Baytex Energy (NYSE:BTE) posted a slight loss for the first quarter due to some non-cash issues. However, cash flow grew at a healthy pace. While an investor might have expected a better earnings response from an Eagle Ford acquisition, it’s clear that management has set out to improve the situation. In listening to the conference call this morning, goals were set, and operational improvements are an important agenda item. In the meantime, it’s not that unusual for a fair number of one-time acquisition items to obscure the benefits of an acquisition for about a year or so. The benefits of the latest acquisition should become more apparent as the fiscal year unfolds.

As was noted in the last article, the large cash flow increase bodes well for debt repayment and potentially larger dividends. Any operational improvements will only make this scenario even better, and management discussed both these in the corporate presentation, the earnings release, and the conference call. Therefore, the strong buy is still in place. But sometimes the actual execution of the plan involves some patience for all the benefits to unfold.

Note: Before we go any further, it needs to be stated that Baytex Energy is a Canadian upstream company that reports in Canadian Dollars.

Note: The earnings call transcript will likely be posted on the Seeking Alpha website today, May 10, 2024, at some point.

First Quarter Progress

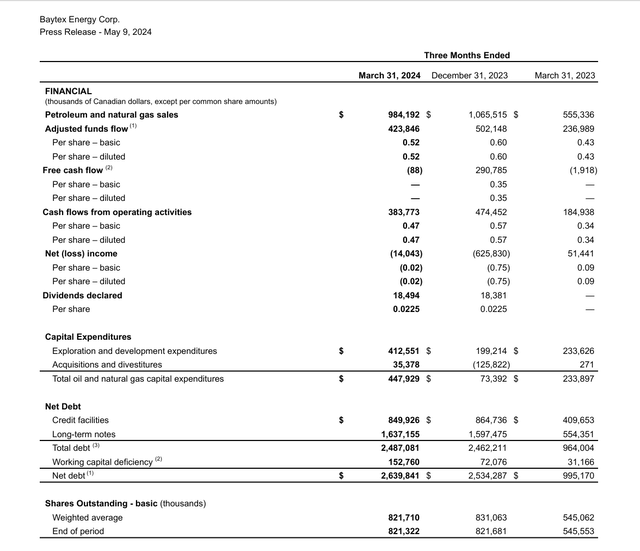

Cash flow per share as shown in the below summary advanced nicely due to the acquisition. Even though the acquisition used some debt to be able to show that progress, the additional debt appears to be easily covered by the additional cash flow.

Baytex Energy First Quarter 2024, Financial Summary (Baytex Energy First Quarter 2024 Earnings Press Release)

If the first quarter (either GAAP number or adjusted number) funds flow is annualized, then the common stock is selling for roughly two times funds flow. That’s a valuation that’s supposed to indicate distress. But the adjusted funds flow annualized is about equal to the long-term debt shown.

There was shareholder concern about the negative free cash flow in the first quarter (as there seems to be with Canadian companies every time this happens). Management replied that to maintain optionality with the budget, the first quarter tends to be “front-end loaded” as far as the budget goes.

This is very typical because Canadian companies have a very unpredictable Spring-Breakup where operations continue at very low levels until things dry out. The time period for this process would, of course, vary widely, as one would expect with the weather.

Therefore, in order to meet annual goals, the first quarter of the fiscal year often has a disproportionate amount of the capital budget spending. That will likely be made up in the second and potentially the third quarter. Therefore, annual guidance is still intact. Needless to say, Spring Breakup will not affect the Eagle Ford operations.

Heavy Oil Assumptions

One of the bigger risks with a company that has heavy oil production is that the multi-year guidance (and really any guidance) generally assumes a discount to WTI pricing for that heavy oil. That relationship has been known to change unpredictably to cause some wildly varying outcomes if it persists.

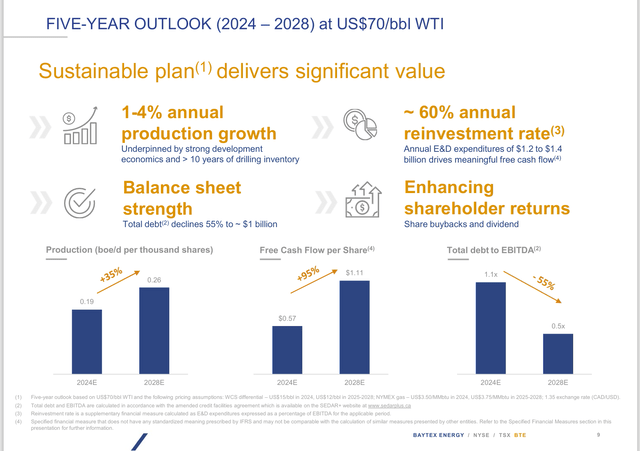

Baytex Energy Long-Term Guidance (Baytex Energy Corporate Presentation May 2024)

Management clearly has reasonable goals. But in addition to the usual warning about the low visibility and volatility of commodity prices, there’s that heavy oil discount that can change. During times of commodity price weakness, that discount regularly widens to cause some material guidance adjustments until there’s a pricing recovery.

Discounted products often cause far more earnings volatility for an upstream company than is the case for light oil producers. Hence, the Eagle Ford production is often very necessary for cash flow during business cycle downturns.

One of the things that management mentioned during the conference call is that with the additional light oil production from the Eagle Ford, the company can handle more heavy oil production.

Basin Profitability

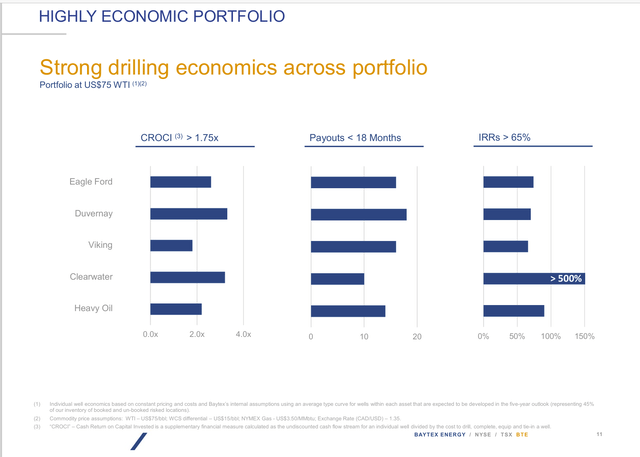

The above consideration is extremely important because the heavy oil Clearwater play is very profitable as shown below:

Baytex Energy Profitability And Payback Periods By Basin (Baytex Energy Corporate Presentation May 2024)

Clearly, the Clearwater Play is easily the most profitable place to drill in the portfolio. If there was not the worry of the heavy oil discount expanding, then all of the capital budget would likely head to Clearwater, as nothing else is close to as profitable as that play. But since any heavy oil play can have negative cash flow during times of weak commodity prices, there are limits upon how much heavy oil production the company can manage with the current debt load.

That means that the priority has to be to have an acceptable level of light oil production so that there is adequate cash flow throughout the business cycle which enables the company to enjoy the Clearwater returns when heavy oil is profitable.

What Changed

The acquisition of Ranger Oil means that the company is now a primarily light oil producer, with most of its operations in the United States. This company began has a heavy oil Canadian producer. The potential for a stock price revaluation as a light oil primarily United States producer listed on the NYSE is significant because Canadian companies traditionally trade at a discount to United States companies and heavy oil producers trade at a discount to light oil producers.

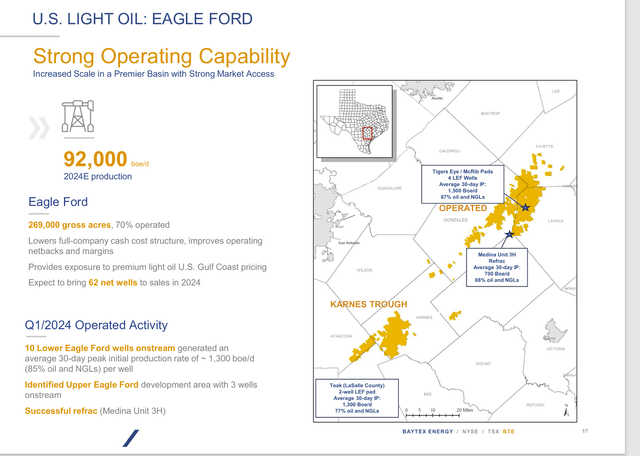

Baytex Energy Total Eagle Ford Production With Details On Operated Eagle Ford Acreage (Baytex Energy Corporate Presentation May 2024)

The other major consideration is that Baytex Energy was a partner in Eagle Ford acreage before the acquisition of Ranger Oil. Long-time readers know that the acreage was operated by Marathon (MRO). Marathon has long been seen as one of the best operators in the business.

Since Baytex is in partnership with Marathon, they have access to those excellent operator practices that they can use as needed elsewhere. It’s a huge advantage over many others that buy into an operating presence in a basin and then have to learn about the basin.

The last consideration is that when the primary profit center is not controlled as was the case with the Eagle Ford before the Ranger Oil acquisition, then the market often discounts the value of the company (in this case for the heavy oil production and the non-operated light oil productions).

But now, Baytex Energy has substantial operated Eagle Ford production which is usually worth far more in the eyes of Mr. Market and that may lead to a re-evaluation as to the value of the non-operated Eagle Ford properties as well because now a majority of the Eagle Ford production is under the company control. So now Baytex Energy is an Eagle Ford operator with some non-operated properties.

Summary

Management has long mentioned that the debt goal should be to have a roughly 1.0 debt ratio when WTI is $40. Right now, management is stating that the goal would be met if the current debt ratio is 0.7 when WTI $70 is the price. Time will tell if the market agrees when the company gets there or if the company needs to get the debt ratio still lower.

However, the current debt ratio is in an acceptable range for the market as long as significant progress in repaying the debt is made. The first quarter report posed some anxiety about this because the company used all the cash flow for budgeted activities. Then again, that is not that unusual for Canadian companies.

What also needs to be considered is that the company has not yet controlled the Ranger Oil assets for a year. The income and cash flow statements will be clouded with non-repeating deferred maintenance and one-time assimilation costs.

Based upon the increasing cash flow numbers in the first quarter, the company acquisition appears to be on track with everything management hoped to achieve with the acquisition. Therefore, the strong buy still holds, as this stock could trade a lot higher once debt levels come down and regular financial results without acquisition costs resumes.

Value

Management is basically attempting to make this a primarily US producer with an NYSE listing. That should, over time, result in a better valuation. The market may demand a post-acquisition track record first, though.

With the company stock trading at roughly two times cash flow (when accounting for the relationship of the Canadian and United States dollars), a revaluation to six times cash flow over time should be expected (even though this is unlikely to happen overnight). That implies about a triple to the stock price over the next 5 years. A value of six times cash flow is likewise conservative.

Risks

Heavy oil profitability is far more volatile than light oil profitability. The discount to light oil can expand with little or no notice. This place limits on the amount of debt a producer like this one can safety finance.

Commodity prices have little or no visibility and are very volatile. A sustained period of weak commodity prices could materially change the outlook of this company.

The loss of key personnel, particularly in the US operations (which are far away from where this company began operations) could be crippling.

This management is using information gained by the Eagle Ford operations to try to bring costs for the Duvernay wells to a competitive level. There can be no assurance that this effort will succeed.

Read the full article here