For many companies the phrase; “We have always done it this way” are famous last words. Some companies are so large and well-established, it seems like they could never go out of business. However, innovation can quickly leave a business behind if it cannot adjust to new ways of operating, or to changing customer demand for new products and services.

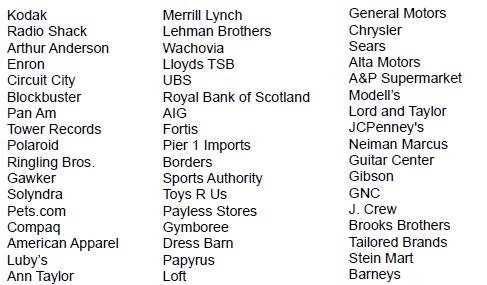

In my lifetime, 88% of the Fortune 500 firms that existed in 1955 are gone. FDIC closed 465 failed banks from 2008 to 2012. USA Today claims 190 banks are in danger of failing today. Here are examples of well-known companies that filed for bankruptcy, went out of business, or needed government bailout in order to survive:

Almost ALL of these companies were part of an index. Some were ridden all the way into bankruptcy. Some were kicked out of the index when they no longer met the basic qualifications for inclusion. This was usually done closer to the bottom than the top.

The economy and therefore the stock markets, are everchanging and dynamic. There is an old Wall Street adage; “Every time you find the key, they change the lock.” Portfolios invested in companies need to keep up and hopefully stay ahead of the change in order to protect and grow capital.

The traditional 60/40 mix of stocks and bonds is an example. It is the most common, widest held, asset allocation for individuals and institutions. However, lately it has proven to be out of date. The Wall Street Journal publishes articles on the debate whether the 60/40 is dead. If it is dead, when did it die? It was certainly dead in 2022! But it died before that. Here is why.

The 60/40 was built on long term (100 year) average returns where stocks average about 10% and bonds about 6%. Blended together the return is around 8% which is the historical actuarial interest rate assumption for many pension plans, and the target return for most endowments and foundations. Given those rate assumptions, the 60/40 works just fine. But when the return of the 40% in bonds goes from 6% to 1%, the model breaks down. Too much pressure is put on the 60% in stocks to make up. The return on a global 60/40 portfolio indexed for the last 10 years is 4.76% as of yearend 2022. In other words, using only indexes, you can’t get there from here.

Diversifying into alternatives is becoming a popular solution. Alternative assets provide additional diversification with less correlated assets. Typically, alternative assets include private equity, hedge funds, real estate, futures, etc. which can help diversify and provide a portfolio. The current model for many investors has evolved from 60/40 into a 40/30/30 portfolio, with the last 30% in alternatives. Equitas is world class in alternative investing. In 2021 our alternative fund won Multi-Strategy Fund of the Year awards from HFM and HedgeWeek, and ranked within the top 10 in our category of the Bloomberg Database worldwide for the preceding 1, 3, 5, and 10-year periods.

Adding alternatives can be a good diversifier, but most investors have a limit to the allocation of alternatives in their portfolio. Plus, alternatives do nothing for the systemic risk of the indexes or traditional money managers used in the core of the portfolio.

Our mission at Equitas is to engineer financial solutions for our clients. When we see a need, we search the market to provide, or engineer a solution. We started this project by researching the universe of all the tactical investment advisors (shown below). We were disappointed. While the tactical investment managers did protect from some of the downside, they also protected from the upside. The average manager performed approximately 4% for approaching 10 years. 4 is only half way to 8. It does not cover the 5% spending policy of foundations and makes a pension plan over 40% underfunded in 10 years.

Below is the universe of tactical investment managers shown by quartile. The combined research from Ned Davis and Dorsey Wright is shown with the letters S for stock, B for bonds, and G for global balanced accounts. By partnering with Ned Davis Research and Nasdaq Dorsey Wright, Equitas has created a solution to index funds’ problem of a lack of risk management which we call the Navigator. A typical index fund doesn’t utilize any relevant technical research and little fundamental information beyond market capitalization and some selection criteria. The index philosophy is an efficient, low cost way to buy and hold the market. However, the philosophy is don’t sell at the bottom when the market drops, and wait for the index to come back from the decline maybe years later. That may be fine for a 30-year-old investor, but indexes can have prolonged down periods which can be unnerving for others, especially investors that need cash flow like pensions, foundations, and retirees. For example, it took the Nasdaq Index 15 years to come back to even from the Y2K blow up of 2000! The static strategy of the 60/40 index portfolio is inflexible and out of date. The locks have been changed. Investment portfolios need to be flexible and to breath in order to play offence in the up markets, and defense to protect capital in declining markets.

Our three Equitas Navigator Strategies include a bond strategy, a stock strategy, and a global (combined bond & stock) strategy. The Equitas Global Navigator Strategy (graphed below) has a historical average of about 60% stocks and 40% bonds. However, this allocation fluctuates significantly, and rarely looks like the average. The Navigator System uses fundamental and technical indicators with the aim to add risk management into index funds.

The graph below shows all of the monthly decisions published by Ned Davis and Dorsey Wright, blended together, since the inception of the exchange traded index funds almost 10 years ago. The performance has to be shown as hypothetical only because there was no one to blend the two companies’ research and execute the monthly trades. This is part of Equitas’ responsibilities.

Fundamental indicators tell us what to buy. Technical indicators tell us when. The strategy is not static. It is dynamic. It rebalances monthly. The Navigator can breathe life into a portfolio by being defensive or offensive based on the indicators. The defense shows up well in 2022 when the indicators went into T-Bills to protect capital. The offense shows up well in 2021 where it out performed the broad 60/40 index with a concentration into the asset classes with the highest sentiment and momentum.

Let’s delve into bonds as a case study. The Bloomberg Aggregate (the main Domestic Bond Index) was down just over -13% in 2022. The Global Bloomberg Aggregate Index was even worse, down -16.25%. The worst year in history for bonds. Our solution, the combination of the Ned Davis and the Dorsey Wright indicator signals which would have returned a positive +1.27% for 2022. This is significant risk management. The indicators are not perfect and in 2017 were up only 1.6% while the Global Aggregate Index was up 7.3%. See the disclaimer for the criteria and assumptions made in calculating performance and to understand risks and limitations of back tested performance.

This return over the index was accomplished still through the use of index funds. The alpha was generated through allocating capital to different index ETF funds on a macro level. There are 6 bond indexes used and holding cash is also an option in the strategy. This provides extra tools in a down market, and helps answer the question: what indexes should be used, and when? An index portfolio does not have to be static. Navigator lets an investment portfolio have the ability to be flexible and breath with the market.

In 2002 Equitas Capital Advisors, LLC was established as a unique company that blends the resources of a large global corporation with the flexibility of a small boutique firm. The registered service mark of Equitas Capital Advisors is Engineering Financial Solutions® and the purpose of Equitas is to design, build, and deliver investment solutions to meet the goals and objectives of our investors. Equitas Capital Advisors, LLC located in New Orleans, has over 260 years of combined investment management consulting experience providing professional investment management services to investors such as foundations, endowments, insurance companies, oil companies, universities, corporate retirement plans, and high net worth family offices.

Disclosures and Disclaimers:

Above information is for illustrative purposes only and has been obtained from reliable sources but no guarantee is made with regard to accuracy or completeness. It is not an offer to sell or solicitation to buy any security. The specific securities used are for illustrative purposes only and not a recommendation or solicitation to purchase or sell any individual security.

Equitas Capital Advisors, LLC is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the advisor has attained a particular level of skill or ability.

Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author on the date of publication and are subject to change. This publication does not involve the rendering of personalized investment advice.

Certain information contained herein is based upon hypothetical performance. Hypothetical performance results may have inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits similar to those shown. In fact, there are frequently significant differences between hypothetical performance results subsequently achieved by following a particular strategy. One of the limitations of hypothetical performance results is that they are prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk associated with actual trading, including changing objectives and constraints on the management of the account. There are numerous other factors related to the markets in general or to the implementation of any specific trading strategy that cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Returns for the Navigator strategies are pro forma returns net of a 0.50% annual management fee for Bond Navigator and 1.00% for Stock Navigator and Global Navigator. Fees are billed quarterly. Historical trades were generated from Ned Davis Research output after proprietary enhancements were engineered by Equitas Capital Advisors using Dorsey Wright’s scoring system. Invested capital began in this program on October 1, 2022. Additional data sources used in the creation of the strategy include, but are not limited to: Ned Davis Research, JPMorgan, MPI Analytics, Bloomberg, FactSet, Morningstar, Standard & Poor’s, Bank of America

BAC

Merrill Lynch, MSCI

MSCI

, Nasdaq Dorsey Wright, Federal Reserve, OECD, Bureau of Labor Statistics.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor. Charts and references to returns do not represent the performance achieved by Equitas Capital Advisors, LLC, or any of its clients.

Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. All investment strategies have the potential for profit or loss. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark. Past performance does not guarantee future investment success.

Read the full article here