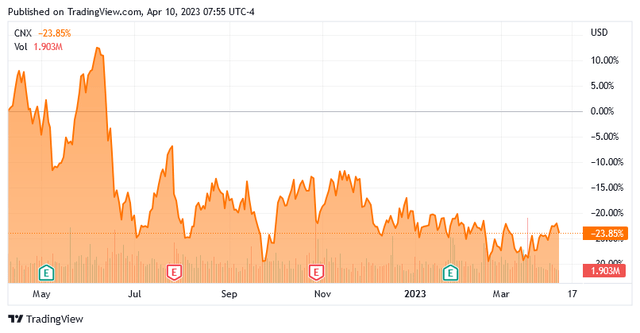

CNX Resources Corporation (NYSE:CNX) is an independent exploration and production company that focuses on the production of natural gas in the Appalachian Basin. This is generally a good place to be right now, as the long-term fundamentals for natural gas are quite strong, despite the fact that prices have fallen over the past several months. This has had a negative impact on the company’s stock price, as CNX Resources is down 23.85% over the past twelve months:

Seeking Alpha

One of the biggest reasons for this is that the winter this year was quite a bit warmer than normal, so natural gas consumption was down. That has been quite fortunate for Europe, as the war in Ukraine and the Western sanctions on Russia are still limiting supplies of natural gas to that area of the world. The real forward growth for natural gas is ultimately expected to come from Asia, however. This should all prove to be a net positive for prices and a net benefit for CNX Resources. It is certainly a multi-year story though so investors today should not expect the stock to skyrocket in the next year or two. Fortunately, CNX Resources looks to be substantially undervalued today so there could still be some reasons to invest in the stock at the present level.

About CNX Resources Corporation

As stated in the introduction, CNX Resources is an independent exploration and production company based in Pittsburgh, PA. The company primarily produces natural gas, which makes sense as its operations are in the Marcellus and Utica Shale plays. This is a pretty good place to be for a natural gas producer, as the Appalachian region is one of the richest sources of natural gas in the world. According to the Energy Information Administration, the Marcellus Shale has total proven reserves of 148.7 trillion cubic feet of natural gas, which makes this the wealthiest resource basin in the United States and one of the ten largest sources globally outside of the Middle East and Siberia. CNX Resources is thus well-positioned to be a significant producer of this substance.

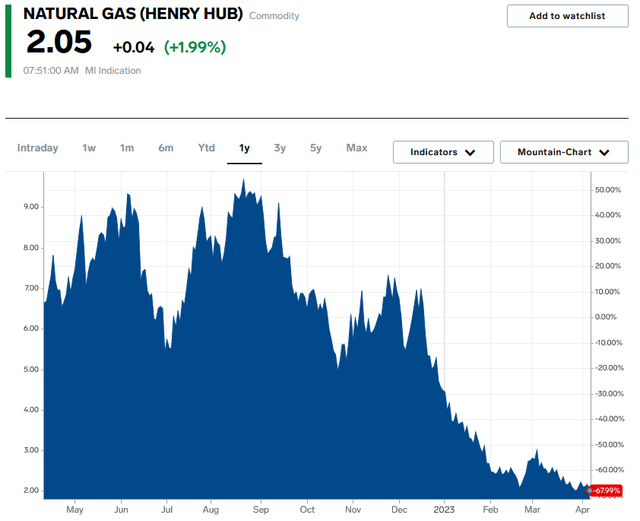

Unfortunately, natural gas prices have not been particularly strong over the past few months. We saw a significant surge early last year following the outbreak of hostilities in Ukraine. This is mostly because Russia is a major producer of natural gas and supplies about a third of the natural gas consumed by the European Union. There were some concerns that this supply would be cut off as Russia and the European Union found themselves on opposite sides of this conflict. However, the price moderated over the year and, combined with a warmer than typical winter, overall natural gas prices at Henry Hub are down 67.99% over the past twelve months:

Business Insider

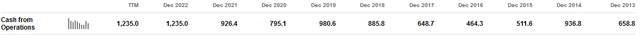

This obviously had an impact on CNX Resources’ stock price. As we saw in the introduction, the company’s stock is down 23.85% over the same period. However, the company’s finances have been holding up just fine. In fact, over the course of 2022, the company reported an operating cash flow of $1.235 billion, which represents a substantial increase over previous years:

Seeking Alpha

The fourth quarter of 2022 was not bad either, as CNX Resources reported an operating cash flow of $442.3 million. That represented a 74.75% increase over the $253.1 million that the company had in the prior-year quarter. Interestingly, CNX Resources managed to achieve this cash flow increase even though its production was down. In the fourth quarter of 2022, the company had an average daily production of 140.6 billion cubic feet of natural gas equivalent compared to 158.2 billion cubic feet of natural gas equivalent during the fourth quarter of 2021. The company did have a slightly higher selling price in the most recent quarter, but that did not account for all of the increase.

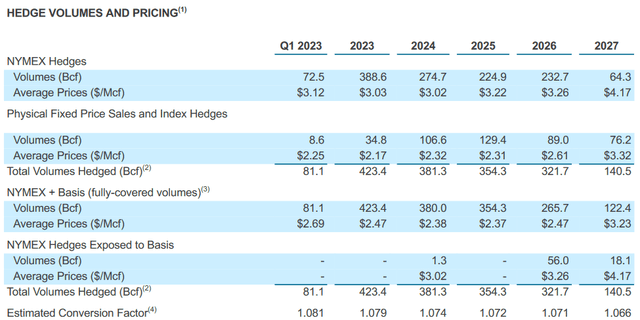

It is worth noting though that the company’s average realized price of $2.96 per thousand cubic feet of natural gas equivalent during the fourth quarter of 2022 is quite a bit higher than the average natural gas price that we have seen so far in 2023. This could be concerning for the company as it will likely result in a decline in revenues, assuming that production remains somewhat similar. Fortunately, CNX Resources does have a way to at least partially protect itself from the effects of this price decline. As is the case with most independent exploration and production companies, CNX Resources employs a hedging program to protect itself against fluctuations in resource prices. The way this basically works is that the company employs derivatives such as forwards and futures contracts to lock in the selling price for the natural gas and other hydrocarbon products that it produces. Currently, the company has about 82% of its expected 2023 natural gas production covered by this program at an average price of $3.03 per thousand cubic feet of natural gas:

CNX Resources

This has enabled the company to provide adjusted EBITDAX guidance of $1.100 billion to $1.250 billion for the full-year 2023 period. That represents a slight decline over the $1.300 billion that the company reported for the full-year 2022 period, but that is not really surprising considering the fact that the energy market will likely be a bit weaker this year. This is especially true as there are a growing number of signs that the United States may be on the verge of a recession, which would likely reduce the demand for natural gas.

Fortunately, the company should be able to produce natural gas profitably even at today’s prices. During the full-year 2022 period, CNX Resources had an average production cost of $1.20 per thousand cubic feet of natural gas equivalent. The company is working to reduce that further and has guided to a $1.10 per thousand cubic feet of natural gas equivalent over the full-year 2023 period. This is nice because it should allow the company to generate a positive free cash flow, much as it did last year. Over the twelve-month period that ended on December 31, 2022, CNX Resources reported a levered free cash flow of $44.9 million and an unleveraged free cash flow of $116.3 million. These figures were unfortunately both down year-over-year:

|

FY 2022 |

FY 2021 |

|

|

Levered Free Cash Flow |

$44.9 |

$74.5 |

|

Unlevered Free Cash Flow |

$116.3 |

$141.9 |

(All figures in millions of U.S. dollars.)

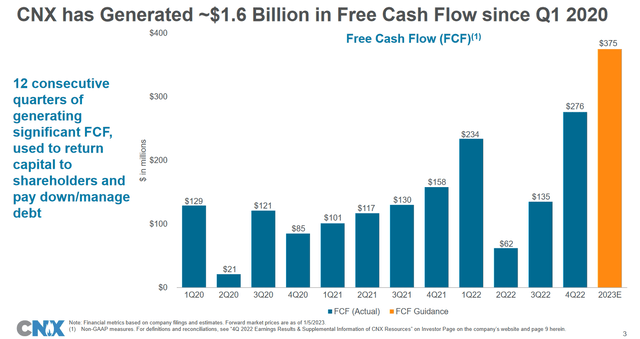

This represents the continuation of the company’s track record since 2020. In fact, since that time, CNX Resources has generated approximately $1.6 billion in free cash flow, which it should be able to continue in 2023:

CNX Resources

This is nice because of the nature of free cash flow. Free cash flow is the money that is generated by a company’s ordinary operations and is left over after it pays all of its bills and makes all necessary capital investments. This is the money that can be used to do things that benefit the shareholders, such as reducing debt, paying a dividend, or buying back stock. This is exactly what CNX Resources has been doing, which we will discuss later in this article. The fact that the company is generating positive free cash flow and paying down debt is perhaps critical given the market environment right now. Several of the major fund houses, such as BlackRock (BLK), have begun to judge a company’s suitability for investment based on its environmental, social, and governance scores. The Biden Administration recently issued an executive order allowing 401k managers and sponsors to do the same thing. Fossil fuel producers do not typically score as well as companies in some other industries, so this policy has had the effect of cutting these companies off from raising capital in the market and forcing them to become financially self-sufficient. This is a staunch departure from the situation a few years ago in which shale producers were the largest issuers of junk bonds in the markets. It is nice to see though as stronger finances are always welcome and the strong cash flow could ultimately result in the company paying a dividend.

Natural Gas Fundamentals

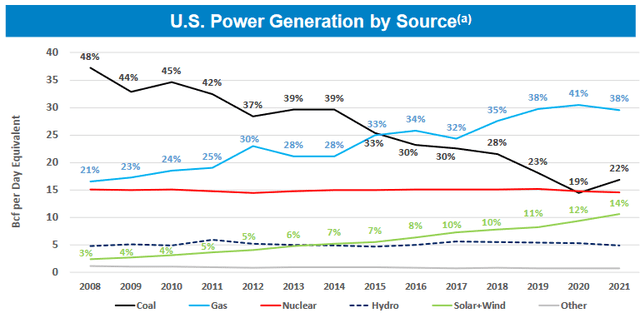

As stated earlier in this article, the fundamentals for natural gas are quite strong, which may come as a surprise to some readers. After all, we have been hearing a lot from politicians and the media about how fossil fuels will soon become obsolete. However, the truth is that renewables cannot completely replace fossil fuels anytime soon. I discussed this in a recent blog post. The biggest reason for this is that renewables such as wind and solar power are unreliable. After all, solar does not work at night and wind power does not work when the air is still. While batteries have been proposed as a potential solution to this, the most powerful battery pack in the world can only power a small city for about thirty minutes. Thus, until we have battery storage technology that is far superior to anything we have today, batteries are not a good option. This is why most utilities have been supplementing their wind and solar projects with natural gas turbines, as natural gas burns cleaner than any other fuel (except for nuclear power) and has sufficient reliability to ensure that the grid remains functional. This is one reason why natural gas currently generates more electricity than any other source in the United States:

Range Resources/Data from EIA

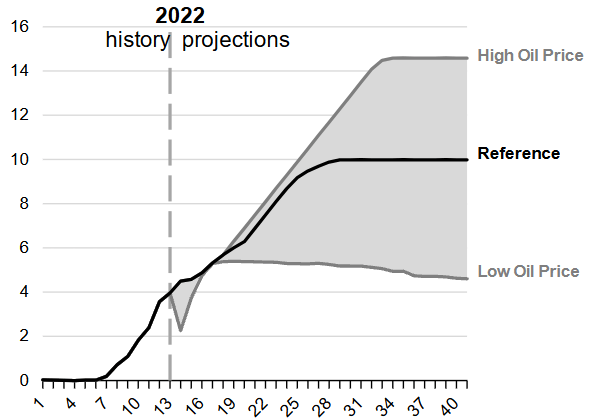

We are seeing the same trend around the world as countries in Western Europe aim to reduce their dependency on Russian natural gas and the rapidly-growing nations of Asia seek to replace coal power with natural gas and renewables in order to reduce their smog problems. The United States is well-positioned to benefit here due to the substantial resources of the Marcellus Shale. The Energy Information Administration is currently projecting that natural gas exports will surge over the coming years:

U.S. Energy Information Administration

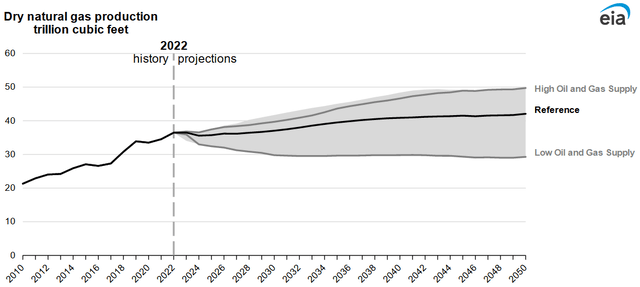

Meanwhile, it is not projected that natural gas production will increase by very much over the same time period:

U.S. Energy Information Administration

This is partly due to the aforementioned environmental, social, and governance investing trend. After all, if natural gas producers cannot easily or affordably raise capital to expand production, they are not going to. CNX Resources’ guidance certainly is not calling for any production growth in 2023 relative to previous levels. Thus, we have a situation in which natural gas demand is expected to rise but production will not. The law of supply and demand tells us that this will result in rising prices over time. It should be fairly obvious how this will benefit a natural gas producer like CNX Resources.

Financial Considerations

It is always important to look at the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a business than equity because debt must be repaid at maturity. This is typically accomplished by issuing new debt and using the money to repay the existing debt. That can cause a company’s interest costs to increase following the rollover in certain market conditions. This is a concern today as interest rates are currently at the highest levels that we have seen in ten years and there are no signs that they will be reduced in the near term. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flow to decline could push it into financial distress if it has too much debt. That is an especially big concern for an exploration and production company like CNX Resources due to the volatility of natural resource prices.

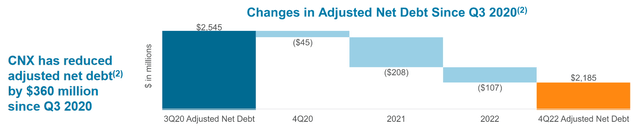

One metric that we can use to evaluate an exploration and production company’s debt load is its leverage ratio, which is also known as the adjusted net debt to trailing twelve-month adjusted EBITDAX ratio. This ratio essentially tells us how long (in years) it would take the company to completely pay off its debt if it were to devote its entire pre-tax cash to that task. As of December 31, 2022, CNX Resources had an adjusted net debt of $2.185 billion compared to a trailing twelve-month adjusted EBITDAX of $1.300 billion. This gives the company a leverage ratio of 1.70x, which is unfortunately quite a bit higher than we really like to see. Range Resources Corporation (RRC), one of the company’s major Appalachian peers, is currently at well under 1.0x as are numerous independent companies operating in the Permian Basin. Thus, we would really like to see CNX Resources get its debt level down in order to better compare with its peers. The company has been working at doing this though, as CNX Resources has reduced its adjusted net debt by $360 million since the third quarter of 2020:

CNX Resources

This is likely why the company still is not paying a dividend despite its respectable free cash flow. For the time being, it appears that the company is focused on reducing this debt, which is a good thing for the reasons that were just mentioned. Unfortunately, this does mean that investors will likely have to wait a while until the company begins to reward them via a dividend.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a sure-fire way to generate a suboptimal return on that asset. In the case of an independent exploration and production company like CNX Resources, we can value it by looking at the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that a stock is undervalued relative to its forward earnings per share growth and vice versa. However, as I have pointed out in the past, pretty much everything in the energy sector has been substantially undervalued for quite some time. As such, the best way to use this ratio is to compare CNX Resources with its peers in order to determine which company currently offers the most attractive relative valuation.

According to Zacks Investment Research, CNX Resources will grow its earnings per share at a 20.72% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.41 at the current price. That certainly represents a significant undervaluation based on the company’s earnings per share growth, but here is how it compares to its peers:

|

Company |

PEG Ratio |

|

CNX Resources |

0.41 |

|

Range Resources |

0.36 |

|

Comstock Resources (CRK) |

NA |

|

Pioneer Natural Resources (PXD) |

1.13 |

|

Devon Energy (DVN) |

0.15 |

As we can see here, CNX Resources is not exactly the most attractively-valued stock out of this peer group, but the company still appears to be undervalued today. Thus, we certainly could do worse than buy the stock at the current price. However, it might also be justifiable to see if the stock falls a bit before we buy the shares considering that both Range Resources and Devon Energy have stronger balance sheets and are a bit cheaper today.

Conclusion

In conclusion, CNX Resources Corporation does appear to have a lot to offer today. The company is one of the few ways to play the growth in natural gas demand, particularly without having exposure to the weaker fundamentals of crude oil. The company probably will not do quite as well this year as it did last year, but it should still deliver reasonably respectable results and it is at least somewhat protected against changes in natural gas prices. The fact that the company has been working to strengthen its balance sheet and is substantially undervalued relative to its growth prospects also adds to its appeal. CNX Resources Corporation might overall be worth considering.

Read the full article here