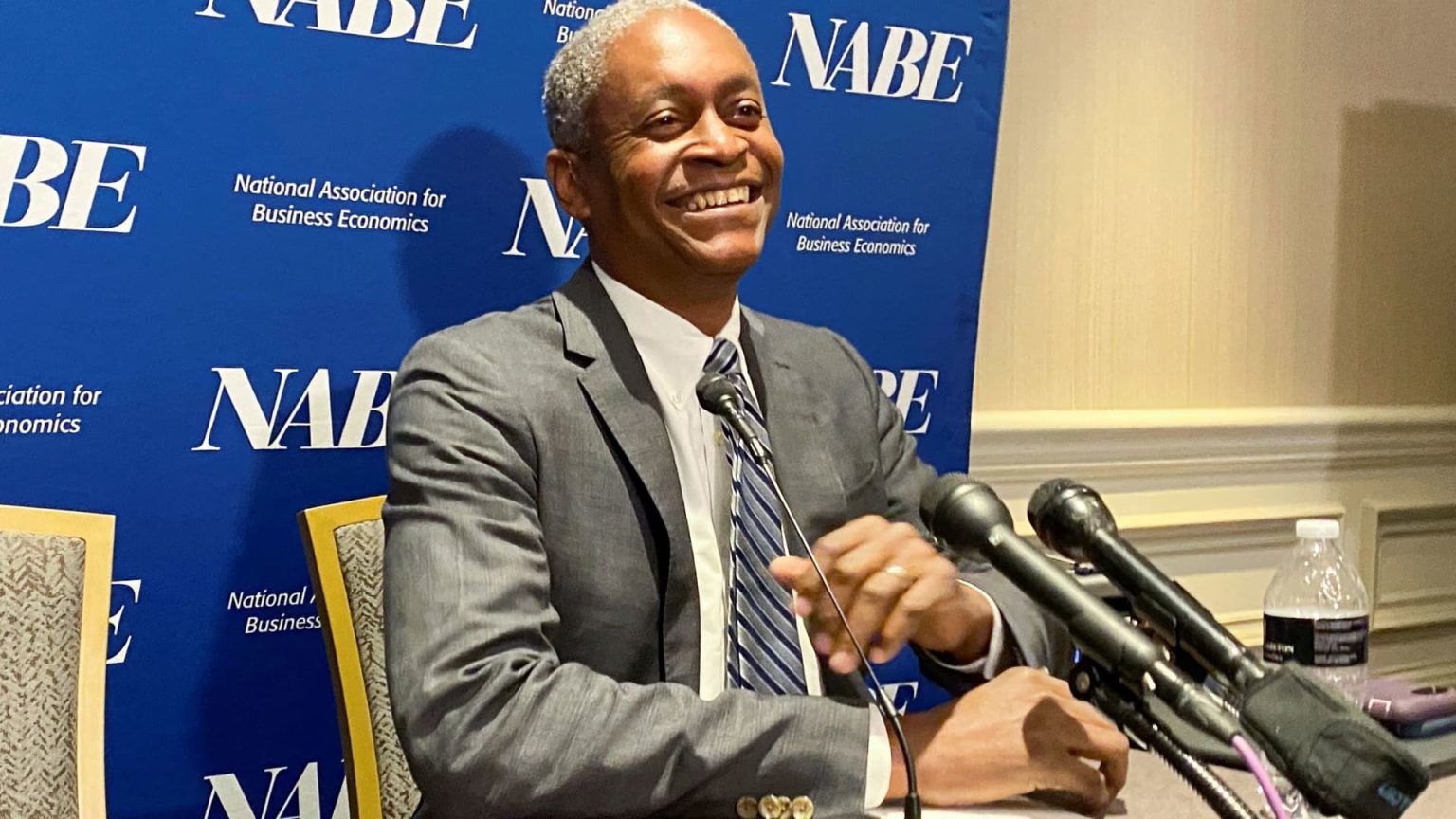

Atlanta Federal Reserve President Raphael Bostic on Friday said he doesn’t envision interest rate cuts happening until well into 2024.

Though he cited progress on inflation and a slowing economy, the central bank official told CNBC that there’s still a lot of work to be done before the Fed reaches its inflation goal of 2% annually.

“I would say late 2024,” Bostic replied when asked for a time frame when the first decrease could come.

The Fed has raised its key borrowing rate 11 times since March 2022 for a total of 5.25 percentage points. While Bostic said he doesn’t see policymakers easing anytime soon, he has been explicit in insisting that rates have hit a “sufficiently restrictive” level where they don’t need to be raised anymore.

However, he cautioned that the road back to acceptable levels of inflation could be a long one.

“There’s still a lot of momentum in the economy. My outlook says that inflation is going to come down but it’s not going to like fall off a cliff,” Bostic said during the “Squawk Box” interview. “It’ll be sort of a progression that’s going to take some time. And so we’re going to have to be cautious, we’re going to have to be patient, but we’re going to have to be resolute.”

Bostic is not a voting member this year of the rate-setting Federal Open Market Committee, but will get a vote in 2024.

He said he does not expect “that we will be cutting rates before the middle of next year, at the earliest.”

“I really do try to keep people focused on what inflation is, still at 3.7%. Our target is 2,” he said. “They’re not the same, and we have to get a lot closer to the 2% before we’re going to consider … any kind of relaxation of our posture.”

Following a slew of Fed speakers in recent days, including Chair Jerome Powell on Thursday, market pricing has removed any chance of a rate increase when the FOMC next meets Oct. 31-Nov. 1. The probability for an increase in December is just 25%, according to the CME Group’s FedWatch Tool, which gauges pricing in the fed funds futures market.

Markets are anticipating two or three quarter-point cuts by the end of 2024.

One reason the Fed could consider easing rates would be a deceleration or recession in economic growth. While Bostic said he does not anticipate a recession ahead, he does see conditions changing. Business contacts have been telling him they are preparing for a slowdown, he said.

“We are not going to see recession, that is not in my outlook,” he said. “We are going to see a slowdown, and inflation will get down to 2%.”

Bostic spoke following some significant move in financial markets, particularly in Treasury yields. After breaching the psychologically important 5% level earlier in the session, the benchmark 10-year Treasury yield eased somewhat, most recently trading around 4.97%.

Read the full article here