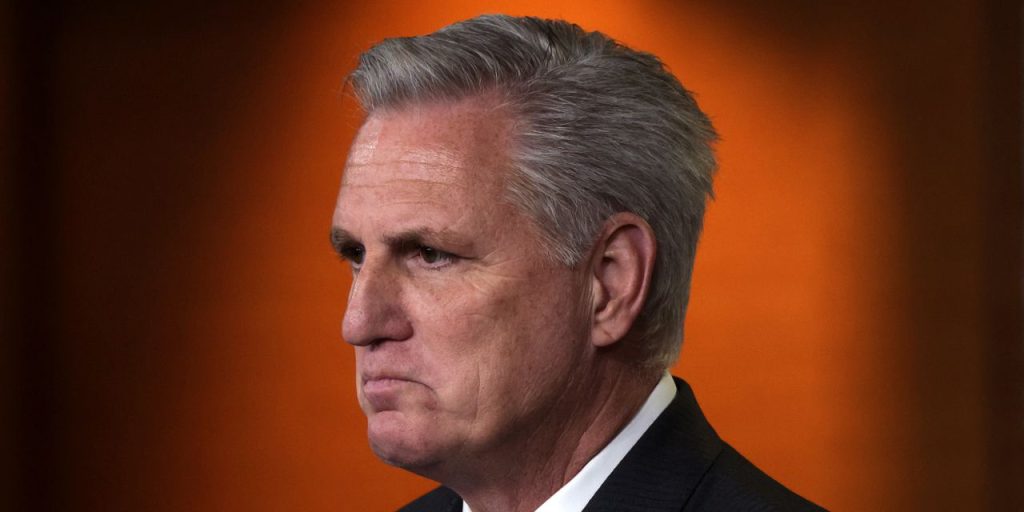

House Speaker Kevin McCarthy is expected to focus on the approaching debt limit in remarks Monday morning at the New York Stock Exchange, as he seeks to appease his fractious party while averting a crisis that could devastate the U.S. economy.

The California Republican and other members of his party are moving toward a framework that could raise the debt ceiling into 2024, allowing for about $2 trillion in spending, the Washington Post reported Saturday, citing people familiar with the matter.

In exchange, Republicans would demand immediate spending cuts and caps on future spending by federal health-care, education, science, and labor agencies, the Post reported.

The potential Republican bargaining framework comes amid resistance in the party to passing legislation needed to authorize new lending for the nation to pay its bills—without deep spending cuts.

President Joe Biden, a Democrat, has called on the GOP to authorize the borrowing free of other conditions to avoid what he characterizes as unnecessary economic pain.

Resolving the conflict has taken on an increased urgency in recent weeks, as the debt limit approaches. The Congressional Budget Office has estimated that the government’s ability to borrow will be exhausted between July and September.

“I consider it essential that Congress come together to recognize that raising the debt ceiling is their responsibility to protect the full faith and credit of the United States,” Treasury Secretary Janet Yellen said at a Senate hearing last month in remarks reported by the Post.

Mark Zandi, chief economist with Moody’s Analytics, wrote in a report this year that a political impasse that delayed the government’s ability to pay its bills for even a few weeks would result in an economic downturn “comparable to that suffered during the global financial crisis,” with unemployment above 7% and the destruction of some $12 trillion in household wealth through stock selloffs.

Even if the impasse is resolved before the government is forced into its first-ever default, the uncertainty will be weighing on an economy that’s been teetering on the brink of recession amid efforts to bring inflation under control, analysts say.

“I do think the debt ceiling will eventually get solved, but the turmoil involved will increase the risk that more things will break,” Matthew Benkendorf, chief investment officer at Vontobel Asset Management’s Quality Growth Boutique, told Barron’s after last month’s banking crises.

Write to Jacob Adelman at jacob.adelman@barrons.com

Read the full article here