The Millennials have taken so much generational bashing that it’s almost become passe. This apparently entitled bunch of the supposedly spoiled should have been the ruin of us all if they had lived down to their billing. How much more, then, should we fear the rise of Generations Y and Z? They will certainly lead us running off the edge of a sluggard’s financial cliff!

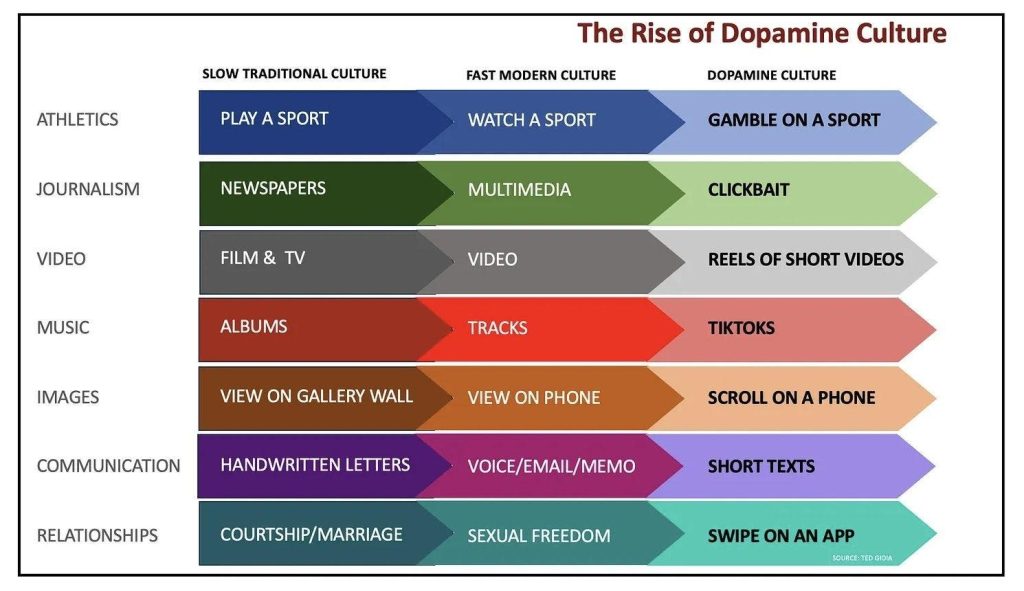

Indeed, I saw a compelling (however curious) infographic designed to illuminate the fall we’re all headed for as a result of the “Rise of Dopamine Culture”:

But upon closer examination, you realize pretty quickly that this is just good ol’ generation-shaming propaganda, hyperbolizing both the purer practices of the commentator and the worldview of the corrupted commentated. And lest we conclude that there really is something uniquely damning about today’s younger generations, let’s recall that this is a long-standing practice.

Indeed, the generations that are most often celebrated today were criticized in their day. The owners of most of today’s wealth, the Baby Boomers (1946-1964), with all their peace and expression, were the notorious antagonists of the Silent Generation (1928-1945). And those free-wheeling Flappers were subject to the condemnation of the external buttoned-upness of the Greatest Generation (1901-1924). All the while the Lost Generation (1883 – 1900) was criticized by older generations for their cynicism and lack of respect for tradition.

Yet we forget that often, by the time the previous generation is old enough to gripe about the present (whom they raised!?), the present has evolved into the future, bringing a host of innovations with it. Gen Z, in particular, may prove to be one of the most financially fit, even from a generational perspective.

For example, a new study by the Investment Company Institute (ICI) finds that “Gen Z households have nearly three times more assets in the [retirement] plan accounts (adjusted for inflation) that Gen X households did at the same age.” More Gen Z-ers have retirement plans set up and they’ve saved more in those accounts.

If you were ready, however, to attribute this out-pacing to Gen Z’s moral superiority—not so fast. The fact is that much has improved about the system, too. Defined contribution—aka 401(k) and 403(b) plans and the like—are much more common, an innovation for which the younger generations owe the older a debt of gratitude.

But perhaps the most powerful boost in retirement savings comes from the field of behavioral economics and finance. Thanks especially to behavioral economics OG’s, Richard Thaler and Cass Sunstein’s, insight, 401(k) plans now have more foresight:

- Plans are opt-out instead of opt-in. That way instead of having to consciously decide if you want to cede a meaningful portion of your salary today to your future self, the default setting for most employers is automatic enrollment.

- Plans have auto-escalation options. You can also decide just once to increase your contribution automatically every year—an advance that came from the behavioral insight that it is easier for us to pledge money in the present that we won’t actually invest until the future.

- Plans also have fewer investment options—because we found that when options were too plentiful, savers fell prey to analysis paralysis.

In short, retirement plans are more plentiful and they are better designed today, thanks to previous generations, and the current generations are taking advantage of these advancements. So perhaps we can set the family feud aside for a generation a day and credit both of them. All of them.

Read the full article here