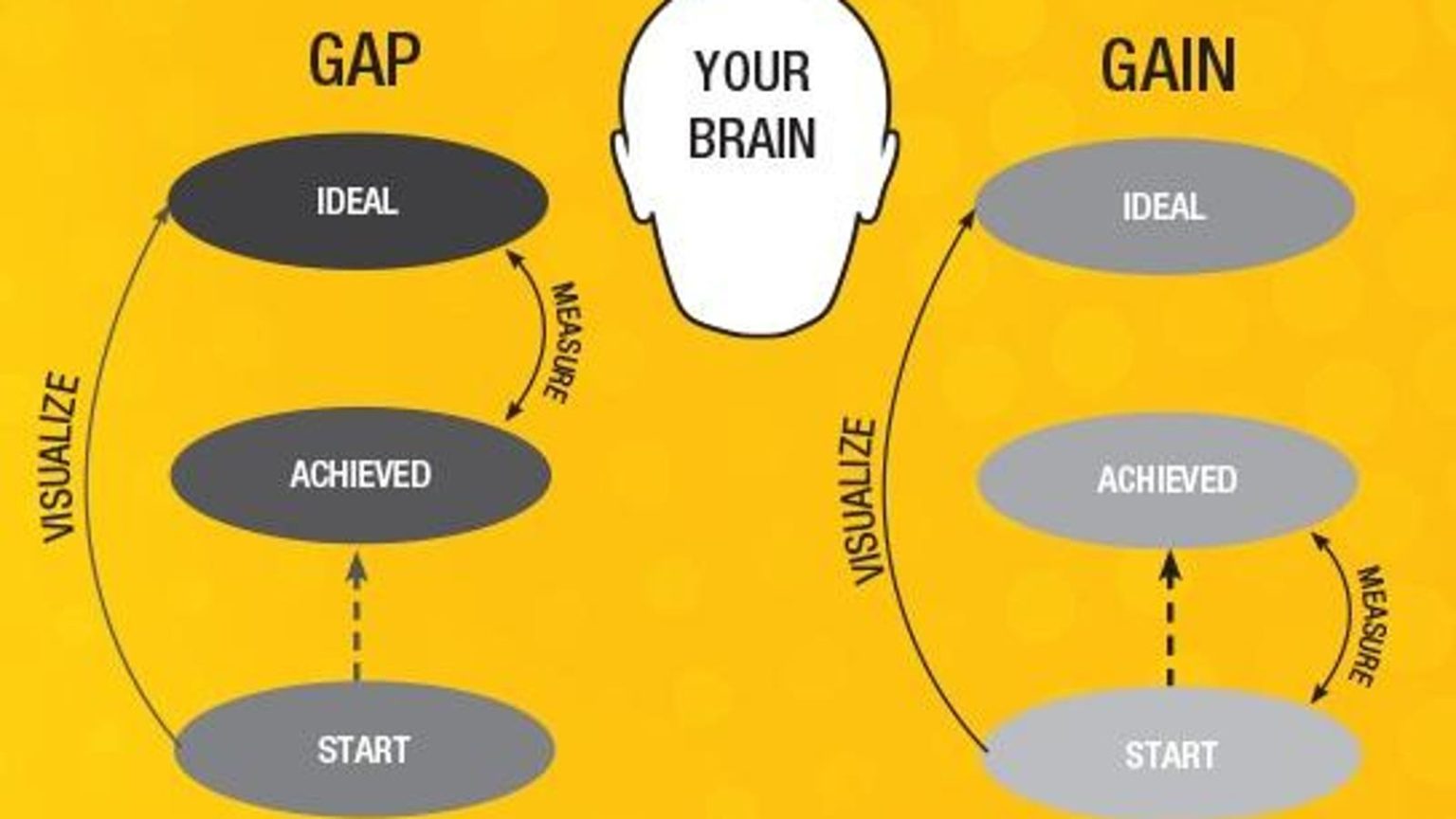

I’m reading the short book, The Gap and the Gain, co-authored by Dan Sullivan, the famed founder of Strategic Coach, and Dr. Benjamin Hardy, and while it applies to many areas of life, its implications in how we approach our finances and goal-setting are profound. This infographic perfectly illustrates the concept:

Here’s how it works:

In virtually every area of life, we find ourselves on a continuum between our starting point and an ideal toward which we are striving. While it doesn’t matter where we are on the calendar, this phenomenon is especially common in late January and early February when we observe our success—or lack thereof—in pursuing New Year’s resolutions:

- The ideal is losing 20 pounds, and you’ve lost seven.

- The ideal is working out five days per week, and you’ve averaged three.

- The ideal is inbox zero, and you have 237 unread emails.

- The ideal is journaling, meditating, or praying every morning, and you average four per week.

- The ideal is cooking at home every weeknight, and you manage three on average.

- The ideal is a date night every week with your spouse, and you’re getting out twice a month.

- The ideal is saving $500 per month in your (much higher yielding) savings account, and you average $275.

Wherever we find ourselves on any of these continua, we can envision our goal pursuit through two different lenses. We are “in the gap” if we only see the distance between what we have achieved thus far and the ideal goal. Conversely, we are “in the gain” if we measure how far we’ve progressed from our original goal.

Please do yourself a favor and reread that last paragraph to allow this simple, but powerful, concept to set in.

Now, I invite you to consider two different instances where you are pursuing a goal—one should be personal and the other professional or somehow attached to your vocation if you are retired or otherwise not working.

Are you stuck in the gap or living in the gain?

Are you in the gap or in the gain as it relates to those two goals?

If you’re normal, you’re likely in the gap. It’s ok. It’s almost as though it is our default, and you don’t need to go any further than glancing at your phone or turning on your TV to be reminded that we are an in-the-gap culture.

Here’s one of the reasons that this matters so much. There’s a connection between our happiness and our gap or gain status. In Gallup’s 2023 “State of the American Worker” report, a mere 39% of Americans believed they were making meaningful progress toward their long-term goals. Meanwhile, in separate studies, between 33% (Harris) and 42% (Gallup) rated themselves as happy.

Dan Sullivan suggests that those who are in the gap are not just prone to frustration, disappointment, and even depression—but that they are also more likely to fail in the accomplishment of their goals. Meanwhile, those in the gain enjoy more satisfaction in life, demonstrate more confidence, and also have a higher probability of succeeding in their goals.

The Money Gap Trap

We may be particularly prone to gap thinking when it comes to our money management, asset accumulation, and financial goals. This is because these things are so easily counted, making our distance from the ideal so starkly evident, but it’s also ironically because no number ever really feels like Enough. Thanks to hedonic adaptation, almost the instant that we arrive at a particular salary, savings goal, or home value, our satisfaction diminishes, and we push the goal out further.

As the Stoic Seneca accurately opined, “The more you get, the more you want.” Yet, his Greek predecessor, Plato, educated, “The greatest wealth is to be content with little,” while Plato’s philosophical mentor, Socrates, gives us a glimpse of how to pursue the path of contentment: “Contentment is the natural wealth of the mind.”

And that, my friend, is precisely the objective of differentiating between gap and gain thinking. It’s a state of mind, a mental framework that helps us reframe our thinking that can ultimately shape how we feel…and act.

Now that you have the language, you have the daily, hourly, and momentary choice to see yourself in the gap or in the gain. And this is what is required—a regular practice of reframing ourselves in the gain because of our proneness to gap thinking.

A Simple Solution

One simple solution to help us achieve our goals without gap thinking in our financial planning is automation. Thanks to the advent of online banking and investing, you can simply determine what your ideal is and then automate your way to goal pursuit. You can set it and forget it, only occasionally checking in to see how much progress you’ve made.

You can automate your emergency savings, sending a specified amount to an account you rarely revisit until an emergency arrives. You can automate your retirement savings by determining a percentage of your income to sweep into your 401(k) monthly, and you can even automate an escalation feature that will increase that percentage at the beginning of every year, in concert with your likely cost-of-living pay increase.

You can even automate the smaller goals, setting cash aside in virtual envelopes for vacations, holidays, travel, and date nights. If it’s a financial goal, you can automate it. Then you can spend the remainder free from guilt.

Final Warning

Here I offer a warning, particularly for the strivers, the high achievers, the uber-competitive, and the serial goal setters: You’re more likely to be stuck in the gap. You are more likely to feel dissatisfied with your accomplishments because you’re always chasing another goal.

The good news is that’s why Sullivan and Hardy wrote The Gap and the Gain. Their audience isn’t the couch potatoes whose only goal is to finish another PBR beer for every episode of Netflix

NFLX

they binge on a Tuesday night. In fact, it may even be true that some would do well to aspire to more in order to achieve their full potential. Sullivan and Hardy want the high achievers—the people who are reading this post—YOU—to enjoy more satisfaction for the hard work you are doing.

So, in what areas of life or money are you stuck in the gap? And how can you live in the gain?

Read the full article here