Dear readers/followers,

In this article, I mean to follow up on Carl Zeiss Meditec, a company in the medtech field. It’s been about 3-4 months since my last update on the business, an article that you can find here. Since that article, the company has underperformed – but this does not really bother me, as you might expect. My thesis at the time was that the company would eventually overcome the margin-related headwinds and destocking issues in China that they had been facing. This has, unfortunately, not yet, been the case. The stock is down around 2.5% since my last piece.

The reason this does not bother me is that the company in question is an extremely solid business. Despite some near-term challenges related to margins and an unfavorable sales mix, I believe the long-term appeal for the business is more than just merely intact.

It’s time for an update on Carl Zeiss Meditec after a 1Q24/1H24. It’s not that the company has seen any major market movement. A small decline isn’t enough to formulate an entirely new thesis – but overall, the company here is still in a position to be bought, despite near-term challenges and forecast uncertainty. My update in this article has to do with analyzing the continued margin challenges and seeing if the company can still maintain, despite current challenges, a 15%+ annualized RoR even on what i would consider a conservative forecast. As of this article, and this thesis update, this is still possible.

Carl Zeiss as an investment once again shows us the importance of investing at the right valuation, and why, with my strategy, I seem to have a decent chance of outperforming the overall market if I focus on qualitative undervalued investments – at least over the long term.

Carl Zeiss Meditec after 1H24 – An upside is here, even if challenges exist

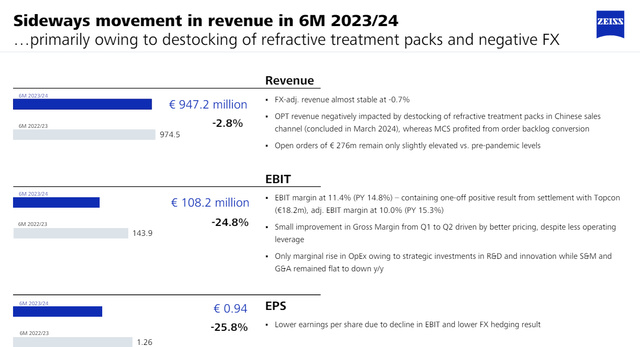

In the last article, I wrote about ongoing challenges in the Chinese sector, where destocking in Chinese distribution continues to characterize the overall company results. On the 8th of May, the company reported Half-year/6M results for 2023/2024, and those results were not that great.

I’m talking about a decline in the first half-year, as well as a non-trivial currency headwind, and a continued overall hesitation to do any sort of investment in the device business sector. This was particularly true for the NA market. We could expect to see continued growth for 2H if the company’s communication is to be believed here, especially also due to increasing measures of cost control, but the company is no longer as certain that the annual original guidance will be achieved at this particular time.

We expect to see our growth accelerate again in the second half of 2023/24 – thanks to the cost-control measures we have taken, we should also be able to achieve the necessary recovery in our operating result to reach our annual targets.

(Source: Carl Zeiss 1H24 report, Bolding/emphasis mine.)

The reasoning for my expectation being the wording here “should”, which to my thinking leaves plenty of possibilities open for outcome and interpretation.

Challenges for the company continue, both on the top line and on the margin level. In the company’s Ophthalmology strategic business unit or SBU, the company saw a significant 5.7% revenue decline – mostly due to China. Microsurgery grew by 6.3%, but this is a far smaller segment for the company.

From a geographic perspective, China continues to be the challenge or main problem. EMEA saw revenue growth of 17%, over 20% if we adjust for FX, but Americas declined by 20% and APAC declined by 3%, with most of that in China due to reductions in the stock for surgical consumables following the latest macro and national trends.

Margins, however, are the main thing here because these continue to decline. For the half-year, the company managed just over €100M in operating results, with a previous-year result of €150M, meaning we’re talking about a significant EBIT decline. Product mix continues to be the main culprit here, with a lower proportion of consumables once again owing to Chinese destocking in distribution. A strong implementation of an internal cost program showed much initial success, leading to sideways trends, but the trend is still very negative.

Carl Zeiss Meditech AG IR

By very negative, which is a strong word, I am talking about a 300+ bps EBIT margin reduction from 14.8% to 11.4%, including also a one-time non-recurring legal settlement.

Current forecast numbers for the company call for full-year revenue of upwards of €2,150M, with an additional €100M contribution from a recent M&A of D.O.R.C. BV, finalized in April. That means that any comparable numbers in revenue growth and forecasts in full-year EBIT results in an EBIT at the same level as last year being due to volume, not great margins.

However, the company has confirmed that the long-term target of a sustainable 20%+ EBIT margin is indeed where the company is going – just not yet or, as I see it, in the near term.

But what exactly was the problem, then? Why are results down despite such impressive top-line trends? Is it just the mix and destocking? For the most part, this does seem to be the case. There were a lot of COVID-19 inflated company trends and sales, which are now winding down and resulting in a very different sales mix.

Carl Zeiss Meditech AG IR

Also, the company continues to have heavy R&D spend, as any medtech and especially leading medtech companies need to have to keep pace. R&D spending for the company remains above 15% and is expected to continue to increase as well.

On the positive side though, we have continued expense control – which also includes hiring freezing, some R&D reprioritization, not cutting, and similar moves. The company has “quantified” its forward target, which now is as follows.

Carl Zeiss Meditec AG IR

We’ve seen a reversal of the commoditization of these typically premiumized stocks, although not to a massive degree. The company remains the leading name in both its segments, namely Ophthalmology and Microsurgery.

Carl Zeiss Meditech AG IR

The forward upside for the company continues to be based on very future-proof sort of concepts. What we are talking about here is an increasingly aging but at the same time affluent population, with an increasing volume of things like cataract surgeries, higher amounts of myopia, and a growing patient load that requires much more efficient workflows. There’s also increasing exposure and access to healthcare in emerging and new markets, which also acts as a tailwind for the company.

The company’s areas in the human body are related to the brain, the ear, the throat, the spine, the eyes, and the teeth. The company has an entire segment dedicated entirely to highly advanced eye care and surgery.

Carl Zeiss Meditech AG IR

Aside from that, in pretty much every market where the company is, it has either leading or close to the leading position, including the important area of microsurgery, where the company’s share of the market is over 60%.

So you can see why I would expect the company to actually do quite well here going forward, even if there are midterm and medium-term margin risks and growth headwinds.

Let’s see where this puts us in terms of valuation.

Carl Zeiss Meditech – The valuation is attractive here, and more attractive than during my last article

This company typically trades at a 40x P/E. I rarely believe that 40x P/E levels are justified, and I don’t believe that they are here. The company is incredibly qualitative – of that there is no question or doubt – but this does not mean that we should pay anything.

This is especially true because of one of the lowest dividend yields for an investment that I cover. We’re talking less than 1.2%, which when compared to any other investment I make, is a very small amount – and when compared to what you can get from a savings amount today, is very small indeed.

So how should Carl Zeiss Meditech be valued?

When considering the fact that we’re talking about a company with a long-term growth rate of 15% per year, the valuation can be argued to be justified at a higher level.

Based on a relatively high level of certainty overall, I would grant the company a forward P/E of at least 30x P/E for the long term, which currently implies a €130/share price target for 2026E, and a 15% annualized RoR – and that’s even with the near-term forecast and estimate cuts that we currently have, including the 12.31% negative drop forecasted for the 2024E fiscal.

F.A..S.T. Graphs Carl Zeiss AG Upside

So, as you can see, despite the company’s drop and the forecast implications of negative growth for this year here, the company is nonetheless fulfilling my criteria for investing here. My reasoning here is the addition from the latest merger moves, as well as the company’s overall long-term premium in the valuation, which is at this time at a high return potential next to the current relatively cheap (cheap being relative with premium businesses like these). I expect in the medium term, Carl Zeiss will be able to stabilize its EBIT margin at a rate of above 18% due to increasing amounts of recurring rather than one-off revenue items. For me, this has become a thesis with a potential return farther off, but due to fundamentals, still enough for an investment.

That is my reasoning here.

Ups and downs do exist for the business. Carl Zeiss Meditech has spent time where I would consider it at a very fair valuation (around 15x P/E), and the bout of high valuation is one that needs to be viewed with a lot of care – but I believe that a certain degree of premiumization remains justified for a company that has managed an average EPS growth of 13.8% for the past 20 years. Again, this growth is confirmed by the longer timeframe and is also one I would consider quite valid going forward. I continue to base my thesis on a double-digit forward growth rate. Even in the scenario that the company, over the longer timeframe, would decline perhaps to a 25-27x P/E, the company would still not result in giving you a negative RoR, if these forecasts are to be believed.

The clear risk I see here is the continued unfavorable mix and EBIT pressure. 1H24 did not see a “lightening” of the overall load here, and we have yet to see a sort of upside for the long term. As I believe it, we may see this during this year, and a continuation to significant growth and reversal during the next year at close to 30% EPS growth is expected here. (Paywalled F.A.S.T Graphs link).

The decline in 2024 has never been “not forecasted”. This was expected this year already, and last year it was also in the forecasts. Because this is nothing new, I view my thesis as largely unchanged, mostly keeping my price target for the company here, and reiterating “buy” here.

Here is my updated thesis for the company.

Thesis

- Carl Zeiss Meditec is an incredibly qualitative Medtech business originating out of Germany but with an international growth and sales profile. It does not offer a compelling yield, but what it does offer is a very compelling overall long-term upside. Even conservatively speaking, if you accept some of the premiumization here, you have triple-digit upside potential.

- However, this requires you, as mentioned, to accept one of the highest premiums I’ve ever seriously considered for this market. Provided it’s essentially a market leader in extremely specialized areas, this might make sense to you as well – but I would size your position with extreme care.

- Nonetheless, I added my voice to the chorus of “buy” with this company. A quality company has the right to cost quite a bit – and this is the highest I accept for a business like this. I say “buy“.

- My PT comes to a 28x-30x forward P/E, which puts the company at around €130/share long-term, an increase from my last price target (which was in turn lowered) – and this is the target that I maintain going into 2H2024E.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative and well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

It’s even possible for me here to call the company actually “Cheap” – and that is rare for this business.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here