NEW DELHI – In a move that reflects the current global oil market trends, the Indian government announced significant reductions in the windfall tax on diesel and today. This decision comes as the latest adjustment in a series of tax changes that respond to fluctuating international oil prices.

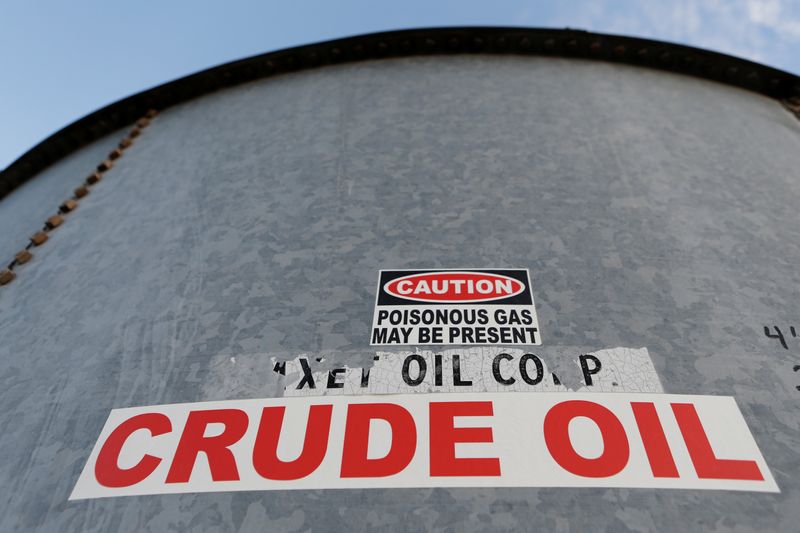

The tax on crude oil has been cut from ₹9,800 ($117.70) per tonne to ₹6,300 ($75.70) per tonne. In a more pronounced reduction, the windfall tax on diesel has been halved from ₹2 to ₹1 per litre. These changes are part of the Centre’s ongoing strategy to align domestic tax rates with the international market.

This pattern of tax reduction began earlier in October when the Centre reduced the windfall tax on crude from ₹12,100 per tonne to ₹9,050 per tonne and eliminated the windfall tax on aviation turbine fuel entirely. These proactive measures have been taken in response to a noticeable drop in the average price of India’s imported crude oil, which was recorded at $84.78 per barrel this month, down from $90.08 in October and $93.54 in September.

The introduction of the windfall tax occurred in July last year when India decided to levy additional taxes on crude oil producers and extend these taxes to exports of gasoline, diesel, and aviation fuel. The government’s rationale was to address the domestic refiners’ preference for exporting due to lucrative refining margins abroad rather than prioritizing domestic markets.

To ensure that domestic tax rates remain in step with global oil prices, the Centre reviews these rates every fortnight, taking into account the average oil prices from the preceding two weeks. This responsive approach aims to balance fiscal needs with market realities, providing stability for both producers and consumers within the country’s energy sector.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Read the full article here