The banking crisis could help the Federal Reserve’s fight to bring down inflation, but the central bank needs to be “cautious” in its actions moving forward, Chicago Fed President Austan Goolsbee said Tuesday.

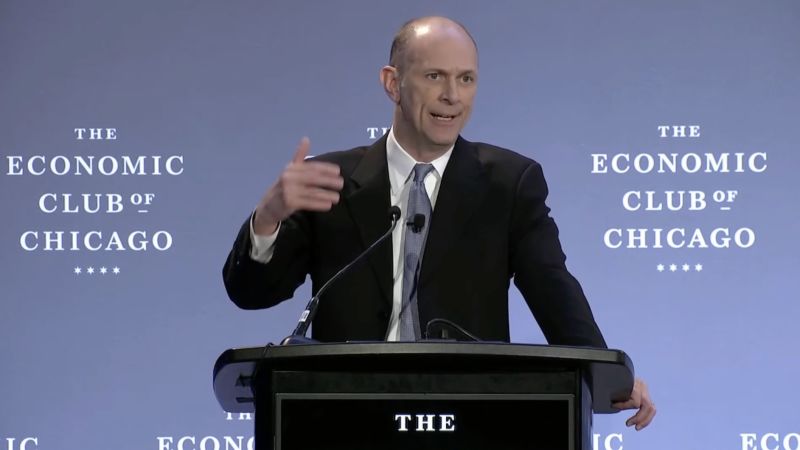

Goolsbee, the newest Fed appointee, spoke before the Economic Club of Chicago and addressed the “new, big, hairy elephant in the room” that was the recent failure of two regional banks, Silicon Valley Bank and Signature Bank, and subsequent market turmoil.

“At moments of financial stress like this, the right monetary policy is really caution and watchfulness and prudence,” he said. “And I don’t say that because I think we should stop prioritizing the fight against inflation just because markets got upset.”

But instead of financial issues trumping monetary policy concerns, financial conditions should certainly be included in monetary policy discussions, Goolsbee said.

“History has taught us that in moments of financial stress, even if they don’t escalate into a crisis, they often mean tighter credit conditions and have a material impact on the real economy in a way that the Fed absolutely needs to take into account when setting monetary policy,” he said.

Currently, he added, there’s not conflict between monetary policy and potentially tightening credit conditions. They would work in tandem to cool inflation, he said.

Still, Goolsbee added, the Fed needs to be “on watch” for the possibility of tighter credit conditions.

“If the response to these banking problems leads the financial industry to tighten on its own, that monetary policy has to do less,” he said. “It’s not clear yet, exactly how much less.”

He referenced private sector analyst estimates that the recent turmoil equates to the Fed enacting rate hikes anywhere from a quarter point to three quarters of a point.

“Given how much uncertainty abounds when these financial headwinds are going, I think we need to be cautious,” he said. “We should gather further data and we should be extra careful about raising rates too aggressively until we see how much work the headwinds are going for us in getting inflation down.”

Goolsbee said the foremost pieces of data he’ll be looking for in advance of the Fed’s next meeting in early May will be about how much credit tightening is occurring.

Read the full article here