It’s often said that Wall Street and Main Street don’t have the same values and concerns. That seems to be playing out with

Anheuser-Busch InBev,

as the beer maker’s stock continues to rally despite stoking recent social controversy.

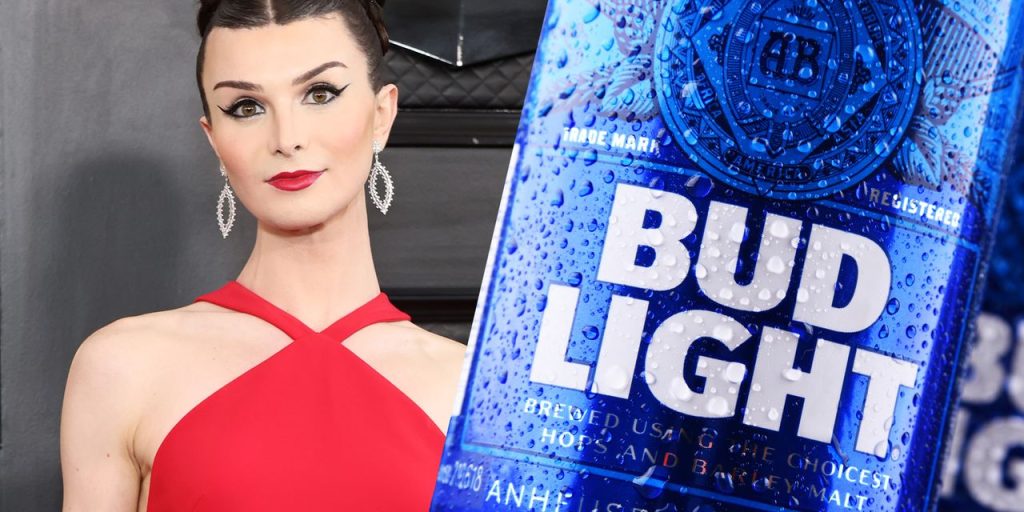

Several weeks ago, AB InBev (ticker: BUD) started a marketing campaign for its Bud Light brand featuring transgender actress and social media personality Dylan Mulvaney, a move that sparked praise and opprobrium along the expected political lines. Conservative commentators and consumers who took exception with Bud Light’s association with Mulvaney called for a boycott.

That led the head of Bud Light to state that the company didn’t intend to stoke division, but hoped to bring “people together over a beer.” For her part, Mulvaney, who has partnered with other brands as high profile as

Nike

(NKE), has gained plenty of new social media followers in the wake of the debate.

Of course there are many Americans who don’t know—or care—about the controversy, as social issues can often be amplified in social media echo chambers.

Nonetheless, it would be wrong to assume no impact: As Truist Securities analyst Michael Roxland wrote last week, leading industry publication Beer Business Daily noted some volume declines in Bud Light over the Easter holiday weekend in some markets following the ad campaign. Additionally, “the publication stated that some AB InBev distributors in the Heartland and South were increasingly cautious given negative consumer reaction.”

That may be the case, but it’s done little to slow AB InBev’s recent rally. The shares have jumped more than 8% over the past month and are up 8.1% since the start of the year, helped by a strong fourth-quarter report in March, and at a recent $64.78 are only about 3% below their 52-week high. Over the past year, AB InBev stock is up 10.6%.

That means that AB InBev has outperformed not only the

S&P 500

but its peers tracked by the

Consumer Staples Select Sector SPDR Fund

(XLP) over the past one-month, one-year and year-to-date periods. In fact, over the past year AB InBev has been a standout in the sector, with its shares outpacing those of

Constellation Brands

(STZ),

Molson Coors Beverage

(TAP),

Boston Beer Co.

(SAM) and

Diageo

(DEO).

“We think the recent backlash in some parts of the U.S. to Bud Light’s new advertising campaign with Dylan Mulvaney is overdone.” writes

Citigroup

analyst Simon Hales. He argues that “recent share price weakness provides an attractive buying opportunity” given factors from China’s reopening to improving sales trends.

And since it’s 2023, there’s also the potential for backlash to the backlash to lead some shoppers to seek out Bud Light.

This isn’t the first time AB InBev has created a stir with its marketing. Many conservatives were unhappy with the company’s 2017 Super Bowl ad that narrated the obstacles faced by founder and German émigré Adolphus Busch at a time when immigration was a hot-button topic. Then President Donald Trump called for a boycott, although that movement’s social media steam was somewhat bedeviled by misspelling.

As of 2022, Bud Light was the best selling beer brand in North America, so it’s always going to be an obvious, high-profile target. It also means it’s not immune to factors like inflation or recessionary fears that might make Americans skittish about their spending, even for categories like alcohol that are often considered recession proof.

Ultimately, the fact that AB InBev has backed off its highs probably has more to do with financial rather than social reasons. Investors were likely looking to take profits after its big post-earnings run given ongoing concerns about inflation and consumers’ ability to spend. Some analysts, like Bonnie Herzog of Goldman Sachs Group, have also highlighted concerns that the company has been increasing its promotions, which tend to eat into margins, at a time when it’s still grappling with out-of-stock issues for some of its brands.

Of course those calculations are less likely to stir emotions and drive clicks than culture war tropes, but in the end, they’re more likely to drive the stock long term.

Write to Teresa Rivas at teresa.rivas@barrons.com

Read the full article here