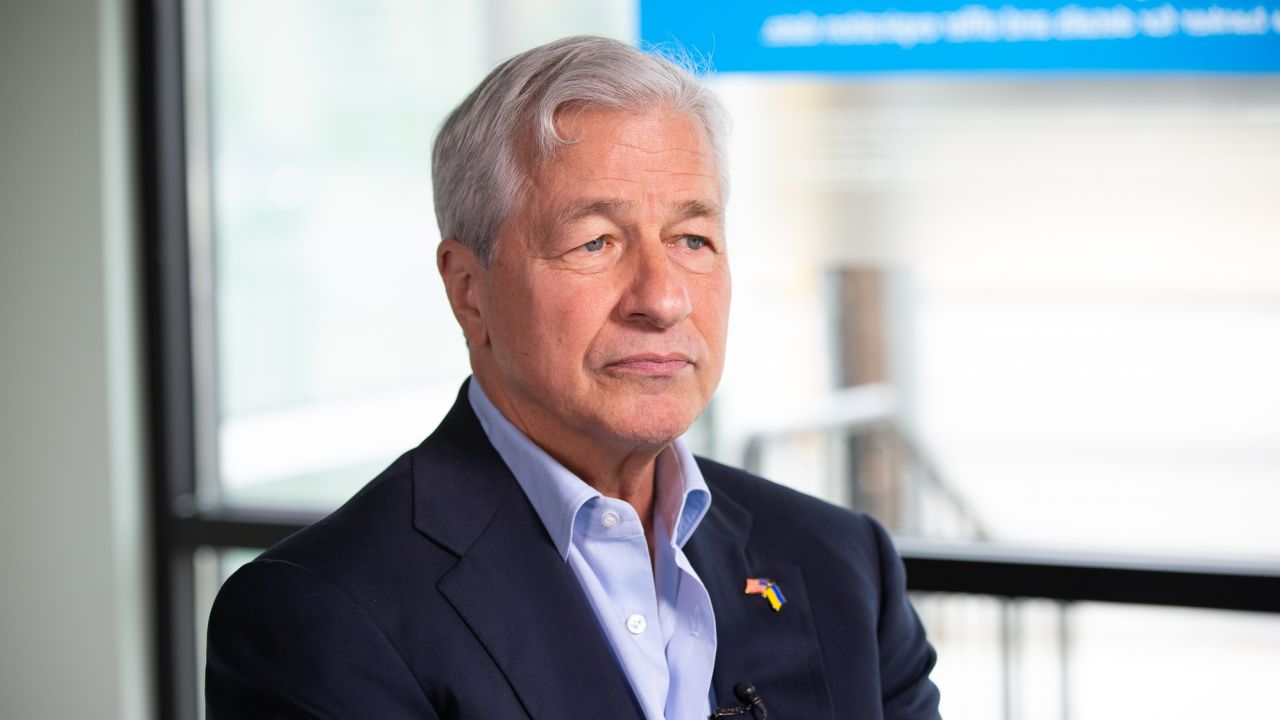

The banking crisis caused by the recent collapse of Silicon Valley Bank and Signature Bank has increased the odds of a US recession, JPMorgan Chase CEO Jamie Dimon told CNN’s Poppy Harlow in an exclusive interview on Thursday.

Speaking in his first interview since the failure of SVB, Dimon said that while the banking system is strong and sound, the recent turmoil around the financial system is “another weight on the scale” towards recession.

“We are seeing people reduce lending a little bit, cut back a little bit and pull back a little bit.” While the banking chaos won’t “necessarily force a recession,” he said, “it is recessionary.”

There are storm clouds ahead for the economy, said Dimon. The Federal Reserve’s current tightening regimen, plus higher, sticky inflation and Russia’s war on Ukraine are the largest risks he sees for the economy. But Dimon said he does feel hopeful about the strength of human capital in the United States.

“I’m a red-blooded, full-throated, free-market, free-enterprise capitalist,” said Dimon of supporting local entrepreneurship. “I think we should applaud free enterprise and we should sing from the hills the benefits while we fix the negatives, as opposed to denigrate the whole thing.”

D

imon sat down with Harlow after the opening of Chase’s Atlanta community branch. The Atlanta bank is Chase’s 16th branch built in conjunction with local communities and which host free events, financial health workshops and skills training for locals. Community branches also provide storefront spaces for small business pop-ups.

These branches, said Dimon, are not charity in any form. They’re good for business. “We need to get money into local communities,” he said. Part of that is as simple as opening a savings account. “A lot of us had moms and dads who took us to open our first accounts,” he said. “And then you see your money go from like $84.75 to $85.17. It was like magic, that interest.”

Dimon said that is part of what he hopes to achieve with his community branches.

“We don’t want people to be afraid to walk into a branch here. Come as you are, bring your kids and learn,” he said.

As part of the initiative, Chase has hired a number of community managers with the express purpose of encouraging those who don’t feel comfortable in a bank setting to come in and learn about their finances.

This role, he said, is essential and is often filled by regional, mid-sized community banks, which is partially why the recent failures of SVB and Signature and the possibility of contagion were so harrowing.

Dimon said he isn’t sure if the US economy is through the thick of the current banking crisis just yet.

“I’m hoping it will resolve, you know, rather shortly,” he said.

Dimon said he doesn’t know if more banks will fail this year, but was quick to point out that this turmoil is nothing like the financial crisis of 2008. In 2008, he said “it was hundreds of institutions around the world with far too much leverage. We don’t have that.”

We don’t have huge problems in our mortgage markets, either, he added. “This is nothing like that. And the American public shouldn’t think that.”

Still, said Dimon, it’s okay to let some banks collapse. “Failure is okay,” he said. “You just don’t want this domino effect.”

Dimon warned that regional banks — and American consumers — should “be prepared for higher [interest] rates for longer. I don’t know if it’s going to happen, but be prepared for that tide.”

There’s a good chance, he said, that rates remain higher for longer — and banks invested in Treasuries need to be prepared for that possibility.

Lawmakers are growing more uneasy about raising the debt ceiling, the self-imposed $31.38 trillion borrowing limit they hit in January. Without new legislation, a default by the US government could come over the summer or in early September, according to various analyses.

But talks between House Republicans and the White House remain stalled.

Dimon, who has worked closely with the White House and Congress this year on various economic problems, told Harlow that there would be no default under his watch. “Not as long as I’m alive. Boy, we’re going to keep fighting this one” he said.

Dimon said he believes Congress will come to a resolution on the debt ceiling within the next few months, but that there could be more economic pain to come before an agreement is made.

“You’ll feel the pain before it happens,” he said of breaching the debt ceiling. As a potential default comes closer “you’ll see it in the markets and that will scare people,” he said.

Still, “When I go to Washington, most people there know how serious this is, and they want to get it to a resolution.”

Dimon served on former President Donald Trump’s business council, and while he doesn’t think that Trump’s indictment and the criminal charges the former president faces this week will impact the economy, he does believe that Trump enacted some good economic policy.

“There are policies that he did that are good,” Dimon told Harlow. “I think the tax reform actually brought a trillion dollars back to America. The Black community had the lowest unemployment rate ever in his last year because it grew the economy.”

That’s not an endorsement, he was quick to add. “That’s not supporting him. That’s just saying that’s true.”

Dimon also commented on another potential 2024 Republican presidential candidate, Florida Governor Ron DeSantis.

Last year, Florida passed legislation to limit discussions of LGBTQ issues in Florida schools, a bill that opponents referred to as the “Don’t Say Gay” law. Disney objected to the law and the state of Florida has since taken action to strip Disney of some of the powers it had over the land that includes and surrounds Disney World.

Those actions prompted Disney CEO Bob Iger to call DeSantis’ actions, and the law “anti-business.”

Dimon on Thursday said that “we support the LGBT community aggressively and actively,” and confirmed that he will continue to do so despite DeSantis.

Read the full transcript here.

Read the full article here