The ClearBridge MLP and Midstream Fund Inc. (NYSE:CEM) is a closed-end fund, or CEF, that investors can use to gain exposure to energy infrastructure companies, including those structured as master limited partnerships, without the hassle of dealing with K-1 income tax forms. This is something that can be very advantageous to investors who wish to use their retirement accounts or similar tax-advantaged accounts to make their investments. This is because the ClearBridge MLP and Midstream Fund can be included in such an account just like any other corporation.

Normally, including master limited partnerships in such an account exposes the investor to potential tax problems that they may not wish to deal with. Unfortunately, investors do have to give up some potential income with this fund, as the ClearBridge MLP and Midstream Fund only has a 6.44% yield at the current share price. This is lower than the 7.60% yield of the Alerian MLP Index (AMLP) and lower than the yield of many other closed-end funds that employ a similar investment strategy:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

ClearBridge MLP and Midstream Fund |

Equity-MLP |

6.44% |

|

Kayne Anderson Energy Infrastructure Fund (KYN) |

Equity-MLP |

8.66% |

|

Neuberger Berman Energy Infrastructure Fund (NML) |

Equity-MLP |

9.01% |

|

NXG Cushing Midstream Energy Fund (SRV) |

Equity-MLP |

12.47% |

|

Tortoise Energy Infrastructure Corp. (TYG) |

Equity-MLP |

8.53% |

We can clearly see that the yield of the ClearBridge MLP and Midstream Fund is very disappointing compared to that of its peer funds. Its yield looks even less appealing when we consider that many midstream partnerships currently boast distribution yields that are well above 7%. For example, Energy Transfer (ET) has an 8.20% yield right now. Investors whose highest priority is on maximizing their income may thus prefer to choose one of this fund’s peers instead of the ClearBridge MLP and Midstream Fund.

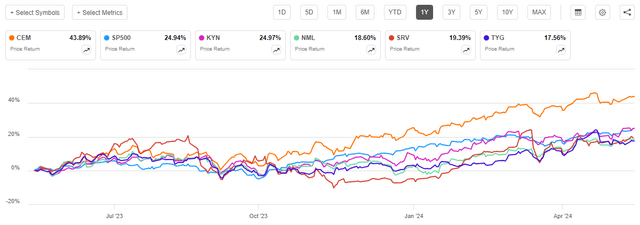

However, one of the biggest reasons why the ClearBridge MLP and Midstream Fund has a lower yield than its peers is because the fund has been delivering strong recent performance. Over the past year, shares of this fund have risen 43.89%, which is much better than the 24.94% gain of the S&P 500 Index (SP550):

Seeking Alpha

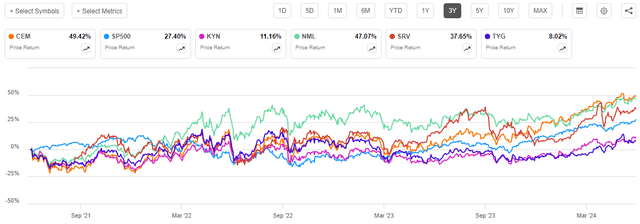

We can also see that the ClearBridge MLP and Midstream Fund managed to outperform all of its peers by a fairly significant margin over the period. We also see the same thing over the past three years:

Seeking Alpha

In this case, though, the much higher-yielding Neuberger Berman Energy Infrastructure Fund came very close to matching the performance of the ClearBridge MLP and Midstream Fund. As is frequently the case, the Tortoise Energy Infrastructure Corporation is the laggard and one of only two midstream funds that did not manage to beat the S&P 500 Index over the period. The fact that the ClearBridge MLP and Midstream Fund delivered much stronger share price appreciation than most of its peers is the reason for this fund’s low yield, as it has not increased its distribution by anywhere near the level that its share price appreciated over the period. While the fact that this fund’s strong price appreciation has had a negative impact on its yield, the rapid increase in its share price might still please some investors.

However, the ClearBridge MLP and Midstream Fund was not the overall best performer in the sector over the past three years. As I explained in a recent article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

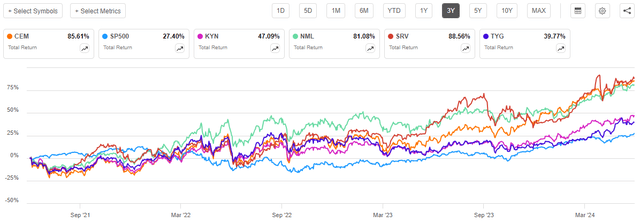

When we include the distributions that were paid out by the ClearBridge MLP and Midstream Fund over the past three years into the performance chart shown above, and then do the same thing with all of its peers, we get this alternative chart:

Seeking Alpha

As we can see, investors in the ClearBridge MLP and Midstream Fund realized an 85.61% total return over the past three years. This is a good return, although this fund did underperform the NXG Cushing Midstream Energy Fund by 295 basis points over the three-year period. That is not really very much underperformance over the period, and as such it is not worth abandoning the consideration of this fund, but the NXG Cushing Midstream Energy Fund does have a higher yield as well.

Overall, the performance of the ClearBridge MLP and Midstream Fund has been excellent over the past few years. However, past performance is no guarantee of future results, so let us take a closer look at this fund and see if it makes sense to purchase it today.

About The Fund

According to the fund’s webpage, the Cushing MLP and Midstream Fund has the primary objective of providing its investors with a very high level of total return. This makes a great deal of sense when we consider the fund’s strategy. The website itself, unfortunately, does not provide a particularly in-depth description of the fund’s strategy. Rather, all that the website provides is two statements that the fund invests its assets in midstream corporations and partnerships:

Franklin Templeton

The strategy description provided by the fact sheet is just a repeat of the website’s description:

[The Fund] provides an efficient, single investment for accessing a portfolio of energy-related master limited partnerships and midstream entities. [The Fund] seeks a high level of total return with an emphasis on cash distributions. [The Fund] targets energy-related midstream entities and MLPs with long-lived assets and predictable cash flows.

Fortunately, the fund’s annual report is much better than this, as it includes an in-depth description of the fund’s strategy and objectives. From the annual report:

The Fund’s investment objective is to provide a high level of total return with an emphasis on cash distributions. The Fund seeks to achieve its objective by investing primarily in energy master limited partnerships and energy midstream entities. Under normal market conditions, the Fund invests at least 80% of its managed assets in energy MLPs and energy midstream entities.

For purposes of the 80% policy, the Fund considers investments in MLPs to include investments that offer economic exposure to public and private MLPs in the form of MLP equity securities, securities of entities holding primarily general partner or managing member interests in MLPs, securities that are derivatives of interests in MLPs, exchange-traded funds that primarily hold MLP interests and debt securities of MLPs. For purposes of the 80% policy, the Fund considers investments in midstream entities as direct or indirect investments in those entities that provide midstream services including the gathering, transporting, processing, fractionation, storing, refining, and distribution of oil, natural gas liquids, natural gas and refined petroleum products. The Fund considers an entity to be within the energy sector if it derives at least 50% of its revenues from the business of exploring, developing, producing, gathering, fractionating, transporting, processing, storing, refining, distributing, mining, or marketing natural gas, natural gas liquids, crude oil, refined petroleum products or coal. The Fund may also invest up to 20% of its managed assets in other securities that are not MLPs or midstream entities.

This description certainly gives us a pretty good idea of what sort of securities this fund will hold. The description clearly mentions that it may own both common equity and debt, but at least 80% of the securities that it includes in its portfolio will be issued by pipeline companies and similar things. These companies have long been fairly popular among income-focused investors because they tend to have relatively high yields, and income has been difficult to come by over the past few years. However, they are also the subject of anxiety among many investors for a few reasons:

- There have been two industry-wide crises over the past decade that were brought about by incredibly low oil prices. These crises forced many midstream companies to cut their distributions, restructure their businesses, or fold.

- Environmental activists and landowners frequently oppose the construction of pipelines and other infrastructure, which makes it difficult for many companies in the sector to generate growth.

- Some international organizations (such as the International Energy Agency) and politicians have promoted the narrative that the oil and gas industry has entered a period of terminal decline. For example, the International Energy Agency said yesterday that crude oil demand will peak in 2029 and then enter a period of permanent decline. While this is directly contradicted by data and research provided by private researchers and analysts, the perception still drags on the stock prices of most companies in the energy industry.

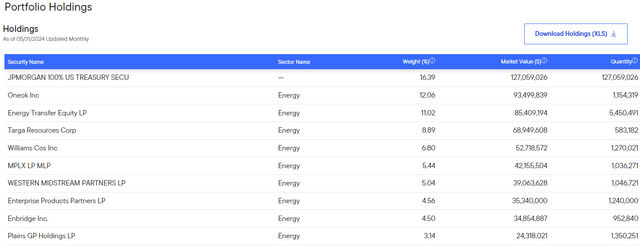

These factors have all made it difficult for companies in this sector to achieve the valuations that are seen in many other sectors. In response, many companies in the sector have adopted policies that result in them paying out high proportions of their cash flow to their shareholders. When combined with fairly low valuations, this has given most of the companies very attractive yields. We can see this by looking at the largest positions that are held by the ClearBridge MLP and Midstream Fund:

Franklin Templeton

Here are the yields of these companies:

|

Company Name |

Current Yield |

|

ONEOK (OKE) |

4.94% |

|

Energy Transfer |

8.20% |

|

Targa Resources (TRGP) |

2.47% |

|

The Williams Companies (WMB) |

4.57% |

|

MPLX LP (MPLX) |

8.26% |

|

Western Midstream Partners (WES) |

9.11% |

|

Enterprise Products Partners (EPD) |

7.25% |

|

Enbridge (ENB) |

7.45% |

|

Plains GP Holdings (PAGP) |

6.60% |

We also see among the fund’s largest positions the JPMorgan 100% U.S. Treasuries Securities Money Market Fund, Institutional Class (JTSXX). As the name suggests, this is a U.S. Treasury-only money market fund that currently has a 7-day SEC yield of 5.27%. Naturally, the difference between this fund and most government money market funds is that it does not invest in repurchase agreements or in agency securities. As this fund is investing in institutional-class shares, it has a lower expense ratio and higher yield than most retail funds that you will likely find in your own brokerage accounts.

It is curious why this fund would have such a high percentage of its assets invested in a money market fund as opposed to equity and debt securities of midstream companies, especially when these securities can offer a much higher total return than a money market fund and fit better with the portfolio that investors in this fund want it to have. It does appear that the large money market fund position is something that the fund only recently entered into. The fund’s first-quarter 2024 holdings report states that the ClearBridge MLP and Midstream Fund had 1.5% of its net assets invested in this fund on February 29, 2024, so it obviously amassed this huge cash position sometime between the end of February and the end of May.

One possible explanation for the increase in cash equivalents is a tender offer that the fund has outstanding. This is explained in a press release dated May 21, 2024:

ClearBridge MLP and Midstream Fund Inc. announced today additional details concerning its previously announced cash tender offer for up to 50% of such Fund’s outstanding shares of common stock at a price per share equal to 100% of the Fund’s net asset value per Share on the day on which the tender offer expires. In the event the tender offer is oversubscribed, Shares will be repurchased on a pro rata basis. The Fund commenced the Offer today, May 21, 2024, with an expiration time of 5:00 p.m., New York City time, on June 20, 2024, unless extended. To ensure that the Fund can pay proceeds for repurchased Shares promptly after the expiration of the Offer, the Fund intends to reposition its portfolio in an orderly manner in advance of the expiration of the Offer.

That last sentence explains a great deal about the rationale for the enormous cash equivalent position that we see in the fund today. The ClearBridge MLP and Midstream Fund is simply selling off some of its assets and building up cash so that it can purchase back its own shares in a few weeks. Therefore, we can expect that this cash position will decline sharply following the closing of the offer window and the fund will return to holding securities that are closer to what we expect from it.

As we can see from the yields of the largest positions in the ClearBridge MLP and Midstream Fund (except for the money market fund), most of the companies that this fund is invested in have higher yields than U.S. Treasuries and cash equivalents right now. In fact, the only firms whose common equities have lower yields are ONEOK, The Williams Companies, and Targa Resources. This is a big departure from common equities that are seen in most other sectors. For example, consider the yields that are currently possessed by the major domestic indices today:

|

Index |

TTM Yield |

|

Dow Jones Industrial Average (DJI) |

2.17% |

|

Dow Jones Transportation Average |

1.99% |

|

Dow Jones Utility Average |

3.47% |

|

Russell 2000 Index (IWM) |

1.48% |

|

NASDAQ 100 Index (QQQ) |

0.79% |

|

S&P 500 Index |

1.36% |

(all figures from The Wall Street Journal.)

As we can immediately see from this chart, most equity indices have lower yields than that of an ordinary money market fund right now. This is true even among utilities, which are frequently considered to be “income” investments. The fact that the positions held by the ClearBridge MLP and Midstream Fund have substantially higher yields thus means that this fund’s portfolio will be generating a higher level of current income than most other equity closed-end funds that have the same size. This explains the fund’s statement in its strategy and overview that it expects a significant portion of its total return to be delivered via the distributions that it pays out.

The fact that many of the companies that comprise the largest positions in the fund’s portfolio deliver a higher proportion of their total return in the form of dividends and distributions does not mean that these companies do not benefit from share price appreciation. For example, consider the following price gains over the past year:

|

Company Name |

TTM Price Gain |

|

ONEOK |

+34.10% |

|

Energy Transfer |

+22.76% |

|

Targa Resources |

+73.20% |

|

The Williams Companies |

+35.96% |

|

MPLX LP |

+22.64% |

|

Western Midstream Partners |

+45.31% |

|

Enterprise Products Partners |

+9.44% |

|

Enbridge |

-4.93% |

|

Plains GP Holdings |

+27.01% |

The S&P 500 Index gained 24.94% over the same period, so we can immediately see that several of these companies actually outperformed the S&P 500 Index over the past year. This sort of thing never happened before the COVID-19 pandemic during the ten-year period of ultra-low interest rates that preceded it.

The strong share price performance that we see from the largest positions in the ClearBridge MLP and Midstream Fund has lasted for more than one year. For example, consider the following three-year price gains:

|

Company Name |

Three-Year Price Gain |

|

ONEOK |

+44.64% |

|

Energy Transfer |

+38.83% |

|

Targa Resources |

+158.08% |

|

The Williams Companies |

+50.98% |

|

MPLX LP |

+34.67% |

|

Western Midstream Partners |

+71.80% |

|

Enterprise Products Partners |

+12.16% |

|

Enbridge |

-12.43% |

|

Plains GP Holdings |

+38.52% |

Once again, we see that most of the companies outperformed the 27.40% gain delivered by the S&P 500 Index over the period. In fact, the only two companies that did not are Enterprise Products Partners and Enbridge. Once again, before the COVID-19 pandemic, the traditional energy sector as a whole (including midstream companies) underperformed the S&P 500 Index by quite a lot. Today, we have the reverse occurring, as these companies are among the few common stocks that are attractive in an environment in which money actually has an opportunity cost.

Therefore, we have a fund that is invested heavily in low-duration common equities that are among the few assets in the market today that deliver a higher yield than cash equivalents. Most of these companies have also managed to outperform the S&P 500 Index over the trailing one-year and three-year periods. There has been no real change in the fundamentals of these businesses over the past few years, although some of them are being a bit more conservative with their balance sheets. The only real change is that inflation and interest rates are much higher today than they were back in the 2010s. Yesterday, the Federal Reserve made comments that suggest that interest rates will permanently remain higher than they were over the past decade. If these securities are outperforming in such an environment, it could speak well for their ability to deliver strong performance going forward. As the ClearBridge MLP and Midstream Fund is invested in a portfolio of such securities, it should also benefit from a secular bull trend.

Leverage

As is the case with most closed-end funds, the ClearBridge MLP and Midstream Fund employs leverage as a method of boosting the effective yield and total return that it earns from the assets in its portfolio. I explained how this works in a number of previous articles on other closed-end funds. To paraphrase myself:

In short, the fund borrows money and then uses that borrowed money to purchase the common equity of midstream companies. As long as the interest rate that the fund has to pay on the borrowed money is lower than the yield of the purchased assets, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will normally be the case, although it is much more difficult to accomplish this yield boost with rates at 6% as opposed to the 0% that we had for most of the past decade.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the ClearBridge MLP and Midstream Fund has leveraged assets comprising 13.61% of its assets. As readers of my other articles on closed-end funds likely noticed quickly, this is a lower leverage ratio than most equity funds possess. It is also well below the one-third of assets levels that I ordinarily prefer to see with a fund like this.

The ClearBridge MLP and Midstream Fund also has a lower level of leverage than its peers:

|

Fund Name |

Leverage Ratio |

|

ClearBridge MLP and Midstream Fund |

13.61% |

|

Kayne Anderson Energy Infrastructure Fund |

22.62% |

|

Neuberger Berman Energy Infrastructure Fund |

17.45% |

|

NXG Cushing Midstream Energy Fund |

25.86% |

|

Tortoise Energy Infrastructure Corp. |

20.90% |

(all figures from CEF Data.)

As we can clearly see, the ClearBridge MLP and Midstream Fund is employing less leverage as a percentage of its portfolio than any of its peers. However, this may be only a temporary situation due to the fund positioning for its massive share buyback offering. When we discussed this fund at Energy Profits in Dividends back in March, it had a 28.36% leverage ratio. That has obviously dropped substantially, and it seems likely that the fund accomplished this drop by paying off the outstanding borrowings that it previously had. This makes sense in preparation for a share buyback because the share buyback will reduce the fund’s net asset value and cause its leverage to increase. By taking action to reduce it now, the fund can ensure that its leverage remains at a reasonable level after it purchases shares from investors and sees its net assets decline in value.

Overall, we probably do not need to worry about this fund’s leverage. It will almost certainly increase due to the share buyback offer, but by reducing the debt now, the fund has ensured that it will not end up with an outsized leverage ratio in a few weeks.

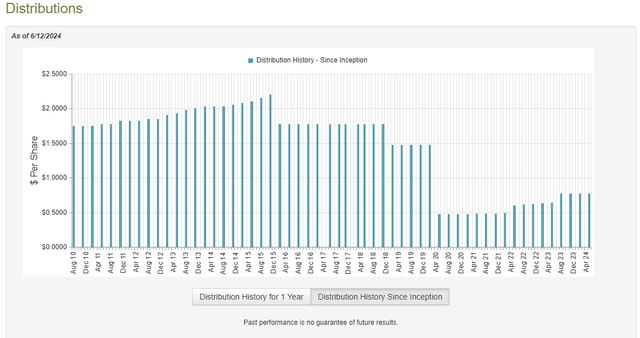

Distribution Analysis

The primary objective of the ClearBridge MLP and Midstream Fund is to provide its investors with a high level of total return. The fund explicitly states that it expects to do this primarily through distributions paid to the shareholders. To this end, the fund pays a quarterly distribution of $0.77 per share ($3.08 per share annually), which gives it a 6.44% yield at the current price.

The ClearBridge MLP and Midstream Fund has not been particularly consistent regarding its distribution over the years:

CEF Connect

As I stated previously:

This seems likely to be a turn-off for any investor who is seeking to earn a safe and consistent level of income with which they can pay their bills or finance their lifestyles. However, it is not especially surprising or unusual for a closed-end fund that invests in the energy infrastructure sector to have such a disappointing distribution track record. After all, the period of time that is covered in the chart above included two industry crises that caused many midstream companies to encounter difficulties obtaining financing in the capital markets. Many of these companies cut their distributions in order to redirect their cash flows towards strengthening their balance sheet and becoming fully financially independent. This is the reason why most companies in the industry (as well as upstream shale producers) are now much more financially strong than they have been in decades. Unfortunately, the distribution cuts and unit price collapses that occurred during these twin crises caused the fund’s income to decline along with the value of its portfolio. It naturally had to reduce its payout in order to ensure its own financial viability. However, now that the industry is stronger than ever, the fund has been able to raise its distribution as returns across the sector have increased.

Let us take a look at the fund’s most recent financial report to determine how well it can sustain its current distribution. After all, the distribution schedule going forward is much more important than the one in the past.

As of the time of writing, the most recent financial report for the ClearBridge MLP and Midstream Fund is the annual report that corresponds to the full-year period that ended on November 30, 2023. A link to this document was provided earlier in this article. This is, admittedly, an older report than I would really prefer as it is more than six months old at this point, but it is the best that we have currently, so we have to use it.

For the full-year period that ended on November 30, 2023, the ClearBridge MLP and Midstream Fund received $57,803,941 in distributions and dividends along with $606,052 from the money market fund where the fund stores its cash. A substantial proportion of this money came from master limited partnerships, so it is considered to be a return of capital for tax purposes. As such, the fund only reported a total investment income of $16,242,103 for the full-year period. This was not sufficient to cover the fund’s expenses, and it ended up reporting a net investment loss of $24,310,100 for the period. Obviously, this was also not enough to cover the $37,373,068 that the fund paid out to its shareholders in distributions.

The fund was, fortunately, able to make up the difference via capital gains. For the full-year period, the fund reported net realized capital gains of $144,450,732, which was partially offset by $59,512,293 net unrealized losses. Overall, the fund’s net assets increased by $17,920,847 after accounting for all inflows and outflows during the period. The fund therefore managed to cover its distributions with excess investment profits left over.

The fund appears to be continuing to cover its distributions so far this year. This chart shows its net asset value per share over the period from November 30, 2023, until today:

Barchart

As we can see, the ClearBridge MLP and Midstream Fund has seen its net asset value increase by 11.80% since the closing date of the most recent financial report. This clearly tells us that it has managed to cover all the distributions that it has paid out since that time, with a large amount of investment profits left over. Overall, there does not seem to be any risk of a distribution cut in the near future.

Valuation

Shares of the ClearBridge MLP and Midstream Fund are currently trading at a 4.30% discount to net asset value. This is reasonably in line with the 4.58% discount that the shares have had on average over the past month.

Conclusion

In conclusion, the ClearBridge MLP and Midstream Fund appears to be a very solid investment for any income-seeking investor who desires exposure to the energy infrastructure sector and the high yields that come along with it. The fund itself has a fairly attractive yield, but it is admittedly not the best one in the sector. The companies in the portfolio have been fairly consistently outperforming the S&P 500 Index over the past few years, and they seem to be better holdings than many other equities in today’s high interest-rate environment. The fund is fully covering its distribution and trades at a reasonable discount, so everything seems good here if the yield is high enough to satisfy your needs.

Read the full article here