I and other economists were expecting the October jobs report to be blah. And we were right, the numbers didn’t change much. Unemployment is still at historic lows at 3.9%. Hourly wages are up as workers slowly get wage increases to make up for inflation. Last month, September 2023, real wages were down 5.8% since January 2021; by October 2023, real wage losses were only 5.4%. (With great relief, low-paid leisure and hospitality workers got solid real wage increases of 5.7% since January 2021.)

Manufacturing employment was down a bit because the UAW strikes were counted on payroll.

The softening in October should not distract from the reality the labor market is hot. The unemployment rate is super low and rising worker power is resulting in wage increases catching up with inflation.

Signs Of Worker Power Softening

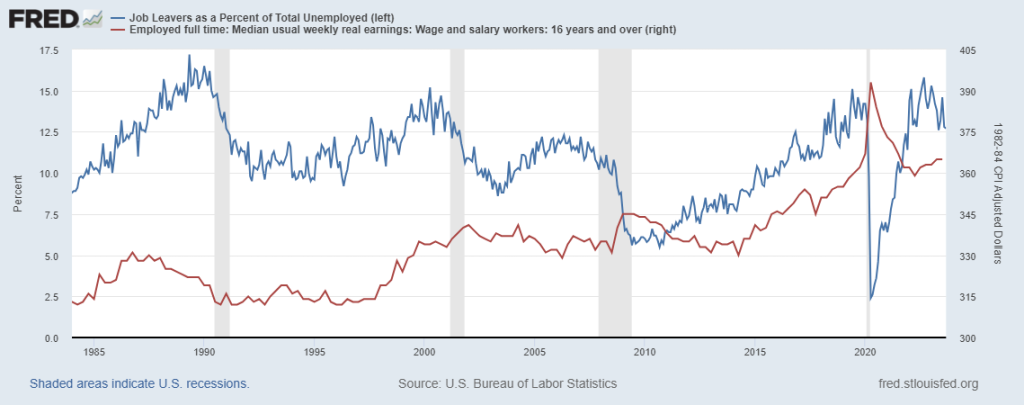

The job leavers share of total unemployed, which complements the quits rate in the monthly Job Opening and Labor Turnover Survey (JOLTS), is rising indicating lower worker confidence.

The job leaver rate in September 2022 was very high (seasonally adjusted) at 15.8%. But one year later, in September 2023, it was much lower at 12.7%, and it fell again last month. The October 2023 share of the unemployed who were job walk-awayers edged down to 12.6% of the unemployed.

And, the share of the unemployed who are on permanent layoff also leaped up from a low of 31.1% in October 2022 and 33.2% last month, to 34.4% in October 2023.

The drop in the “take-this-job-and-shove-it” numbers (quits and job-leaver rates) predict softening real wage hikes. The nifty graph below– you create these graphs yourself with the St. Louis Federal Reserve Economic Data (FRED) tool – shows workers leave jobs at higher rates during economic expansions; and, consistent with common sense, quit less in recessions. When workers quit or threaten to quit wages inch up.

Signs Worker Power May Rise

The UAW stopped their strike against the Big Three American Automakers last week, and workers are expected to vote for it. Nonunion Elon Musk’s Tesla

TSLA

and the foreign automakers must be standing up straight; the UAW signaled to their workers that unionization pays off. According to the Wall Street Journal, the UAW contract raises wages and benefits to $87 to $90 an hour for each worker, up from the mid-$60s now and much higher than at Tesla and Japanese and Korean nonunion automakers.

The union also won some job guarantees and extra 401(k) contributions. It is painful management had to wait 6 weeks to offer what it could afford and make up for inflation; the settlement was not that far off to what there were what automakers were offering in September. Take a look at Chicago Fed’s Kirstin Dziczek’s blogs to discover how much UAW workers gave up over the last 15 years.

Though it is relieving the 6-week strike is over; strikes are such a waste, but necessary in our peculiar system that favors employers over workers. Inflation erodes wages and profits soar before workers can catch up. The UAW had to wait four years to make up for inflation and share profits. UPS management settled this summer without a strike — it seems GM, Ford, and Stellantis management are slower learners.

The Near Term Economy

Economists are walking back from their gloomy predictions of a coming recession. Still new graduates at the end of this semester might want to take job offers quickly. And if you don’t like your boss, or commute, or return to the office – still might happen Rick McGahey writes in Forbes — you may hesitate before quitting until you to snag a better job.

I plan to go easy on my wallet this holiday (#homemade gifts2023). Economists don’t’ expect a recession, but we don’t expect rapid growth either.

Read the full article here