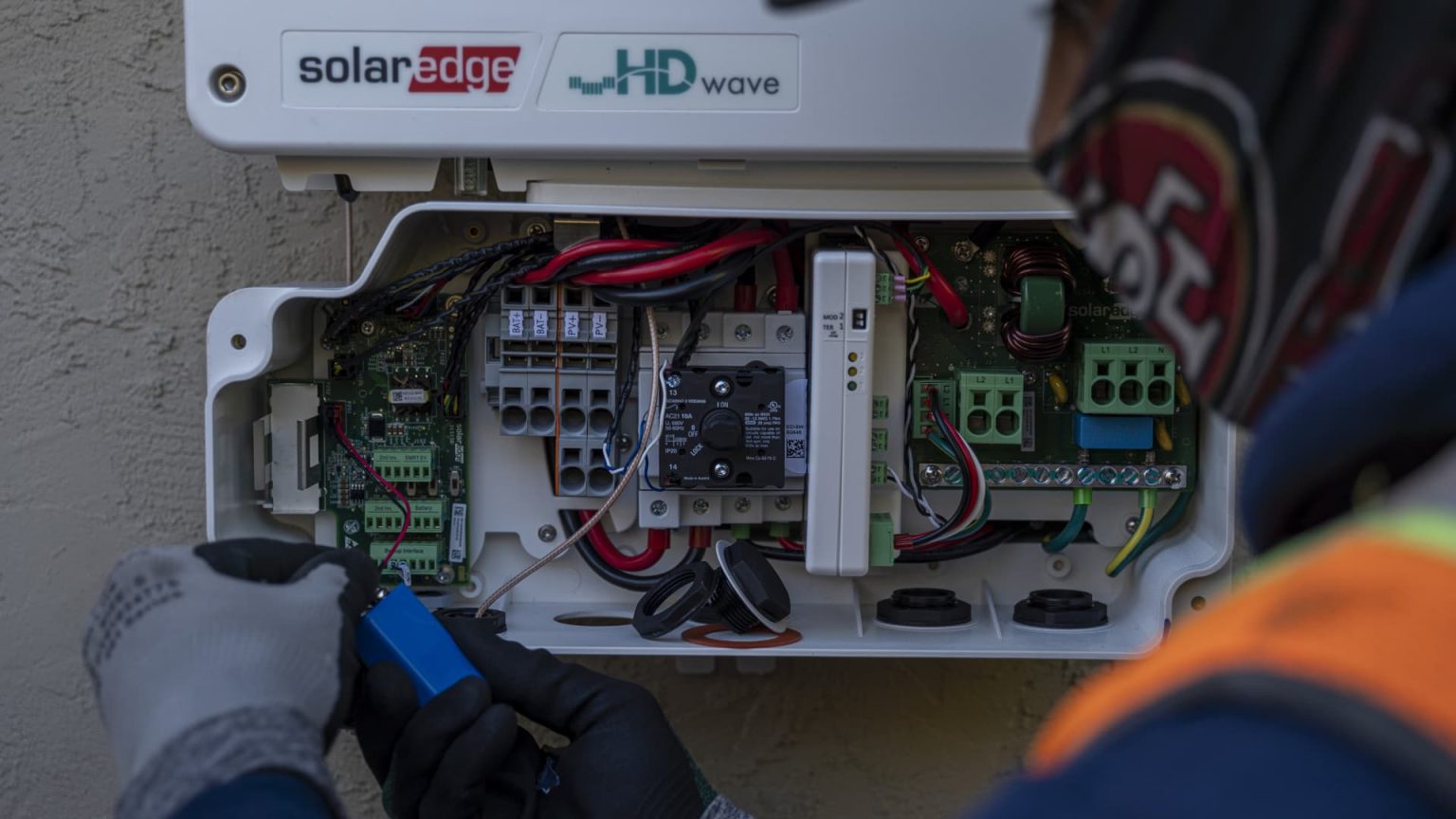

Check out the companies making the biggest moves in premarket trading: SolarEdge Technologies — The solar stock tumbled nearly 29% after the company lowered its third-quarter guidance post market Thursday. SolarEdge CEO Zvi Lando cited substantial and unexpected cancellations among the reasons for the cut. On Friday, Deutsche Bank downgraded SolarEdge, Sunrun and Sunnova to hold from buy based on declining demand. Sunrun and Sunnova both fell around 9%, while Enphase Energy dropped 15.7%. The Invesco Solar ETF was down 5.2%. Schlumberger — The oil and gas company slumped 1.8% after reporting revenue for the third quarter of $8.31 billion, missing estimates of $8.33 billion, per LSEG. Its earnings per share of 78 cents, however, beat estimates of 77 cents. Intuitive Surgical — Shares slipped nearly 6.6% after the company posted a revenue miss following Thursday’s close. Revenue came in at $1.74 billion, versus the $1.77 billion expected from analysts polled by LSEG. However, adjusted earnings per share came in at $1.46, topping expectations of $1.41. Regions Financial — The regional bank stock fell 4.7% after reporting an earnings per share of 49 cents for its third quarter, less than the 58 cents expected from analysts polled by StreetAccount. Net interest also fell short at $1.29 billion, versus the $1.32 billion expected. Knight-Swift — Shares of the transportation company soared 12.4% after Knight-Swift beat estimates on the top and bottom lines in its third-quarter report. The company reported 41 cents in adjusted earnings per share on $2.02 billion of revenue. Analysts surveyed by LSEG expected 36 cents per share and $1.89 billion of revenue. Total revenue rose more than 6% year over year. CEO David Jackson said in a press release that the less-than-truckload market is showing relative strength. American Express — Shares were little changed after the credit card company posted its third-quarter results. American Express earned $3.30 per share on revenue of $15.38 billion. Analysts polled by LSEG expected a profit of $2.94 per share on revenue of $15.36 billion. — CNBC’s Jesse Pound contributed reporting.

Read the full article here