The United Auto Workers are battling with the Detroit-Three auto makers. The union is also planning to battle foreign auto makers that operate in the U.S. without unions. They are battling against dividends, too.

The third front in their war is a risky strategy.

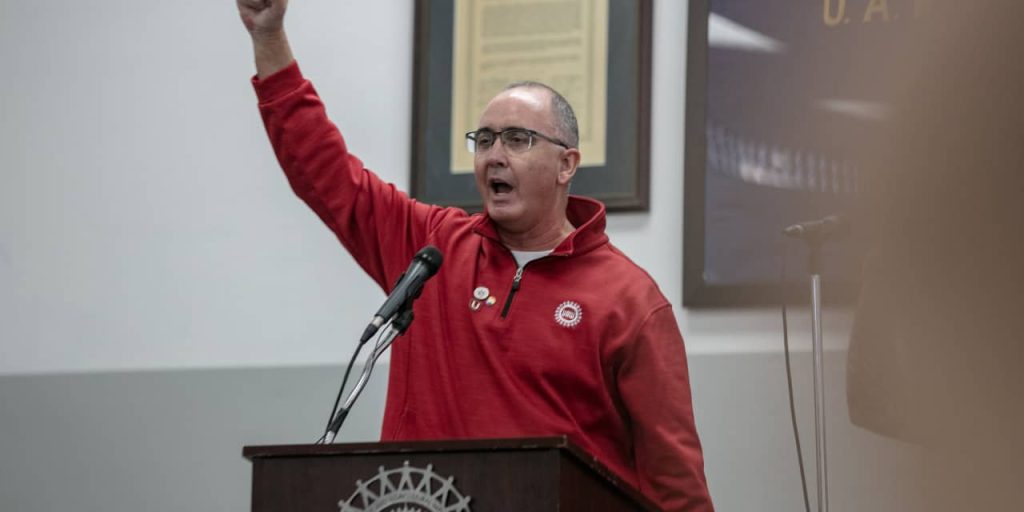

UAW President Shawn Fain updated his members, and investors, in an event on Friday evening. He outlined some of the concessions won from

General Motors

(ticker: GM),

Ford Motor

(F) and

Stellantis

(STLA). The auto markers are offering wage increases north of 20% over the life of the contract. Fain believes there is more, using a decision from Ford to support his position.

“Billionaire Bill Ford made his own speech this [past] week, talking down to us and telling us what we should be willing to accept,” said Fain. “Literally, the next day the company made the astounding announcement…said they were going to give an additional $600 million in shareholder dividends this year.”

Fain misspoke a little. For starters, Ford executive chair William “Bill” Clay Ford Jr. might not be a billionaire. His family controls the Detroit Lions. He directly owns roughly 20 million shares of Ford worth some $230 million.

Ford didn’t respond to a request for comment about Ford Jr.’s net worth.

The far more important point is that there is no additional $600 million in dividends. Ford declared their regular quarterly dividend of 15 cents a share on Oct. 17. Regular dividends, of course, are typically paid out of the cash flow after paying workers and other operating expenses.

There is no reason not to declare a regular quarterly dividend. What’s more, cutting or foregoing a dividend can be a disaster for a stock. It’s a sign to investors that future cash flow won’t cover dividend payments, and cuts make it much harder for publicly traded companies to raise capital in the future.

Company managers and company owners also have a relationship that is based on a simple trust: If I give you my savings you will give me more in the future. That “more” is cash in the form of dividends and buybacks or a company that is larger and generates more earnings than when they started.

(Growth isn’t always bad for labor, either. It can create more jobs.)

Vilifying dividends the way sometimes buybacks get criticized is silly, and bordering on dangerous. For starters, dividends have accounted for roughly 40% of stock market returns for the past century and have been paid by companies for hundreds of years. The system for funding businesses has worked. What’s more, a majority of U.S. households, some 72 million, hold stocks.

There is nothing wrong with dividends.

Roughly 80% of the companies in the

S&P 500

companies pay dividends. Over the past 12 months, they paid out about 40% of their free cash flow back to owners as dividends. That’s roughly $600 billion out of $1.4 trillion. Huge numbers. Another huge number: about $15 trillion. That’s what S&P 500 companies spent generating $1.4 trillion.

Some of that is labor’s cut. Of course, that doesn’t answer the question of what is fair for UAW workers in 2023.

Fain makes valid points that workers have given back a lot over the past 10-plus years to help make the Detroit-Three auto makers more competitive. U.S. auto makers weren’t doing well around the financial crisis, losing money and market share. The union deserves some of the credit for the turnaround. Barron’s calculated that union give backs added roughly $2 billion in profit a year for the past decade-plus.

Ford Jr. appealed to the union that their battle wasn’t against Ford but against foreign auto makers that have taken share and that don’t have unions. Fain wasn’t swayed. His reply was essentially

Toyota Motor

(TM) workers are future UAW members.

Targeting other auto makers makes sense for the UAW. Attacking dividends doesn’t.

Write to Al Root at allen.root@dowjones.com

Read the full article here