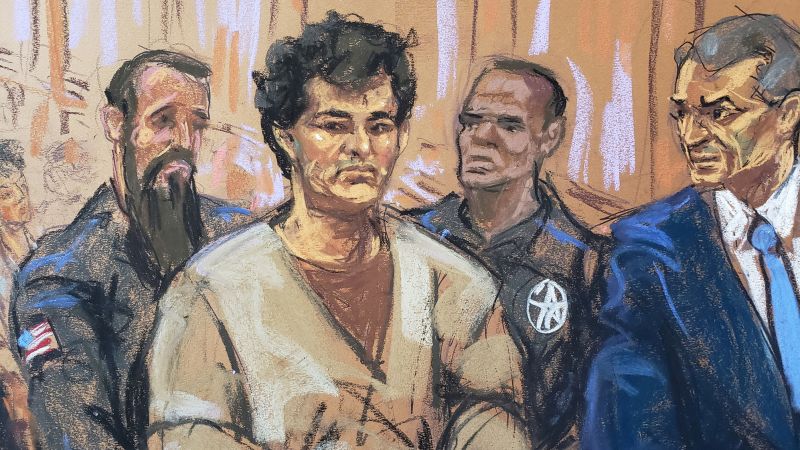

Sam Bankman-Fried plans to take the stand as soon as Thursday to defend himself against prosecutors’ claims that he stole billions of dollars from customers and defrauded investors in his now-bankrupt crypto exchange, FTX.

Lead defense attorney Mark Cohen told the court on Wednesday that he plans to call three witnesses, as well as Bankman-Fried, to testify after he and his co-counsel begin presenting their case to the jury in Manhattan federal court. Up until now, it wasn’t clear whether Bankman-Fried would take the stand, as lawyers typically caution against it.

Bankman-Fried, 31, has pleaded not guilty to seven counts of federal fraud and conspiracy related to the collapse of FTX and its sister trading house, Alameda Research, nearly a year ago.

For the past three weeks, jurors have heard damning evidence from prosecutors that cast Bankman-Fried as a criminal mastermind behind a multibillion-dollar fraud. Several witnesses, including his ex-girlfriend and other members of his inner circle, have cooperated with the prosecution and pleaded guilty in the hopes of receiving a lighter punishment.

Witnesses have told the jury that Bankman-Fried ordered them to siphon funds from customer deposits in FTX, a site where people could buy and sell crypto. Those ill-gotten funds, they said, were moved through a secret portal in FTX’s code that gave Alameda a virtually unlimited line of credit to place speculative bets on risky crypto assets and repay lenders.

Bankman-Fried founded both Alameda and FTX, and oversaw the operations of both even after he handed the title of Alameda’s CEO to Caroline Ellison, an Alameda trader who also dated Bankman-Fried off and on for two years.

The most damning testimony against Bankman-Fried came from Ellison, who offered rare insight into Bankman-Fried’s mindset as he built up both companies, which he claimed were separate entities despite much of the staff sharing offices and even living together in a $35 million penthouse apartment in the Bahamas.

Among other things, Ellison testified that she personally, under Bankman-Fried’s orders, misled lenders and the public about the true relationship between Alameda and FTX. In one instance, she prepared multiple “dishonest” balance sheets to present to outsiders in order to mask “FTX borrows” — her shorthand within company communications for funds that Alameda was taking from FTX customers.

By November of last year, when both companies were collapsing, Ellison described an “overwhelming sense of relief” that the inevitable end was playing out. It was “overall the worst week of my life,” she testified, but said she was glad she wouldn’t have to lie anymore.

The decision to call Bankman-Fried is seen by some legal experts as a Hail Mary for a defense that has so far struggled to counter the prosecution’s narrative. Typically, lawyers in white-collar criminal cases advise their clients against testifying because it opens them up to cross-examination by the prosecution.

In opening statements, Cohen told jurors that Bankman-Fried never committed fraud. He echoed his client’s previous public statements, saying that he made honest mistakes that are common in startups. Bankman-Fried and his co-founders, he said, were “building the plane as they were flying it,” and that some things were “overlooked” in the process.

Read the full article here