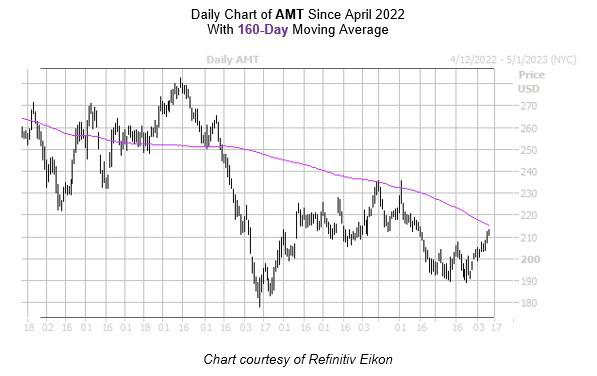

Shares of real estate investment trust (REIT) American Tower (AMT) were last seen 0.9% higher at $212.29, and pacing for their sixth-straight daily win. The equity has added nearly 15.5% over the last six months, and now sports a fractional year-to-date lead. However, traders shouldn’t get excited just yet, as AMT is now trading near a trendline with historically bearish implications.

Specifically, American Tower stock is within one standard deviation of its 160-day moving average. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, the security saw six similar signals over the last three years, and was lower one month later 83% of the time with an average 4.5% loss. A comparable move from its current perch would place the equity below $203.

An unwinding of analysts’ optimism could also weigh on American Tower stock. Of the 15 in coverage, 13 recommend a “buy” or better, while the 12-month average price target of $242.20 is a 14.3% premium to the stock’s current perch. This indicates that downgrades and/or price-target cuts could be overdue.

It’s also worth noting that premiums are attractively priced at the moment, making this an opportune time to bet on the stock’s next moves with options. In fact, AMT’s Schaeffer’s Volatility Index (SVI) of 28% stands in the relatively low 28th percentile of readings from the last 12 months. What’s more, the equity’s Schaeffer’s Volatility Scorecard (SVS) stands at 77 out of 100, meaning it has exceeded options traders’ volatility expectations during the past year – a boon for options buyers.

Read the full article here