Winter 2024 Market Commentary

A strong economy, corporate earnings growth, a booming technology industry and easing monetary policy led the major stock market benchmarks to a second year of double-digit growth. The S&P 500 (SP500, SPX) returned 25.02%. It has a trailing 12-month price-to-earnings ratio of 29.0 vs the five-year average of 24.2 and 10-year average of 22.1. The equal weight S&P (SP500EW) gained 13% for the year. FactSet estimates that S&P 500 earnings in the fourth quarter will grow 11.9%, which would be the best quarter since Q4 2021. For 2025 they are projecting 14.8% growth. Strong earnings have been supported by stock buybacks which reached nearly $1 trillion in 2024 and are anticipated to be $1.5 trillion in 2025 according to Goldman Sachs (GS). The dearth of Initial Public Offerings and increasing foreign investment flows have extended the favorable supply/demand dynamic for US stocks in general. Credit spreads between the highest and lowest risk bonds continue to be historically tight. The 20-year Treasury (US20Y) declined 9.55% for the quarter and 7.71% for the year (ICE US Treasury 20+ Year Index). This compares to the short-term Treasury bill gain of 5.32% for the year with little risk (S&P US Treasury Bill 0-3 Month Index).

US stocks in the fourth quarter rallied immediately after the Republicans took back the presidency and both chambers of Congress. Investors are encouraged by the pro-growth, pro-tech shift in policy focusing on deregulation, cutting waste in government spending, reducing taxes, lowering energy prices and reshoring. This is attracting massive foreign investment while unleashing animal spirits in the markets. However, by year end uncertainty over interest rates, tariffs, trade wars and increasing bond supplies necessary to feed growing structural deficits led to a sharp correction for most stocks.

The new administration’s Department of Government Efficiency (DOGE) led by Elon Musk is making significant inroads in ferreting out government waste to the tune of $4 billion a day. Companies like Palantir Technologies (PLTR) are utilizing AI to make government more efficient. Last year Argentina under the libertarian leadership of Javier Gerardo Milei had the best performing stock market in the world, up over 160%. He is gradually dismantling the stranglehold of socialism. Conversely, Brazil which is heading in the opposite direction espousing statism suffered a 20% currency decline and a 28% decline in their market.

Commercial Real Estate

Office vacancies continue to be an issue for corporate real estate even as the prevalence of remote work declines. According to Moody’s (MCO), the office vacancy rate is 20.1% in the US which is a 30-year high. Earlier in 2024 Portland, Oregon was reported to have an office vacancy rate of around 30%, the highest in the country. Recently Ameriprise Financial’s (AMP) Minneapolis office was sold to a private firm for just $6.25 million. The building last traded for $200 million in 2016. High vacancies and lower property values lead to lower tax revenue, ultimately making these cities less desirable places to live.

AI Boom Driving Excitement and Interest in Risky Alternative Investments

Technology and communication were once again the best performing sectors for the year as AI excitement reached new highs. The “Magnificent Seven” which includes Alphabet (GOOG,GOOGL) , Amazon (AMZN), Apple (AAPL), META, Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA), drove about half of the S&P 500’s gain in 2024 according to S&P Global. Nasdaq expects these seven companies to report earnings growth of 33% for 2024 compared to 4% growth for the remaining S&P 500 companies. With markets being so strong on the back of record tech sector investment speculators are becoming more confident in riskier alternative investments like zero-day options–ultra short-term derivatives that expire on the same day they are traded–that appeal to investors who are increasingly searching for ways to make quick returns. According to Cboe Global Markets data, zero-day options became the most popular option strategy as they accounted for 51% of the overall S&P 500 index options volume during the fourth quarter. Volume for these options has tripled since the same period in 2021. The danger with strategies like these that promise quick and easy gains is that they can be incredibly volatile and their value can rapidly drop to zero. Other areas of speculation that are adding to the leverage in the market include double levered ETFs and synthetic derivatives. With the internet, group behavior is magnified more than ever and envy abounds. We have learned over decades that the “get rich quick” mentality can lead to permanent capital loss. We much prefer the slow and steady approach to compounding with a focus on enduring businesses that are supported by growing earnings and cash flow.

Strong Leadership Can Create Long-Term Shareholder Value

Finding businesses with a “heart and soul” takes a lot of time and research. We look for companies with passionate managers who put significant care into the products and services they provide. Founder CEOs are ideal. Probably the most relevant example today would be Nvidia CEO Jensen Huang. He co-founded Nvidia in 1993 alongside Chris Malachowsky and Curtis Priem and has served as CEO since the company’s inception. We like the focus and vision that a founder can bring to a company over a long period of time. Nvidia went from trading at $0.04 per share 26 years ago to being the second most valuable company in the world today. Another long-running founder is Mark Zuckerberg at Meta. Over the last several years Zuckerberg has led Meta from being a declining social media business to one of the largest AI companies in the world. Other notable companies currently led by their founders include DELL, Palantir, Berkshire Hathaway (BRK.A, BRK.B) and Salesforce (CRM). We like leaders who love the business, have “skin in the game,” grit and a tenacious attention to detail.

Property and Casualty Insurance

The insurance market was mixed during the fourth quarter and the full year with some sectors seeing positive rate movement while others slowed. According to Market Scout composite personal lines rates increased by 4% during the quarter and 5.79% for the full year. This was the highest annual rate increase in 12 years. Rate growth continues to be supported by rising natural disaster losses which reached $310 billion globally in 2024 up from $268 billion in 2023, according to Munich Re. Of these losses, $140 billion were insured making 2024 the third highest year for insured losses and higher than the inflation-adjusted averages of the past 10 and 30 years. Looking forward, January 1 reinsurance renewals saw global property catastrophe reinsurance rates fall by 8% according to insurance broker Howden. Rate declines came as dedicated reinsurance capital ended the year at a record high of $463 billion thanks to the growth of catastrophe bonds. The higher supply of dedicated capital has led to more competitive pricing which is pressuring rates at renewal. Despite the drop in reinsurance rates going into 2025 overall insurance rates are expected to increase in 2025 due to recent weather events. The severe fires in southern California which started after rates declined will likely lead to hikes down the line from firms who see the highest losses. These fires could lead to the largest wildfire insured loss in US history with catastrophe modeling company Karen Clark & Co estimating that insured losses could reach $28 billion. These fires throw more uncertainty over the industry going into 2025 as some areas could see better pricing while others may see pricing decline. We have exposure to Berkshire Hathaway, Travelers (TRV), Arch Capital (ACGL), Marsh McLennan (MMC) and Aon (AON).

Contributors

Financials were the biggest contributors to the Fund during the quarter, which included Ameriprise Financial, Bank of America (BAC), Bank of New York Mellon (BK), Citigroup (C), Travelers and Unum (UNM). Investors are expecting that a Trump presidency could lead to more rational regulations in the sector. Banks benefited from strength in equity markets, a positive sloping yield curve and increasing trading revenue. The major banks recorded the highest fourth quarter trading revenue in five years. Insurance companies have also had a positive quarter as they have been benefiting from strong pricing and growing coverage. Global travel trends continue to be strong, especially with the sharp increase in the US dollar. TSA screened 904 million passengers in 2024, up 17% since 2022. Mastercard’s (MA) cross-border transactions recently were up 20%. Visa (V), American Express (AXP) and Booking (BKNG) continue to enjoy improving fundamentals.

The technology sector was once again a positive component in the Fund thanks to the performance of companies like Alphabet, Corning (GLW), Microsoft and Meta Platforms. The growth of cloud computing, digital advertising and now Artificial Intelligence are driving gains. The popularity of AI has contributed to Alphabet’s cloud business which has grown over 30% the last 12 months. Meta is also utilizing AI to enhance their targeted advertising business. We are concerned by the large capital investment in AI by the leading tech firms and government. Wedbush is projecting $2 trillion over the next three years. Large language models are already becoming commoditized with open models like Meta’s Llama and DeepSeek. Recently Alibaba (BABA) has introduced Qwen 2.5-Max which outperforms the highly acclaimed DeepSeek -V3 (DEEPSEEK), currently number one on the Apple App Store.

We also continue to favor businesses that are in repair and replacement. Gates (GTES) is a leader in hydraulic hoses which have a high turnover. FirstService (FSV), a very boring Canadian property maintenance company has returned over 9,200% since we purchased in 2003.

Detractors

The weakest performing sector in the Fund for the fourth quarter was healthcare. There are many very high-quality businesses that sport attractive free cash flows selling at significant discounts to the market. Some fear that if Affordable Care Act programs are targeted or reduced that healthcare companies could see a decline in customers. Health insurers like UnitedHealth (UNH) and Elevance (ELV) were hit hard, however their massive bond portfolios help to mitigate risk and stabilize earnings. UnitedHealth’s portfolio is $35 billion while Elevance’s is $21.37 billion. They are also not subject to Chinese competition, tariffs and trade wars. Higher medical utilization rates have been leading to higher medical loss ratios for all the health insurers while reimbursement rates have not kept up. We see recent positive renewal rates as helping to correct the mismatch.

Beverage and food companies underperformed. Fears over GLP-1 obesity drugs and Robert F Kennedy’s stance on processed food together with soaring cocoa and coffee prices have left these enduring franchises hopelessly out of favor. However, today with over $100 trillion in global debt these businesses have survived some of the worst recessions and depressions in US history. Dr. Pepper (KDP) was founded in 1885, Pepsico (PEP) in 1898 and Hershey (HSY) in 1894. Monster Beverage (MNST) purchased at the height of the dot-com bubble in 2000 returned over 70,000% the next twenty years. Investing is the craft of the specific. It is so important to focus on cash flow, earnings and execution.

Fourth Quarter 2024 Performance Update

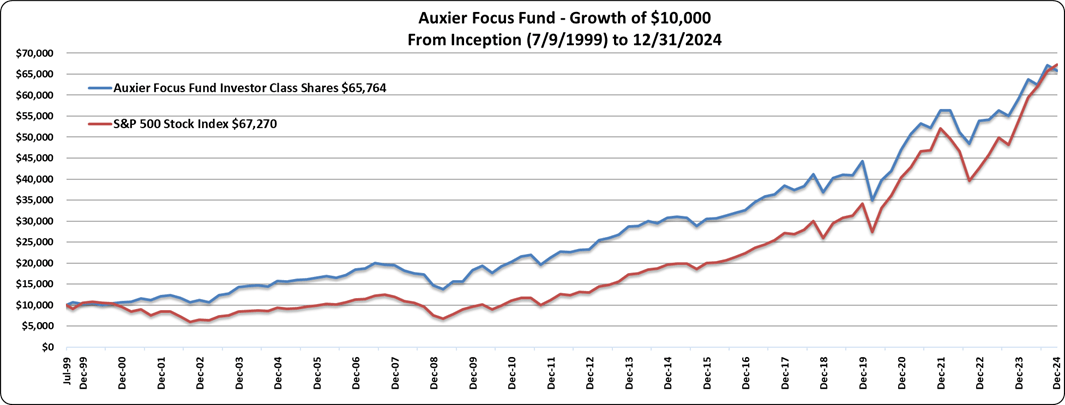

Auxier Focus Fund’s Investor Class declined 2.06% in the fourth quarter 2024. The S&P 500 cap-weighted index returned 2.41% for the fourth quarter, while the equal weight fell 1.87%. The Russell 1000 Value lost 1.98%. For the full year the stocks in the Fund returned 13.09% while the Fund gained 11.32%. Fixed income investments as measured by the S&P US Aggregate Bond Index dropped 2.61% while the longer dated ICE US Treasury 20+ Year Index declined 9.55%. Stocks in the Fund comprised 95.5% of the portfolio. The breakdown was 86.9% domestic and 8.6% foreign, with 4.5% in cash and short-term debt instruments. A hypothetical $10,000 investment in the Fund since inception on July 9, 1999 to December 31, 2024 is now worth $65,764 vs $67,270 for the S&P 500 and $55,385 for the Russell 1000 Value Index. The equities in the Fund (entire portfolio, not share class specific) have had a gross cumulative return of 1,046.27%. The Fund had an average exposure to the market of 82.6% over the entire period. Our results are unleveraged.

In Closing

Looking forward we are encouraged by the new administration’s pro-growth policies. Heavy handed regulation stifles small businesses which are the engine of the economy. We recently attended CES, the most powerful tech event in the world, and visited a number of businesses utilizing Artificial Intelligence. The potential for inference to make most companies more efficient is incredible. Open AI models like DeepSeek and Meta’s Llama are helping to drop the cost for edge software applications dramatically which should accelerate adoption for all businesses. Application layer AI companies can leverage more advanced open-source models to produce better analysis for enterprise clients.

Now more than ever it is so important to know what you own. We continue to increase the research effort to help improve investment odds, mitigate risk and avoid permanent capital loss. When we started the Fund in July of 1999 there were funds that were up 100% or more in a year that failed three years later. The 1999-2002 tech telecom euphoria led to a dramatic overinvestment in dot.com stocks and telecom infrastructure, and ultimately a dramatic 72% drop in the Nasdaq. Due to our broad and cumulative research effort we achieved a positive return over that same three-year period. The tendency during investment booms is to concentrate one’s assets in the biggest winners. That concentration can be extremely costly when fundamentals break down. To enjoy the long-term fruits of compounding you need to have durable businesses with capable management, and a stomach that can deal with the inherent volatility and sharp drawdowns of individual stocks. Barron’s recently wrote, “Innovation and the rule of law are the essence of America.” Both are positively reinforced with the recent change in government leadership.

We appreciate your trust.

Jeff Auxier

|

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by calling (877) 328-9437 or visiting the Fund’s website. Please read the prospectus carefully before you invest. Fund returns (i) assume the reinvestment of all dividends and capital gain distributions and (ii) would have been lower during the period if certain fees and expenses had not been waived. Performance shown is for the Fund’s Investor Class shares; returns for other share classes will vary. Performance for Investor Class shares for periods prior to December 10, 2004 reflects performance of the applicable share class of Auxier Focus Fund, a series of Unified Series Trust (the “Predecessor Fund”). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds. The performance of the Fund’s Investor Class shares for the period prior to December 10, 2004 reflects the expenses of the Predecessor Fund. The Fund may invest in value and/or growth stocks. Investments in value stocks are subject to risk that their intrinsic value may never be realized and investments in growth stocks may be susceptible to rapid price swings, especially during periods of economic uncertainty. In addition, the Fund may invest in mid-sized companies which generally carry greater risk than is customarily associated with larger companies. Moreover, if the Fund’s portfolio is overweighted in a sector, any negative development affecting that sector will have a greater impact on the Fund than a fund that is not overweighted in that sector. An increase in interest rates typically causes a fall in the value of a debt security (Fixed-Income Securities Risk) with corresponding changes to the Fund’s value. Earnings growth is not a measure of future performance. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS). Foreside Fund Services, LLC, distributor. The S&P 500 Index (also known as the S&P 500 Cap-Weighted Index) is a broad-based, unmanaged measurement of changes in stock market conditions based on 500 market-capitalization-weighted widely held common stocks. The Russell 1000 Value Index refers to a composite of large and mid-cap companies located in the United States that also exhibit a value probability. The Russell 1000 Value is published and maintained by FTSE Russell. The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance. S&P US Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. The S&P U.S. Treasury Bill 0-3 Month Index is designed to measure the performance of U.S. Treasury bills maturing in 0 to 3 months. ICE US Treasury 20+ Year Index (4PM), is a 4pm pricing variant of the ICE US Treasury 20+ Year Index, which is market value weighted and is designed to measure the performance of U.S. dollar-denominated, fixed rate securities with minimum term to maturity greater than twenty years. S&P US Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange One cannot invest directly in an index or average. As of 12/31/2024, the Fund’s top equity holdings were: Microsoft Corp. (6.2%); Mastercard Inc. (5.8%); UnitedHealth Group Inc. (5.0%); Kroger Co. (4.2%); Philip Morris International (3.8%); Bank of New York Mellon Corp (3.8%); Visa, Inc. (3.3%); Bank of America Corp (3.1%); Alphabet, Inc Voting Class (2.7%); Berkshire Hathaway Inc. Class B (2.7%). The views in this shareholder letter were those of the Fund Manager as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here