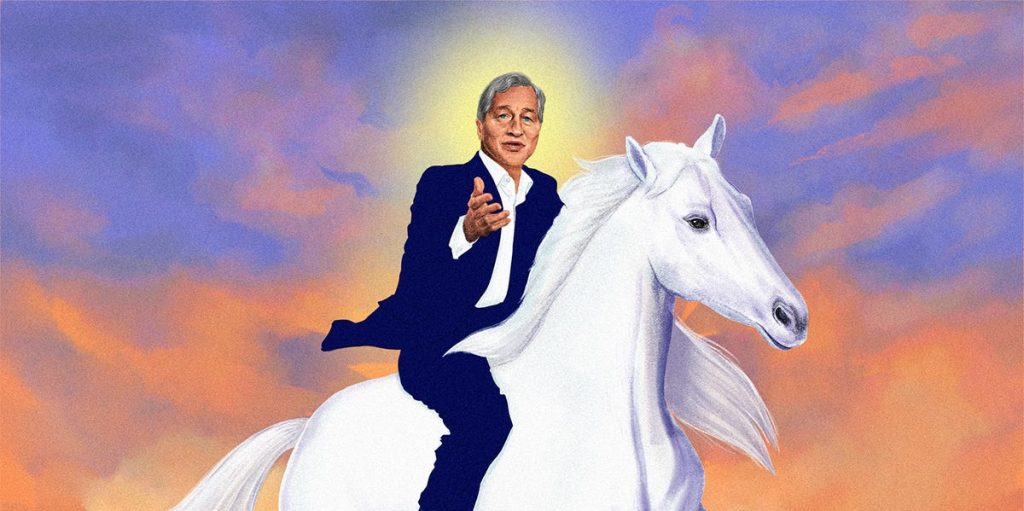

For many Americans, the sight of JPMorgan CEO Jamie Dimon wrangling a coordinated, private-industry lifeline to First Republic Bank on the heels of the collapse of Silicon Valley Bank in March was a familiar one.

After all, Dimon had stepped up and served as the de-facto face of the banking industry as markets erupted into chaos during the Great Recession. JPMorgan acquired not one but two troubled financial firms at the behest of the government and has widely come to be viewed as the only bank that didn’t need the federal bailout money foisted upon 13 financial-industry giants.

Dimon’s hero status was short-lived, though, as the tide of public opinion soon turned against JPMorgan and its CEO. Rather than basking in the glow of the government’s gratitude, he saw his relations with Washington, DC, sour as he began openly slamming regulators’ proposals to rein in the very banks that had caused the crash.

JPMorgan also drew ire for its share of questionable mortgages and foreclosures, as well as a $6 billion trading loss in 2012. Soon, the man called “Obama’s favorite banker” by The New York Times was letting it be known to anyone who would listen that he regretted having stepped in to help.

“Let’s get this one exactly right. We were asked to do it. We did it at great risk to ourselves,” Dimon said in October 2012 of the bank’s 2008 acquisition of the troubled investment bank Bear Stearns. “Would I have done Bear Stearns again knowing what I know today? It’s real close.”

Fast-forward to 2023, and Dimon appears to have found himself once again working with regulators to help contain a banking crisis. The failure of Silicon Valley’s favorite bank led to fears of contagion and selling pressure on a longtime JPMorgan client, First Republic. Dimon coordinated a private-sector deposit infusion in First Republic to the tune of $30 billion.

This time, Dimon appears to be on safer ground. Unlike in 2008 (or even 1907, when JPMorgan’s namesake famously ended a run on the banks), this banking crisis stands to be one that will benefit JPMorgan financially and burnish Dimon’s image. Already, some are predicting that it could cement his legacy as the most powerful figure on Wall Street — and one of the most powerful figures in the country — almost regardless of what happens to First Republic.

“JPMorgan is the biggest bank in America, more than $4 trillion in assets,” Dick Bove, a bank analyst at Odeon Capital, said. “They are the backstop of the banking industry. Jamie Dimon is the true chairman of the Federal Reserve.”

If this prediction comes true, it couldn’t come at a better time for Dimon, a banker who has a reputation for being sensitive to his legacy. He turned 67 in March, and who will succeed him at JPMorgan is a perennial question — as is what sort of role Dimon envisions for himself upon his retirement from the bank.

JPMorgan declined to make Dimon available for an interview.

JPMorgan is no stranger to chaos in the banking system. Whether it be 1907, 2008, or 2023, the nation’s largest bank has always weathered storms and come out on top. But the same hasn’t always been true of JPMorgan’s figureheads — starting with John Pierpont Morgan in 1907, and then Dimon a century later.

In both cases, the men stepped in to mitigate the contagion, only to be held up as symbols of American greed. Both times, they found themselves at the center of debates over how much government intervention was required to rein in the excesses of bankers.

In an often told story of J.P. Morgan, he sequestered the leaders of the nation’s largest banking houses inside his Manhattan mansion during what would come to be known as the Panic of 1907. The stock market was crashing, and customers were withdrawing millions of dollars from banks and trust companies.

Morgan, who also controlled railroads and other companies, coordinated a $25 million capital injection and quelled the financial turmoil, first earning adulation — and then backlash.

“For a moment in 1907, he was a national hero. Crowds cheered as he made his way down Wall Street, and world political leaders saluted his statesmanship with awe,” Jean Strouse wrote in her 1999 biography on him, “Morgan.”

“The next moment, however, the exercise of that much power by one private citizen horrified a nation of democrats and revived America’s long-standing distrust of concentrated wealth,” Strouse wrote.

By 1912, Morgan was called to testify before a congressional committee investigating the power of Wall Street financiers accused of colluding to control American banking and industry. Those hearings led to the creation of the Federal Reserve in 1913.

Roughly a hundred years later, it was Dimon who found himself pushed into a cold embrace with regulators. After working with government officials to prevent a wider collapse of the financial system, Dimon soon found himself regularly sparring over the government’s proposal to reduce risk.

One of his frequent foils was Elizabeth Warren, then a Harvard law professor and the head of an oversight panel for the Treasury’s Troubled Asset Relief Program. Things got so bad that Warren, now a Massachusetts senator, singled him out in a 2010 Wall Street Journal article bemoaning the short-sightedness of bankers.

“The reputations of Wall Street’s most storied institutions are evaporating as the lack of meaningful consumer rules has set off a race to the bottom to develop new ways to trick customers,” Warren wrote in an op-ed with the phrase “Jamie Dimon is wrong” in the subtitle.

That’s not to say JPMorgan didn’t benefit financially from its actions in 2008, despite the slow torture of $19 billion in fines and settlements tied to the bank’s acquisitions of Bear Stearns and Washington Mutual.

The purchase of Washington Mutual at bargain-basement prices in September 2008 boosted JPMorgan’s deposits and branch footprint almost overnight. In 2017, less than a decade later, it surpassed Bank of America as the largest US bank by deposits. It took 11 years for JPMorgan to break even on the acquisition of Bear Stearns, but it expanded JPMorgan’s investment-banking and trading operations, divisions that paid off handsomely during the pandemic deals boom.

Dimon was quick to push back against charges levied against him, JPMorgan, and the banking industry generally. “The incessant broad-based vilification of the banking industry isn’t fair and it is damaging,” he told The Wall Street Journal in 2010.

But as with the bank’s namesake in the early 1900s, there’s little question that in the court of public opinion, Dimon emerged from the 2008 financial crisis looking worse for the wear. Why, then, has Dimon been so willing to swing back into action in the wake of Silicon Valley Bank’s collapse?

The Sunday following Silicon Valley Bank’s closure by federal regulators on March 8, JPMorgan announced a partnership with the Federal Reserve to offer $70 billion in financing to First Republic, which some predicted would be the next bank to fall. When First Republic’s stock continued to plummet, Dimon coordinated a private-sector effort that resulted in $30 billion in deposits being infused into the bank on March 16.

It’s too early to say whether this will be enough to save First Republic, which lost roughly 90% of its value in March. And more banks could face trouble: A JPMorgan research note this week said some $1 trillion in deposits had been withdrawn from “vulnerable” banks since March 2022 (with half that amount coming from SVB).

But it’s starting to look like JPMorgan — and Dimon — will end up winners no matter how things turn out.

Big banks like JPMorgan have already raked in billions in deposits after customers fled from Silicon Valley Bank and other small banks to safe havens. They are expected to continue to see deposits flow their way as small businesses and Main Street investors wise up to the insurance limits of the Federal Deposit Insurance Corp.

SVB’s decline also helps pave the way for JPMorgan to snag a bigger share of the startup and founder clients it has been eyeing. JPMorgan opened a tech-innovation campus in Palo Alto, California, last year. It also recently launched its Capital Connect platform for linking early-stage companies with investors, CNBC reported.

In backstopping First Republic, JPMorgan helps a client and a bank that experts say would fit nicely into its business. Current rules limit the extent to which the nation’s largest banks can acquire others — with exceptions.

“If the laws of the United States didn’t prevent it, they would pick up First Republic in a heartbeat,” Odeon Capital’s Bove said of JPMorgan.

By saving First Republic, JPMorgan also stands to gain goodwill from Silicon Valley startups, which are customers of the smaller bank.

“Bear Stearns and Washington Mutual, both at some level, represented businesses that Dimon and that JPMorgan as an institution were interested in. I think something similar is going on here,” Dixie Rodgers Noonan, the founder and CEO of DLRN Advisory and previously the senior counsel to the Financial Crisis Inquiry Commission, said of JPMorgan’s efforts to save First Republic.

Meanwhile, JPMorgan’s exposure to First Republic is perhaps small. In the form of a loan, it put up just $5 billion of the total $70 billion in financing alongside the Federal Reserve, a person familiar with the deal who asked to remain anonymous told Insider.

The bank contributed another $5 billion as part of the coordinated deposit effort, which The New York Times reported would be paid back with interest in as few as four months. If First Republic fails, the money will be reimbursed by the government, The Times said.

The paper also reported that regulators asked Dimon, Bank of America, and other banks to buy Silicon Valley Bank and pay out depositors over the insured limit. He said no.

“Jamie is important because he’s a warehouse lender, because he lends a lot of money to other banks,” Christopher Whalen, the chair of Whalen Global Advisors, told Insider. “He has a perspective that allows him to come to somebody’s aid if it makes sense. He’s not going to do it if the bank is going to lose money. He was coming to the aid of somebody who is a counterparty and a client.”

Parallels are already being drawn between Dimon’s work and Morgan’s 1907 rescue — without mention of the public outrage or regulatory backlash that followed. And there’s good reason for that: Big banks that were forced to shore up their balance sheets in the aftermath of the housing meltdown now find themselves above the fracas of a brewing blame game as regulators and the public seek answers for what went wrong.

The emerging villains of today’s crisis are a mix of wealthy venture-capital investors who urged on the rapid withdrawal of deposits from SVB and then agitated for a government-coordinated rescue, regional bank managers who failed to properly prepare for rising interest rates, and regulators who appeared to fall asleep at the wheel.

On Tuesday, Michael Barr, the Federal Reserve’s vice chair of supervision, who is now leading a review of regulatory missteps in the lead-up to the failure of Silicon Valley Bank, testified before the Senate’s banking committee, of which Warren is now a member. Barr said regulators saw SVB’s failure as a “textbook case of mismanagement.” He also indicated that banks of SVB’s size — large but not on the scale of JPMorgan — could see increased supervision as a result.

One might even argue that the regulatory reform that emerged from the last banking failure set Dimon up to be the hero of the latest crisis.

“The Fed is no longer allowed and the FDIC is no longer allowed to lend to specific institutions unless they make a systemic risk exception. What that means is that really Jamie and the big guys are all that’s left,” Whalen said.

Dimon didn’t need this crisis to save his legacy. He not only helped steer JPMorgan and the financial industry out of their darkest days but also went on to build the nation’s biggest bank by assets, with a market cap of roughly $380 billion, more than double its size in 2007. But his stewardship of JPMorgan is also not without missteps.

On Tuesday, the Financial Times reported that Dimon would be deposed in litigation around JPMorgan’s ties to its longtime private-banking client Jeffrey Epstein. Other bleak spots include the “London Whale” trading mishap in 2012, when a rogue trader’s outsize derivatives bets cost the bank more than $6 billion. More recently, JPMorgan’s troubled acquisition of Frank — albeit a blip on the bank’s income statement — cast into doubt the bank’s aggressive moves to compete with fintech competitors.

His latest effort to save the banking system may have come at a good time. Questions have echoed for years about when Dimon plans to retire. JPMorgan’s board of directors provided one clue in 2021 when it granted Dimon a hefty incentive to stay on as the bank’s leader through 2026 — now just three years away.

What he might do in retirement is hard to say, but he’s long been considered a favorite for US treasury secretary, an idea he dismissed in 2020. Support for Dimon as treasury secretary was mixed in the aftermath of the financial crisis. Maybe this time his supporters will outweigh the critics.

“He’s willing to be a leader when leaders are needed,” Kim Leslie Shafer, a senior policy advisor at Impact Capital Managers and former senior research consultant to the Financial Crisis Inquiry Commission, told Insider.

JPMorgan “could gain a ton of business if a bunch of other banks go down,” Shafer said, adding: “He’s being a civic leader. He’s saying this is bad for the system and he wants to fix it.”

Read the full article here