Applovin’s Advertising Investment Thesis Remains Robust

Applovin (NASDAQ:NASDAQ:APP) is a SaaS company that offers advertising software solutions for mobile/ web app developers, which allows the enhancement of their app marketing and monetization globally.

The robust recovery in the global advertising market is undeniable indeed, with the two market leaders, Google (GOOG) and Meta (META), already reporting robust growth in their top/ bottom lines despite the uncertain macroeconomic outlook.

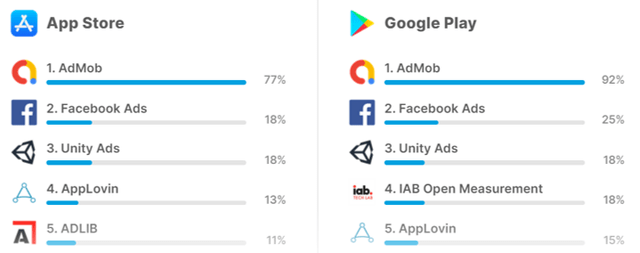

The Most Popular Ads & Monetization SDKs

App Figures

Combined with its leading market share in the most popular advertising and monetization Software Development Kits in both the iOS and Android platform, it is unsurprising that APP has also reported a double beat FQ1’24 earnings call, with revenues of $1.06B (+11% QoQ/ +47.9% YoY) and GAAP EPS of $0.67 (+36.7% QoQ/ +6800% YoY).

Much of the top/ bottom-line tailwinds are attributed to the accelerating Software Platform growth to annualized revenues of $2.71B (+17.6% QoQ/ +91.2% YoY), with the high margin SaaS segment continually reporting growing adj EBITDA margins of 72.5% (-0.3 points QoQ/ +10.9 YoY).

It is apparent that APP’s AXON 2.0 technology launched in early 2023 has greatly benefitted its core business, with the “ongoing self-learning, additional data, and engineering enhancements” triggering “greater return on ad spend (ROAS) for our advertisers, leading to increased investment” and top-line growth.

This also explains its stable Monthly Active Payers [MAP] of 1.8M (inline QoQ/ inline YoY) and growing Average Revenue Per MAP [ARPMAP] of $48 (+2.1% QoQ/ +4.3% YoY).

At the same time, APP already guides incremental improvements in AXON 2.0’s AI models along with robust demand for advertising in online/ mobile gaming platforms in the FQ1’24 earnings call, especially since “many larger gaming advertisers are still in the process of integration and ramping their UA spend.”

Combined with the management’s highly efficient operating expenses of $329.16M after discounting for non-cash Stock-Based Compensation (+2.1% QoQ/ +9.9% YoY), it is unsurprising that the SaaS company reports accelerating growth in its overall adj EBITDA to $549M (+15.1% QoQ/ +100% YoY) and increasingly rich overall adj EBITDA margins to 51.8% (+1.9 points QoQ/ +13.6 YoY).

As a result, it is unsurprising that APP has offered a promising FQ2’24 earnings guidance, with overall revenues of $1.07B (+1% QoQ/ +41.3% YoY) and overall adj EBITDA of $560M (+2% QoQ/ +67.1% YoY), implying similarly rich overall adj EBITDA margins of 52.3% (+0.6 points QoQ/ +7.9 YoY).

The Consensus Forward Estimates

Tikr Terminal

Perhaps this is why the consensus have raised their forward estimates, with APP expected to generate an accelerated top/ bottom line growth at a CAGR of +18.1%/ +58.9% through FY2026.

This is compared to the previous estimates of +10.8%/ +31.1% and the historical growth of +34.8%/ +28.4% between FY2016 and FY2023, respectively.

Retail Media Ad Spend

eMarketer

We believe that much of the optimism may also be attributed to APP’s new growth opportunities in the web-eCommerce segment, based on the projected growth in retail media ad spending from $115B in 2023 to $165.94B in 2025, expanding at an accelerated CAGR of +20.1%.

With the management already guiding the first launch of “web advertising on our platform” in Q2’24, we believe that we may see incremental growth in its top/ bottom lines moving forward, potentially triggering another beat quarter in FQ2’24.

At the same time, APP’s robust Free Cash Flow generation of $1.16B over the LTM and the projected expansion in cash flow through FY2026 imply its ability to opportunistically invest in its growth opportunities without having to stress its balance sheet.

This will also allow the management to sustain its robust shareholder returns thus far, based on the retirement of 24.57M or the equivalent 6.5% of its float over the last twelve months and 39.71M/ 10.2% since FY2021, with $500M still available in its existing share repurchase program.

Combined with the relatively healthy balance sheet with decent net debt situation of -$3.09B (+17.9% QoQ/ +26.7% YoY) and the well laddered debt maturity through 2028/ 2030, we believe that APP remains well positioned to excel during the upcoming ad-tech boom over the next few years.

So, Is APP Stock A Buy, Sell, or Hold?

APP 2Y Stock Price

Trading View

For now, APP has lost part of its recent gains after the excellent FQ1’24 earnings call, though still trading well above its 50/ 100/ 200 day moving averages.

APP Valuations

Seeking Alpha

Despite so, we believe that APP remains reasonably valued at FWD EV/ EBITDA valuations of 12.79x and FWD P/E GAAP valuations of 27.10x.

This is compared to its ad-tech peers, such as the highly profitable Trade Desk (TTD) at 44.25x/ 130.31x, Perion Network (PERI) at 4.84x/ 12.59x prior to the recent correction from Bing’s changes, and the yet profitable Digital Turbine, Inc. (APPS) at 5.96x/ NA, respectively.

This is especially when comparing APP’s projected top/ bottom line growth through 2026 to TTD’s at +21.6%/ +22.9%, PERI’s at +16.2%/ -30.1%, and APPS’ at -2.8%/ -22.8%, respectively, implying that the former’s accelerated profitable growth is cheaply valued indeed.

Readers must also note that generative AI has entered the ad-tech picture, with the ecosystem expected to benefit from “the higher speed of content creation, more effective advertising campaigns, and enhanced ad returns,” naturally triggering accelerated growth for market leaders such as APP.

This is especially since the global ad-tech market size is expected to grow tremendously from $987.52B in 2023 to $2.81T in 2030, expanding at an impressive CAGR of +16.1%.

For now, based on the FQ1’24 annualized GAAP EPS of $2.68 (+36.7% QoQ/ +6800% YoY) and the FWD P/E GAAP valuation of 27.10x, it is apparent that APP is trading above our fair value estimates of $72.60.

Even so, based on the consensus FY2026 GAAP EPS estimates of $4.66, it is apparent that the stock continues to offer an excellent upside potential of +59.2% to our long-term price target of $126.20.

Combined with the robust shareholder returns and the attractive risk/ reward ratio, we are initiating a Buy rating for APP, though with no specific entry point since it depends on individual investor’s dollar cost average and risk appetite.

With the stock currently retesting its previous resistance levels of $80, interested readers may want to observe its movement for a little longer before adding after a moderate pullback to its previous trading range of between $66s and $74s for an improved margin of safety.

Read the full article here