Bed Bath & Beyond

BBBY

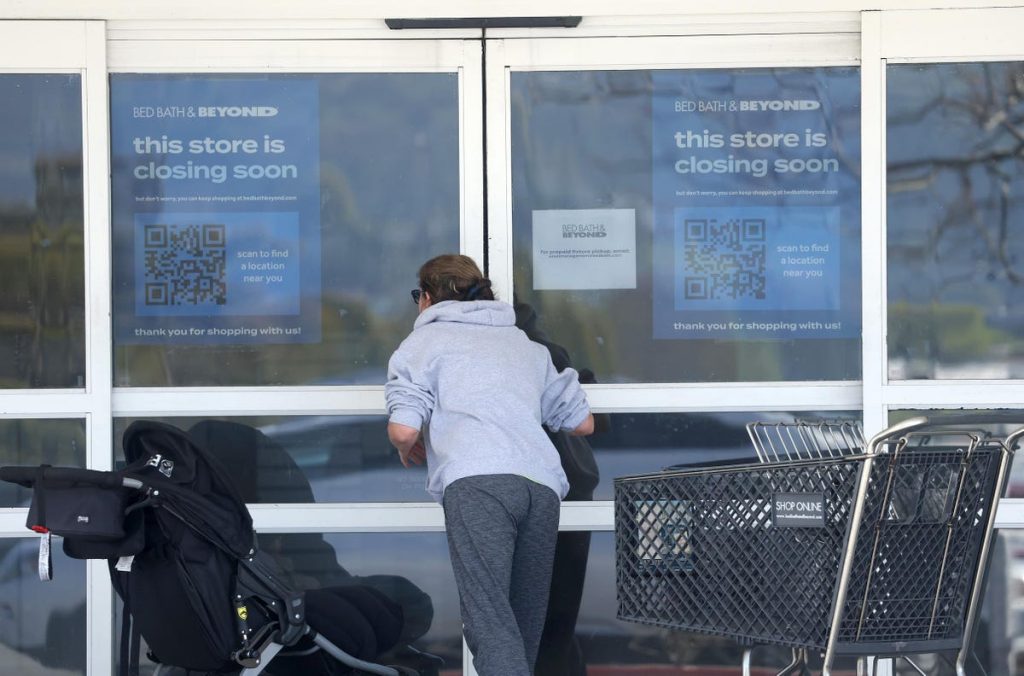

filed for bankruptcy on April 23, according to the Wall Street Journal.

BBBY — which was founded in 1971 and went public in 1992 — will eventually close all its retail stores, noted the Journal, and has obtained $240 million from Sixth Street Specialty “to fund its operations in bankruptcy,” according to New York Times

NYT

.

BBBY will keep some stores operating. According to a company statement, these include “360 Bed Bath & Beyond and 120 buybuy BABY stores and websites…as the company begins its efforts to effectuate the closure of its retail locations.”

Since peaking at around $80 a share in January 2014, BBBY stock has lost almost all of its value — trading in the after-market at 28 cents a share on April 23.

BBBY’s Last Gasp

BBBY has been on its death bed ever since BBBY board member, Sue Gove, took over in October 2022 as CEO after Mark Tritton — a former Target executive brought in to revive the retailer — departed last June.

The 2022 holiday season marked BBBY’s last stand. Its death motion included borrowing $375 million loan to get through the holidays; delaying its bankruptcy in February with “an unusual $1 billion financing deal with a hedge fund,” scrapping that deal in April and failing to raise $300 million from investors, “and closing hundreds of stores,” the Journal reported.

To be sure, the rise of Amazon — where customers can buy all the same merchandise at a lower price — did not immediately drive BBBY out of business. As the Times reported, BBBY’s stores “ full of towels and kitchen aids — all available at a reduced price with that big blue coupon,” kept shoppers coming back after the 2008 financial crisis while rivals such as Sharper Image and Linens ‘n Things went bankrupt.

For decades after its founding, BBBY provided consumers with a very compelling value proposition. Its founders used their limited capital to buy merchandise — which they piled to the ceiling — rather than spending on fancy stores and later the technology and processes needed for e-commerce. Store managers stocked what local shoppers wanted. And BBBY offered 20%-off coupons in lieu of spending on newspaper circulars, noted the Journal.

Why BBBY Went Bankrupt

Legendary retailers fail in a predictable way. Their founders preside over rapid growth and market leadership. After the founders step back, aggressive rivals go after their customers and they lose market share.

They hire so-called professional CEOs from well-regarded rivals who bull-headedly apply what worked at their previous employer while skipping the crucially important step of listening to customers and giving them more of what they need than competitors do. That final failure sends the once-proud retailing icon into bankruptcy.

This brings to mind the 2008 bankruptcy of electronics retailer Circuit City. As I wrote in November 2021, Circuit City’s bankruptcy was due to its inability to pay back the money it had borrowed to stock its shelves with inventory that customers were not buying.

In applying so-called five whys analysis — in which an analyst seeks to get to the bottom of a problem by asking why in a chain of questions — it became clear that Circuit City was solving the wrong problem: trying to boost Circuit City’s earnings per share so its CEO could earn a big bonus.

How so? Customers did not buy the products that Circuit City had on its shelves because customers were shopping at Best Buy

BBY

and Amazon instead. The reason for that was a huge spike in customer complaints about Circuit City’s service (along with its poor locations and failure to stock merchandise that customers wanted).

The poor service ratings came in the wake of Circuit City’s decision to replace 3,400 experienced sales people with 2,100 lower wage inexperienced people. The CEO did this to lower costs, boost EPS and receive a $7 million bonus in 2007 — the year before Circuit City flamed out.

Five Reasons Behind BBBY’s 2023 Bankruptcy

BBBY ran out of cash because of its severely botched decision to force a strategy that helped Target — private label products — onto a very different group of customers.

Here is how I applied the five whys analysis last September which marked the beginning of BBBY’s end.

1. Why was BBBY short on cash?

BBBY’s cash position was not encouraging. According to its financial report, for the quarter ending May 2022, it had about $108 million in cash. Yet on August 31, the company estimated that it had burned through $325 million in cash in the August-ending quarter.

BBBY was short on cash because its costs were higher than its revenue. How so? That $325 million in negative free cash flow came during a quarter in which its sales fell 25% from the previous year. What’s more, BBBY forecast a 20% decline in sales for the full year.

BBBY’s financial condition has since gotten worse. This January, its banks decided it lacked the funds to repay them after it defaulted on its credit lines. In February, BBBY closed a deal with a hedge fund to raise $225 million and more over the following 10 months as the retailer closed stores and cut costs. In April, it canceled that deal as its stock fell — ultimately failing to raise $300 million by selling new shares.

2. Why did BBBY’s revenues fall?

BBBY’s revenue — down 33% in the November 2022-ending quarter — was falling because consumers were not buying the merchandise on its shelves.

That’s because under Triton’s direction BBBY replaced what customers wanted to buy — such as All-Clad cookware, OXO kitchen gadgets, and Mikasa china — with so-called private label goods. When customers saw that store brands had replaced what they were seeking, they walked out empty-handed.

A case in point was a store in Irvine, Calif. As I wrote in July 2022, PJ Gumz, the store manager who left when BBBY closed her store, said, “We’d get large quantities of stuff that we couldn’t sell. [We] once got a shipment of 95 purple rugs under the Wild Sage private brand that [we] had to discount by 80%.”

3. Why did BBBY replace its branded goods with private label ones?

in November 2019, BBBY hired Mark Tritton as CEO from Target. Previously local store managers bought 70% of merchandise to satisfy local tastes. Tritton discounted the branded goods on BBBY’s shelves to make way for the private label merchandise without asking customers how they would react to the changes.

4. Why did Tritton push private label goods onto BBBY customers?

Tritton, who had been Target’s chief merchandising officer, helped oversee a successful turnaround there that included stocking its shelves with private label products and improving the customer in-store and online experience. BBBY’s board hired Tritton to apply what worked at Target to BBBY.

5. Why did BBBY’s board think Tritton would solve BBBY’s problems?

BBBY’s board thought what he did at Target would work at BBBY. According to a 2019 statement from Patrick Gaston, then BBBY’s chair, “Mark’s ability to re-define the retail experience and drive growth at some of the world’s most successful retailers and brands” would help solve BBBY’s problems.

In June 2022, BBBY replaced Tritton — which made me think Gaston miscalculated. BBBY should have hired someone like Hubert Joly — who crafted a winning turnaround strategy for Best Buy by first listening to employees and customers.

What’s Next For BBBY Stock?

If you own BBBY stock, you will likely take a loss.

To be sure, there was hope for you a year ago when GameStop

GME

chairman Ryan Cohen got involved with BBBY. But Cohen bailed “five months after appointing three board members, [He] sold his shares in the company, sending its value plummeting,” reported NBC News.

However, in the bankruptcy process, shareholders are last in line when the company’s assets are liquidated. Simply put, BBBY stock is not going up from here.

BBBY’s once loyal customers have moved on with sadness. Sheryl Bilus, a 68-year-old retired bank manager from Canton, Ga. told the Journal that she lost faith in BBBY in 2021 when it substituted a private label mixer with the Cuisinarts it used to sell.

As she said, “They used to be my go-to place for bedding, appliances, anything I needed for the house. Now, I buy all of that on Amazon.”

The lesson for business leaders? Before imposing a new strategy, make sure you are solving the right problem.

Read the full article here