Company description

Wizz Air Holdings Plc (OTCPK:WZZAF / OTCPK:WZZZY) offers passenger air transportation services on scheduled short-haul and medium-haul point-to-point routes in Europe and the Middle East. Their fleet of 154 aircraft operates services for around 1000 routes from 194 airports in 51 countries.

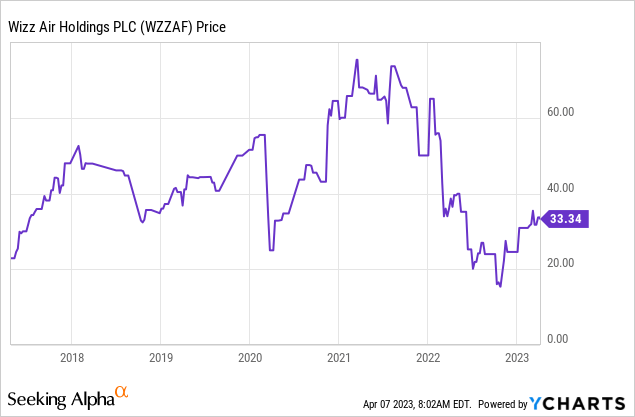

Share price

Wizz’s share price was trending up before the pandemic but now looks to be far more volatile. Gains were made in late 2020 as the prospect of returning travel loomed but this quickly reversed as the reality of several lockdowns and soft air travel became apparent. Wizz is now trading only slightly higher than its 2017 price, which could represent an opportunity for investors.

Financial analysis

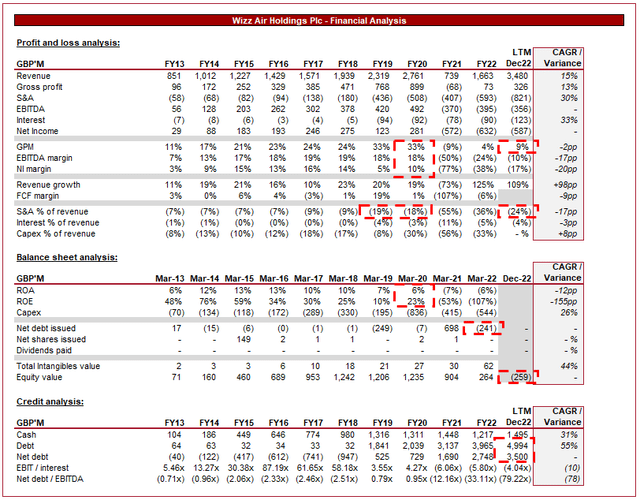

Wizz Air Financials (Tikr Terminal)

Presented above is Wizz’s financial performance for the last decade.

Revenue

Despite the impact of the pandemic, revenue has grown at an impressive CAGR of 15%.

Wizz has been expanding its routes throughout the decade, doing so impressively due to its pricing structure. Wizz is a “loss-cost airline”, essentially an airline that limits its services and quality as a means of driving down prices. Consumers are fine with this as it is targeted at those who want convenience and/or affordable flights as a priority. Low-cost carriers have been rapidly gaining popularity in Europe as a greater number of consumers see less value in the services that come with a flight, preferring to be cost-effective instead. This has allowed Wizz to gain market share from the likes of IAG.

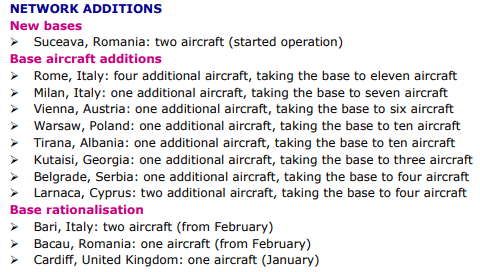

Wizz network expansion (Wizz Air)

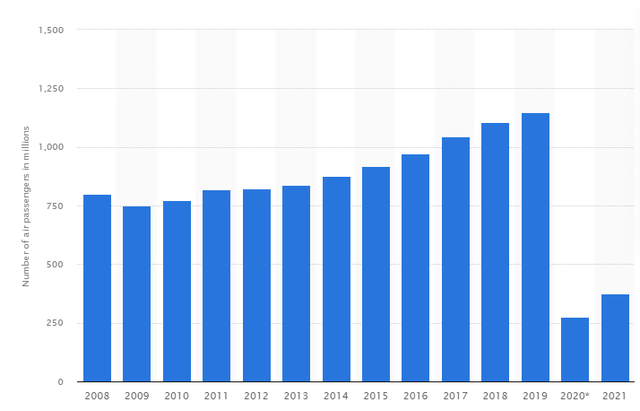

With the economic growth in Europe and increasing disposable income, the demand for air travel has been rising steadily. As the following graph illustrates, Europe has seen a consistent rise in travel numbers. Our view is that growth should continue in this vein in the coming years as the impact of Covid-19 subsides.

Number of passengers (Statista)

Wizz is continuously adding new aircraft to its fleet to support its route expansion plans. This is the largest driver of revenue growth and has been supported by the points stated above. Wizz currently has 177 aircrafts, with an average age of 4.6 years. This gives the company one of the youngest fleets in Europe, giving the business a long runway to monetize these planes. Wizz Air has a monster delivery backlog, with a total of 388 aircrafts due for delivery as of Dec22. This should allow revenue to grow rapidly in the coming year from volume growth.

Wizz has also been able to grow through active pricing. Although the business is a low-cost carrier, it does not mean Wizz cannot price aggressively where possible. In the most recent period, Wizz has seen its Revenue per Available Seat-Kilometer (RASK) increase as active pricing has not deterred people from traveling following the Covid lockdowns. load factor % has increased to 87%, supporting the need for a greater number of planes.

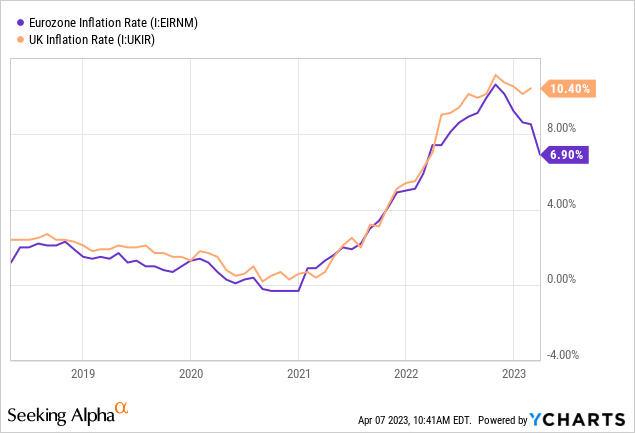

The company is facing short-term headwinds, however. We are currently experiencing inflationary conditions, with the Eurozone and UK inflation rates at 6.9% and 10.4% currently.

This is contributing to a decline in discretionary spending as consumers see their living costs increase and their behavior turns defensive. Holiday spending is generally considered a luxury and something which can be easily deferred, which many will likely do in the coming 12 months. As a result of this, Wizz could see a slow period in the coming year as the focus remains on bringing inflation under control.

Another issue the business faces in the coming years is a change in consumer habits. The pandemic has shown that in many cases, business travel is unnecessary and can be replaced by video calls. This has contributed to a decline in business travel which may not necessarily bounce back as rapidly as discretionary travel. Further, growth in this segment may now slow to a level below the pre-Covid period.

Margins

Wizz produced pretty fantastic margins historically, achieving an EBITDA-M of 18% and a NI margin of 10% in the year before the pandemic. For any mature industry, this is a respectable performance and Wizz showed the ability to maintain this for several years. The target is to return to this level.

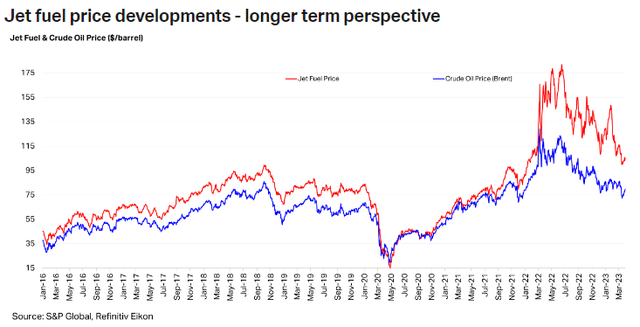

Currently, however, Wizz is seriously struggling with margins. Despite revenue exceeding the pre-Covid levels, everything below GP has not. This has been driven in large part to fuel costs. Energy prices are one of the main reasons we are seeing the levels of inflation we have. As the following graph illustrates, Jet fuel remains noticeably above the levels we have seen in the last decade, making it extremely difficult for airliners to operate at a profitable level.

Jet fuel price (S&P global)

Oil prices in general are trending down, however, it is difficult to forecast where they will normalize in the coming year. In the most recent period, Wizz has seen a 62% increase in fuel unit costs, reflecting the difficulty currently. Management has currently hedged 59% of their planned consumption for FY23 and 45% for FY24.

Outside of fuel costs, Management has sought to reduce other operating costs as a means of finding efficiencies but the business has struggled. S&A expenses currently represent 24% of revenue, which is far higher than the FY19/20 levels.

Based on what we are seeing with costs, it looks difficult for Wizz to return to its pre-Covid profitability levels, at least in the next 12-18 months.

Balance sheet

Once again, Wizz’s pre-Covid levels look incredibly attractive, having consistently achieved a ROE of >20%. We continually highlight the pre-Covid levels as the business can return to these levels, at least once macro conditions soften.

Historically Wizz operated conservatively, with little debt beyond aircraft financing. This has changed as a result of the pandemic, with its net debt reaching £3,500M. At FY20’s EBITDA, this represents an ND/EBITDA ratio of 7x. The good news for Wizz is that it is cash flow generative and has £1,495M, which should mean no immediate solvency risk. This being said the business has a long road ahead to adequately deleverage its balance sheet.

Peer comparison

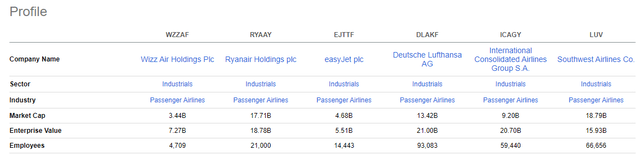

Peers (Seeking Alpha)

To assess Wizz’s relative performance, we have compared the business to the following companies. The majority of those chosen are European operators, to best align economics.

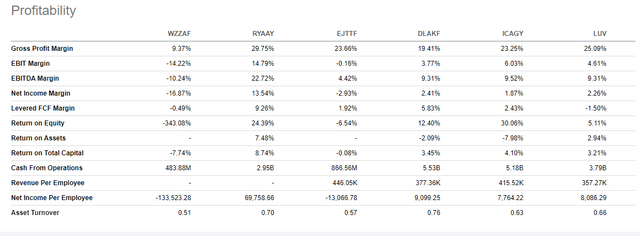

Profitability (Seeking Alpha)

Wizz is an outlier based on profitability, as it is the only business that remains loss-making in the LTM period. This is a poor performance which will drag on the business in the coming year.

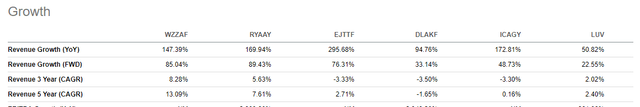

Growth (Seeking Alpha)

Wizz scores far better from a growth perspective, suggesting this is Management’s focus as a means of driving alpha in the medium term. This is not a bad strategy as the business is rapidly expanding its fleet. Gaining market share during uncertain times before transitioning back to profitability could be a strategy that yields gains.

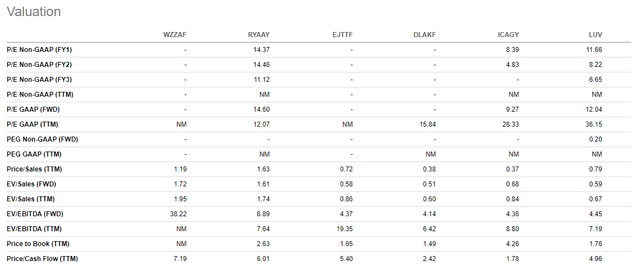

Valuation

Valuation (Seeking Alpha Valuation)

Despite the underperformance, Wizz is trading at a premium to its peers. Due to its negative EBITDA, the best metric to consider is NTM EV/Sales. The reason for this is likely investors pricing in aggressive growth in the coming years, as Wizz’s order book is gradually delivered. The key to Wizz’s fortunes is where margins will normalize in the coming years.

Final thoughts

We are a big fan of how Wizz has achieved growth, with it being realistic that things will continue due to the backlog of planes that will be delivered. The issue with the business currently is that it is difficult to take a view of where margins will land. They will certainly improve with peers reflect as much. If Wizz was able to return to its pre-Covid levels, we would consider the business highly attractive, despite its high level of debt. With its current premium valuation, we do not see scope for investors to be rewarded for taking this risk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here