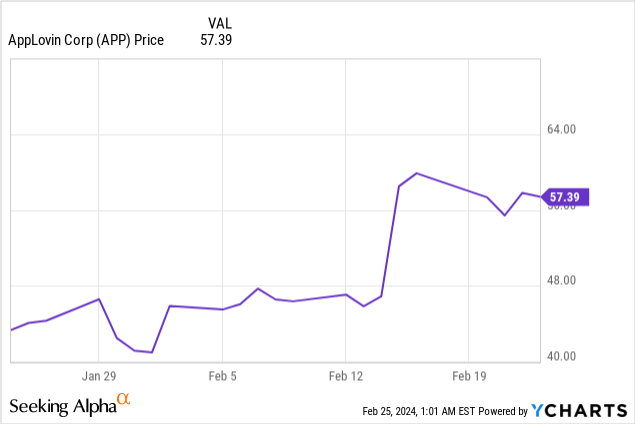

Investor sentiment towards AppLovin Corporation (APP) appears positive after it reported fourth-quarter 2023 earnings on February 14, 2024, after the bell. Revenue was $25.23 million higher than analysts’ consensus expectations, and earnings beat expectations by $0.14. Additionally, the company’s free cash flow (FCF) jumped significantly higher in 2023. The stock rose 25% after reporting earnings, adding to gains made earlier this year and its 278% rise in 2023. Even after the stock’s recent surge, the market may be undervaluing the stock in my view, and there could be more potential upside.

AppLovin operates in the mobile app monetization space and successfully leverages artificial intelligence (AI), a growing theme attracting investor interest. This article will discuss what AppLovin does, how it monetizes AI, its recent earnings report, a case for why the market may undervalue the stock, a few risks, and why it may be a buy for aggressive growth investors even after its fantastic rise.

What the company does

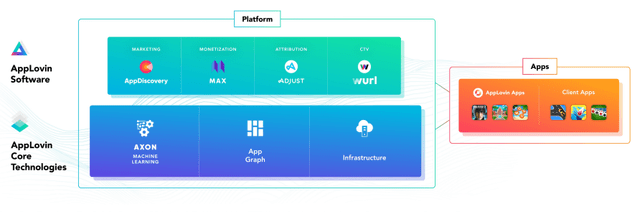

AppLovin provides tools and helps mobile app developers, especially game developers, get their apps discovered by users, and it monetizes those apps for customers primarily through advertising. AppLovin generates income mainly by acting as a supply-side platform (SSP), representing publishers in programmatic ad auctions. The following image visually represents the services it offers developers (game publishers).

AppLovin 2022 10-K

AppLovin’s Core Technologies underlie and power the software and consist of the following:

- The Axon machine-learning or AI recommendation engine.

- The company’s proprietary App Graph.

- An elastic cloud infrastructure.

Core Technologies collects anonymous data from millions of devices about what apps people use, when, and how they interact with them. It catalogs and stores that information in a giant map of mobile app usage called the App Graph. Every day, the App graph collects millions of new interactions. Axon acts like a super-intelligent librarian who finds the information it needs on the App Graph and uses AI algorithms to understand each user’s preferences and interests. Based on this understanding, AXON picks the most relevant advertising content to show that user. AppLovin recently released Axon 2.0, an improved version of the original Axon.

The infrastructure is the “backbone” connecting the whole system. AppLovin’s infrastructure consists of a cloud computing system that can automatically spin up or wind down the computing resources needed in response to changes in the massive amount of information the system needs to process. The part of the platform on the above image called AppLovin’s Software is a set of tools that lies on top of the cloud infrastructure that helps app developers sell and monetize their apps. These tools include the following:

- AppDiscovery: This program is AppLovin’s ad network. It matches the types of users that advertisers seek with users on a publisher’s app through a real-time ad auction at vast scale and microsecond-level speeds. AppDiscovery uses the platform’s AXON machine-learning recommendation engine with predictive algorithms to help developers match their apps to users who are more likely to download them.

- Adjust: AppLovin’s analytics platform helps mobile app marketers grow their businesses by providing intelligent software with automation for measuring and improving advertising campaigns while keeping user data safe. Additionally, if a developer ever needs help, the company has a global customer support team that is responsive.

- MAX: The platform’s in-app programmatic ad bidding software helps app developers (publishers) make more money from their advertising inventory by running a real-time competitive auction that attracts more competition and higher returns for publishers. Many developers that integrate MAX have gained a measurable increase in their average revenue per daily active user over traditional monetization methods. Plus, they can save much time by automating manual monetization work through its advanced feature set.

- Wurl: AppLovin acquired connected TV (CTV) platform Wurl in April 2022, which primarily distributes streaming video for content companies and provides tools to maximize advertising revenue and attract consumers. This platform is a relatively new part of the business that management believes has the potential to become a meaningful contributor to annual income.

- Array: This new product doesn’t appear on the above image because management started Array in May 2023, after it produced the image in the 2022 10-K released in February 2023. Array is a suite of solutions for smartphone OEMs and telecom carriers to help them monetize their app ecosystems on mobile devices. This initiative is very early, with Chinese smartphone manufacturer Oppo, the only company with a press announcement stating that it uses AppLovin’s mobile app recommendation engine. Array is another product that management believes has the potential to become a meaningful contributor to annual revenue.

Up until recently, mainly gaming developers used the company’s platform. However, now it plans on ramping up the same services for non-gaming apps. The non-gaming business may take some time to develop, as non-gaming app developers need to familiarize themselves with AppLovin.

Last, AppLovin owns Lion Studios, which manages a portfolio of over 350 free-to-play mobile games across five genres. These gaming apps encompass a combination of AppLovin-owned and partner studios-developed games and utilize the AppLovin Software Platform to market and monetize these apps. Earlier in the company’s history, its Apps and the Software Platform had a symbiotic relationship, where the Software Platform gave the Apps an economic advantage, and Lion Studios using the Software Platform helped the platform reach scale by 2022, according to management. AppLovin management now believes the Software Platform business can stand independently and has contemplated divesting its App business. It has already spun out one small indie app developer named Redemption Games in March 2023. Management states in the company’s 2022 10-K:

Early in 2022, given the scale reached by our Software Platform solutions, in particular AppDiscovery and MAX, we determined we no longer required access to a first-party portfolio of Apps and therefore commenced a strategic review of our Apps. We are continuing the optimization of our Apps portfolio and its cost structure, focusing on how to best optimize each of those asset’s contribution to our overall financial performance. This review has resulted in the divestiture or closure of certain studios, a reduction of headcount, restructuring of earn out arrangements, and other changes to our Apps portfolio, such as restructuring of certain assets or choosing to make changes to optimize the cost structure of certain Apps rather than investing in revenue growth.

Source: AppLovin 2022 10-K

AppLovin has kept many of its first-party gaming Apps since the end of the fourth quarter of 2023. Management will manage its App portfolio to produce a profit instead of selling off all the games at present. However, the company may restructure or sell the App assets in the future. Investors should keep close tabs on company news releases for further developments.

Management believes its recent revenue growth spurt since the middle of last year is due to the introduction of its Axon 2.0 AI engine in the second quarter of 2023, which has boosted revenue growth. CEO Adam Foroughi said on the company’s second quarter 2023 earnings call:

We’d attribute the growth in our platform really 100% from the advancements in our core technology [Axon 2.0]. The upgrade made our platform a lot more accurate for advertisers and allows us to really monetize more of a breadth of advertisers. So being able to do both things enabled us to really grow our business on the back half of the quarter as we rolled out this technology.

Source: AppLovin Second Quarter 2023 Earnings Call Transcript.

AppLovin uses Axon 2.0 AI technology in its ad network AppDiscovery and its ad bidding software Max. Using AI in programmatic advertising is currently among the best ways to monetize AI technology. The company’s recent financial performance, combined with AI being high on the list of investing themes in 2024, has attracted investor interest in the stock. Let’s look at the company’s latest quarter.

Fourth quarter 2023 earnings report

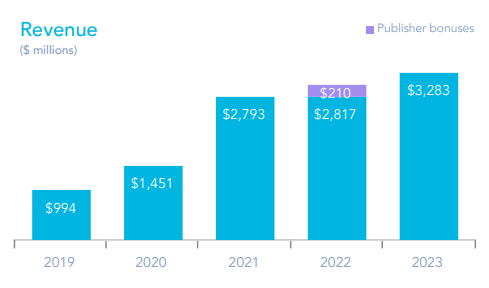

AppLovin produced total revenue for the full year 2023 of $3.3 billion, up 17% year-over-year.

AppLovin Fourth Quarter 2023 Shareholders Letter

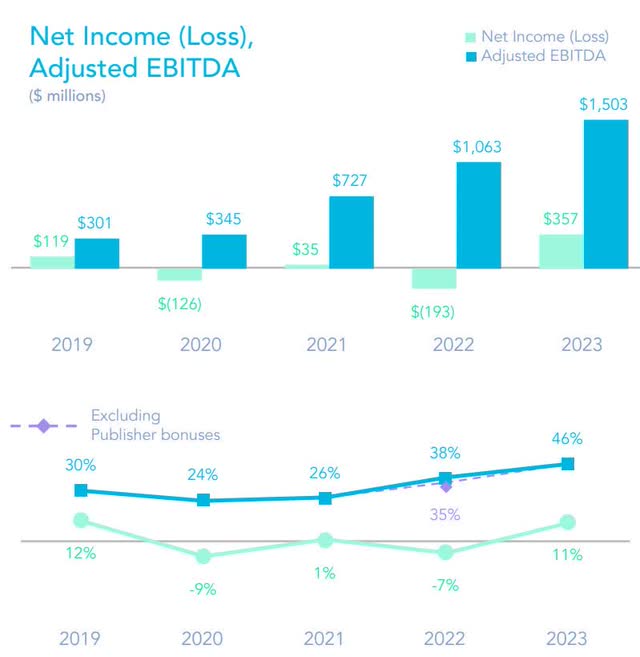

The company’s total consolidated adjusted EBITDA was $476 million, up 83% year-over-year, with an Adjusted EBITDA margin of 50%. AppLovin likely emphasizes EBITDA because it’s still a young company. EBITDA eliminates the impact of non-operating expenses like taxes and interest on debt, allowing investors to focus on the company’s core profitability and future earnings potential. Over the last several years, the company hasn’t been consistently profitable on the net income line. However, it did generate a net income of $357 million in 2023, with a net margin of 11% compared to a net loss of $193 million and a net margin of -7% in 2022. The chart below shows how the adjusted EBITDA margin has increased by 1600 basis points over the past five years, a positive trend.

AppLovin Fourth Quarter 2023 Shareholders Letter

The star of the show and the main reason that AppLovin maintained solid overall revenue growth and profitability in 2023 was the company’s Software Platform segment. Right at the beginning of the fourth quarter 2023 earnings call, Chief Executive Officer (CEO) Adam Foroughi said the following:

After a challenging 2022, characterized by stagnant growth, we refocused on growing our existing business and investing in new initiatives. I am immensely proud of our team’s dedication and hard work, which has resulted in our software platform revenue growing by 76% in 2023. Despite a challenged economic landscape and mobile gaming sector, we have continued to grow. This is a clear testament to the strength and potential of the updates we have made to our AI advertising engine, AXON.

Source: AppLovin Fourth Quarter 2023 Earnings Call Transcript.

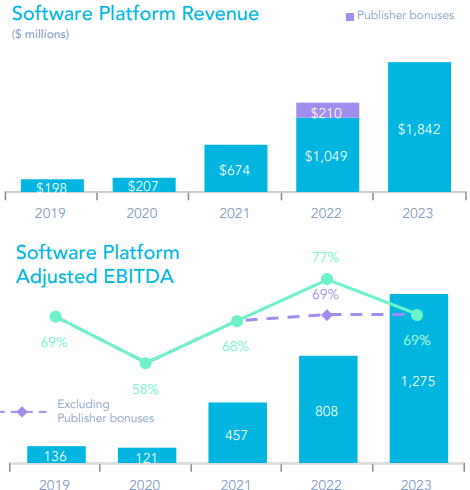

AppLovin has a history of producing robust Software Platform segment revenue growth. It grew the Software Platform segment’s annual revenue over nine times over the past five years. At the same time, the segment maintained an approximate 70% Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin during that period. The following image shows AppLovin’s Software Platform’s historical annual revenue and adjusted EBITDA over the last five years.

AppLovin Fourth Quarter 2023 Shareholder Letter.

In contrast, the company’s 2023 Apps segment revenue declined 18% from the previous year’s comparable quarter to $1.4 billion. The poor economy and a downturn in the gaming segment were partially responsible for the decline. The other reason for the revenue decline is that the company changed its focus from growth in the App segment to maintaining profitability. As a result, management reduced its studio footprint and user acquisition spending in 2023.

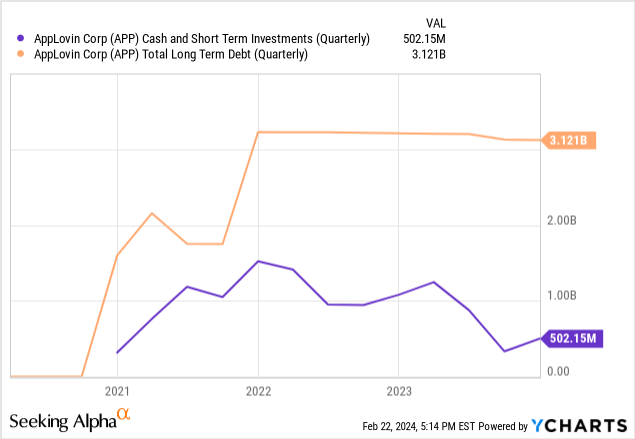

Let’s look at the company’s financial health. AppLovin has $502 million in cash versus $3.1 billion. It has a debt-to-equity (D/E) ratio of 2.48. A company with a D/E over 2.0 means over two-thirds of its capital financing comes from debt — a company with high leverage. Although a D/E of over 2.0 doesn’t mean the company is in financial danger, the company’s overall financial condition warrants close monitoring in future quarters. AppLovin has a quick ratio of 1.71, meaning the company can pay its short-term obligations. It has a debt-to-EBITDA ratio of 2.15, indicating the company has moderate risk in its ability to pay off its debts. The company’s interest coverage in the fourth quarter was 3.77, indicating it can pay the interest on its debt.

The company’s Chief Financial Officer (CFO) Matt Stumpf said during the fourth quarter earnings call about its debt:

During the year, we extended the maturity of our term loan to 2030. At the same time, reducing our interest rate to continue to manage our ongoing costs.

Source: AppLovin Fourth Quarter 2023 Earnings Call Transcript.

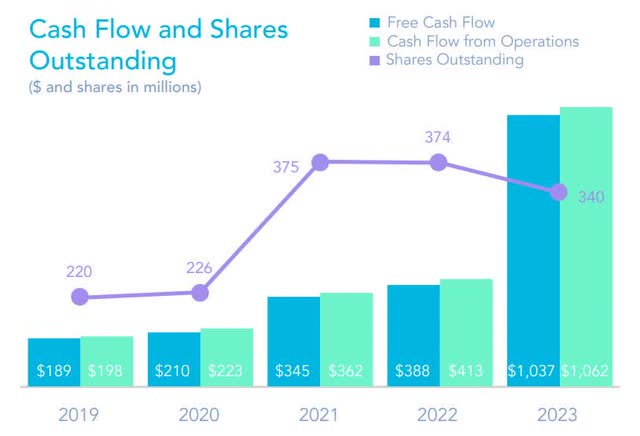

AppLovin shows the benefits of having an asset-light business model and scale by producing a robust 2023 FCF of $1.06 billion, 69% of its adjusted EBITDA of $1.5 billion. The company’s goal is to retain 70% of adjusted EBITDA as FCF annually, with the qualification that the quarterly percentage may vary due to changes in working capital and tax payments. FCF margin was a solid 32.6%.

AppLovin Fourth Quarter 2023 Shareholder Letter.

AppLovin CEO Adam Foroughi said about the company’s EBITDA margin and FCF on the fourth quarter earnings call:

And as you look at that software segment, there’s not a lot of software businesses with 70% plus EBITDA margin growing at the rate that is, I mean, rule of 140, 150 or whatever. And so, it’s just an astounding number. And then we convert a very high percentage of that EBITDA to cash flow as well. So we think because the technologies are new, it’ll take a while for investors to understand what we already see, which is not only is this very powerful technology in our core market, we’ve been able to grow much greater than the market is growing because this technology is efficient.

Source: AppLovin Fourth Quarter 2023 Earnings Call Transcript.

In 2023, the company repurchased 54.3 million shares, reducing the total shares outstanding by 10%. AppLovin plans to continue to use some of its FCF to repurchase shares moving forward. CFO Matt Stumpf said during the earnings call:

Through the combination of free cash flow generation and share management, we hope to continue to generate significant long-term value for our existing and our new shareholders. Our Board has also approved an increase in our share repurchase authorization by $1.25 billion. We plan to use this to continue to manage our outstanding shares.

Source: AppLovin Fourth Quarter 2023 Earnings Call Transcript.

Management gave first-quarter 2024 revenue guidance for $955 million and $975 million, above analysts’ consensus estimates of $923.8 million. The company forecasts that the first quarter of 2024 adjusted EBITDA will be in the range of $475 million to $495 million, implying an adjusted EBITDA margin of between 50% and 51%.

Risks

The company faces fierce competition from other companies focusing on helping game developers monetize their apps. According to the company 6Sense, AppLovin only has a 6.04% market share in mobile ad technologies and is only the fourth largest mobile ad network.

| Technology | Market Share (Est.) | Customers |

| URX | 50.75% | 3,204 |

| Alphabet’s (GOOGL) (GOOG) Google AdMob | 10.87% | 686 |

| Mobusi | 7.32% | 462 |

| AppLovin | 6.04% | 381 |

| Chartboost | 4.06% | 256 |

| Others | 20.97% | 1,324 |

Source: Data from 6Sense

However, the above list only encompasses mobile ad network market share. The list fails to include many other things that AppLovin specializes in, such as programmatic ad bidding software, analytics, user acquisition services, and Lion Studios, which helps developers publish and market their games. The company’s most direct competitor with similar services might be Unity Software (U), especially after Unity purchased ironSource in November 2022. Other significant competitors include Meta Platform (META) and Amazon (AMZN). The company also competes against SSPs with broader focuses outside of gaming, like Magnite (MGNI) and PubMatic (PUBM). If AppLovin fails to innovate fast enough and keep up with the technological innovations of its competitors, its market share and profitability could shrink.

Another risk investors must pay attention to is management’s ability to find and retain qualified talent. The mobile app industry is rapidly expanding, with numerous companies searching for employees with similar skill sets in areas like AI, advertising technology, and data analysis. AppLovin faces a ton of competition to find qualified employees in the same talent pool that larger companies like Google, Meta, and Amazon might also be fishing in, making finding and hiring the best candidates challenging. For instance, there is a talent shortage for AI developers and engineers. AppLovin needs to hire enough qualified people with AI expertise, or it may eventually be unable to compete effectively.

Next, AppLovin’s business fortunes depend highly on access to the two most dominant mobile platforms: Android and iOS. Changes to the Apple App Store or the Google Play Store’s policies and practices, including policies surrounding Apple’s Identifier for Advertisers (“IDFA”), could restrict AppLovin’s access to those platforms, making it harder to advertise or distribute products — a significant risk. Additionally, governmental agencies have a say about what happens on Android and iOS and could create regulations that aid or hurt AppLovin. It would be in investors’ best interests to pay attention to this risk.

Lastly, this company is in the early stages. AppLovin grew annual FCF 168% year-over-year with 32% FCF margins in 2023. Additionally, it has impressive EBITDA margins. Existing competitors and potential adversaries have likely noticed the company’s performance. The company’s robust margins and FCF growth over the last year could attract even more competition to the space. In my opinion, the company doesn’t have much of a moat, and it is uncertain if its advanced AI can provide a differentiating factor in helping it maintain market share.

Valuation

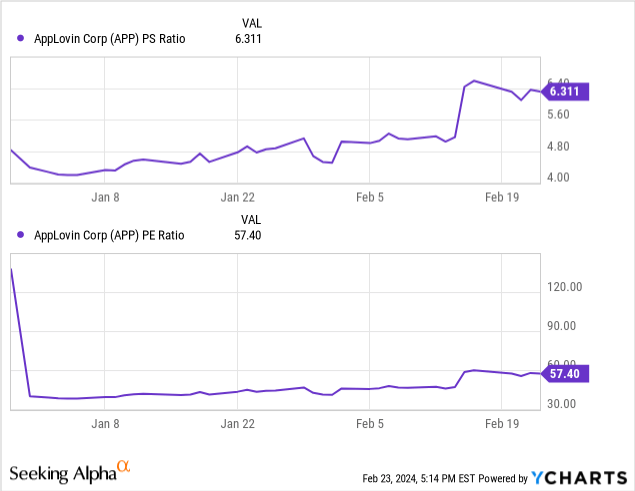

By traditional price-to-sales (P/S) and price-to-earnings (P/E) ratios, the market looks like it overvalues AppLovin’s stock. The stock trades at a P/S ratio of 6.31 versus a sector median P/S ratio of 2.93 and a P/E ratio of 57.40 versus a sector median P/E ratio of 29.18. The market may overvalue the company’s sales and earnings-per-share (“EPS”) over the trailing 12 months.

However, the above valuation metrics are backwards-looking. Let’s look at several forward-looking valuation metrics. The stock trades at a forward P/E ratio of 23.67, below the sector median forward P/E ratio of 27.70. Suppose the stock were to sell at its sector median P/E ratio; the implied stock price would be $67, around 17% upside. The average analyst price target for AppLovin shares is $62.38, with only an 8.7% upside, according to Seeking Alpha. Therefore, you could make the case that the market undervalues the stock by anywhere from 9% to 17% as of the closing stock price on February 24, 2024. According to Yahoo Finance, its 5-year forward price-to-earnings-to-Growth (PEG) Ratio is 0.76 — a sign that the market potentially undervalues AppLovin’s expected EPS growth over the next five years. Also, investors have traditionally considered PEG valuations under 1.0 a sign of an undervalued stock.

Let’s look at AppLovin’s reverse DCF to determine what FCF growth rate the current stock price assumes.

Reverse DCF

|

The third quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$1037 |

| Terminal growth rate | 2% |

| Discount Rate | 11.5% |

| Years 1 – 10 growth rate | 10% |

| Current Stock Price (February 23, 2024, closing price) | $57.39 |

| Terminal FCF value | $2.744 billion |

| Discounted Terminal Value | $9.724 billion |

Usually, I give most stocks a discount rate of ten. However, because of the company’s high D/E ratio, debt could become an issue if growth stalls for any reason (poor execution, competition, macro economy). The company currently engages in stock buybacks, and management may be wiser to spend that FCF paying down debt or investing in Research and Development at this stage of the company’s growth. Therefore, I give this stock a discount rate of 11.5% to reflect some debt risk. With the above figures, AppLovin would only have to grow FCF by 10% over the next ten years. An FCF growth rate of 10% over the next ten years could be more than achievable if you believe the company is an emerging FCF machine. The market may be undervaluing AppLovin’s potential FCF growth over the next ten years in my opinion.

Why AppLovin is a buy

Although AppLovin might not have a clear cut moat today, its diversified product portfolio, global reach, growing scale, and focus on innovation make it a formidable company that competitors may find challenging to take share from or dent its margins.

This stock is a high-risk, high-reward investment. You may want to avoid the stock if you are a risk-averse investor. However, if you are an investor willing to accept some risk for a chance to achieve a potentially high upside, consider an investment in AppLovin. I rate the stock a buy for aggressive growth investors.

Read the full article here