The Nvidia success rocket just keeps shooting upwards.

The AI chipmaker, whose stock has helped power the market’s feverish rally this year, once again exceeded Wall Street’s expectations when it reported earnings for its fiscal second quarter on Wednesday.

Nvidia reported sales of more than $30 billion in its fiscal second quarter, up 122% from the same period a year ago, and ahead of the $28.7 billion Wall Street analysts had expected. Profits from the quarter also more than doubled to $16.6 billion, up from the $15 billion analyst projection.

[ORIGINAL STORY FOLLOWS]

For the past few weeks, investors have been laser focused on the Federal Reserve. Now, they’re directing their attention to this $3 trillion artificial intelligence gem.

Shares of Nvidia are up a dizzying 154% this year, thanks to the AI frenzy.

More than that, shares of Nvidia have surged about 3,000% over the past five years. That means anyone who invested $100,000 in the stock back then — when it was little known to many people — would now have roughly $3 million.

The company’s market value is now over $3 trillion, one of only three US companies ever to achieve that milestone.

Nvidia’s outsized roughly 7% weighting in the S&P 500 means that large swings in the stock can have a sizeable impact on the broader market. The chipmaker’s stock has averaged an 8.1% one-day swing in either direction in reaction to earnings, according to Bespoke Investment Group. That has translated to an average 0.5% move in the benchmark index.

The company’s “earnings report has become the world’s most important financial news event. Federal Reserve officials must be getting nervous,” wrote Bespoke in a Wednesday note.

The Santa Clara, California-based company has trounced analysts’ earnings expectations in recent quarters, and some investors had been expecting the same this time around. Wall Street analysts expected Nvidia to post sales and profit growth of more than 100% year over year for the second quarter, according to Refinitiv estimates.

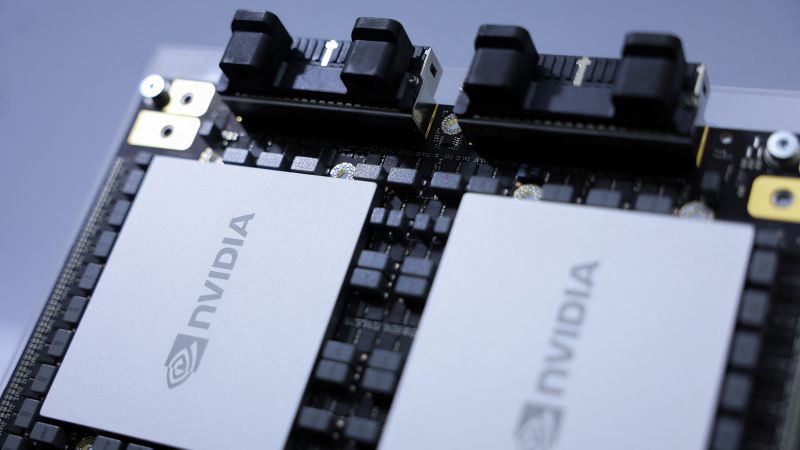

Nvidia is heralded for its processors, largely viewed as the best for powering artificial intelligence technology. The company has seen a monster run in its stock over the last couple of years after the creation of OpenAI’s ChatGPT in 2022 helped spur an AI craze on Wall Street.

Investors look to the AI bellwether for clues about the demand for artificial intelligence: As companies continue pumping cash into developing their AI products and tools, Wall Street in recent weeks has become skeptical about whether artificial intelligence will result in massive productivity gains and a boost to firms’ top lines.

Dave Sekera, chief US market strategist at Morningstar, said investing in AI isn’t only a matter of growth — tech companies also need to invest in AI to keep themselves from falling behind their competitors.

“A lot of that capex spending on AI is needed to protect the existing business from AI upstarts that we see out there, and as firms fail to invest enough in AI and especially in the tech sector, you could become quickly antiquated,” wrote Sekera in a Tuesday note.

Capex, or capital expenditures, refers to large purchases such as buildings and land, as well as the cash spent on maintaining them.

But at least for now, it appears Nvidia has little to worry about in terms of its dominant position as a beneficiary of tech capital expenditures, as Silicon Valley heavyweights continue to expand their investments in AI infrastructure, much of which will go to purchasing chips from Nvidia.

In their own earnings reports earlier this month, Google, Microsoft and Meta Platforms all signaled that they would be upping their AI spending.

Meta said it expects full-year capital expenditures to be between $37 billion and $40 billion, raising the low end of its guidance from the previous quarter by $2 billion. Microsoft said it expects to spend more in fiscal year 2025 than its $56 billion in capital expenditures from 2024. Google projected capital expenditure spending “at or above” $12 billion for each quarter this year. (Even for extremely rich companies, those are big numbers — for Google, its second quarter capital expenditures amounted to about 17% of its total sales).

That should mean that even if the Nvidia hype — which has reached such a point that people are organizing earnings call listening parties as if it’s a championship game — dies down, the company’s fundamentals should remain strong for the foreseeable future.

As Google CEO Sundar Pichai put it, “the risk of underinvesting (in AI) is dramatically greater than the risk of overinvesting.”

Read the full article here