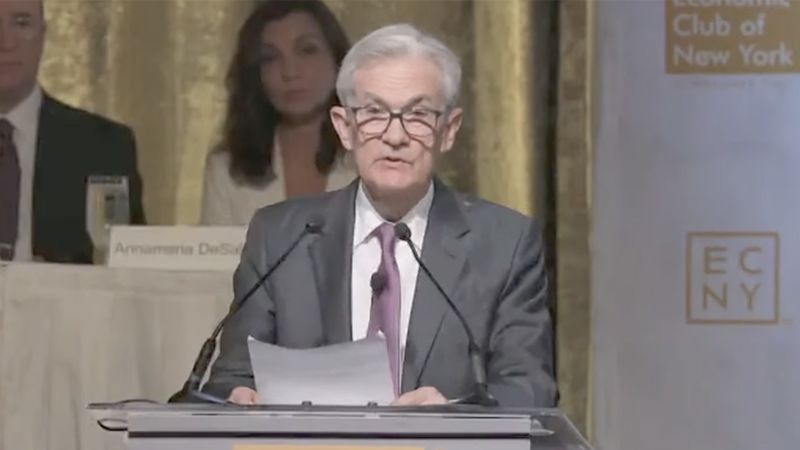

Federal Reserve Chair Jerome Powell said Thursday that soaring bond yields could help the Fed slow the economy, further cooling inflation and the possibly signaling the end of rate hikes. But he stopped short of declaring victory, citing the economy’s resilience.

“Tight policy is putting downward pressure on economic activity and inflation,” Powell said during a discussion at the Economic Club of New York.

While he acknowledged steady progress on slowing inflation — and the role of rising yields — he still left additional action from the Fed on the table. Whether the Fed raises rates or not depends on the economy’s performance in the coming months. The 10-year Treasury yield was close to breaching 5% on Thursday.

Treasury yields have soared recently on expectations that the Fed will keep rates higher for longer, which could slow the economy. The 10-year Treasury yield fluctuated slightly on Thursday as Powell spoke about inflation and the economy, but continued to hover just under the 5% threshold last breached in 2007.

If economic growth continues to be robust and inflation’s descent stalls, a rate hike in December is in play, though a November pause seems to be cemented. But the Fed chair isn’t ready to make any pronouncements just yet, saying the Fed would continue to proceed carefully.

“A range of uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little,” Powell said Thursday.

The job market, economic growth and consumer spending have all held steady despite the Fed’s 11 rate hikes, and the war between Israel and Hamas could rattle global energy markets if the conflict escalates to destabilize the broader, oil-rich Middle East.

The Fed chief said the attack on Israel earlier this month was “horrifying,” and he warned of the uncertain outcome of “highly elevated” geopolitical tensions on the global economy.

Shortly before Powell was set to deliver his prepared remarks, climate change protesters approached the front of the stage, unfurling a sign and chanting. The event’s live stream was turned off and Powell was quickly escorted off the stage as security forcibly removed the protesters from the room. The event continued a few minutes later.

The protesters were from a climate activist group called Climate Defiance, whose stated mission is to “end fossil fuel extraction on federal lands and waters,” according to a post on its site. Protesters from the group interrupted Transportation Secretary Pete Buttigieg’s remarks at a conference held in Baltimore last week.

Powell’s strategy echoes that of other Fed officials, who have said the central bank’s decisions are based on doing just enough to defeat inflation while not doing so much that its actions trigger higher unemployment, or risking “unnecessary harm to the economy,” as he put it.

Fed Vice Chair Philip Jefferson, who holds an influential role at the US central bank, also laid out that strategy earlier this month, saying that the Fed should “balance the risk of not having tightened enough, against the risk of policy being too restrictive.”

Financial markets are overwhelmingly pricing in another Fed pause on rate hikes for the October 31-November 1 meeting, but the chances of an additional pause in December are much lower, at around 61%, according to the CME FedWatch Tool.

The economic landscape

US inflation has slowed markedly from its four-decade peak last summer as the Fed raised short-term rates at its most aggressive pace since the 1980s. The closely watched Consumer Price Index rose 3.7% in September from a year earlier, up from June’s 3% annual rate, mostly due to rising gas prices, but still down from the 9.1% rate in June 2022. That’s a welcome development for the Fed, but officials aren’t quite yet ready to declare victory.

The Fed’s preferred inflation gauge has shown a similar deceleration, with the Personal Consumption Expenditures price index rising 3.9% for the 12 months ended in August, the lowest annual increase that index has seen in two years. Inflation is still above the Fed’s 2% target, and officials have said they need to see further evidence of the economy cooling.

“If we continue to see a cooling labor market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work,” San Francisco Fed President Mary Daly said earlier this month. “Importantly, even if we hold rates where they are today, policy will grow increasingly restrictive as inflation — and inflation expectations — fall.”

However, the US job market remains on strong footing. Employers added a robust 336,000 jobs in September, while the unemployment rate held at a low 3.8% that month. Meanwhile, a separate report showed that job openings unexpectedly surged to 9.6 million in August.

In addition to soaring Treasury yields cooling the economy, dwindling savings accounts, fatigue from high inflation, the resumption of student loan payments this month and even the uncertainty around ongoing labor strikes could ultimately break the US consumer.

New concerns have surfaced around the war between Israel and Hamas, which could roil energy markets if the conflict escalates to disrupt the Middle East. So far, however, investors have mostly shrugged off the conflict.

For now, most economists agree the US economy will likely be spared a downturn this year. Bets of a 2023 US recession have collapsed and gross domestic product, the broadest measure of economy output, was likely robust in the July-through-September period, based on strong economic data in recent months. The Commerce Department reports third-quarter GDP next week.

On top of a strong labor market, retail sales rose in September for the sixth-straight month while US industrial production rose in September to its highest level in nearly five years.

One theme of the US economy this year has been resilience, but that sturdiness will certainly be put to the test in the coming months.

– CNN’s Elisabeth Buchwald and Nicole Goodkind contributed to this report.

Read the full article here