The focus on fraud in the trial of Sam Bankman-Fried has overshadowed many important psychological issues about cryptocurrency markets and financial management. There are lessons to be learned, which extend well beyond fraud, from the saga of SBF and the firms he founded.

Crypto markets are part of the real economy in the same way that casinos and lotteries are part of the real economy. They are entities which use real resources to provide people with opportunities for satisfying the psychological need to make large, speculative bets. In addition to needs, human psychology features vulnerabilities and pitfalls such as gambling addiction, biased assessments of risk, and misplaced trust.

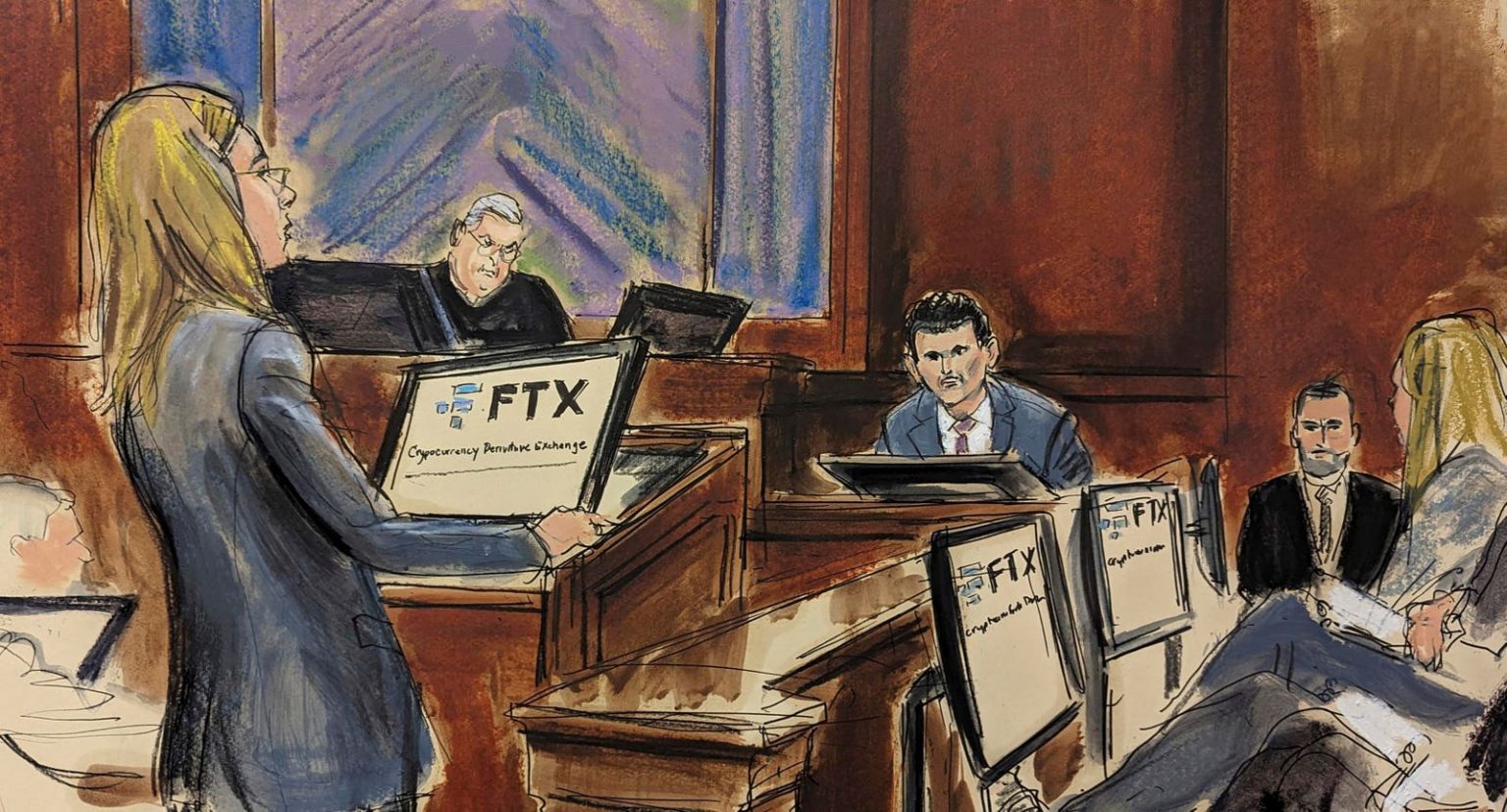

The managers who run cryptocurrency firms, like traders and investors, are vulnerable to the same psychological pitfalls. These pitfalls can lead them to make serious errors in the way they run their firms; and this is what happened at crypto exchange FTX and hedge fund Alameda Research.

Fast And Slow Thinking

SBF’s psychological profile lies at the heart of his meteoric rise and swift fall. Economists employ a framework in which they assume that people are very skilled at making probability judgments about risks, evaluating potential consequences, scoring consequences using a “utility scale,” and making decisions to maximize “expected utility.”

Very few people actually make decisions this way. But SBF was an exception.

Most people make decisions by relying on a combination of feeling and thoughts, what psychologist Daniel Kahneman calls fast and slow thinking. Most people heavily depend on their emotions to help them feel what constitutes a good decision and what not. SBF was an exception.

SBF’s emotional system was deficient relative to the norm, especially in regard to feeling empathy. The academic literature documents that most entrepreneurs are high in agreeableness, meaning they like interacting with other people. SBF was an exception, and more of a loner.

Emotions are especially important when it comes to following rules and being disciplined. People who habitually follow rules do so by habit, which is emotionally regulated. Most drivers automatically stop at intersections when the light is red. Their first impulse is not to make an expected utility computation to decide whether or not to go through a red light. We rely on our emotions for self-regulation and self-control.

SBF had a tendency to act as if the rules did not apply to him. After his indictment, he posted bail in order to be able to live with his parents. Bail came with rules, which SBF breached. As a result, in August 2023, the judge overseeing his case revoked his bail, and sent him to jail, where he resided in poor conditions until his trial. In a related vein, financial institutions face rules about protecting customer deposits, which was the basis for the charges he faced about fraud.

Gray Area Between Black And White Portrayals Of Intent

Those who followed SBF’s trial about his having committed fraud heard two versions of the saga. One was the prosecution’s version of SBF as a fraudulent con artist, and the other was the defense’s version as a nerdy CEO who unintentionally made serious mistakes.

Between the black and the white lies gray, and in his new book Going Infinite, Michael Lewis documents many of the nuances underlying the rise and fall of SBF, Alameda Research and FTX. There is much to learn from Lewis’ account, beginning but not ending with fraud.

Lewis makes clear that more than $10 billion of FTX customers’ money found its way into SBF’s private trading funds at Alameda Research; and this was clearly illegal. Lewis writes at length about trying to ascertain if SBF himself transferred the funds, and states that the closest SBF came to admitting that he was responsible was in not objecting to a statement made to him that he had done so. Cognitive dissonance is a distinct possibility here.

Given Lewis’ account of events, it seems reasonable to attach a high probability to SBF having transferred the funds to his private trading funds. Relatedly, Caroline Ellison, who had been Alameda Research’s CEO, testified at the trial that SBF had instructed her to borrow customer deposits in order to fund major financial transactions.

Behavioral Corporate Finance

Behavioral finance, the application of psychology to financial decision making and financial markets, focuses both on investors and on corporate managers. SBF was both an investor and a manager. Although he demonstrated that he had the skills to be a successful investor, he was a very poor manager.

FTX had no real board of directors, no chief financial officer and no chief risk officer. Not wanting a board of directors is an extreme example of the psychological trait known as “desire for control.” This trait in combination with high overconfidence is extremely dangerous. It is not that overconfident people lack intelligence. They can be very smart, not just as smart as they judge themselves to be.

SBF contended that he could do the job of CFO, especially tracking money and making financial projections. Given the way things turned out at FTX, SBF was overconfident about his ability to perform the CFO’s function. A CFO would have understood the implications of having a sizeable portion of Alameda’s balance sheet consisting of the token FTT issued by FTX.

FTT entitled its holders to a claim on FTX revenues, and in this respect was similar to equity. Alameda acquired the FTT by repurchasing it in the market. However, when firms repurchase equity, the treasury stock does not sit on the balance sheet as an asset. In the end, the FTT position was highlighted in an article published by CoinDesk. This article was the catalyst for the subsequent run on FTX. With nobody with true CFO skills at FTX and Alameda, the leadership failed to see the threat.

SBF was certainly overconfident about not needing a CRO, and eventually admitted that this was a big mistake. His FTX associates viewed the firm’s major risk as SBF being kidnapped. But they seriously underestimated the liquidity risk that eventually took it into a bank run followed by bankruptcy. An effective CRO would have focused on liquidity risk long before the liquidity event.

SBF ran FTX so that he and he alone understood the big picture. Everyone else could only see a small piece of the puzzle. In respect to business continuity, doing so was a big mistake, and an example of excessive optimism bias. If SBF was kidnapped, or run over by a bus, nobody else would know how all the pieces fit together. This became apparent when an interim-CEO took over after FTX declared bankruptcy.

Most of the time, venture capitalists who invest in a company accept preferred stock in a company they fund and provide adult supervision in the form of a board of directors, an experienced C-suite, and guidance. They also understand when it is time for the founding CEO to step aside and be replaced by a CEO who knows how to manage growth. For a variety of reasons, this did not happen at FTX.

In the end, what got SBF convicted of fraud was his psychology, especially weak mental accounting. By this I mean that mentally, he could not keep FTX and Alameda Research in separate mental compartments. Michael Lewis tells us that he called this an accounting error; but, it was a mental accounting error. He managed both firms simultaneously when he operated out of Hong Kong, and never separated them properly when he moved his operation to the Bahamas. This, perhaps, was the major cost of not having a CFO. A proper CFO does not just track money and engage in planning, but puts structures and policies in place.

SBF had an enormous appetite for risk. Part of this might have been high ambition and the strong need to feel like a winner. When crypto prices were soaring, FTX thrived with profit margins between 40 and 50 percent. Yet SBF aspired for more.

Another part of his risk appetite might have stemmed from an addiction to gaming. SBF routinely played video games at the same time he was conducted conversations and made important decisions. He also admitted to feeling sad most of the time, which suggests that he experienced difficulty generating dopamine flows. Problems regulating dopamine surface in people with addictions.

Investor Psychology

In the end, none of SBF’s psychological traits and poor practices needed to bring down the company. Instead it was investor psychology that induced a fatal run on FTX, based on rumors that the brokerage firm was financially fragile.

There is no evidence to support the claim that FTX was actually insolvent, just rumors that began with the CoinDesk article that were fanned by the CEO of SBF’s main competitor, Binance. Indeed, nobody at FTX or Alameda Research took the rumors seriously, until forced to do so. Their initial reaction was that FTX was on a sound footing, and that investors were rational enough to recognize that this was so. SBF and his fellow officers learned the hard way about excessive rationality assumption bias. And by that time, it was too late.

Crypto valuations in the market mostly reflect sentiment, not economic fundamentals. In the main, crypto markets provide investors to bet on changes in sentiment. Economist John Maynard Keynes described this state of affairs as a beauty contest in which judges bet on which contestant other judges will find most attractive. That feature makes for volatile dynamics, and that is certainly the case with crypto markets.

SBF’s conviction on seven counts of fraud is highly salient. Less salient but perhaps more important are the behavioral lessons to be learned about the managers of crypto firms and the investors who are their customers. Having both investors and managers fail to address their psychological vulnerabilities creates a recipe for disaster.

Read the full article here