Corporate bonds from the big money-center banks are rallying in concert with their stock prices amid more bullish sentiment on Wall Street about potential interest-rate cuts in 2024.

Also read: Wall Street divided on how many Fed rate cuts there will be in 2024

Corporate-bond prices for JPMorgan Chase & Co.

JPM,

-0.73%

and Morgan Stanley

MS,

-0.89%

outpaced those for Citigroup Inc.

C,

+1.04%,

Goldman Sachs Group Inc.

GS,

-0.53%

and Bank of America Corp.

BAC,

-1.06%

into positive territory, including an upward jump on Wednesday, according to data from BondCliQ Media Services, as shown by the chart below.

Equity prices for the banks have been on the rise as well, including a 2.1% rise for JPMorgan Chase on Thursday, a gain of 5.7% for both Goldman Sachs and Bank of America, and gains for Citigroup of 3.3% and Morgan Stanley of 6.6%.

While bond prices have risen, yields have come down, and the spreads against yields on 10-year Treasuries

BX:TMUBMUSD10Y

have tightened in a sign of healthy demand for money-center bank debt, as this chart shows:

Spreads for Goldman Sachs and Bank of America have fallen more dramatically than for JPMorgan Chase, Morgan Stanley and Goldman Sachs.

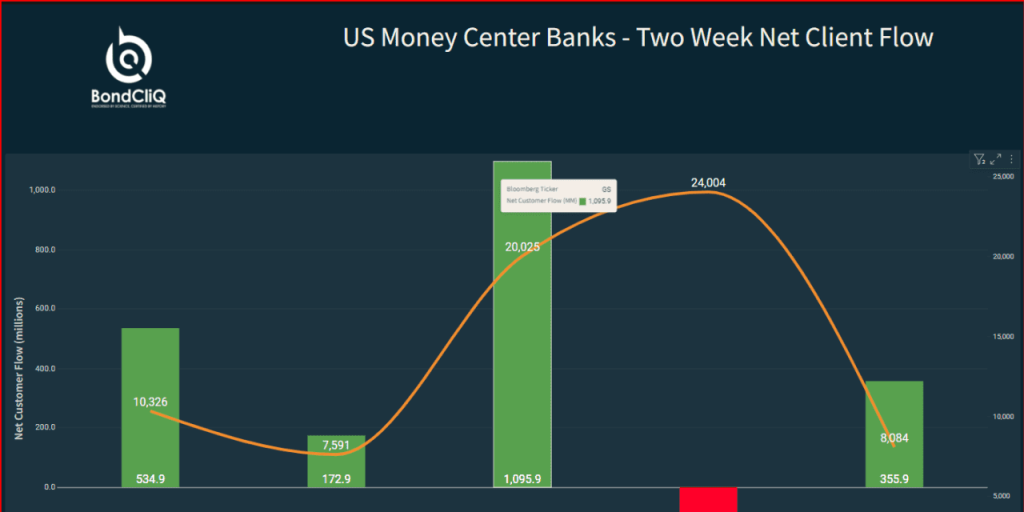

Money has flowed out of JPMorgan Chase, while investors put more money to work with Goldman Sachs than with the other four money-center banks.

Read the full article here