Thesis

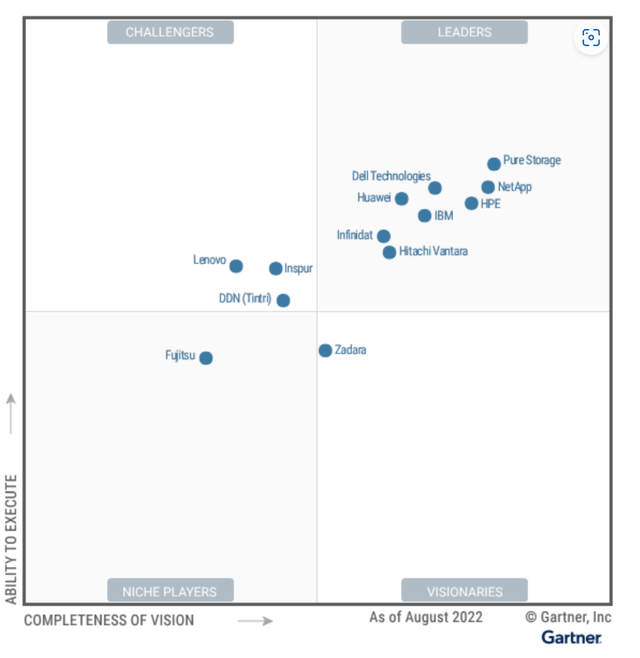

Business has been good for Pure Storage (NYSE:PSTG). From its humble beginnings in 2009, the company has become an industry leader in the digital storage business. The company pioneered storage as a service model and its technology was cutting-edge when it was developed. They continue to develop and differentiate themselves and the results so far have validated their approach to the storage business. Their strong top line and focus on profitability have made them more attractive over the last year but the stock has not seen much action since its IPO. My guess is that the business it operates in is not seen as alluring as some of the other technology businesses which tilted the bias against this stock. PSTG stock is on my radar and in our analysis, I will try to take an objective view and elaborate on where the company has done well and where it can do better, and what it would take me to be a buyer of this stock.

The Good

The edge in its business

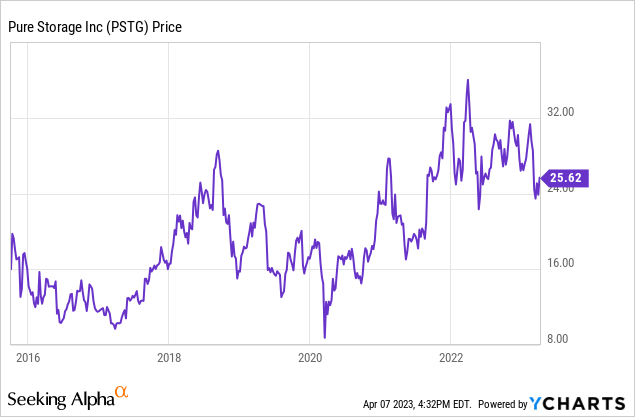

Key Features (Pure Storage Company Website)

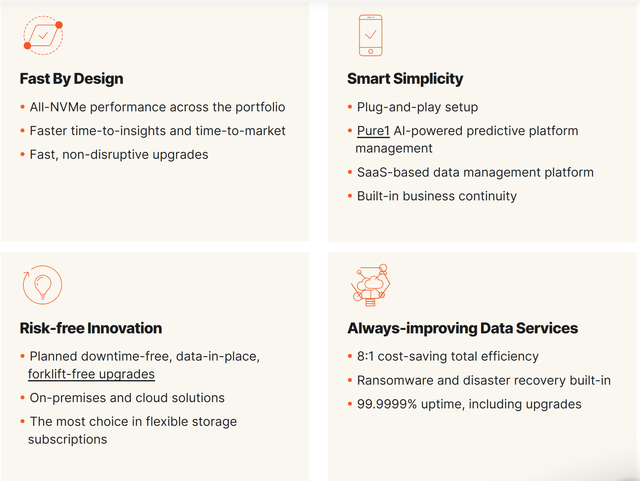

As a leader in global data storage, the company has a very simple mission: Modernizing the storage and interaction with the data. As such, the company bundles both hardware and software to deliver a seamless data storage experience. Their hardware touts “evergreen” architecture which means it is future-proof and prides on non-disruptive upgrades which means both hardware and software can be updated completely non-disruptively. The software that manages the storage is called Purity software and it focuses on providing great performance, high reliability, and efficiency. It counts Dell EMC, Hitachi Vantara, HP Enterprise, IBM, and NetApp as its main competitors and sees itself as having a big edge over its competitors.

Pure Storage V Competitors (Pure Storage Company website)

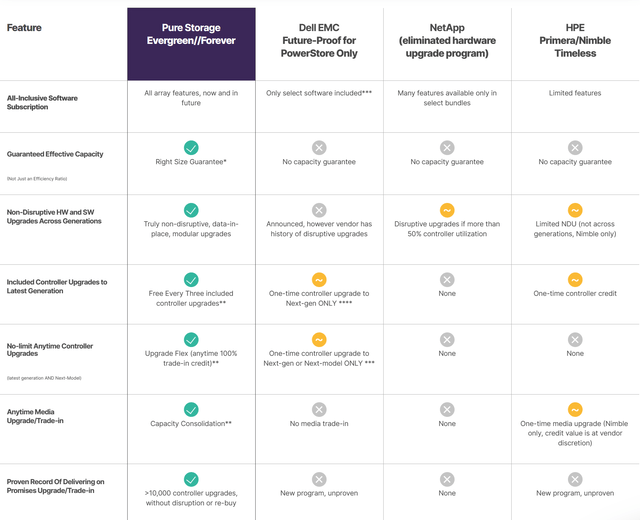

In a report compiled by Gartner, Pure Storage has been marked as a leader for nine consecutive years because of its ability to execute and its ability to complete its vision.

Magic Quadrant for primary Storage (Gartner)

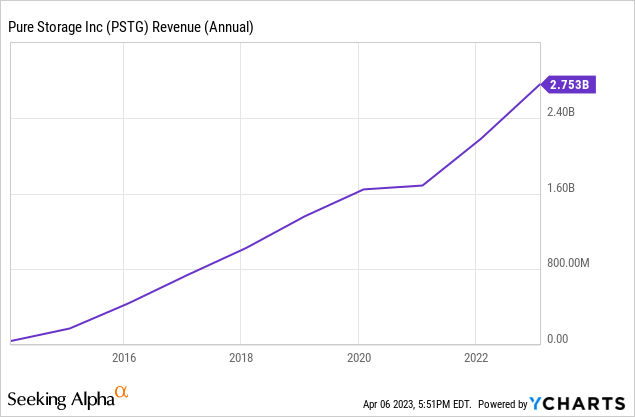

Their edge in their business combined with a laser-sharp focus to deliver to their customers has resulted in them growing their business year over year.

Numbers from their latest quarter results were quite impressive. They ended the year with more than 11k total customers (490 new customer additions in the latest quarter alone) and $810M in quarterly revenues. Active subscriptions increased by 30% YoY, coming in at $1.1B.

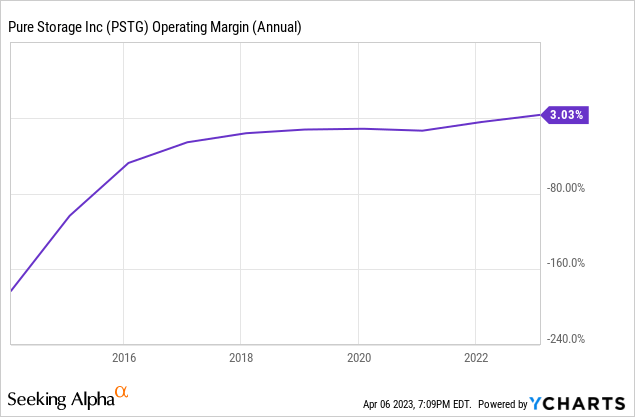

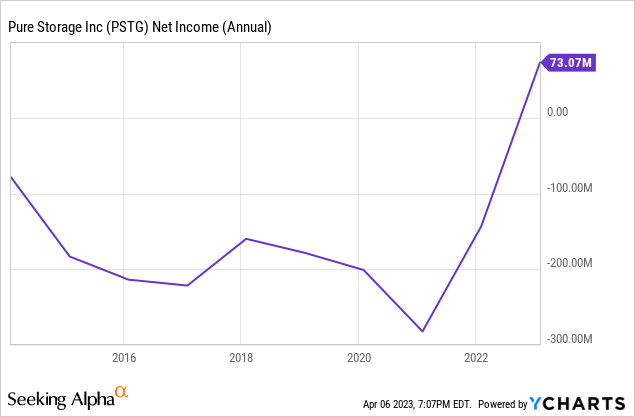

Gross margins have not seen much improvement but operating margins saw a big improvement which resulted in them having their first profitable year as a public company.

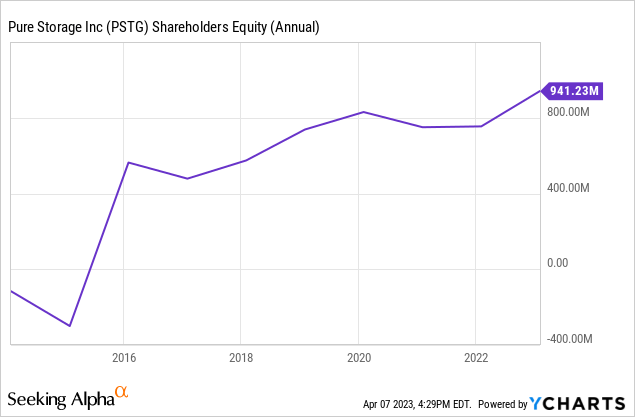

It’s also commendable that through their pursuit of growth, they have been able to maintain a clean balance sheet. Their cash and short-term investments of $1.6B fully cover their debt of $600M. It’s also a good indication that the shareholders’ equity has been trending up all these years.

The Bad

Dilution and Insider Selling

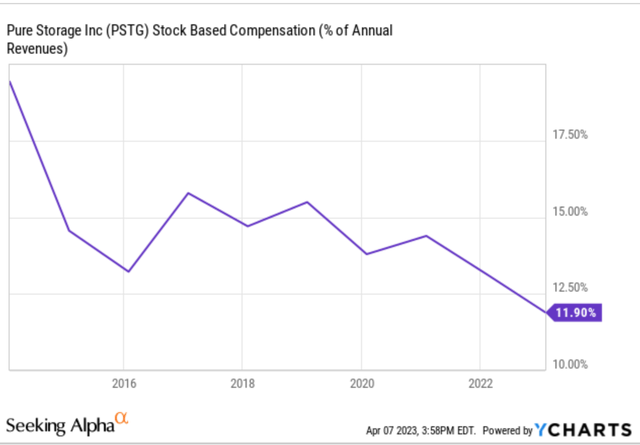

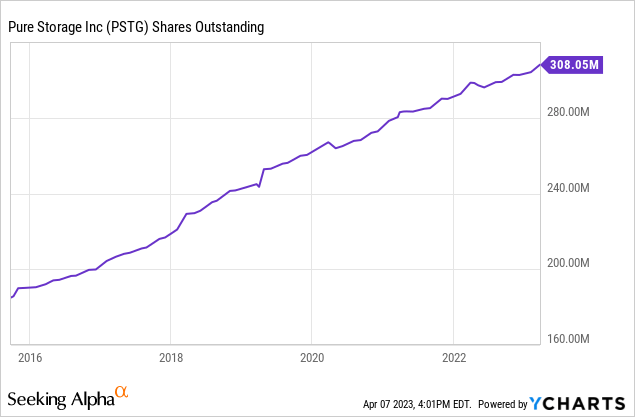

This is a big area where I felt the company can do better. Over the last few years, the company’s growth was mostly funded through SBC, and ideally, when I compare stock-based compensation to revenues, I would like to see it not exceeding more than 10% as a worst-case scenario. But here it does not look like it was ever in that range. Excessive SBC has also resulted in massive shareholder dilution (The outstanding share count has almost doubled in the last six years).

YCharts

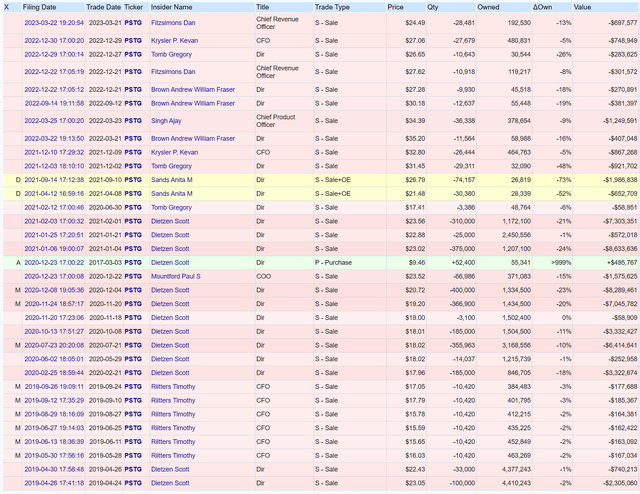

Data from Open Insider also reveals that insiders have been net sellers of the stock in the last couple of years. This may indicate decreased confidence in the stock being able to generate good returns in the future.

Insider Selling and Buying of shares (Open Insider)

Valuation

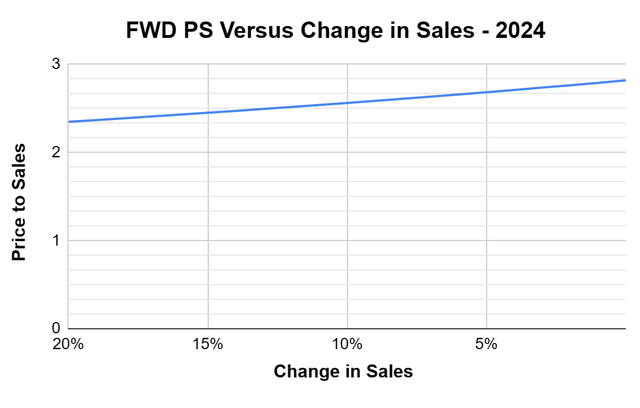

Another area of slight concern would be its valuation. As the company just started turning a profit from the latest year, its Price to Earnings multiple would not be reliable. Its cash flows are significantly inflated by SBC and I avoid using cash flow ratios when this is the case. That leaves us mostly with Price to Sales ratio. From its latest quarter, the company has provided revenue guidance for FY24 to be “Mid to High Single Digit Y/Y Growth”. This was seen as muted and sometimes companies provide low guidance to be able to surprise to the upside. The economy may also prove to be more uncertain than originally accounted for, which means the revenues would surprise to the downside. So let us leave some room for error and calculate the Price to Sales ratio for a wide and continuous range of scenarios.

Author Computed from company data

At the high end of sales at 20% growth, the PS ratio comes in at 2.3. At the lowest end where the sales remain flat for the year, the PS ratio comes in at 2.8. While certainly not expensive, it is not cheap either. When compared to other companies in the sector, it is quite close to the sector median.

Concluding Thoughts

At this point in time, the stock is on my radar but I will be on the sidelines till I see the following –

- Continue to see an increase in profitability while also growing sales (even if it is a modest growth in sales, it is acceptable as the company is past its growth phase now)

- Return value to shareholders. They have announced a stock buyback program of up to $250M with no end date or commitment. So I am not entirely sure how much of an effect it will have on arresting share dilution. Their current strategy for growth has been coming at the expense of shareholders

- Valuation that is more attractive

Read the full article here