Armada Hoffler Properties, Inc. (NYSE:AHH) is a relatively small-cap real estate investment trust, or REIT, with a market cap of just below $1 billion. AHH is classified as a diversified REIT due to its exposure to several property types such as office, retail, and residential. While having a mix of different real estate segments in a portfolio is not that uncommon, what is quite unique about AHH is that it is a vertically integrated enterprise providing also general construction and development services to third-party clients.

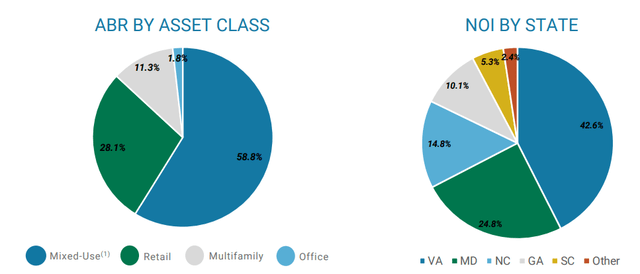

The underlying portfolio breakdown indicates a rather notable bias towards office properties, as almost 59% of the total ABR is generated by this specific segment. The second-largest segment explaining 28% of AHH’s ABR is retail and only 11% stems from the inherently defensive multifamily segment.

AHH Investor Presentation

If we look at how AHH has performed over the past 5-year period, we will notice a clear divergence from the overall REIT market. We can see that really starting from the outbreak of the pandemic back in early 2020 AHH has plunged deeper than the rest of the REIT space and still has failed to recover the losses in market cap level.

Ycharts

Part of this is certainly justified given the significant presence of office properties in AHH’s portfolio that is not only experiencing headwinds from the higher interest rates, but also from the work from home dynamics. For example, in 2020 AHH was forced to cut its dividend by almost a half to protect its liquidity profile.

With that being said, AHH currently trades at a P/FFO (funds from operations) of 9x and offers a dividend yield of 7.4%. The question is whether this is an attractive entry point for investors to capture value (and yield) without assuming too much of a risk.

Let me now explain why I think that it makes sense to consider adding AHH to a portfolio.

Thesis

Besides the clearly enticing entry point from the valuation and dividend yield perspective, there are three distinct aspects, which, in my opinion, render the overall case a buy.

The first one is the underlying structure of the AHH-owned properties. Most of the properties are mixed-use, which means that the demand drivers for space are not limited by a single factor. Instead, there is inherently a greater demand for such properties, where tenants can access different services via through a single location (e.g., combining office with residential).

Currently, AHH has one-third of its retail exposure in mixed-use communities. For multifamily and office stock, the mixed-use component is more pronounced, accounting for circa 60% and 95% of the total ABR, respectively.

Here it is important to underscore the office segment, which is almost entirely located in mixed-use communities, thereby reducing the demand risk of the properties becoming obsolete. Plus, all of AHH’s offices are classified as trophy-like, which introduces an additional layer of safety. This is what we can also infer from the ~94% occupancy ratio and double-digit leasing spreads.

The second aspect, which, in my opinion, renders the case attractive, is AHH’s cash generation profile. Over the TTM period, AHH has not experienced a negative decline in the AFFO (adjusted FFO), and instead it has managed to register a positive growth despite the pressures stemming from the higher interest rate environment.

During this period, AHH has even directed some of its retained AFFO to share buybacks, which have certainly been accretive given the depressed P/FFO multiple. On top of this, none of the AHH’s property segments have experienced a drop in same-store NOI with the office and retail remaining flat, but multifamily ticking higher by ~2.5% (Q1, 2024 vs. Q1, 2023).

Moreover, the cash flows are further strengthened by the solid lease maturity profile, where the weighted average lease term remaining is circa 6.7 years. This gives the necessary stability in the business and decreases the concentration risk of an excessive amount of space coming due in a single year.

Finally, it is critical to underscore the fact that each quarter AHH retains roughly 23% of its AFFO in the books, which enables the Management to optimize slowly but surely optimize the capital structure.

The third aspect is related to the balance sheet, which from the surface seems to be one of the key drivers (with the focus on office properties) for the depressed multiple. For example, the current net debt to EBITDAre of AHH stands at 7.4x, which could be indeed deemed as a relatively risky level. The typical sweet spot for REITs is somewhere between 4x and 5x in net debt to EBITDAre. The more defensive the business is, the more leverage could be assumed without damaging the overall credit risk profile.

While this is indeed a concern, here are three things, which de-risk the situation:

- As stated above, AHH can retain about one-fourth of its quarterly AFFO that could be used as fuel for paying down the outstanding debt in a more accelerated fashion.

- The portfolio weighted average interest rate is 4.4%, which is not that far away from the prevailing cost of financing level that BBB REITs (like AHH) can access. Given that 95% of the debt is fixed, it has and will continue to allow AHH to avoid the full convergence in its cost of financing towards the current market level.

- AHH has structured its debt maturities favorably, whereas most of the fixed rate financing has back-end loaded maturity dates. As we can see in the chart below, in 2024 and 2025 there will be a minimal amount of debt that AHH will have to roll over, especially considering that part of this will be organically repaid through the undistributed AFFO.

AHH Investor Presentation

The bottom line

All in all, AHH is a solid pick for income-seeking investors, who aim to pocket price returns on top of capturing attractive dividend streams.

There are two major reasons why AHH is trading at a P/FFO multiple of 9x – (1) notable concentration of ABR generation in office properties and (2) elevated debt levels. Both of these risks are, in my view, nicely mitigated.

When it comes to the office issue, if we go into the details, we will realize that AHH owns properties that are protected from the negative work from home dynamics. The mixed-use angle coupled with trophy-like properties de-risk the situation significantly. We can see this in double-digit leasing spreads and strong occupancy levels.

The balance sheet risk is also managed. While the debt is indeed high, the distant debt maturity dates, fixed rate financings, and conservative AFFO payout allow AHH to gradually bring down the debt level to the optimum without experiencing notable refinancing risk in the process.

Theoretically, one might argue that the higher for longer scenario and AHH’s relatively elevated debt level could create just too huge a risk for going long. In my view, even if interest rates stay where they are now, Armada Hoffler Properties, Inc. would still perform well and avoid a dividend cut. This is due to growing same-store figures and ample room in undistributed AFFO that could in such case cover the increased interest costs.

As a result of this, I am assigning a buy rating for Armada Hoffler Properties.

Read the full article here