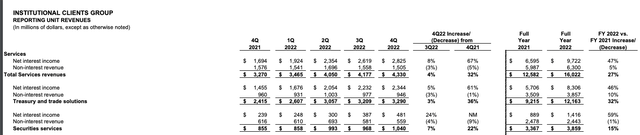

So far, Citi has made great strides in the Services business. It has grown massively in 2022 partly powered by rates and is comfortably delivering RoTCE in the ~30s currently.

Citi Investor Relations

The Q4’2022 revenue exit number, annualized at $17.3 billion, is especially impressive and this bodes well for additional strong growth in 2023 and beyond. Make no mistake about this, Services is an absolute crown jewel and Citi is investing strongly in it. The most interesting opportunity for TTS is in the commercial banking space and as I explained in my prior article, the recent banking crisis is a strong tailwind for Citi’s business model. So in short, the Services bubble in the chart is growing strongly and approaching, from a revenue perspective, the Markets division 2021 size.

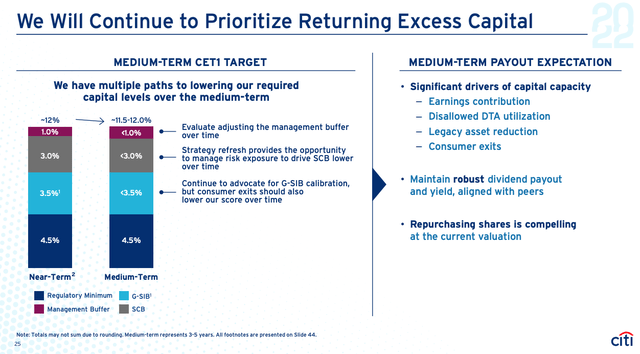

The other important business tagged for accelerated growth is the Wealth Management business which Citi targeted in its 2022 Investor Day, with revenue growth of high single digits to low teens. Citi invested strongly in wealth management IT platforms as well as hiring a large number of relationship managers globally, however, the performance has been rather disappointing with a revenue decline of 2% year-on-year.

Citi Investor Relations

The lackluster performance in wealth management, however, is hardly surprising given the bear market persisting in 2022. Citi has guided for a moderate recovery in Q1’2023 as both the equity and bond markets are more stable currently which is driving investors’ activity as well as AUM recovery. As I shared in my prior article, Citi is also a direct beneficiary of the collapse of Credit Suisse, especially in Asia where Citi is the #3 player in wealth management.

In short, the outlook for GBM, whilst challenged currently, in the medium term is exceptionally strong as and when the markets recover.

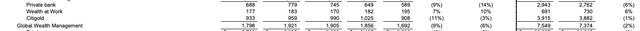

The Capital Return Disappointment

One of the most disappointing aspects for Citi since its 2022 Investor Day is the suspension of share buybacks. This is exceptionally painful given that the stock is trading at such a wide discount to its tangible book value.

As illustrated in Investor Day, Citi expects to operate with a target CET1 ratio of 11.5% to 12%.

2022 Investor Day

However, currently, due to adverse outcomes from the 2022 CCAR stress test cycle, Citi’s CET1 target ratio has increased to 13%. I have covered this topic in great detail in my recent article, Citigroup: The CCAR Question. In short, I do expect Citi to resume share buybacks in earnest in the 2nd half of 2023 and 2024 primarily driven by excess capital gained through disposals of the Global Consumer Bank (“GCB”) and a reduction in the target CET1 ratio,

The Path To $100 Valuation By End Of 2024

By the end of 2024, Citi should have completed the disposal of the GCB, releasing a significant amount of capital and reducing its target CET1 to ~12%. This should enable Citi to resume a massive share buyback program of between 20% to 30% of the current market cap. This includes proceeds from Mexico sale or IPO ($6 – $8 billion), completion of other GCB disposals, net income (excluding dividends), reduction in the target CET1 ratio following the 2023 and 2024 CCAR cycles, and utilization of Citi’s disallowed DTA.

Notably, Citi’s business model in 2024 will be a much higher quality and deservedly of higher multiples. The key bubble of the stable and low-risk Services division should be proportionally a much bigger part of Citi’s composition and a business that is consistently delivering RoTCE in the 30%s.

The GWM division should be back on the growth path subject to macroeconomic conditions.

Finally, as guided by the CFO in the latest earnings call, costs should begin to reduce in 2024 as Citi reaps the benefit of its investments in operational transformation and modernizing the bank.

I expect Citi’s tangible book value to increase to ~$95 by the end of 2024 driven by net earnings, reversal of AOCI, and share buybacks at below tangible book value. I also expect Citi to generate RoTCE greater than 10% and EPS above $9.50. Given the higher-quality business model, removal of execution risks, and operational transformation of the bank, I expect the valuation multiples (PE ratio) to re-rate to between 10 and 11 forward PE.

Putting this all together, a target share price of ~$100, by the end of 2024, is reasonable in my view.

Key Risks To The Thesis

My base case is a shallow recession in the second half of 2023 followed by a recovery in 2024 and the Fed’s funds rate of between 2.5% to 3%. Like many other banks, the overall macroeconomic settings would have a great influence over the operating performance as well as the valuation of the stock. For example, a deep and prolonged recession with interest rates back to 0% and quantitative easing would be a strong negative for Citi.

The second key risk is the target capital ratio. A key part of the thesis is the ability of Citi to return capital to shareholders. The risk of a higher capital ratio for Citi may manifest if it doesn’t perform as expected in the Fed’s stress tests and/or regulators will increase the capital requirements of the large U.S. banks. Additionally, a suspension or major delay in the sale of Banamex Mexico will also be negative for Citi.

The above key risk is the wall of worry that Mr. Market will need to climb. There are signposts along the way including the imminent announcement of the sale of Mexico as well as the release of the 2023 CCAR stress test results in June 2023. A positive outcome on these should instantaneously reflect in the share price.

Final Thoughts

Stepping back, the “new” Citi business model is much higher quality and should also sustainably drive lower capital requirements. Mr. Market is still not giving it credit for it in terms of valuation multiples.

Services are outperforming expectations by a wide margin and consistent returns on equity in the 30s are on the cards. GBM is challenged by the 2022 bear market but expects a strong bounce once markets recover.

The game changer in the valuation will probably start when share buybacks are resumed. This could be restarted as early as the second half of 2023.

The path to a $100 valuation is credible by the end of 2024 but investors should look out for the proof points along the way (2023 CCAR and the sale of Banamex Mexico).

Read the full article here