Private-equity funds aimed at wealthy individuals continue to draw in fresh capital as the universe of alternative investments grows beyond its roots serving endowments, pension funds and other institutions, according to industry data.

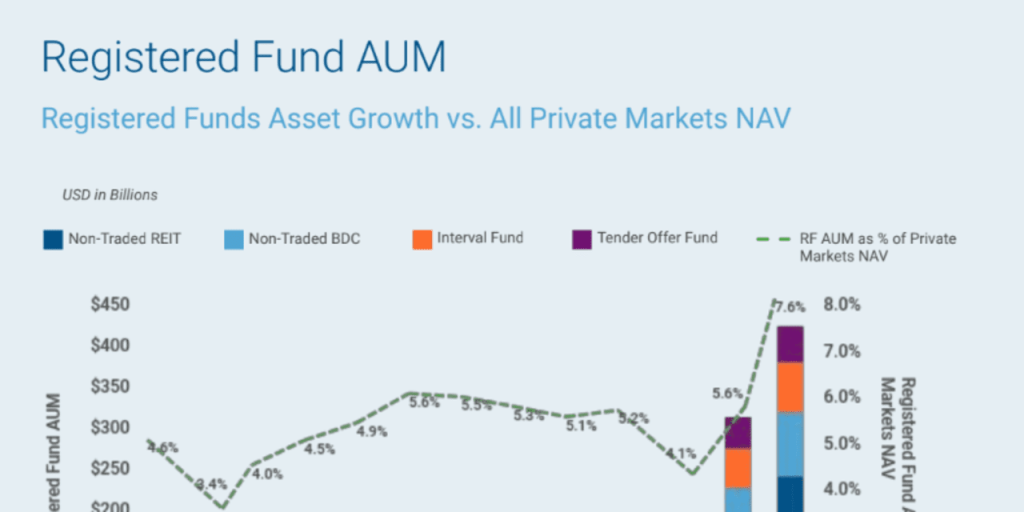

Registered funds that take investments from individuals and smaller institutions rose by about $125 billion in 2022 from the previous year to total assets under management (AUM) of $425 billion, according to data from private-equity investor and data provider Hamilton Lane Inc.

HLNE,

+0.52%.

The asset class of registered funds also grew its market share of total private market AUM to about 7.6% in 2022 from under 5.6% in 2021. (See chart below).

Hamilton Lane’s research also shows a a big opportunity for private-equity firms and other managers of alternative investments outside of traditional stocks and bonds.

As of 2021, high net worth individuals held about $86 trillion in assets, while private markets AUM tipped the scales at $7 trillion. (See chart)

That’s a big pie to go after.

For its part, Hamilton Lane has focused its resources as a data collector and alternatives investor to document why investors should consider putting money into alternatives.

Simply put, it means people could make better returns on their money.

Private equity offers a 15.1% ten-year, median annualized return, compared to 11.8% for public equities, 9.5% for real estate and 4.2% for fixed income, according to Hamilton Lane data (See chart below).

To be sure, plenty of headwinds face private markets such as a lack of deal-making partly due to lower valuations of private companies after a rocky 2022 and 2023.

Private-equity firms have been reluctant to sell because reduced company prices will eat into fund performances.

With fewer sale proceeds, private-equity firms are returning less money to their investors. This in turn, impacts the amount of money institutional investors will commit to new funds.

Institutional LPs are also faced with the denominator effect of having too high a portion of their money invested in alternatives after weaker performances in public markets.

But even with down years, private-equity has outperformed public markets, Hamilton Lane and others point out.

Hartley Rogers, chair of Hamilton Lane, said the asset class has grown from $600 billion in 2000 to nearly $10 trillion partly because private companies add value in ways that public companies cannot.

“Private-equity succeeds because it historically performs well,” he said.

For example, boards of directors at private companies tend to be more empowered. It’s not unusual for a private-equity-backed board of directors to cycle through more than one management team, while among publicly traded companies, this is more rare, Rogers said.

Alternative managers have been gaining traction with the wealthy through their own sales networks as well as money inflows from the world of registered investment advisers.

While traditional private-equity funds have been built for institutional investors with participant thresholds well into the millions of dollars and with their money locked up for up to 12 years, these newer fund types offer much lower minimum investments.

They’re also set up with evergreen structures that allow investors to withdraw money on a quarterly basis, as well as make monthly deposits.

To qualify to invest in many of these funds, individuals often must be accredited investors, which is defined under U.S. securities laws as having $1 million of assets outside the value of their primary home, and income of more than $200,000 individually or $300,000 with a spouse in each of the prior two years.

Other funds have higher minimum thresholds requiring their participants to be qualified purchasers, which is defined as a person or family business with a value of $5 million or more.

With an eye on drawing in more capital from individuals, KKR & Co. Inc.

KKR,

+1.47%

this week published A New Foundation for Global Wealth: Rebuilding Portfolios for the New Regime, the first release in a series of notes on the “evolving role” of private market assets.

“A confluence of tectonic geopolitical and macroeconomic shifts, a shrinking and more concentrated public company universe and expanded access to private markets are making asset classes such as private equity, private credit, private infrastructure and private real estate more attractive to individual investors than ever before,” said Paula Campbell Roberts, KKR’s chief investment strategist for private wealth, in a statement.

One of the larger examples of private-equity funds aimed at individuals is Partners Group Private Equity (Master Fund) LLC, with $13.6 billion in net assets for the fiscal year ended March 31. Its minimum investment is $50,000.

Newer contenders include Brookfield Infrastructure Income Fund, which is launching in the U.S. after building up $1.5 billion from investors in Asia Pacific and Europe. The fund is managed by Brookfield Asset Management

BAM,

-1.82%

and Oaktree Capital Management.

For its part, Hamilton Lane runs three funds with combined assets under management of $4.5 billion, including one aimed at U.S. investors.

The funds offer monthly subscriptions to allow customer inflows and are evergreen. Hamilton Lane’s U.S.-focused private equity fund has generated an annual 17% time-weighted rate of return.

Another way some individuals are getting access to private equity is through their employers — if their company happens to be another private-equity firm.

Rich Lawson, chief executive of middle-market private-equity firm HGGC, says the firm offers qualified employees access to its funds as a way of boosting alignment with its investors.

“There needs to be a democratization of the alternatives space to give access to everybody,” Lawson said.

Blackstone reportedly launching BXPE after a delay

In the realm of private real estate, Blackstone Real Estate Income Trust or BREIT, now tips the scales at $66 billion as of Sept. 30, with participation from individuals.

Since inception seven years ago, BREIT’s Class I shares — its most widely held share class — have produced an 11% annualized net return, or about four times the performance of publicly-traded real estate investment trusts (REITs). It has also outperformed its non-traded REIT peers by eight percentage points in the past year, according to a spokesperson for the firm.

BREIT drew some headlines in 2023 for limiting redemptions as dictated by its existing structure: monthly redemptions limited to 2% of its net asset value and 5% per quarter.

The redemption requests took place for six quarters when investors were pulling money out of crypto assets as FTX collapsed, followed by rapid withdrawals of uninsured deposits around the collapse of Silicon Valley Bank in the spring.

Blackstone received more withdrawal requests from BREIT than allowed and was forced to limit redemptions. Those redemptions have since dropped for several months.

“We were pleased to see October repurchase requests decline meaningfully from the January peak and to fulfill 56% of share repurchase requests in the month, the highest level since October 2022,” a Blackstone spokesperson said.

The redemptions at BREIT reportedly caused Blackstone to delay the launch of Blackstone Private Equity Strategies Fund or BXPE, aimed at individual investors.

But now the fund is on track to begin its launch, according to reports.

A Blackstone spokesperson declined to comment.

On an Oct. 19 call with investors, Blackstone President Jonathan Gray said BXPE is structured differently than BREIT but it’ll still appeal to a wide variety of investors with exposure to secondary private equity fund stakes, as well as life sciences and tactical opportunities.

“This is going to be very attractive,” Gray said.

Vanguard reaches milestone with private equity fund

Vanguard is more widely known to individual investors as a giant in the world of exchange-traded funds (ETFs) and defined contribution plans such as 401(k)s.

In 2020, Vanguard teamed up with private-equity manager HarbourVest to launch its first fund offering access to alternatives for small institutions with $25 million or more in assets. It’s also available to high net worth investors with more than $5 million in assets.

The product has now reached the milestone of $1 billion.

“We’re very pleased with that given it is brand new for us and it’s brand new for many of our clients,” said Rich Powers, head of private equity product at Vanguard.

So far, however, Vanguard is not seeing strong demand for private-equity investments from a wider audience of individual investors through defined contribution retirement plans, such as 401(k)s.

While regulators at the Securities and Exchange Commission and the U.S. Department of Labor have signaled that target-date 401(k) funds could potentially include alternative investments, any such move would brush against the current trend of using much lower-cost public stock ETFs for target-date funds. Any first-mover to offer alternatives in target-date funds would likely face a legal challenge.

“Private equity does bring higher cost and less transparency and more complexity,” Powers said. “And then there’s the regulatory question. That’s why it hasn’t gained any traction at this point.”

Also read: Opinion: Why is everybody suddenly talking about defined-benefit plans?

Eric Gregory, member at Dickinson Wright who advises employers on company retirement plans, said private equity also faces the challenge of so-called dry powder, which is money from its investors waiting to be deployed. If alternative managers draw in a further injection of capital from retail investors, they could be even more challenged to put all those assets to work.

“Private Equity is complicated and it has a longer time horizon and higher fees,” Gregory said. “A retirement plan administrator would have to consider if it’s appropriate to offer those features.”

If private-equity firms are able to draw in more retirement money from defined contribution plans, it would open up a world of trillions of dollars and help compensate for the dwindling number of traditional pensions, also known as defined benefit plans.

Defined contribution plans tipped the scales at $10.2 trillion in the second quarter, up 8.5% from $9.4 trillion in the year-ago period, according to the Investment Company Institute. Private-sector defined benefit plans rose by 6.7% to $3.2 trillion from $3 trillion during the same time period.

But for now, private-equity continues to grow from other investors such as wealthy individuals and by moving into management of insurance company assets, among other newer areas.

“The biggest challenge we’re facing is willingness to be a first mover,” said Josh Lichtenstein, partner, Ropes & Gray. “It’s sort of a chicken and the egg problem. If there were a number of defined contribution and 401K plan sponsors already doing it, there would be a lot doing it.”

Also read: Private equity: Everything you always wanted to know about this $12 trillion asset class but were afraid to ask

Read the full article here