Candel Therapeutics, Inc. (NASDAQ:CADL) is a clinical-stage biopharmaceutical company developing biological immunotherapies for several types of cancer. CADL’s treatments combine anti-tumor elements with immune-stimulatory components, improving the immune system’s targeting of malignant cells. CADL uses proprietary technology to target and destroy cancer cells while stimulating an immune response. The company’s enLIGHTEN Discovery platform leverages herpes simplex viruses [HSV] to create new multimodal immunotherapy candidates for solid tumors rapidly. This means CADL also integrates artificial intelligence-driven cytotoxic components with programmable vectors. Its pipeline comprises CAN-2409 and CAN-3110, yielding promising trial results to date. Unfortunately, valuation and financial constraints supersede my optimism regarding CADL’s IP, so I rate it a “sell” until it raises additional funds.

Oncology Focus: Business Overview

Candel Therapeutics is a clinical-stage biopharmaceutical company headquartered in Needham, Massachusetts. CADL was originally known as Advantagene, Inc. but rebranded to its current name in 2020. The company focuses on biological immunotherapies that leverage anti-tumor and immune-stimulatory elements. The underlying principle rests on “teaching” the body’s immune system to identify and eliminate malignant cells.

Source: Corporate Presentation. June 2024.

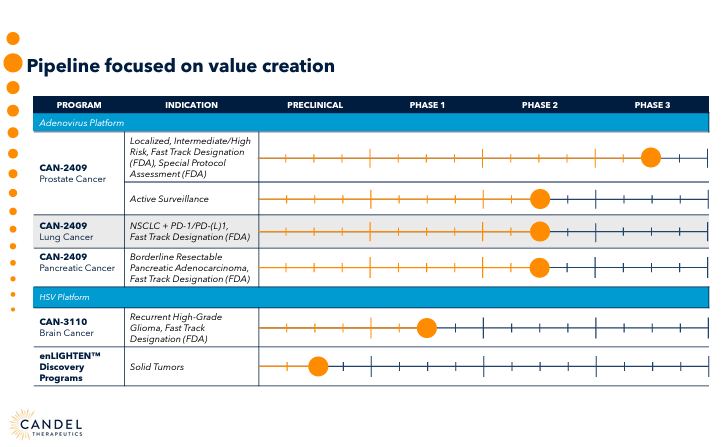

The company’s proprietary platforms serve several specific purposes. First, its adenovirus platform uses engineered adenoviruses designed to target and destroy cancer cells while stimulating an immune response. Second, there is a herpes simplex virus [HSV] platform that uses modified herpes simplex viruses to generate oncolytic viruses to attack cancer cells selectively and simultaneously trigger an immune response against the tumor. Finally, CADL has a complementary platform called enLIGHTEN Discovery, an HSV-based system that produces new viral immunotherapies for solid tumors.

Leading Drug Candidate: CAN-2409

However, it’s important to highlight CADL’s leading drug candidate: CAN-2409. CADL’s pipeline under its Adenovirus platform includes CAN-2409 in various clinical trials for multiple cancers. It is in phase 2 for non-small cell lung cancer [NSCLC], in phase 3 for prostate cancer, and in phase 2 for the active surveillance of this disease. It is also in phase 2 for pancreatic cancer.

Moreover, the FDA granted CADL a Fast Track Designation for the previously mentioned indications. Its prostate cancer indication is conducted with the FDA’s Special Protocol Assessment as well. The FDA has also issued the Orphan Drug designation for pancreatic cancer. This shows regulators favor CAN-2409, so I believe it’s easily the company’s main value driver.

For instance, CADL’s phase 2 trial results on CAN-2409 on borderline resectable pancreatic cancer demonstrated a median overall survival of 28.8 months compared to 12.5 months in the control group. This disease presents approximately 13,000 patients annually in the US and the EU.

Source: Corporate Presentation. June 2024.

Then, on May 23, 2024, the company also reported positive results for CAN-2409 for NSCLC. Here, the median overall survival was 20.6 months after two administrations of the drug plus valacyclovir, an antiviral medication used to treat herpes infections. This survival time is nearly double compared to the 11.6 months observed with standard-of-care [SoC] therapies in similar patient populations. The treatment activated the immune response with increased memory T cells and circulating cytotoxics.

Interestingly, CAN-2409 also shows a favorable safety profile. These results promise positive outcomes in NSCLC and other solid tumors. The results were encouraging even in patients with advanced disease despite receiving prior anti-PD-(L)1 treatment, suggesting this new therapy can overcome resistance by enhancing the immune response. It’s also a reasonably sized market if successfully developed and commercialized. For context, NSCLC’s patient population is approximately 74,000 annually in the US and the EU.

Innovative Advances in Cancer Therapy

Overall, CADL’s adenovirus and HSV platforms are the basis for its late-stage drug candidates. In contrast, the company’s IP relying on the enLIGHTEN discovery platform remains pre-clinical. For example, CADL’s HSV platform includes CAN-3110, a therapy for recurrent high-grade glioma [rHGG].

CAN-3110 is a phase 1 drug candidate granted FDA Fast Track and Orphan Drug designations. While still in the early stages, CAN-3110 complements its pipeline. In October 2023, CADL released phase 1 clinical data from its recurrent HGG CAN-3110 trials. The results showed a strong systemic anti-tumoral response and improved survival after one injection of the drug. Phase 1b is ongoing, and it plans to test multiple injections of CAN-3110 by 2H2024. So far, CAN-3110 seems well tolerated, and no dose-limiting toxicity has been reported. This suggests that a single shot was enough to achieve an expected median survival of 12 months compared to less than 6 to 9 months under the existing standard of care.

Source: Corporate Presentation. June 2024.

Unfortunately, CAN-3110 targets an aggressive brain malignancy with no cure. Still, its Fast Track Designation could expedite its progression along regulatory pathways and hopefully relieve this unmet medical need.

Beyond Drugs: enLIGHTEN Discovery

It’s worth mentioning that the company’s enLIGHTEN Discovery differs from the first two platforms because it does not focus on specific drugs. Instead, it’s designed to develop a pipeline of new multimodal immunotherapy candidates. These multimodal treatments use multiple mechanisms to boost the immune system’s effectiveness against cancer cells through specially engineered oncolytic viruses. This, in turn, uses immunomodulators to enhance immune responses, gene therapy, and vaccines using cancer-specific antigens.

Source: Corporate Presentation. June 2024.

For the enLIGHTEN Discovery Platform, immunotherapy candidates in the preclinical stage are indicated for solid tumors. These therapies promote the formation of Tertiary Lymphoid Structures [TLS] that are similar to lymph nodes and enable a microenvironment for immune cells to produce an effective response against tumor antigens, enhancing the body’s ability to destroy cancer tumors. This is why I think CADL’s development of these platforms seems to be paying off so far. It could offer a new cancer treatment paradigm similar to an “in-situ vaccination” for malignant tumors.

Then, on April 09, 2024, CADL reported preclinical data using its enLIGHTEN Discovery platform, which generated a second immunotherapy drug candidate. The presentation’s results validate enLIGHTEN Discovery for rapidly creating new drug candidates. Since enLIGHTEN Discovery integrates artificial intelligence-driven cytotoxic components with programmable vectors, it could theoretically allow CADL to quickly iterate through several cancer immunotherapies and fast-track regulatory approval for one of them.

Source: Corporate Presentation. June 2024.

CADL’s multifaceted approach to fighting cancer and the positive outcomes obtained offer hope for patients and establish the company as a leader in immunotherapy treatments against cancer. This is why I think CADL is well-positioned as a pioneer in a new paradigm of cancer therapies overall. But more importantly, it has a somewhat diverse IP portfolio, which mitigates risks for investors.

Expensive Short Runway: Valuation Analysis

From a valuation perspective, CADL has a market cap of $168.1 million, essentially a micro-cap biotech. Unfortunately, the company’s balance sheet only holds $25.7 million in cash and equivalents. Its financial debt is $19.8 million, mostly from bank loans. Moreover, I estimate the company’s latest quarterly cash burn was $8.4 million by adding its CFOs and Net CAPEX. This implies a yearly cash burn of $33.6 million, implying a concerning cash runway of just 0.8 years. My estimate aligns with the company’s expectation of having enough resources until Q4 2024. The problem is that it’s almost inevitable that CADL will have to tap into the capital markets again in the near term, likely issuing more equity and diluting current shareholders.

Source: Seeking Alpha.

This is unfortunate because I can’t ignore such glaring liquidity constraints. In my experience, these types of biotech companies typically would raise at least two or three years’ worth of cash burn. For simplicity, assuming CADL raises around $100.0 million through equity, it would translate into approximately a 37.3% stock dilution. Since I believe dilution is almost inevitable in the near term, I can’t give the company a favorable rating. In fact, I have to lean bearish on the shares until such a dilutive event occurs, which is why I rate CADL a “sell” despite its promising IP.

Lastly, it’s worth remembering that the company remains pre-revenues, and its book value is just $6.0 million, mostly due to its large accumulated losses. If we use this figure, CADL’s P/B ratio is self-evidently high at 28.0. For context, its sector’s median P/B is only 2.3, so the shares are undoubtedly expensive by comparison. Therefore, CADL’s valuation multiple, coupled with its short cash runway, further corroborates a “sell” rating.

Rating Caveats: Risk Analysis

Naturally, the risk to the upside in this scenario is that CADL’s market cap is relatively small. This makes it a feasible acquisition candidate for larger pharmaceutical companies looking to bolster their IP in the sector. If such a potential M&A announcement occurred, the shares would probably rise sharply in response.

Source: TradingView

In fact, acquisitions often carry a premium, so the upside would be considerable in this scenario. Nevertheless, as it stands, it’s impossible to be bullish on the company, in my opinion, while its financials suggest it will run out of cash by yearend. I remain confident CADL can raise additional funds through equity, so I discount bankruptcy risks. However, the resulting dilution will probably be meaningful, so I ultimately rate it a “sell.”

Unfortunate “Sell”: Conclusion

CADL has an exciting IP, but its short cash runway and stretched valuation are hard to ignore. While recognizing its potential, I think dilution risks are highly likely and will probably be meaningful for potential new investors. The company can be a viable investment after bolstering its balance sheet with an equity raise. Still, until then, I believe financial constraints will ultimately be the deciding investment factor. Hence, I rate the company a “sell” until it raises additional funds.

Read the full article here