Investment Summary

ABM Industries Incorporated (NYSE:ABM) is a facility solutions provider in the US. Their services range from janitorial and cleaning to electrical and lighting, heating, ventilation, air conditioning, and energy management. They serve a wide range of customers from different industries such as commercial, industrial, healthcare, and education. This wide array of services has netted the company a very strong cash position at $1.3 billion. But that is about where the excitement ends in my opinion.

The company has not been able to experience any significant growth. The earnings last report had the revenues increase 3% YoY, with most of that increase coming from acquisitions. Even though the company has a lot of cash, it seems the priority lies in distributing a dividend and buying back shares instead of making investments that show better results. With this lack of movement and willingness to take bolder steps, I wouldn’t want to be invested and will rate the company a sell. I think there are better quality companies out there that offer exposure to the same industry.

Industry Overview And Outlook

The facility solutions industry is a sector that has been growing quickly and offers various services to businesses and organizations. This industry comprises companies that provide services ranging from janitorial and maintenance to HVAC, electrical, and energy management.

According to a report by Fact.MR the industry is expected to grow at a CAGR of 6.3% between 2022 and 2032 worldwide. But given that ABM operates in the United States I find it more interesting to look at that market specifically. The US market is according to the report instead to see a 5.8% CAGR in the same timeline. I think this has clearly not been reflected in the earnings report by ABM, which makes me quite worried honestly.

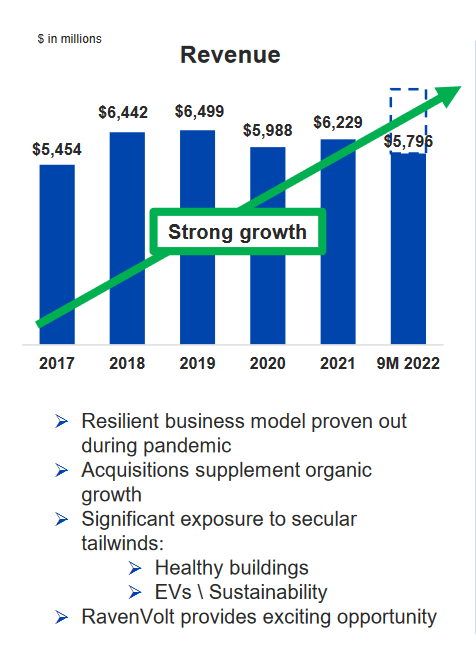

Company Growth (Company Presentation)

In a presentation by the company, they showcased what they found to be strong growth. Between 2017 and 2022 the company achieved around a 44% growth in top-line revenues as they generated $7.8 billion in 2022. This amounts to about 8.8% in CAGR, which I don’t see as sufficient to make a buy case for the company. Perhaps if you take the dividend into account the picture looks a little better.

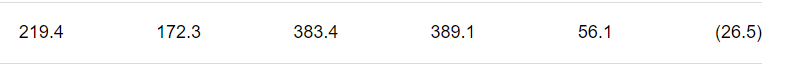

Operating Expenses (Earnings Report)

But as I mentioned before, the company experienced a 3% growth in revenues YoY in the last report. The worrying part was the operating expenses growing at a faster pace, 5.8% YoY. This makes me wonder how the future margins might look for the company. Unless they are able to handle expenses the levered cash flows will continue to stay negative. What I want to showcase is that the outlook looks too shaky in my opinion. The growth doesn’t seem to be there and cracks are already showing.

Risks

One of the major risks I see with the company is the negative levered cash flows it has. It was at very good levels a few years ago but has since dropped and is as of the last 12 months negative.

Cash Flow History (Seeking Alpha)

I think this has made investors worried about the company and the management’s ability to provide value to shareholders through either the company growing revenues or buying back shares. Instead, I think the question arises if share dilution is necessary in order for ABM not to default on any debt.

I don’t think investing in companies with negative levered cash flows is very wise. It opens up too many risks in my opinion. Without positive levered cash flows, any short-term headwinds can create a lot of difficulties and push the share price further down.

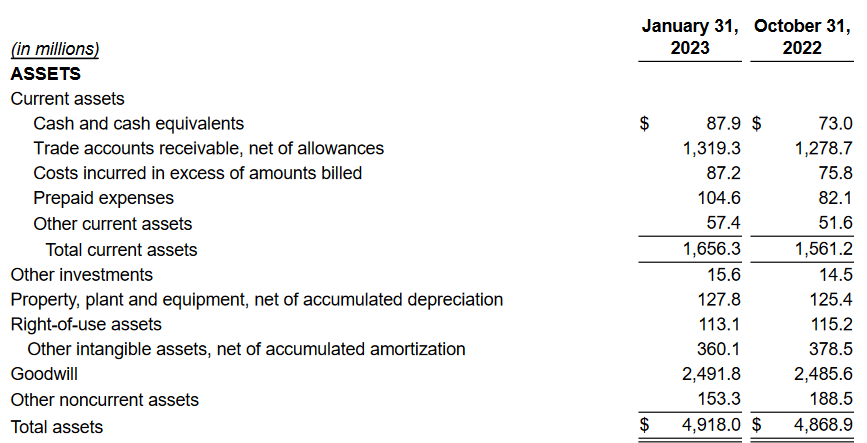

Financials

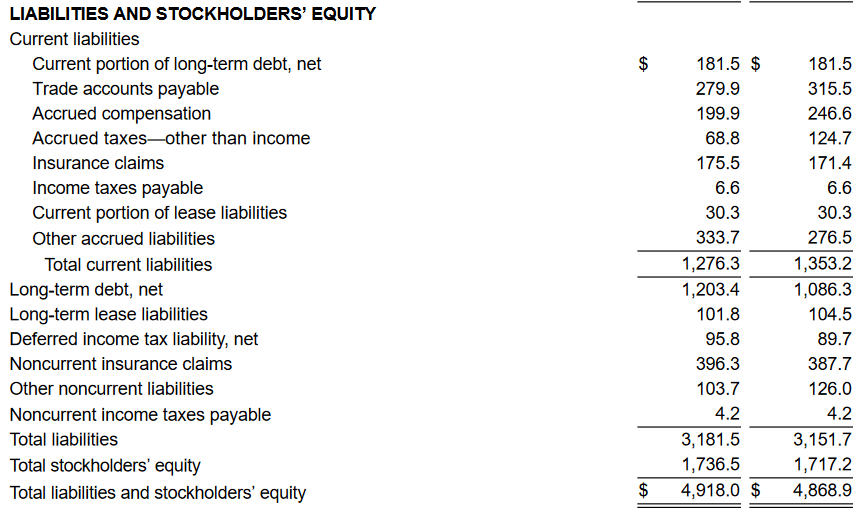

ABM Industries Incorporated’s balance sheet as of January 31, 2023, shows that the company’s total assets are $4,918.0 million, an increase of $49.1 million from the previous quarter. This isn’t particularly impressive despite the company having a very decent amount of growth in 2022 compared to 2023. The worrying part is the levered cash flows being negative in the last 12 months. This is a worrying trend that I think could make the debt the company has more challenging.

Company Assets (Earnings Report)

Total liabilities rose by $29.8 million to $3,181.5 million. But the good news is that the company’s current portion of long-term debt and lease liabilities stayed the same, suggesting that they are effectively handling their short-term debts at least. But as was mentioned before, the company has had negative levered cash flows as of the last 12 months which I think opens up the possibility of potential debt issues further down the road. Without levered cash flows, the company will need to tap from its saved-up cash position or start diluting shares. Neither of which I think creates a very good situation.

Company Liabilities (Earnings Report)

Moving forward I will especially be watching the margins the company has and whether or not they are able to regain their positive levered cash flows. At that point, it might be about a turn-around story instead for ABM. Until then I still remain confident about the sell rating for ABM stock as better opportunities in the same industry seem to be out there.

Valuation & Wrap Up

Looking at the valuation of the company it doesn’t seem overvalued at a forward p/e of just 12. But I think when you dive deeper into the company there are some clear reasons as to why this is the case and the market isn’t valuing it for the same reason. Looking at the profitability of the company, it’s quite disappointing compared to some peers in the industry. Companies like CWST or SRCL both have better gross margins and perhaps could offer more potential as investments. Besides having higher gross margins they also seem to have better and more consistent levered cash flows than ABM, creating less risk and a more enticing opportunity for investors in my opinion. What I think is another red flag is the high net debt/EBITDA ratio of around 3.3 when using the TTM numbers. I think this presents a decent risk that the company might struggle to pay down debt and open up the possibility of share dilution, hurting any investor in the company. As a reference, anything under 2.5 is generally what I go for regarding the net debt/EBITDA ratio, it just gives me more confidence in that the company is financially flexible and able to take on challenges efficiently.

Firstly, the levered cash flows are negative in the last 12 months which makes it very difficult to predict the future of the company and its ability to invest and gain more market share. Instead, debt might create issues and share dilution is in my opinion on the table if this persists.

Price Chart (Seeking Alpha)

Secondly, I don’t think the growth story is just not there. The last 5 years have netted around an 8.8% CAGR in revenues, which I quite frankly don’t see as enough to justify a buy case given the issues I have previously laid out. This leads me to are them as a sell for the moment.

Read the full article here